# ETH$ETH

126K

LittleQueen

#ETH$ETH Overall, Ethereum still remains within the predicted range over the past few days. The long entry points provided during this period have yielded some profit. Trading long during this time has been relatively less comfortable, so remember to take profits and set stop-losses defensively (around 20 points profit before acting). Personally, I still prefer to mainly go long, but of course, if it rebounds to yesterday's high, you can set a good stop-loss and consider a short. Below are some reference points based on my analysis; use them as a guide, not as investment advice. You can enter

ETH-4,86%

- Reward

- 4

- 7

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

#ETH$ETH Overall, Ethereum still remains within the predicted range over the past few days. The long entry points provided during this period have yielded some profit. Trading long during this time has been relatively less comfortable, so remember to take profits and set stop-losses defensively (around 20 points profit before acting). Personally, I still prefer to mainly go long, but of course, if it rebounds to yesterday's high, you can set a good stop-loss and consider a short. Below are some reference points based on my analysis; use them as a guide, not as investment advice. You can enter

ETH-4,86%

- Reward

- like

- Comment

- Repost

- Share

As of February 3, 2026, Ethereum (ETH) is navigating a volatile recovery phase. After a sharp January decline to the $2,100–$2,200 zone, the price has stabilized around $2,310–$2,350. While on-chain activity remains at record highs, macro pressures like gold's dominance and regulatory uncertainty are currently capping immediate gains.

Possible Next Move

The short-term trend is a cautious rebound. Analysts suggest that if ETH can decisively break and hold above the $2,396 level, it could trigger a "Change of Character"

(CHoCH), leading to a rally toward $2,600 and eventually $2,800. However, fa

Possible Next Move

The short-term trend is a cautious rebound. Analysts suggest that if ETH can decisively break and hold above the $2,396 level, it could trigger a "Change of Character"

(CHoCH), leading to a rally toward $2,600 and eventually $2,800. However, fa

ETH-4,86%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

Thank you for the helpful and accurate information.#ETH$ETH

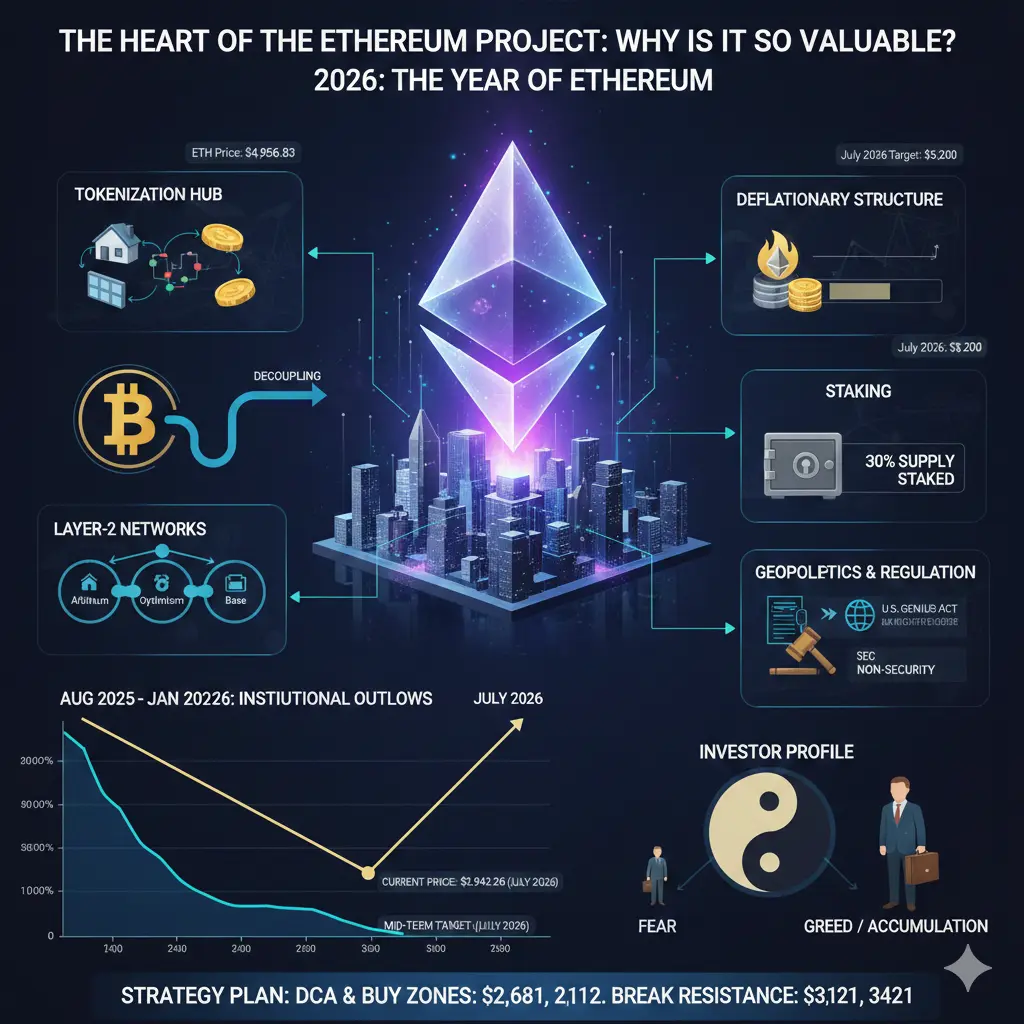

The Heart of the Ethereum Project: Why Is It So Valuable?

Ethereum is the "World’s Computer," hosting thousands of applications. What makes it valuable is not just its price, but the smart contracts within it. In 2026, Ethereum stands out as:

- Center of Tokenization: The main platform where banks and companies digitize real-world assets (real estate, stocks).

- Deflationary Structure: ETH is burned with each transaction. This reduces supply over time, and with demand increasing, the price remains under natural upward pressure.

2. What Drives Ethereum?

ETH is known in the mark

The Heart of the Ethereum Project: Why Is It So Valuable?

Ethereum is the "World’s Computer," hosting thousands of applications. What makes it valuable is not just its price, but the smart contracts within it. In 2026, Ethereum stands out as:

- Center of Tokenization: The main platform where banks and companies digitize real-world assets (real estate, stocks).

- Deflationary Structure: ETH is burned with each transaction. This reduces supply over time, and with demand increasing, the price remains under natural upward pressure.

2. What Drives Ethereum?

ETH is known in the mark

ETH-4,86%

- Reward

- 96

- 97

- Repost

- Share

alex19x :

:

2026 GOGOGO 👊View More

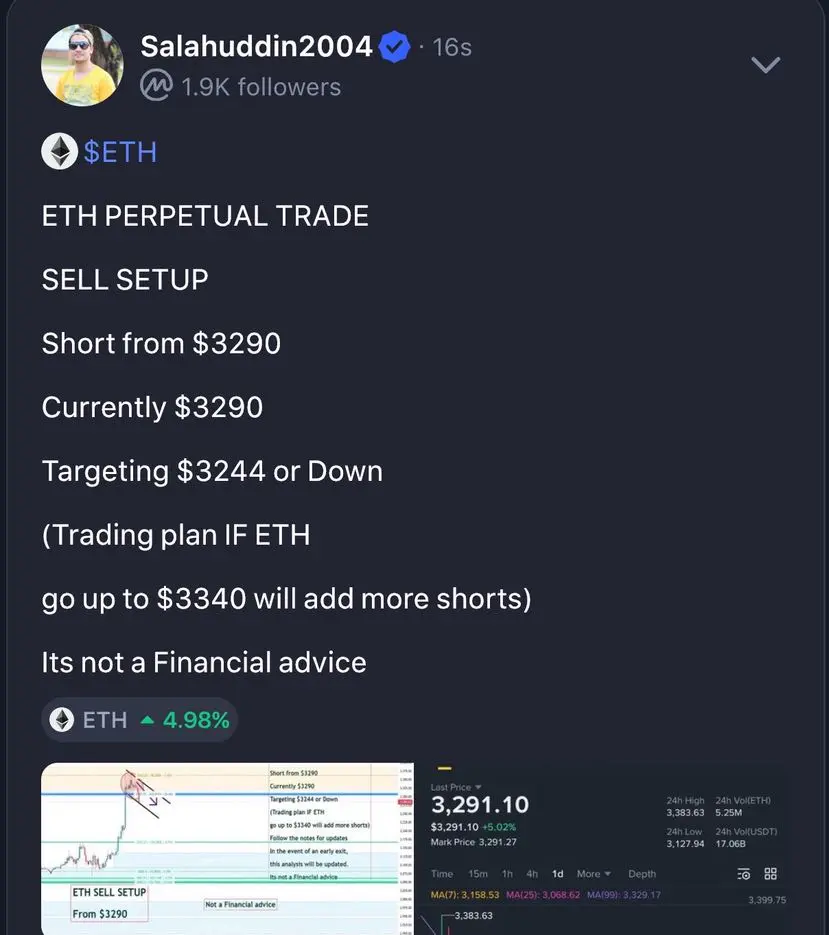

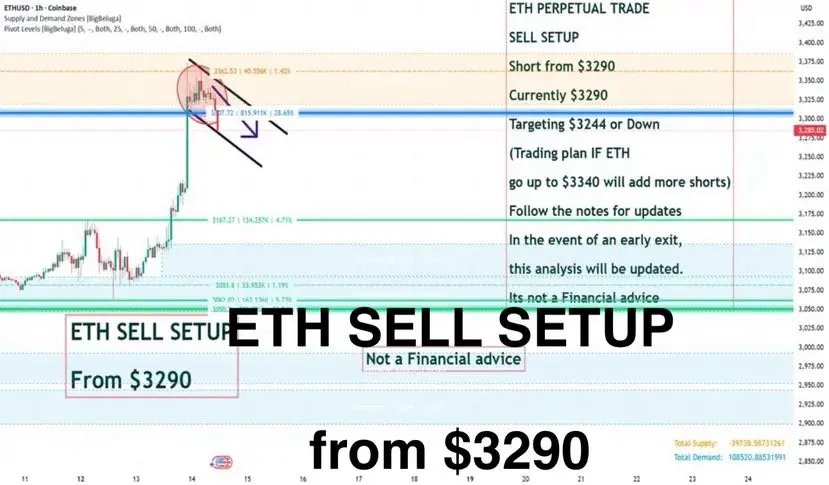

ETH PERPETUAL TRADE

SELL SETUP

Short from $3290

Currently $3290

Targeting $3244 or Down

(Trading plan IF ETH

go up to $3340 will add more shorts)

Its not a Financial advice

#GateTradFiIsLive #eth #ETH$ETH #SALAHUDDIN2004 #GeopoliticalRiskImpact

$ETH $BTC $XRP

SELL SETUP

Short from $3290

Currently $3290

Targeting $3244 or Down

(Trading plan IF ETH

go up to $3340 will add more shorts)

Its not a Financial advice

#GateTradFiIsLive #eth #ETH$ETH #SALAHUDDIN2004 #GeopoliticalRiskImpact

$ETH $BTC $XRP

- Reward

- 1

- Comment

- Repost

- Share

#ETH$ETH Overall, Ethereum still remains within the predicted range over the past few days. The long entry points provided during this period have yielded some profit. Trading long during this time has been relatively less comfortable, so remember to take profits and set stop-losses defensively (around 20 points profit before acting). Personally, I still prefer to mainly go long, but of course, if it rebounds to yesterday's high, you can set a good stop-loss and consider a short. Below are some reference points based on my analysis; use them as a guide, not as investment advice. You can enter

ETH-4,86%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$18.65KHolders:400

100.00%

- Reward

- 3

- 7

- Repost

- Share

LittleGodOfWealthPlutus :

:

2026 Prosperity Prosperity😘View More

#ETH$ETH Real-time Strategy

Daily free sharing of Bitcoin and altcoin strategies

Follow us so you don't get lost, brothers

$ETH Bullish

Above 2950

Take profit around 2980-3060

If it continues to fall, consider adding positions around 2935

Stop loss at 2920

Please share the Bitcoin and altcoin strategies daily

Follow us so you don't get lost, brothers

Daily free sharing of Bitcoin and altcoin strategies

Follow us so you don't get lost, brothers

Daily free sharing of Bitcoin and altcoin strategies

Follow us so you don't get lost, brothers

$ETH Bullish

Above 2950

Take profit around 2980-3060

If it continues to fall, consider adding positions around 2935

Stop loss at 2920

Please share the Bitcoin and altcoin strategies daily

Follow us so you don't get lost, brothers

Daily free sharing of Bitcoin and altcoin strategies

Follow us so you don't get lost, brothers

ETH-4,86%

- Reward

- 3

- 3

- Repost

- Share

AutumnWindEth :

:

Short-term bullish, brothers. The trend is still bearish.View More

Short-term bullish momentum is exhausted, with strong resistance around 3055.

A further rally requires breaking through the key resistance level.

Below, 2990-2970 serves as short-term support; a break below could lead to a downward trend.

Currently, gold has reached the first target of 5200 points.

Aggressive traders can consider short positions; 5400 depends on news and related geopolitical influences.

View OriginalA further rally requires breaking through the key resistance level.

Below, 2990-2970 serves as short-term support; a break below could lead to a downward trend.

Currently, gold has reached the first target of 5200 points.

Aggressive traders can consider short positions; 5400 depends on news and related geopolitical influences.

- Reward

- 1

- Comment

- Repost

- Share

The two-basket strategy remains clear: use the rebound as an opportunity, with a bearish trend as the main line.

Driven by last night's US stock market sentiment, prices quickly surged to around 2950 during the session, but the upward momentum failed to continue, and then retreated to around 2885. During the early morning hours, bulls and bears repeatedly tugged, and currently, the price has returned above 2920 for consolidation.

From the 4-hour structure, the previous dip found effective support at around 2785, triggering a short-term bullish rebound, with the price returning above the midlin

Driven by last night's US stock market sentiment, prices quickly surged to around 2950 during the session, but the upward momentum failed to continue, and then retreated to around 2885. During the early morning hours, bulls and bears repeatedly tugged, and currently, the price has returned above 2920 for consolidation.

From the 4-hour structure, the previous dip found effective support at around 2785, triggering a short-term bullish rebound, with the price returning above the midlin

ETH-4,86%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

65.14K Popularity

88 Popularity

92 Popularity

136 Popularity

100 Popularity

104 Popularity

108 Popularity

112 Popularity

13.83K Popularity

9.44K Popularity

28.29K Popularity

11.15K Popularity

23.16K Popularity

20.15K Popularity

213.09K Popularity

News

View MoreU.S. XRP Spot ETF experienced a total net inflow of $4.83 million in a single day.

7 m

Feltsense completes $5.1 million funding round, with moltbook founders and others participating

7 m

European major stock index futures generally decline, with the STOXX 50 index down 0.3%

9 m

Crypto KOL CBB takes a $9 million on-chain US stock short profit, with holdings previously focused on the storage sector, which led the decline today.

10 m

RootData: APT will unlock tokens worth approximately $13.34 million in one week

11 m

Pin