# CryptoMarketPullback

350.47K

Trade concerns have pushed BTC and major altcoins lower, weakening short-term risk appetite. Is this a defensive phase, or a setup for the next rebound?

MrFlower_XingChen

#CryptoMarketPullback As of January 22, 2026, the crypto market is undergoing a noticeable pullback following several weeks of elevated volatility and strong upside momentum. While corrections often trigger uncertainty among short-term participants, pullbacks remain a natural and necessary phase within healthy market cycles.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

After recent rallies across major assets — including Bitcoin, Ethereum, and high-beta altcoins — profit-taking has increased as traders reassess exposure amid shifting macroeconomic signals and changing liquidity conditions.

This retracement is not occurring in isolation.

- Reward

- 17

- 22

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#CryptoMarketPullback #CryptoMarketPullback

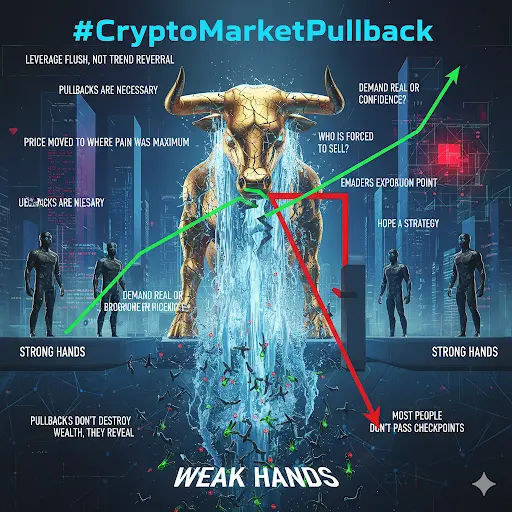

Let’s kill the lie first:

This pullback did not happen because the market “suddenly turned weak.”

It happened because too many traders believed price only goes up once a narrative feels safe.

That’s how markets trap crowds.

Every strong trend needs a reset. Not for technical beauty — but for capital control. When leverage stacks, when funding stretches, when late money piles in without a plan, the market doesn’t reward it. It cleans it.

This pullback is a leverage flush, not a trend reversal.

And if you can’t tell the difference, you shouldn’t be tra

Let’s kill the lie first:

This pullback did not happen because the market “suddenly turned weak.”

It happened because too many traders believed price only goes up once a narrative feels safe.

That’s how markets trap crowds.

Every strong trend needs a reset. Not for technical beauty — but for capital control. When leverage stacks, when funding stretches, when late money piles in without a plan, the market doesn’t reward it. It cleans it.

This pullback is a leverage flush, not a trend reversal.

And if you can’t tell the difference, you shouldn’t be tra

- Reward

- 4

- 2

- Repost

- Share

Yunna :

:

buy to earnView More

#加密市场回调 The cryptocurrency market is showing renewed correction pressure today, with Bitcoin slipping below key support levels and broader risk-off sentiment emerging. As of the latest trading sessions, Bitcoin is trading around the mid‑$80,000s to low‑$90,000s, struggling to hold above psychological thresholds as traders reassess risk in the face of macro uncertainty and profit‑taking pressure.

At the same time, Ethereum is also under pressure, trading near the $2,900–$3,000 range, reflecting weakening momentum in the second‑largest digital asset. This dynamic has reverberated across altcoins

At the same time, Ethereum is also under pressure, trading near the $2,900–$3,000 range, reflecting weakening momentum in the second‑largest digital asset. This dynamic has reverberated across altcoins

- Reward

- 8

- 14

- Repost

- Share

MissCrypto :

:

1000x VIbes 🤑View More

#加密市场回调 The cryptocurrency market is showing renewed correction pressure today, with Bitcoin slipping below key support levels and broader risk-off sentiment emerging. As of the latest trading sessions, Bitcoin is trading around the mid‑$80,000s to low‑$90,000s, struggling to hold above psychological thresholds as traders reassess risk in the face of macro uncertainty and profit‑taking pressure.

At the same time, Ethereum is also under pressure, trading near the $2,900–$3,000 range, reflecting weakening momentum in the second‑largest digital asset. This dynamic has reverberated across altcoins

At the same time, Ethereum is also under pressure, trading near the $2,900–$3,000 range, reflecting weakening momentum in the second‑largest digital asset. This dynamic has reverberated across altcoins

- Reward

- 2

- Comment

- Repost

- Share

Grayscale Keeps the Faith in NEAR Despite the Dip – A New ETF Application Signals Strong Belief**

You know, I've been following the crypto space closely, and the recent news from Grayscale has really caught my attention. They've just filed with the SEC for a NEAR Protocol spot ETF, and it's quite a statement considering the overall market conditions.

It’s been a rough ride for NEAR, like so many altcoins. Remember the hype around AI in 2022? NEAR shot up to around $20. But then the bear market hit hard, and it plummeted – we’re talking a drop of over 90%! It's been bouncing around the $1.50 to

You know, I've been following the crypto space closely, and the recent news from Grayscale has really caught my attention. They've just filed with the SEC for a NEAR Protocol spot ETF, and it's quite a statement considering the overall market conditions.

It’s been a rough ride for NEAR, like so many altcoins. Remember the hype around AI in 2022? NEAR shot up to around $20. But then the bear market hit hard, and it plummeted – we’re talking a drop of over 90%! It's been bouncing around the $1.50 to

- Reward

- 63

- 58

- Repost

- Share

GateUser-c3c7f5a1 :

:

Grayscale maintains confidence in NEAR despite the price decline—A new ETF application shows strong conviction** You know, I have been closely following the cryptocurrency space, recently

The exchange is known for its ETFs and ETPs. This is an important step.

What’s more interesting is that Grayscale in BNB and HYPE

View More

🇯🇵 Japan Bond Market Shock: A Liquidity Event With Global Consequences

Japan’s government bond market has just experienced an extraordinary shock.

Long-term Japanese Government Bond (JGB) yields surged at a pace not seen since 2003.

The 30-year yield jumped more than 30 basis points to ~3.9%, marking a 27-year high — a move so extreme that officials described it as a six-standard-deviation event.

This was not a routine sell-off.

It was a liquidity breakdown.

📉 What Happened

The disruption began around January 20–21

Buyers stepped aside, causing bond prices to collapse

Liquidity dried up com

Japan’s government bond market has just experienced an extraordinary shock.

Long-term Japanese Government Bond (JGB) yields surged at a pace not seen since 2003.

The 30-year yield jumped more than 30 basis points to ~3.9%, marking a 27-year high — a move so extreme that officials described it as a six-standard-deviation event.

This was not a routine sell-off.

It was a liquidity breakdown.

📉 What Happened

The disruption began around January 20–21

Buyers stepped aside, causing bond prices to collapse

Liquidity dried up com

- Reward

- 41

- 47

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch #CryptoMarketPullback

📉 The market is cooling off — and this is a healthy pause, not a warning sign.

Following the strong momentum seen earlier in January, Bitcoin, Ethereum, and leading altcoins are now moving into consolidation. This phase looks less like panic and more like a reset of positioning and leverage.

🔍 What stands out right now:

Bitcoin is stabilizing within a key demand range, flushing out late entries and excess leverage

Ethereum continues to defend higher support levels, showing resilience rather than weakness

Altcoins remain selective, with certain names q

📉 The market is cooling off — and this is a healthy pause, not a warning sign.

Following the strong momentum seen earlier in January, Bitcoin, Ethereum, and leading altcoins are now moving into consolidation. This phase looks less like panic and more like a reset of positioning and leverage.

🔍 What stands out right now:

Bitcoin is stabilizing within a key demand range, flushing out late entries and excess leverage

Ethereum continues to defend higher support levels, showing resilience rather than weakness

Altcoins remain selective, with certain names q

- Reward

- 10

- 10

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

#CryptoMarketPullback #CryptoMarketPullback

📉 Crypto is taking a breather, and this is exactly what smart traders expect.

After early January highs, Bitcoin, Ethereum, and major altcoins are consolidating. This pullback isn’t fear — it’s structure resetting leverage.

💡 Key Observations:

• BTC: Retraced to $88,000 – $93,000, clearing liquidations and weak hands.

• ETH: Oscillating near $3,300 – $3,350, holding higher lows.

• Altcoins: Mixed performance, some showing early signs of accumulation.

Why this matters:

• Institutional inflows continue quietly, supporting the floor.

• Volatility is t

📉 Crypto is taking a breather, and this is exactly what smart traders expect.

After early January highs, Bitcoin, Ethereum, and major altcoins are consolidating. This pullback isn’t fear — it’s structure resetting leverage.

💡 Key Observations:

• BTC: Retraced to $88,000 – $93,000, clearing liquidations and weak hands.

• ETH: Oscillating near $3,300 – $3,350, holding higher lows.

• Altcoins: Mixed performance, some showing early signs of accumulation.

Why this matters:

• Institutional inflows continue quietly, supporting the floor.

• Volatility is t

- Reward

- 13

- 17

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

Crypto Market Pullback: Defensive Phase, Structural Correction, or Setup for the Next Bull Run?

The crypto market has recently experienced a notable pullback, with Bitcoin and major altcoins retreating amid rising trade concerns, geopolitical tensions, and shifts in risk sentiment. Short-term risk appetite has weakened, prompting both retail and institutional investors to reassess positions and recalibrate strategies.

While some see this as a defensive phase, others warn of a potential larger structural correction. Understanding the dynamics at play is critical for anyon

Crypto Market Pullback: Defensive Phase, Structural Correction, or Setup for the Next Bull Run?

The crypto market has recently experienced a notable pullback, with Bitcoin and major altcoins retreating amid rising trade concerns, geopolitical tensions, and shifts in risk sentiment. Short-term risk appetite has weakened, prompting both retail and institutional investors to reassess positions and recalibrate strategies.

While some see this as a defensive phase, others warn of a potential larger structural correction. Understanding the dynamics at play is critical for anyon

- Reward

- 15

- 21

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#CryptoMarketPullback

The market started 2026 strong: BTC briefly topped ~$95K–$98K on ETF inflows, pro-crypto policy hype (CLARITY Act, Strategic Bitcoin Reserve talk), and institutional momentum.

But since mid-January, it's pulled back sharply — BTC down from highs near $98K to lows around $87K–$88K, now stabilizing ~$89K–$90K.

Broader market: 92/100 top coins red in recent 24h periods; altcoins hit harder (ETH -5%+ to ~$2,965–$3,000, SOL/XRP following suit).

Sentiment flipped: Fear & Greed Index back in "fear" zone; options pricing in ~30% chance BTC dips below $80K by late June (downside

The market started 2026 strong: BTC briefly topped ~$95K–$98K on ETF inflows, pro-crypto policy hype (CLARITY Act, Strategic Bitcoin Reserve talk), and institutional momentum.

But since mid-January, it's pulled back sharply — BTC down from highs near $98K to lows around $87K–$88K, now stabilizing ~$89K–$90K.

Broader market: 92/100 top coins red in recent 24h periods; altcoins hit harder (ETH -5%+ to ~$2,965–$3,000, SOL/XRP following suit).

Sentiment flipped: Fear & Greed Index back in "fear" zone; options pricing in ~30% chance BTC dips below $80K by late June (downside

- Reward

- 1

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

8.82K Popularity

71.06K Popularity

27.66K Popularity

9.58K Popularity

9.53K Popularity

8.58K Popularity

7.84K Popularity

7.69K Popularity

74.06K Popularity

20.72K Popularity

81.18K Popularity

23.26K Popularity

49.51K Popularity

43.47K Popularity

196.6K Popularity

News

View More"Maqi" increased position and went long on HYPE to $8.1 million, with an unrealized profit of $1.1 million.

7 m

Bitwise Report: By Q4 2025, corporate Bitcoin holdings will reach 1.1 million coins, with 19 new publicly listed companies buying in

18 m

Former Revolut project leader Bleap completes $6 million seed funding round

24 m

1inch denies team and treasury selling tokens, plans to review the tokenomics model this year

37 m

BTC breaks through 90,000 USDT

37 m

Pin