⚡ Gold Surges Amid Rising U.S.–Iran Tensions

Current Market Snapshot – Dragon Fly Official:

Gold has jumped above $5,000/oz due to escalating geopolitical tensions.

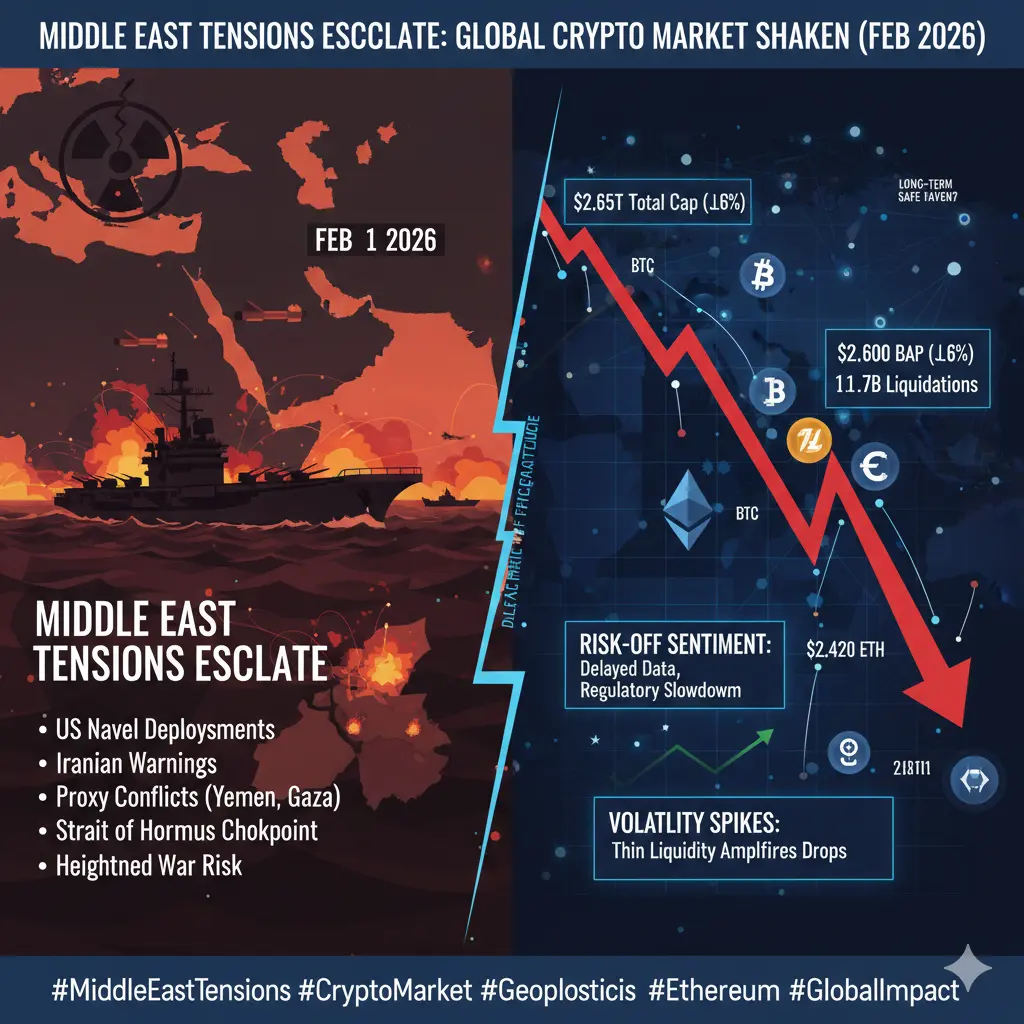

Bitcoin has pulled back, reflecting cautious market sentiment.

📉 Market Analysis: Price vs Sentiment

Price Signals:

Gold shows strong upward momentum on geopolitical news.

Bitcoin and risk assets are under pressure, testing support levels.

Market Insight – Dragon Fly Official:

Safe-haven demand is driving gold prices higher.

BTC’s pullback reflects risk-off sentiment as traders reassess positions.

The divergence between gold and BTC highlights capital rotation between traditional and digital assets.

🔎 Why the Divergence Exists

Geopolitical Tensions: Rising U.S.–Iran concerns increase safe-haven flows into gold.

Liquidity Reallocation: Risk assets, including BTC, are temporarily under pressure.

Market Sentiment: Investors are cautious, prioritizing stability over high volatility.

Technical Factors: BTC pullback aligns with resistance zones and market consolidation.

💡 Strategy Considerations

Allocate to Gold: Rising tensions may continue to push gold higher; monitor support levels for entry.

Wait for BTC Dip: A pullback may present a buying opportunity at stronger technical support.

Observe Relative Strength: Compare performance between gold and BTC to gauge market preference.

Manage Risk: Use stop-losses and position sizing for volatile periods.

📈 Long-Term Outlook

Gold remains a reliable hedge against geopolitical and macroeconomic risk.

Bitcoin may recover, but short-term volatility suggests caution.

Monitoring both markets helps balance safety (gold) and growth potential (BTC).

Summary Table

Gold Price: Above $5,000/oz

BTC Price: Pullback, testing support zones

Trend: Gold rising, BTC cautious

Market Sentiment: Risk-off, cautious

Strategy: Allocate to gold or look for BTC dip

Key Takeaway: Gold benefits from geopolitical tension, while BTC pullbacks require careful timing — balance between safe-haven and growth exposure is key.

⚠️ Risk Warning

Trading or investing in gold or BTC carries significant risk:

Prices can swing sharply and unpredictably.

Past performance does not guarantee future results.

Only invest what you can afford to lose.

Use proper risk management and position sizing.

#MiddleEastTensionsEscalate

Current Market Snapshot – Dragon Fly Official:

Gold has jumped above $5,000/oz due to escalating geopolitical tensions.

Bitcoin has pulled back, reflecting cautious market sentiment.

📉 Market Analysis: Price vs Sentiment

Price Signals:

Gold shows strong upward momentum on geopolitical news.

Bitcoin and risk assets are under pressure, testing support levels.

Market Insight – Dragon Fly Official:

Safe-haven demand is driving gold prices higher.

BTC’s pullback reflects risk-off sentiment as traders reassess positions.

The divergence between gold and BTC highlights capital rotation between traditional and digital assets.

🔎 Why the Divergence Exists

Geopolitical Tensions: Rising U.S.–Iran concerns increase safe-haven flows into gold.

Liquidity Reallocation: Risk assets, including BTC, are temporarily under pressure.

Market Sentiment: Investors are cautious, prioritizing stability over high volatility.

Technical Factors: BTC pullback aligns with resistance zones and market consolidation.

💡 Strategy Considerations

Allocate to Gold: Rising tensions may continue to push gold higher; monitor support levels for entry.

Wait for BTC Dip: A pullback may present a buying opportunity at stronger technical support.

Observe Relative Strength: Compare performance between gold and BTC to gauge market preference.

Manage Risk: Use stop-losses and position sizing for volatile periods.

📈 Long-Term Outlook

Gold remains a reliable hedge against geopolitical and macroeconomic risk.

Bitcoin may recover, but short-term volatility suggests caution.

Monitoring both markets helps balance safety (gold) and growth potential (BTC).

Summary Table

Gold Price: Above $5,000/oz

BTC Price: Pullback, testing support zones

Trend: Gold rising, BTC cautious

Market Sentiment: Risk-off, cautious

Strategy: Allocate to gold or look for BTC dip

Key Takeaway: Gold benefits from geopolitical tension, while BTC pullbacks require careful timing — balance between safe-haven and growth exposure is key.

⚠️ Risk Warning

Trading or investing in gold or BTC carries significant risk:

Prices can swing sharply and unpredictably.

Past performance does not guarantee future results.

Only invest what you can afford to lose.

Use proper risk management and position sizing.

#MiddleEastTensionsEscalate