#RussiaStudiesNationalStablecoin The exploration of a potential national digital stablecoin by Russia reflects a deeper strategic shift in 21st-century monetary competition, where financial networks are becoming extensions of geopolitical influence. Reports suggesting that Russian policymakers are studying sovereign blockchain settlement models indicate that the initiative is not simply about digital payments but about strengthening economic resilience under long-term external pressure. Institutions such as the Central Bank of Russia are expected to play a central role if any official structure emerges, ensuring that monetary policy control remains aligned with national macro-financial objectives.

The proposed concept is increasingly viewed as a hybrid sovereign digital asset rather than a traditional retail cryptocurrency. Unlike decentralized public tokens, a state-backed stablecoin would likely operate within permissioned or tightly supervised infrastructure, supporting trade settlement between Russia and selected partner economies. Analysts suggest the primary motivation is expanding alternative payment corridors for energy exports, cross-border commodity trade, and regional financial cooperation networks that bypass conventional Western-dominated clearing systems.

Another emerging dimension is the potential integration of the digital asset into international trade chains involving Eurasian and Global South markets. If implemented, the system could enable programmable settlement contracts for natural resources, industrial goods, and strategic exports. This would allow automated payment execution once delivery verification conditions are satisfied, potentially improving efficiency in large-scale intergovernmental commerce.

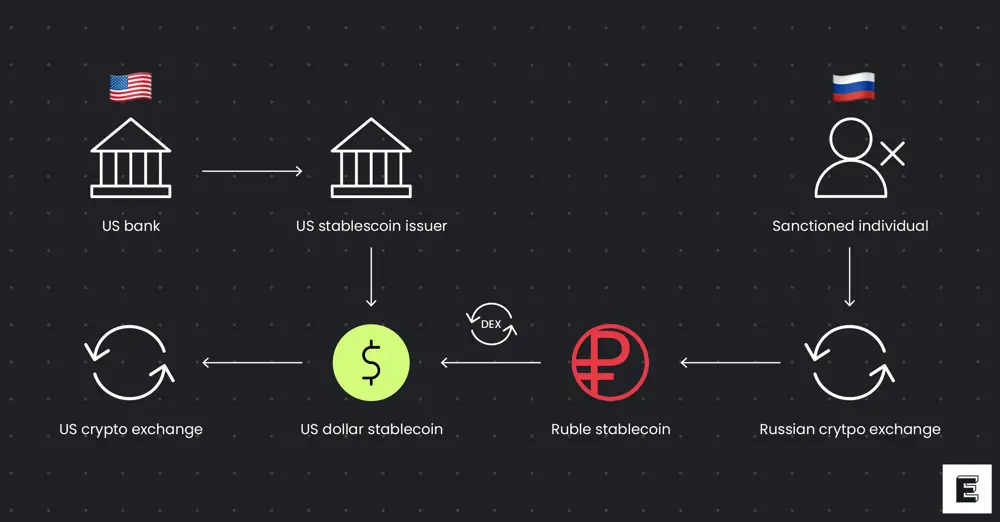

Global liquidity structures may gradually respond if sovereign digital settlement platforms gain adoption. Currently, international digital trading liquidity is heavily concentrated around U.S. dollar-pegged stablecoins. A Russian sovereign digital instrument could contribute to the formation of multi-currency blockchain corridors where regional payment blocs operate semi-independently. Such fragmentation does not necessarily replace existing systems but introduces competitive pressure across settlement ecosystems.

However, the primary determinant of success will remain trust and convertibility rather than issuance volume. Market participants generally prioritize reserve transparency, exchange accessibility, and price stability mechanisms. Without broad international exchange integration, even state-supported digital assets may face limited circulation outside domestic or allied financial environments. Sanctions risk management and compliance interoperability will also influence adoption potential.

From a technological perspective, future sovereign stablecoins may adopt layered architecture combining centralized reserve management with programmable blockchain settlement modules. This design could allow governments to maintain strict monetary oversight while enabling automation in supply chain finance, cross-border credit clearing, and tokenized asset transfers.

Looking further ahead, the competition between sovereign digital currencies may reshape global monetary diplomacy. If multiple major economies deploy state-backed blockchain settlement systems, international trade could evolve into a network of interoperable digital corridors rather than a single dominant reserve currency structure. Such a transition would unfold gradually across decades, driven more by institutional adoption than by sudden policy announcements.

The broader macro message is that digital money is shifting from a technological experiment into a strategic statecraft tool. Whether or not a Russian national stablecoin launches soon, the direction of travel is clear: monetary sovereignty is increasingly being redefined in programmable, network-based form. The 2026–2035 period may become the decisive phase where global finance migrates from legacy clearing dominance toward multi-layered digital settlement ecosystems. 🚀

The proposed concept is increasingly viewed as a hybrid sovereign digital asset rather than a traditional retail cryptocurrency. Unlike decentralized public tokens, a state-backed stablecoin would likely operate within permissioned or tightly supervised infrastructure, supporting trade settlement between Russia and selected partner economies. Analysts suggest the primary motivation is expanding alternative payment corridors for energy exports, cross-border commodity trade, and regional financial cooperation networks that bypass conventional Western-dominated clearing systems.

Another emerging dimension is the potential integration of the digital asset into international trade chains involving Eurasian and Global South markets. If implemented, the system could enable programmable settlement contracts for natural resources, industrial goods, and strategic exports. This would allow automated payment execution once delivery verification conditions are satisfied, potentially improving efficiency in large-scale intergovernmental commerce.

Global liquidity structures may gradually respond if sovereign digital settlement platforms gain adoption. Currently, international digital trading liquidity is heavily concentrated around U.S. dollar-pegged stablecoins. A Russian sovereign digital instrument could contribute to the formation of multi-currency blockchain corridors where regional payment blocs operate semi-independently. Such fragmentation does not necessarily replace existing systems but introduces competitive pressure across settlement ecosystems.

However, the primary determinant of success will remain trust and convertibility rather than issuance volume. Market participants generally prioritize reserve transparency, exchange accessibility, and price stability mechanisms. Without broad international exchange integration, even state-supported digital assets may face limited circulation outside domestic or allied financial environments. Sanctions risk management and compliance interoperability will also influence adoption potential.

From a technological perspective, future sovereign stablecoins may adopt layered architecture combining centralized reserve management with programmable blockchain settlement modules. This design could allow governments to maintain strict monetary oversight while enabling automation in supply chain finance, cross-border credit clearing, and tokenized asset transfers.

Looking further ahead, the competition between sovereign digital currencies may reshape global monetary diplomacy. If multiple major economies deploy state-backed blockchain settlement systems, international trade could evolve into a network of interoperable digital corridors rather than a single dominant reserve currency structure. Such a transition would unfold gradually across decades, driven more by institutional adoption than by sudden policy announcements.

The broader macro message is that digital money is shifting from a technological experiment into a strategic statecraft tool. Whether or not a Russian national stablecoin launches soon, the direction of travel is clear: monetary sovereignty is increasingly being redefined in programmable, network-based form. The 2026–2035 period may become the decisive phase where global finance migrates from legacy clearing dominance toward multi-layered digital settlement ecosystems. 🚀