Bidashi

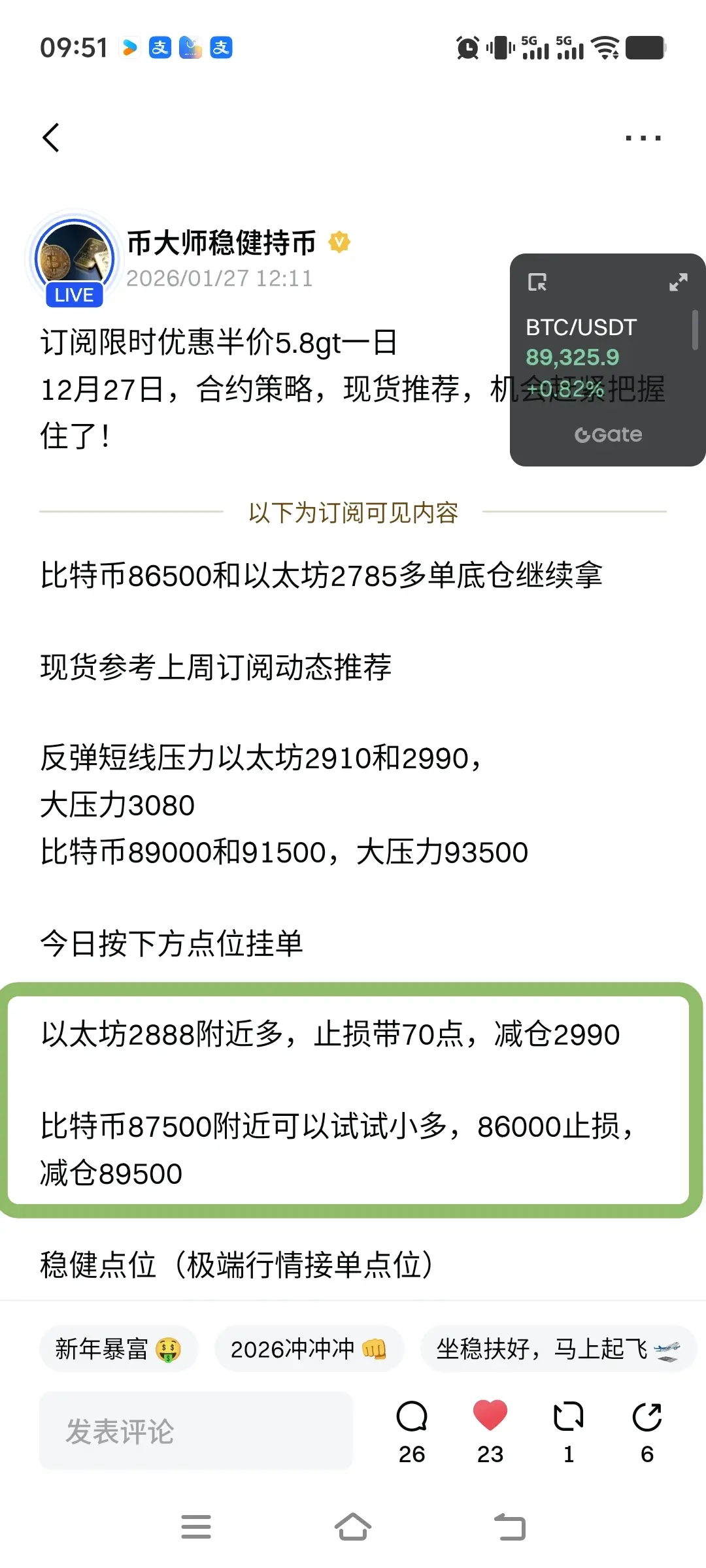

Subscription discount of 5.8gt ends today, subscribe quickly if interested!

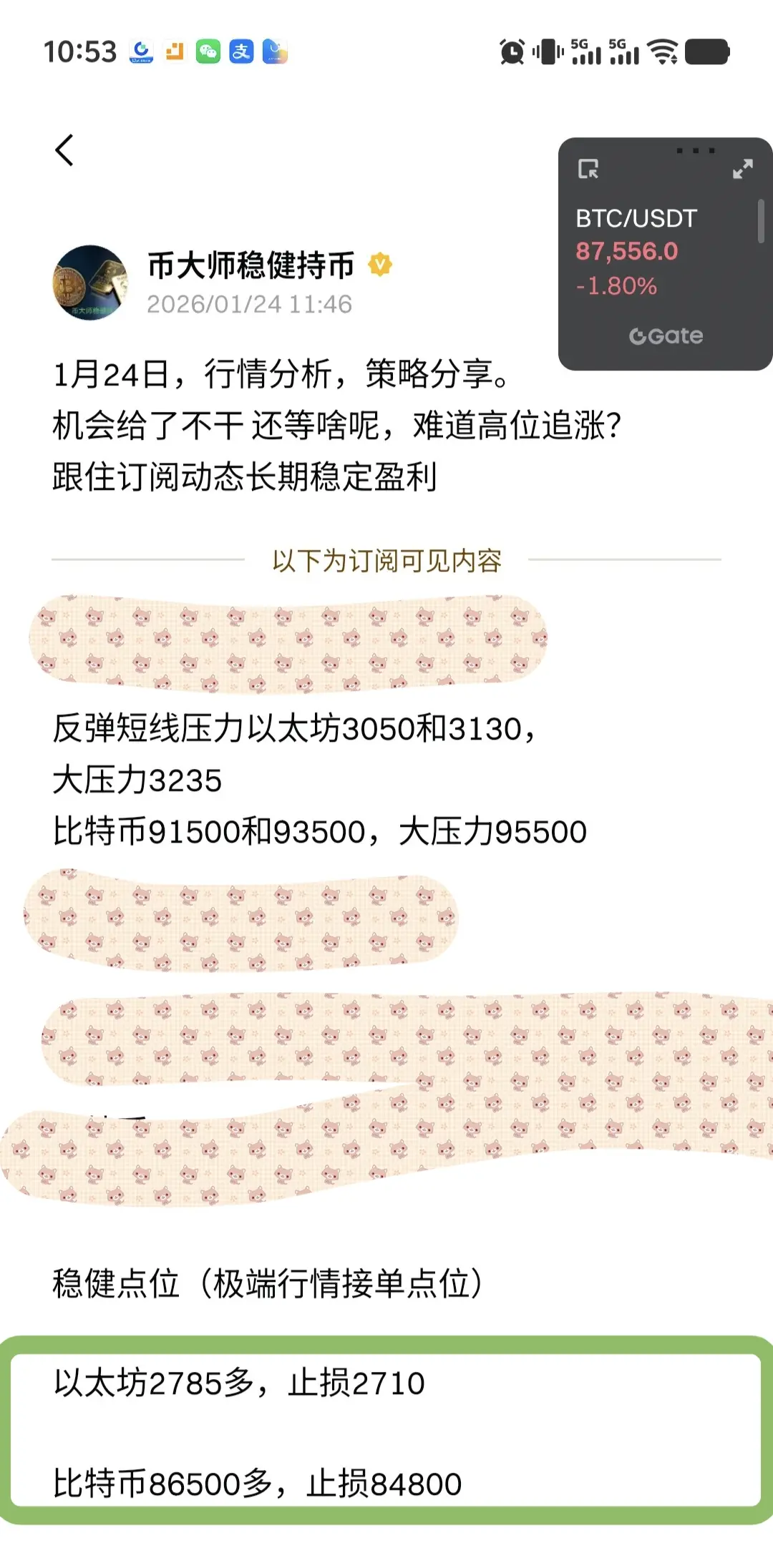

Last night, Ethereum was at 2909, and everyone was bullish. Did you join the trend? The Bitcoin subscription update shows over 87,500 buy orders.

On Saturday, the Bitcoin subscription update perfectly matched buy orders at 86500 and Ethereum at 2785. Holding onto this wave feels great. Follow Coin Master for subscription updates, follow Coin Master live room, and enjoy long-term stable profits—no compromise.

The main trend orders are so steady.

Spot market bottomed out last week; spot recommendations are included in th

View OriginalLast night, Ethereum was at 2909, and everyone was bullish. Did you join the trend? The Bitcoin subscription update shows over 87,500 buy orders.

On Saturday, the Bitcoin subscription update perfectly matched buy orders at 86500 and Ethereum at 2785. Holding onto this wave feels great. Follow Coin Master for subscription updates, follow Coin Master live room, and enjoy long-term stable profits—no compromise.

The main trend orders are so steady.

Spot market bottomed out last week; spot recommendations are included in th

- Reward

- 23

- 23

- Repost

- Share

Earn30uPerDay :

:

2026 Go Go Go 👊View More

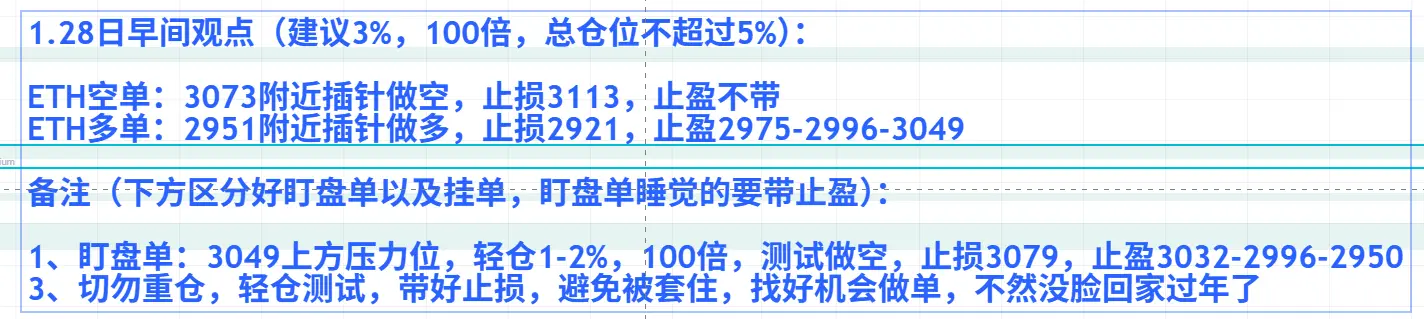

Morning View on the 28th (Recommendation: 3%, 100x leverage, total position not exceeding 5%):

ETH Short: Dip around 3073 to short, stop loss at 3113, no take profit

ETH Long: Dip around 2951 to go long, stop loss at 2921, take profit at 2975-2996-3049

Remarks (Differentiate between monitoring orders and pending orders below; monitoring orders that are sleeping should have take profit):

1. Monitoring Order: Resistance above 3049, small position 1-2%, 100x leverage, test short, stop loss at 3079, take profit at 3032-2996-2950

3. Do not hold heavy positions, test with small positions, set proper

ETH Short: Dip around 3073 to short, stop loss at 3113, no take profit

ETH Long: Dip around 2951 to go long, stop loss at 2921, take profit at 2975-2996-3049

Remarks (Differentiate between monitoring orders and pending orders below; monitoring orders that are sleeping should have take profit):

1. Monitoring Order: Resistance above 3049, small position 1-2%, 100x leverage, test short, stop loss at 3079, take profit at 3032-2996-2950

3. Do not hold heavy positions, test with small positions, set proper

ETH2,45%

- Reward

- 13

- 7

- Repost

- Share

Sober :

:

2026 Go Go Go 👊View More

The New Architect of Finance.Artificial Intelligence is no longer just an assistant answering our questions; it is a financial mastermind that manages our portfolios, analyzes data in seconds, and most importantly, takes action! With the #AIBotClawdbotGoesViral trend, the crypto world has officially transitioned from the era of "smart investment" to "autonomous investment."

So, what is happening in the Gate.io ecosystem and why is everyone talking about this bot? Here are the magnificent details you need to know:

The Clawdbot Effect and Gate.io Integration

Forget traditional bots! Clawd

So, what is happening in the Gate.io ecosystem and why is everyone talking about this bot? Here are the magnificent details you need to know:

The Clawdbot Effect and Gate.io Integration

Forget traditional bots! Clawd

- Reward

- 8

- 8

- Repost

- Share

JioCoins :

:

Watching Closely 🔍️View More

#GoldandSilverHitNewHighs

📈 Gold & Silver – Breaking Records, Current Trends, and 2026 Outlook

Gold and silver have surged to unprecedented new highs, reflecting the intersection of macroeconomic uncertainty, geopolitical tension, and investor sentiment. Gold recently breached the $5,000 per ounce mark, while silver has moved above $110 per ounce, marking a historic period for precious metals. This rally is driven by multiple converging factors: escalating global conflicts, central banks maintaining accommodative monetary policies, and a weakening US dollar creating strong safe-haven demand.

📈 Gold & Silver – Breaking Records, Current Trends, and 2026 Outlook

Gold and silver have surged to unprecedented new highs, reflecting the intersection of macroeconomic uncertainty, geopolitical tension, and investor sentiment. Gold recently breached the $5,000 per ounce mark, while silver has moved above $110 per ounce, marking a historic period for precious metals. This rally is driven by multiple converging factors: escalating global conflicts, central banks maintaining accommodative monetary policies, and a weakening US dollar creating strong safe-haven demand.

- Reward

- 6

- 7

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

- Reward

- like

- 5

- Repost

- Share

XiaoDashuai :

:

EmptyView More

- Reward

- 2

- 4

- Repost

- Share

爱吹泡泡 :

:

Is it going up or 📉?View More

#加密市場觀察

Gate announces the completion of its brand upgrade and feature update for its decentralized trading product, with the original Gate Web3 officially renamed to Gate DEX. This adjustment is not only a name update but also a systematic restructuring of Gate's positioning of the decentralized trading gateway, product capabilities, and overall user experience under the All in Web3 strategic framework. $BTC $ETH $DOGE

View OriginalGate announces the completion of its brand upgrade and feature update for its decentralized trading product, with the original Gate Web3 officially renamed to Gate DEX. This adjustment is not only a name update but also a systematic restructuring of Gate's positioning of the decentralized trading gateway, product capabilities, and overall user experience under the All in Web3 strategic framework. $BTC $ETH $DOGE

- Reward

- 4

- 5

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

- Reward

- like

- 4

- Repost

- Share

在海边聆听 :

:

Pull back to go long, continue to break through todayView More

Daytime Price Levels

Ethereum support at 3006, 2978, 2950

Resistance at 3070, 3120, 3180

#内容挖矿焕新公测开启

Ethereum support at 3006, 2978, 2950

Resistance at 3070, 3120, 3180

#内容挖矿焕新公测开启

ETH2,45%

- Reward

- 3

- 3

- Repost

- Share

huangjinshizi :

:

Received. Hope it can pull back again 🤣View More

- Reward

- like

- 3

- Repost

- Share

平淡无奇的心态 :

:

Short-term trading is possibleView More

#VanEckLaunchesAVAXSpotETF

The launch of the VanEck Avalanche ETF (VAVX) on January 26, 2026, is a landmark moment for the Avalanche ecosystem. While the immediate market reaction was a bit "sell the news" (with the ETF closing its first day down roughly 2%), the structural shifts it introduces are indeed long-term bullish catalysts.

Here is a breakdown of why this matters for AVAX:

1. The "Staking Alpha"

Unlike the initial Bitcoin ETFs, VAVX is designed to stake its AVAX holdings.

Yield Generation: The fund targets a gross staking yield (currently around 5.57%). These rewards accrue to the N

The launch of the VanEck Avalanche ETF (VAVX) on January 26, 2026, is a landmark moment for the Avalanche ecosystem. While the immediate market reaction was a bit "sell the news" (with the ETF closing its first day down roughly 2%), the structural shifts it introduces are indeed long-term bullish catalysts.

Here is a breakdown of why this matters for AVAX:

1. The "Staking Alpha"

Unlike the initial Bitcoin ETFs, VAVX is designed to stake its AVAX holdings.

Yield Generation: The fund targets a gross staking yield (currently around 5.57%). These rewards accrue to the N

- Reward

- 4

- 4

- Repost

- Share

GateUser-87b8cc56 :

:

2026 bayView More

After going off the air last night, I said to reduce positions to protect capital or sell out, but it keeps going down and won't stop.

View Original- Reward

- like

- 4

- Repost

- Share

BuildingBlocks_ :

:

Yesterday was really walking on a knife's edge, but luckily I took profit early and enjoyed a big gain, almost doubling my position.View More

- Reward

- 1

- 3

- Repost

- Share

LiliLiliLili :

:

Now what🤣View More

- Reward

- 7

- 2

- Repost

- Share

OneAfternoon :

:

Did they give the court a few million in bribes?View More

Load More