# MajorStockIndexesPlunge

18.51K

U.S. stocks closed lower as risk appetite weakened, with crypto stocks also under pressure. Strategy (MSTR) fell over 7% in one day. How are you managing risk or finding opportunities in this pullback?

xxx40xxx

#CryptoMarketPullback

🧠 How to Position in This Market?

When fear is high, winners are not the fastest — they are the clearest thinkers.

The market is in Extreme Fear.

Price action is indecisive.

Volume is selective.

In this environment, positioning is not about trading more —

it’s about deciding who you are in the market.

① Position Your Mind First

The biggest mistake during fear phases:

➡️ Acting fast

➡️ Reacting emotionally

📌 Reality check:

If the market is uncertain, you cannot be aggressive.

Position size shrinks. Discipline expands.

② No Volume, No Strength

Price can rise.

But without

🧠 How to Position in This Market?

When fear is high, winners are not the fastest — they are the clearest thinkers.

The market is in Extreme Fear.

Price action is indecisive.

Volume is selective.

In this environment, positioning is not about trading more —

it’s about deciding who you are in the market.

① Position Your Mind First

The biggest mistake during fear phases:

➡️ Acting fast

➡️ Reacting emotionally

📌 Reality check:

If the market is uncertain, you cannot be aggressive.

Position size shrinks. Discipline expands.

② No Volume, No Strength

Price can rise.

But without

- Reward

- 59

- 53

- Repost

- Share

Seyyidetünnisa :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Early 2026 is rapidly evolving into a defining moment for global markets. What initially appeared as a routine equity pullback has escalated into a synchronized cross-asset repricing event, dragging stocks, bonds, and digital assets into the same volatility vortex. This is no longer a correction driven by earnings or valuation compression — it is a systemic response to macro uncertainty stacking all at once.

What makes this phase especially fragile is the absence of a clear stabilizer. Liquidity conditions are tightening, geopolitical signals are becoming more erratic

Early 2026 is rapidly evolving into a defining moment for global markets. What initially appeared as a routine equity pullback has escalated into a synchronized cross-asset repricing event, dragging stocks, bonds, and digital assets into the same volatility vortex. This is no longer a correction driven by earnings or valuation compression — it is a systemic response to macro uncertainty stacking all at once.

What makes this phase especially fragile is the absence of a clear stabilizer. Liquidity conditions are tightening, geopolitical signals are becoming more erratic

- Reward

- 5

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

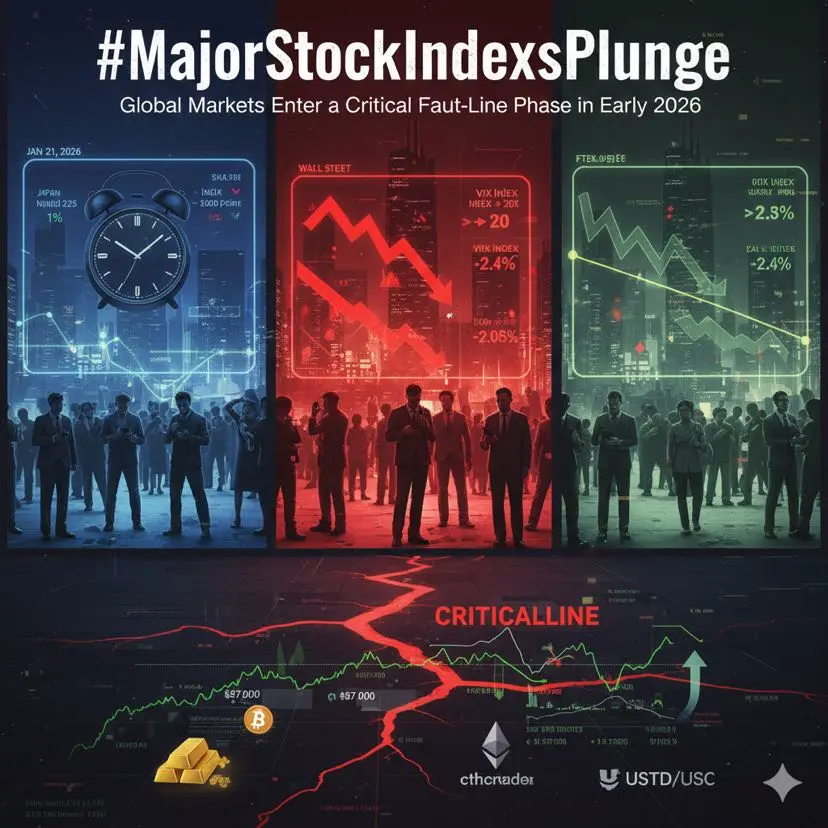

🌈🌈#MajorStockIndexesPlunge Global Markets Face a Fault-Line Moment in Early 2026

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.☘️

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Don

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.☘️

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Don

- Reward

- 2

- 8

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge Global Markets Face a Fault-Line Moment in Early 2026

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

- Reward

- 16

- 14

- Repost

- Share

LittleQueen :

:

Happy New Year! 🤑View More

#MajorStockIndexesPlunge

As of January 23, 2026 (early AM PKT), global financial markets are still processing one of the sharpest, geopolitically-driven sell-offs in months. On Tuesday, January 20, 2026, the Dow, S&P 500, and Nasdaq experienced their worst single-day declines since October 2025, with over $1.2 trillion wiped from the S&P 500 alone within hours. Volatility surged, with the VIX spiking to ~21, gold and silver hitting all-time highs around $4,689–$4,920, and risk assets, including Bitcoin and major altcoins, plunging before rebounding.

This episode highlights the classic “headli

As of January 23, 2026 (early AM PKT), global financial markets are still processing one of the sharpest, geopolitically-driven sell-offs in months. On Tuesday, January 20, 2026, the Dow, S&P 500, and Nasdaq experienced their worst single-day declines since October 2025, with over $1.2 trillion wiped from the S&P 500 alone within hours. Volatility surged, with the VIX spiking to ~21, gold and silver hitting all-time highs around $4,689–$4,920, and risk assets, including Bitcoin and major altcoins, plunging before rebounding.

This episode highlights the classic “headli

- Reward

- 34

- 23

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#MajorStockIndexesPlunge Global Markets Face a Fault-Line Moment in Early 2026

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

- Reward

- 2

- Comment

- Repost

- Share

#MajorStockIndexesPlunge

Major U.S. Stock Indexes Plunge Sharply Yusfirah’s Thoughts on Broader Market Volatility, Investor Sentiment, and Crypto Correlations

As I see it, the recent pullback in U.S. stock indexes represents more than just a one-day drop — it’s a reflection of weakening risk appetite across multiple asset classes, and the effects are being felt in crypto-linked equities and digital assets as well. For example, Strategy (MSTR) fell over 7% in one day, showing how closely crypto-adjacent stocks are tethered to broader equity sentiment. From my perspective, this environment offe

Major U.S. Stock Indexes Plunge Sharply Yusfirah’s Thoughts on Broader Market Volatility, Investor Sentiment, and Crypto Correlations

As I see it, the recent pullback in U.S. stock indexes represents more than just a one-day drop — it’s a reflection of weakening risk appetite across multiple asset classes, and the effects are being felt in crypto-linked equities and digital assets as well. For example, Strategy (MSTR) fell over 7% in one day, showing how closely crypto-adjacent stocks are tethered to broader equity sentiment. From my perspective, this environment offe

- Reward

- 9

- 9

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge Global Markets Enter a Critical Fault-Line Phase in Early 2026

Global financial markets are now moving through one of the most fragile moments of early 2026. What began as a sharp correction on Wall Street has rapidly transformed into a synchronized global sell-off, pushing Asia and Europe deep into negative territory. This is no longer a localized reaction — it is a structural stress test for the entire financial system.

The atmosphere across trading desks reflects more than fear. It reflects uncertainty about stability itself. As of January 21, 2026, markets are bein

Global financial markets are now moving through one of the most fragile moments of early 2026. What began as a sharp correction on Wall Street has rapidly transformed into a synchronized global sell-off, pushing Asia and Europe deep into negative territory. This is no longer a localized reaction — it is a structural stress test for the entire financial system.

The atmosphere across trading desks reflects more than fear. It reflects uncertainty about stability itself. As of January 21, 2026, markets are bein

- Reward

- 8

- 5

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#MajorStockIndexesPlunge Global Markets Face a Fault-Line Moment in Early 2026

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

- Reward

- 3

- 2

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

📉 Risk Appetite Fades — Crypto Stocks Under Pressure

U.S. stocks closed lower today as risk sentiment weakened, and crypto-related stocks didn’t escape the pressure. Notably, Strategy (MSTR) fell over 7% in a single session, highlighting the sharp swings in this sector.

🔍 What’s Driving the Move?

1️⃣ Macro caution: Rising trade concerns, rate expectations, and global uncertainty are weighing on risk assets.

2️⃣ Crypto correlation: Stocks tied to Bitcoin and other crypto are still high-beta — when BTC pulls back, these names often follow.

3️⃣ Positioning unwind: Shor

📉 Risk Appetite Fades — Crypto Stocks Under Pressure

U.S. stocks closed lower today as risk sentiment weakened, and crypto-related stocks didn’t escape the pressure. Notably, Strategy (MSTR) fell over 7% in a single session, highlighting the sharp swings in this sector.

🔍 What’s Driving the Move?

1️⃣ Macro caution: Rising trade concerns, rate expectations, and global uncertainty are weighing on risk assets.

2️⃣ Crypto correlation: Stocks tied to Bitcoin and other crypto are still high-beta — when BTC pulls back, these names often follow.

3️⃣ Positioning unwind: Shor

BTC-9,85%

- Reward

- 20

- 15

- Repost

- Share

Flower89 :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

91K Popularity

11.7K Popularity

385.66K Popularity

297 Popularity

41 Popularity

45 Popularity

29 Popularity

93 Popularity

37 Popularity

3.19K Popularity

10.34K Popularity

6.05K Popularity

18.27K Popularity

25.89K Popularity

22.4K Popularity

News

View MoreAmadeus Protocol acquires Bitte for $1.7 million

3 m

The current Bitcoin weekly oversold signal strength is comparable to June 2022.

11 m

Spot silver drops up to 15% intraday, crypto KOL CBB establishes a 16.6 million long position to buy the dip in silver

12 m

Bitcoin plummet triggers crypto market panic: $2.7 billion leveraged liquidations, sentiment index drops to 9, hitting multi-year lows

14 m

Data: A total of 616,011.3 SOL transferred to anonymous addresses, worth approximately $482 million.

15 m

Pin