Aguofthe

No content yet

Aguofthe

ODDS THE U.S. GOVERNMENT SHUTS DOWN THIS SATURDAY NEARS 80%

WOULD MARK THE FOURTH SHUTDOWN IN TRUMPS PRESIDENCY

WOULD MARK THE FOURTH SHUTDOWN IN TRUMPS PRESIDENCY

- Reward

- like

- Comment

- Repost

- Share

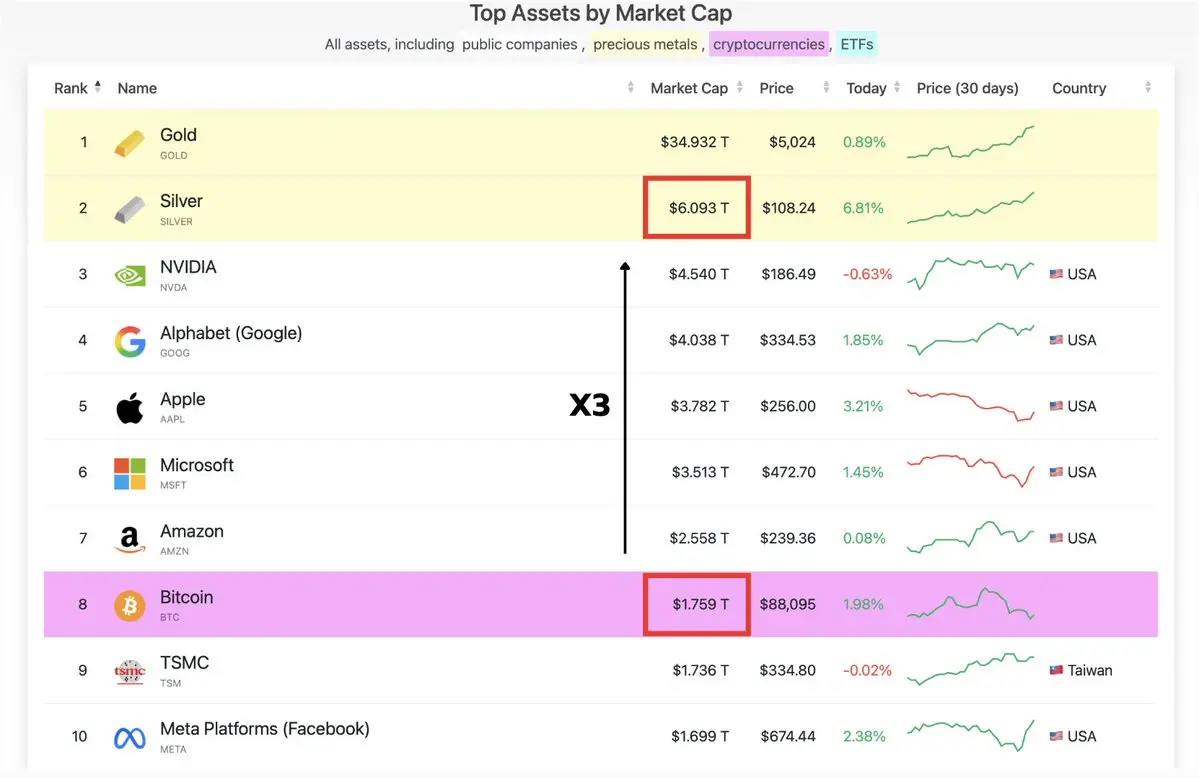

#Silver is now more than 3X the market cap of Bitcoin.

$SLVON $BTC

#GoldandSilverHitNewHighs

#BitcoinFallsBehindGold

$SLVON $BTC

#GoldandSilverHitNewHighs

#BitcoinFallsBehindGold

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Bitmine's shareholders have approved a proposal to expand its authorized shares, giving the Ethereum treasury firm the option to issue new equity to potentially fund more $ETH purchases.

#CryptoMarketWatch

#CryptoMarketWatch

ETH2,33%

- Reward

- like

- Comment

- Repost

- Share

Denmark's Foreign Minister announced that they have rejected US President Donald Trump's request for negotiations regarding the takeover of Greenland.

#TariffTensionsHitCryptoMarket

#TariffTensionsHitCryptoMarket

- Reward

- like

- Comment

- Repost

- Share

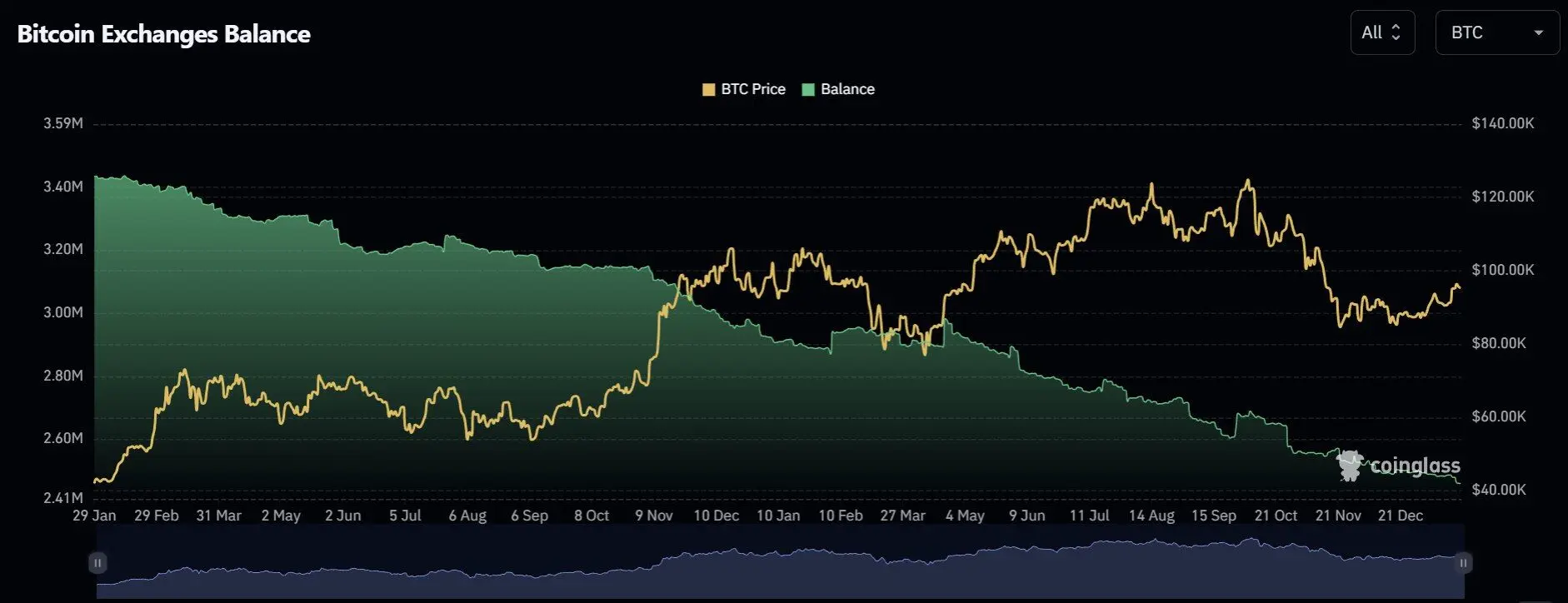

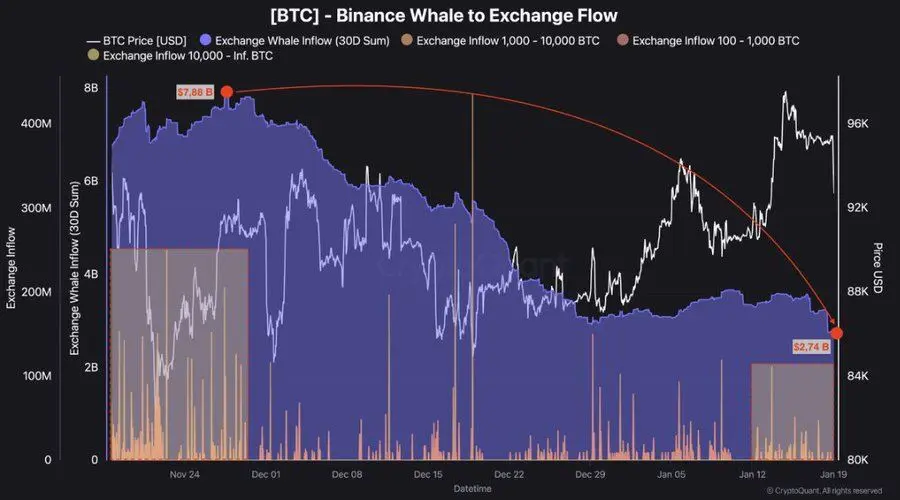

Whale selling pressure has sharply declined, with $BTC inflows to exchanges falling roughly 3x from late November levels, signaling large holders are no longer aggressively selling during the current consolidation phase.

#BTCMarketAnalysis

#BTCMarketAnalysis

BTC0,87%

- Reward

- like

- Comment

- Repost

- Share

$BTC Rejecting from its bull market support band on this first retest.

Price is still in relatively close proximity, but for this to properly turn around, the bulls need to get a weekly close back above at some point.

#BTCMarketAnalysis

Price is still in relatively close proximity, but for this to properly turn around, the bulls need to get a weekly close back above at some point.

#BTCMarketAnalysis

BTC0,87%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin options open interest hit $74.1B, surpassing futures at $65.2B for the first time, signaling a shift toward structured risk strategies.

$BTC

#BTCMarketAnalysis

$BTC

#BTCMarketAnalysis

BTC0,87%

- Reward

- like

- Comment

- Repost

- Share

This morning:

- Trump's imposition of a 10% additional tariff on European countries sending troops to Greenland led to new record highs in gold and silver: $4690 and $94 per ounce, respectively.

- Another important piece of news: The US aircraft carrier Abraham Lincoln is approaching the Persian Gulf. Oil prices are currently stable.

- Stock markets are falling amid increased risk: US and European futures fell by about 1%, with a limited recovery seen in Asia. Bitcoin fell by 2.5%. The US is closed today due to a public holiday. A rise in defense stocks worldwide this week would not be surp

- Trump's imposition of a 10% additional tariff on European countries sending troops to Greenland led to new record highs in gold and silver: $4690 and $94 per ounce, respectively.

- Another important piece of news: The US aircraft carrier Abraham Lincoln is approaching the Persian Gulf. Oil prices are currently stable.

- Stock markets are falling amid increased risk: US and European futures fell by about 1%, with a limited recovery seen in Asia. Bitcoin fell by 2.5%. The US is closed today due to a public holiday. A rise in defense stocks worldwide this week would not be surp

XAUT4,78%

- Reward

- like

- Comment

- Repost

- Share

Coins to be unlocked this week:

$ZRO ~24.7 million units and $42.5M (2.47% of total supply) Tuesday, January 20

$PLUME ~1.37 billion units and $23M (39.75% of circulating supply) Wednesday, January 21

$XPL ~89 million units and $12.5M (4.33% of circulating supply) Sunday, January 25

$H ~131 million units and $24M (1.31% of total supply) Sunday, January 25

#CryptoMarketWatch

$ZRO ~24.7 million units and $42.5M (2.47% of total supply) Tuesday, January 20

$PLUME ~1.37 billion units and $23M (39.75% of circulating supply) Wednesday, January 21

$XPL ~89 million units and $12.5M (4.33% of circulating supply) Sunday, January 25

$H ~131 million units and $24M (1.31% of total supply) Sunday, January 25

#CryptoMarketWatch

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$ETH is trying to reclaim the 20OD EMA level.

Last 2 times this happened, Ethereum pumped 50% and 100%

#CryptoMarketWatch

Last 2 times this happened, Ethereum pumped 50% and 100%

#CryptoMarketWatch

ETH2,33%

- Reward

- like

- Comment

- Repost

- Share