#LatestMarketInsights 📈 Latest Market Insights – February 25, 2026

Markets remain at a critical inflection point as volatility continues across crypto and equities. While stocks are attempting stabilization, digital assets remain under sustained pressure from macro headwinds, tariff uncertainty, and liquidity tightening. With major catalysts ahead, including Nvidia earnings and further tariff developments, risk sentiment could shift rapidly.

Global Equities: Stabilization Attempt, But Fragile

U.S. equity markets staged a notable rebound after earlier heavy selling pressure. The S&P 500, Nasdaq, and Dow Jones all recovered meaningfully, supported by renewed buying in AI-linked technology stocks and dip-buyers stepping in at key technical levels. However, futures suggest a cautious tone heading into the next session, reflecting uncertainty ahead of major earnings releases.

Asian markets also participated in the rebound, led by semiconductor and AI-infrastructure names. Japan’s Nikkei and South Korea’s Kospi showed strength, supported by ongoing enthusiasm surrounding AI hardware demand and global chip supply expansion.

Despite the rebound, market dispersion remains elevated. Large-cap tech continues to drive index movement, while defensive and value sectors show relative resilience. Investors are positioning carefully ahead of upcoming catalysts rather than aggressively chasing upside.

AI Sector Focus: Nvidia Earnings as a Risk Catalyst

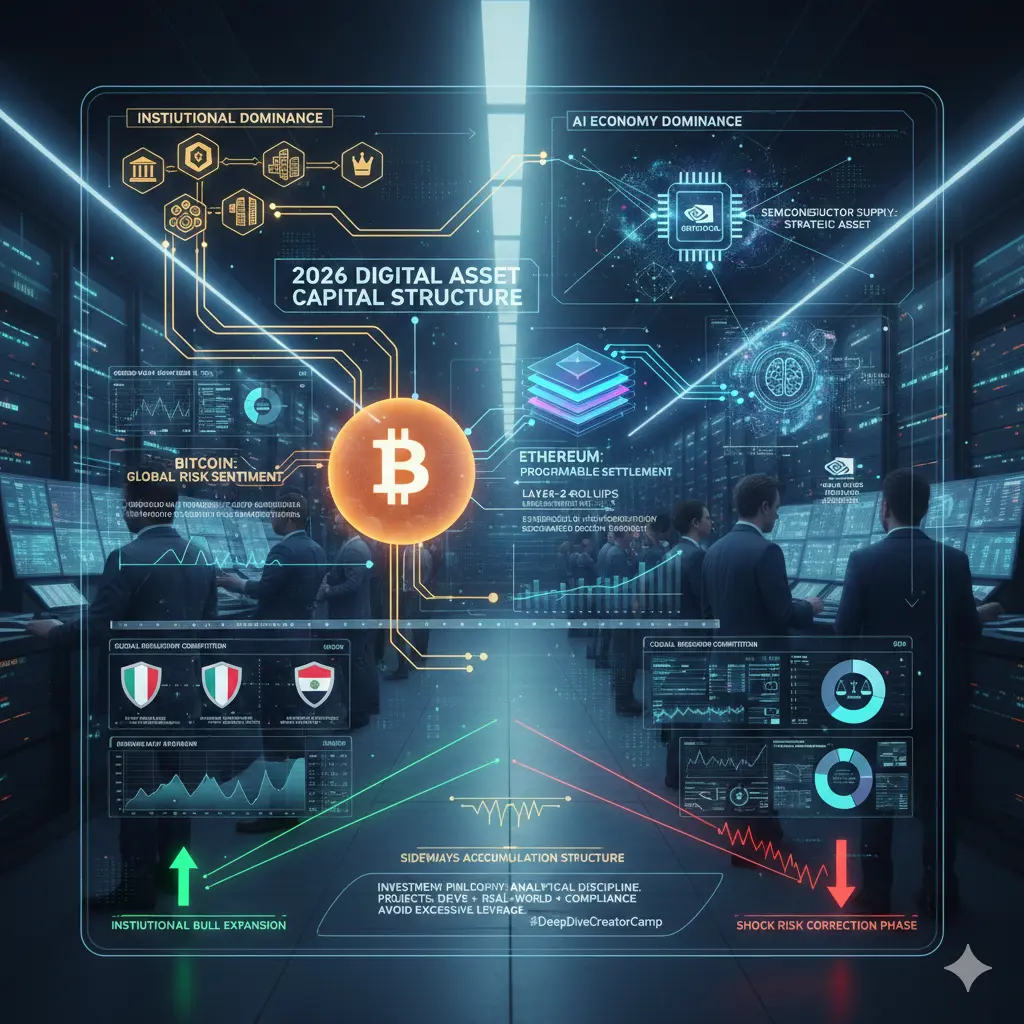

The AI infrastructure theme remains the central driver of equity flows. Nvidia’s upcoming Q4 earnings report is viewed as a pivotal event that could influence not only semiconductor stocks but overall market risk appetite.

Expectations remain high for continued revenue growth driven by AI data center demand. However, guidance will be critical. A strong outlook could reignite broader tech momentum and support risk assets globally. Conversely, any sign of slowing AI capex or margin compression could pressure high-multiple tech names and spill into broader markets, including crypto.

Meanwhile, AMD has gained attention following a major multi-year AI GPU supply agreement with Meta Platforms. This deal signals sustained infrastructure build-out and diversification of AI chip suppliers, reinforcing that hardware remains at the center of the AI expansion cycle.

Tariffs and Macro Cross-Currents

Trade policy continues to weigh on sentiment. The newly implemented global tariff rate began at 10%, lower than the originally announced 15%, offering temporary relief. However, the potential escalation to 15% remains an overhang for global supply chains, trade-sensitive sectors, and emerging markets.

Consumer confidence has shown modest improvement from prior lows, but labor sentiment presents caution. More respondents indicate jobs are becoming harder to obtain, raising early concerns about employment stability despite broader economic resilience.

Central bank expectations remain fluid. Markets continue to price in potential rate adjustments later in the year, but policymakers face a delicate balance between inflation management and growth preservation. This uncertainty is contributing to elevated volatility across asset classes.

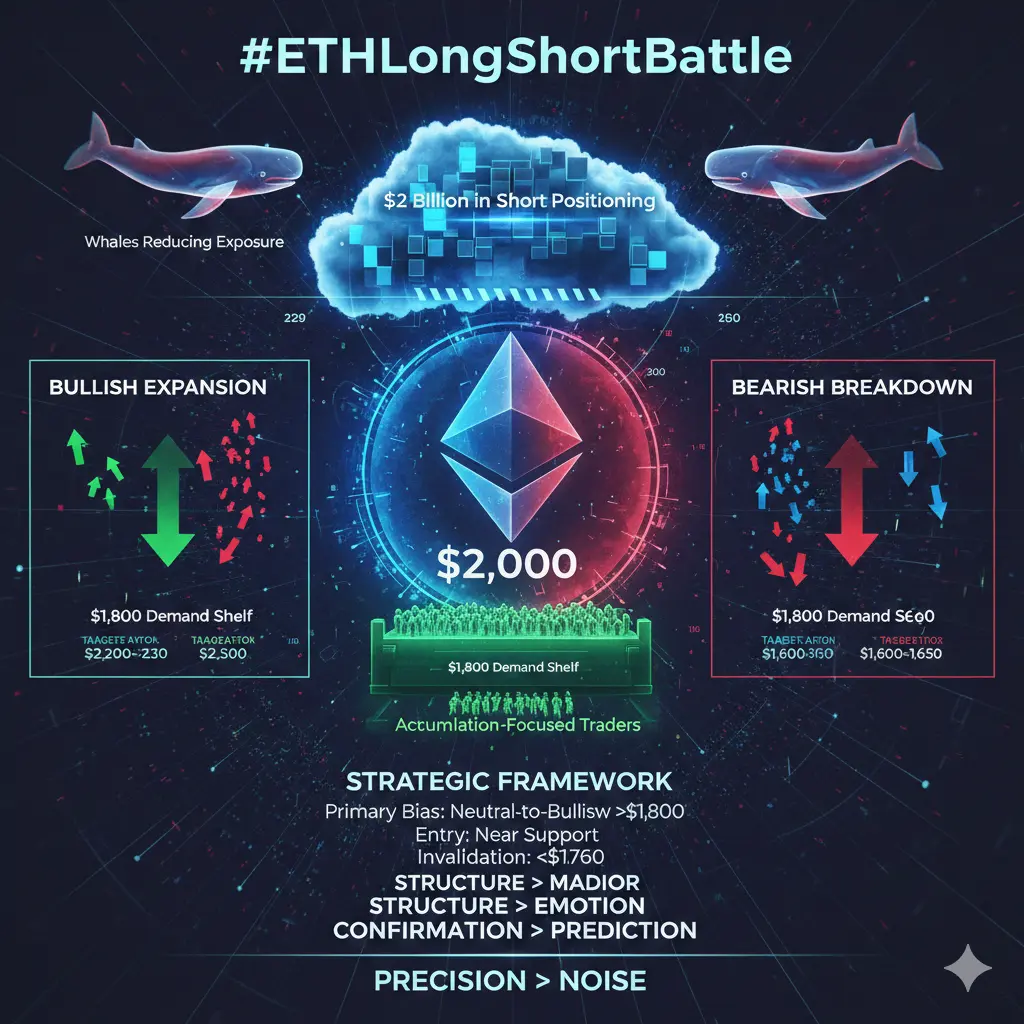

Cryptocurrency Market: Deep Correction, Testing Structural Support

Crypto markets remain under significant pressure. Bitcoin continues to trade within a critical support zone around the low-to-mid $60,000 range, reflecting a sharp year-to-date decline and nearly 50% drawdown from all-time highs. Ethereum is also struggling near major technical levels, with broader altcoins showing even weaker relative performance.

Heavy liquidations during peak volatility sessions amplified downside moves, reinforcing how sensitive crypto remains to macro-driven risk flows. The correlation between crypto and equities has strengthened during this phase, confirming that digital assets are trading as high-beta risk instruments rather than independent safe havens.

However, technical analysts note that price action is testing February lows. A sustained hold in this region could form the basis of a potential double-bottom structure, allowing for a relief rally if macro conditions stabilize. A breakdown below support would open the door to deeper retracement toward prior consolidation zones.

Sentiment indicators remain in extreme fear territory, historically associated with either capitulation phases or early stages of stabilization.

Market Outlook: What to Watch Next

The immediate focus is Nvidia’s earnings report, which may determine short-term direction for equities and risk appetite globally. Strong AI guidance could lift tech and indirectly support crypto. A disappointment could intensify volatility across markets.

Further tariff clarification will also be critical. Confirmation of escalation to 15% would likely renew risk-off positioning, while expanded exemptions could stabilize sentiment.

Upcoming macro data, labor signals, and central bank commentary will shape expectations for liquidity conditions heading into March.

Overall Market Pulse

Markets are balancing between stabilization and renewed downside risk.

Equities are attempting recovery, led by AI infrastructure stocks.

Crypto remains in a corrective structure, testing key support levels.

Tariff uncertainty and labor market caution continue to cloud the macro backdrop.

Volatility remains elevated, favoring disciplined and patient positioning.

The coming sessions could define whether this phase becomes a base-building consolidation or the prelude to another volatility spike.

Markets remain at a critical inflection point as volatility continues across crypto and equities. While stocks are attempting stabilization, digital assets remain under sustained pressure from macro headwinds, tariff uncertainty, and liquidity tightening. With major catalysts ahead, including Nvidia earnings and further tariff developments, risk sentiment could shift rapidly.

Global Equities: Stabilization Attempt, But Fragile

U.S. equity markets staged a notable rebound after earlier heavy selling pressure. The S&P 500, Nasdaq, and Dow Jones all recovered meaningfully, supported by renewed buying in AI-linked technology stocks and dip-buyers stepping in at key technical levels. However, futures suggest a cautious tone heading into the next session, reflecting uncertainty ahead of major earnings releases.

Asian markets also participated in the rebound, led by semiconductor and AI-infrastructure names. Japan’s Nikkei and South Korea’s Kospi showed strength, supported by ongoing enthusiasm surrounding AI hardware demand and global chip supply expansion.

Despite the rebound, market dispersion remains elevated. Large-cap tech continues to drive index movement, while defensive and value sectors show relative resilience. Investors are positioning carefully ahead of upcoming catalysts rather than aggressively chasing upside.

AI Sector Focus: Nvidia Earnings as a Risk Catalyst

The AI infrastructure theme remains the central driver of equity flows. Nvidia’s upcoming Q4 earnings report is viewed as a pivotal event that could influence not only semiconductor stocks but overall market risk appetite.

Expectations remain high for continued revenue growth driven by AI data center demand. However, guidance will be critical. A strong outlook could reignite broader tech momentum and support risk assets globally. Conversely, any sign of slowing AI capex or margin compression could pressure high-multiple tech names and spill into broader markets, including crypto.

Meanwhile, AMD has gained attention following a major multi-year AI GPU supply agreement with Meta Platforms. This deal signals sustained infrastructure build-out and diversification of AI chip suppliers, reinforcing that hardware remains at the center of the AI expansion cycle.

Tariffs and Macro Cross-Currents

Trade policy continues to weigh on sentiment. The newly implemented global tariff rate began at 10%, lower than the originally announced 15%, offering temporary relief. However, the potential escalation to 15% remains an overhang for global supply chains, trade-sensitive sectors, and emerging markets.

Consumer confidence has shown modest improvement from prior lows, but labor sentiment presents caution. More respondents indicate jobs are becoming harder to obtain, raising early concerns about employment stability despite broader economic resilience.

Central bank expectations remain fluid. Markets continue to price in potential rate adjustments later in the year, but policymakers face a delicate balance between inflation management and growth preservation. This uncertainty is contributing to elevated volatility across asset classes.

Cryptocurrency Market: Deep Correction, Testing Structural Support

Crypto markets remain under significant pressure. Bitcoin continues to trade within a critical support zone around the low-to-mid $60,000 range, reflecting a sharp year-to-date decline and nearly 50% drawdown from all-time highs. Ethereum is also struggling near major technical levels, with broader altcoins showing even weaker relative performance.

Heavy liquidations during peak volatility sessions amplified downside moves, reinforcing how sensitive crypto remains to macro-driven risk flows. The correlation between crypto and equities has strengthened during this phase, confirming that digital assets are trading as high-beta risk instruments rather than independent safe havens.

However, technical analysts note that price action is testing February lows. A sustained hold in this region could form the basis of a potential double-bottom structure, allowing for a relief rally if macro conditions stabilize. A breakdown below support would open the door to deeper retracement toward prior consolidation zones.

Sentiment indicators remain in extreme fear territory, historically associated with either capitulation phases or early stages of stabilization.

Market Outlook: What to Watch Next

The immediate focus is Nvidia’s earnings report, which may determine short-term direction for equities and risk appetite globally. Strong AI guidance could lift tech and indirectly support crypto. A disappointment could intensify volatility across markets.

Further tariff clarification will also be critical. Confirmation of escalation to 15% would likely renew risk-off positioning, while expanded exemptions could stabilize sentiment.

Upcoming macro data, labor signals, and central bank commentary will shape expectations for liquidity conditions heading into March.

Overall Market Pulse

Markets are balancing between stabilization and renewed downside risk.

Equities are attempting recovery, led by AI infrastructure stocks.

Crypto remains in a corrective structure, testing key support levels.

Tariff uncertainty and labor market caution continue to cloud the macro backdrop.

Volatility remains elevated, favoring disciplined and patient positioning.

The coming sessions could define whether this phase becomes a base-building consolidation or the prelude to another volatility spike.