# eTh

23.83M

小木论

1.25 Sunday Bitcoin and Ethereum Afternoon Analysis

Bitcoin today is around 89,000, without a significant drop.

Overall, this short-term rapid decline is still a shakeout; you can consider short-term trading.

Bitcoin around 89,000, watch for 88,000

Ethereum around 2960, watch for 2900

#BTC #ETH #BNB

View OriginalBitcoin today is around 89,000, without a significant drop.

Overall, this short-term rapid decline is still a shakeout; you can consider short-term trading.

Bitcoin around 89,000, watch for 88,000

Ethereum around 2960, watch for 2900

#BTC #ETH #BNB

- Reward

- 6

- Comment

- Repost

- Share

1.24 Saturday Bitcoin and Ethereum Midday Analysis

In the short term, after continuous upward movement, the momentum has weakened, and the validity of the upper pressure zone has been further confirmed. It is expected that there will be no effective breakthrough in the short term. Market participation tends to be relatively light over the weekend, and the trend is likely to be dominated by oscillation and consolidation, so focus on short-term trades.

Bitcoin around 90200 watch near 89500

Ethereum around 2980 watch near 2920

#BTC #ETH #BNB

View OriginalIn the short term, after continuous upward movement, the momentum has weakened, and the validity of the upper pressure zone has been further confirmed. It is expected that there will be no effective breakthrough in the short term. Market participation tends to be relatively light over the weekend, and the trend is likely to be dominated by oscillation and consolidation, so focus on short-term trades.

Bitcoin around 90200 watch near 89500

Ethereum around 2980 watch near 2920

#BTC #ETH #BNB

- Reward

- 6

- Comment

- Repost

- Share

ZEC's Largest Short Position Partially Closes ETH Short

On January 24, a notable address known for its significant short position on ZEC executed a partial profit-taking on its ETH short position. According to BlockBeats On-chain Detection, the address reduced its ETH short by 1,055.93 ETH. Despite this reduction, the ETH short position remains substantial, valued at $118.7 million, with a current floating profit of approximately $11.04 million.

The address gained recognition for establishing a large short position on ZEC, initially shorting from $184. After incurring a floating loss of $21 mi

On January 24, a notable address known for its significant short position on ZEC executed a partial profit-taking on its ETH short position. According to BlockBeats On-chain Detection, the address reduced its ETH short by 1,055.93 ETH. Despite this reduction, the ETH short position remains substantial, valued at $118.7 million, with a current floating profit of approximately $11.04 million.

The address gained recognition for establishing a large short position on ZEC, initially shorting from $184. After incurring a floating loss of $21 mi

ETH-0,62%

- Reward

- 1

- 1

- Repost

- Share

Miwhu_ :

:

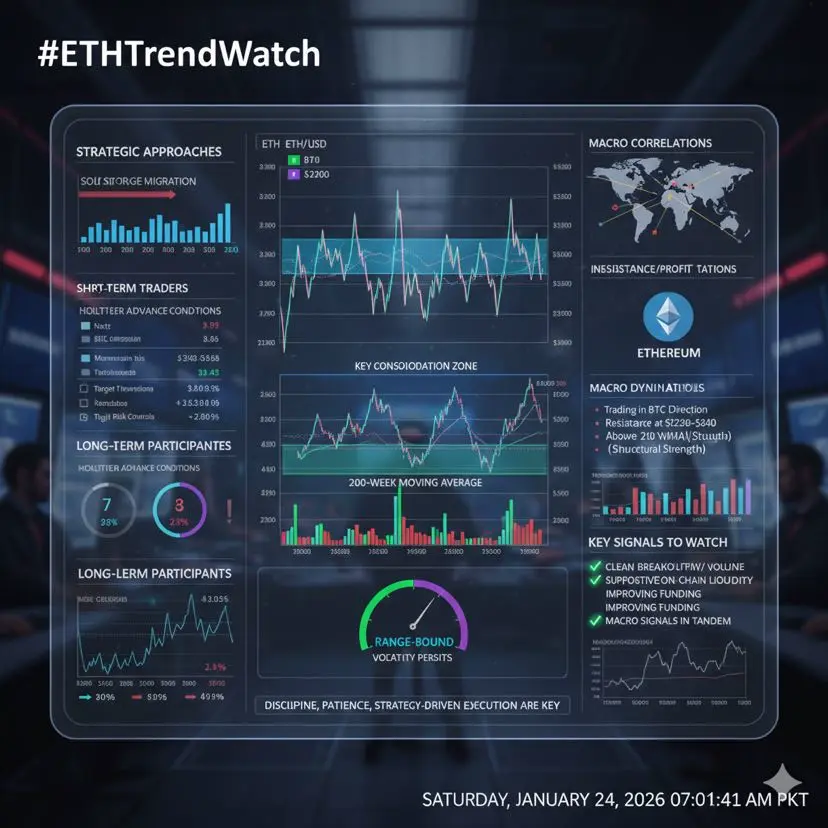

Happy New Year! 🤑🔥 #ETHTrendWatch | Ethereum in Consolidation Mode

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

- Reward

- 1

- Comment

- Repost

- Share

Analyst Says Ethereum Lacks Aggressive Buying Despite Holding Key Demand Zone

Ethereum is showing signs of structural weakness as recent price rebounds appear corrective rather than impulsive, according to crypto analyst CyrilXBT.

In a post on X, CyrilXBT noted that while Ether (ETH) remains positioned within a higher-timeframe demand zone, market behavior suggests a lack of aggressive buying interest. The absence of strong bid-side momentum typically indicates that traders are not yet ready to increase risk exposure.

“Price is bouncing, but the structure is corrective — not impulsive,” the an

Ethereum is showing signs of structural weakness as recent price rebounds appear corrective rather than impulsive, according to crypto analyst CyrilXBT.

In a post on X, CyrilXBT noted that while Ether (ETH) remains positioned within a higher-timeframe demand zone, market behavior suggests a lack of aggressive buying interest. The absence of strong bid-side momentum typically indicates that traders are not yet ready to increase risk exposure.

“Price is bouncing, but the structure is corrective — not impulsive,” the an

ETH-0,62%

- Reward

- 2

- 3

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH-0,62%

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Ethereum Poised to Benefit from Asset Tokenization, Says Liquid Capital Founder

On January 24, Liquid Capital founder Yi Lihua shared insights from BlackRock's 2026 thematic outlook report, highlighting Ethereum's potential as a key beneficiary of asset tokenization.

Approximately 65% of tokenized assets are currently deployed on the Ethereum network.

Yi Lihua emphasized that the globalization of stablecoins and the integration of finance onto blockchain are significant opportunities for Ethereum. He noted that short-term fluctuations are a normal part of the process, and his recent efforts h

On January 24, Liquid Capital founder Yi Lihua shared insights from BlackRock's 2026 thematic outlook report, highlighting Ethereum's potential as a key beneficiary of asset tokenization.

Approximately 65% of tokenized assets are currently deployed on the Ethereum network.

Yi Lihua emphasized that the globalization of stablecoins and the integration of finance onto blockchain are significant opportunities for Ethereum. He noted that short-term fluctuations are a normal part of the process, and his recent efforts h

ETH-0,62%

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

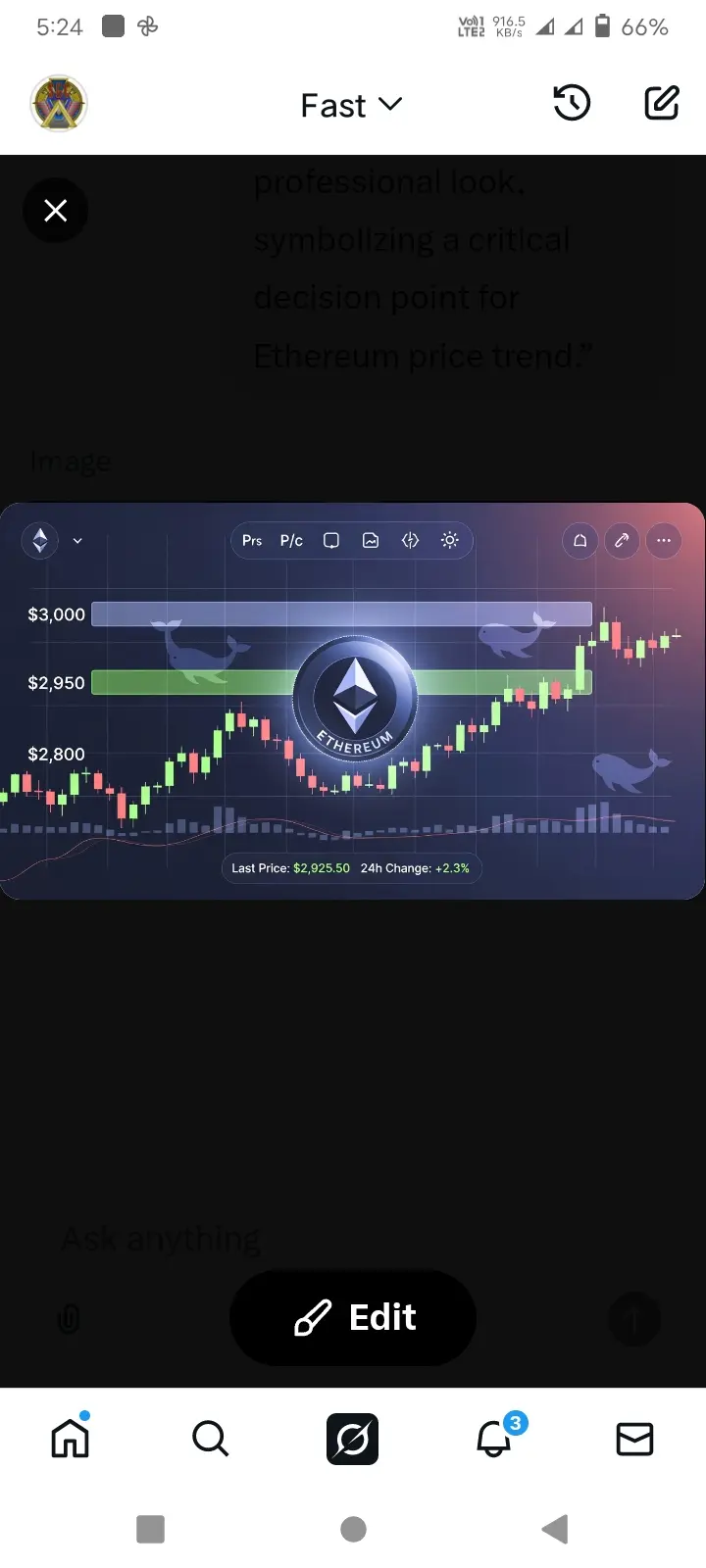

#ETHTrendWatch

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

ETH-0,62%

- Reward

- 7

- 5

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

🚨 #ETHTrendWatch – Ethereum Market Structure Update 🚨

Ethereum is currently in a compression phase — volatility exists, but directional conviction is limited. Price is rotating within a defined range, showing positioning, not momentum.

📊 Key Levels:

Support: ~$3,000 ✅ Buyers active on pullbacks

Resistance: Mid-$3,000s ✅ Sellers defending higher levels

💡 Technical Takeaways:

Price remains above the 200-week MA, preserving the broader bullish framework

Volume spikes near support → accumulation

Volume thins near resistance → profit-taking, capped rallies

Range-bound market suggests energy is

Ethereum is currently in a compression phase — volatility exists, but directional conviction is limited. Price is rotating within a defined range, showing positioning, not momentum.

📊 Key Levels:

Support: ~$3,000 ✅ Buyers active on pullbacks

Resistance: Mid-$3,000s ✅ Sellers defending higher levels

💡 Technical Takeaways:

Price remains above the 200-week MA, preserving the broader bullish framework

Volume spikes near support → accumulation

Volume thins near resistance → profit-taking, capped rallies

Range-bound market suggests energy is

ETH-0,62%

- Reward

- 1

- 1

- Repost

- Share

repanzal :

:

Happy New Year! 🤑Whale Transfers 1,999 ETH to Exchange Amid Potential Losses

A cryptocurrency whale has transferred 1,999 ETH, valued at $5.92 million, to an exchange. According to NS3 AI, this move comes after the whale initially purchased 6,411 ETH last year at approximately $3,873 each. Selling at current market prices could lead to a loss of around $1.8 million. Despite this transaction, the whale retains 3,803 ETH.

#ETH #AI $ETH

A cryptocurrency whale has transferred 1,999 ETH, valued at $5.92 million, to an exchange. According to NS3 AI, this move comes after the whale initially purchased 6,411 ETH last year at approximately $3,873 each. Selling at current market prices could lead to a loss of around $1.8 million. Despite this transaction, the whale retains 3,803 ETH.

#ETH #AI $ETH

ETH-0,62%

- Reward

- 2

- 1

- Repost

- Share

Miwhu_ :

:

Happy New Year! 🤑Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

68.03K Popularity

42.57K Popularity

35.58K Popularity

13.54K Popularity

28.73K Popularity

20.49K Popularity

16.9K Popularity

86.06K Popularity

45.87K Popularity

26.68K Popularity

16.52K Popularity

5.52K Popularity

262.27K Popularity

26.61K Popularity

184.41K Popularity

News

View Morea16z Crypto: The security focus of public chains like BTC and ETH should be on protocols and governance, and there is no need to blindly follow switching to quantum-resistant attack solutions.

8 m

Michael Saylor releases Bitcoin Tracker information again; increased holdings data may be disclosed next week.

41 m

OCC: The procedural review of WLFI's application for a banking license will remain non-political

1 h

Alchemy Pay obtains Nebraska MTL license, expanding the compliant map in the United States to 14 states

1 h

Data: In 2025, stablecoins on Ethereum generated approximately $5 billion in revenue, with the supply increasing by about $50 billion.

2 h

Pin