Prithvir

No content yet

Prithvir

Remotion was a mistake. Roll it back\n\nTimeline now:\nai-slop-launch-vid\nai-slop-launch-vid\nai-slop-launch-vid\n.

- Reward

- like

- Comment

- Repost

- Share

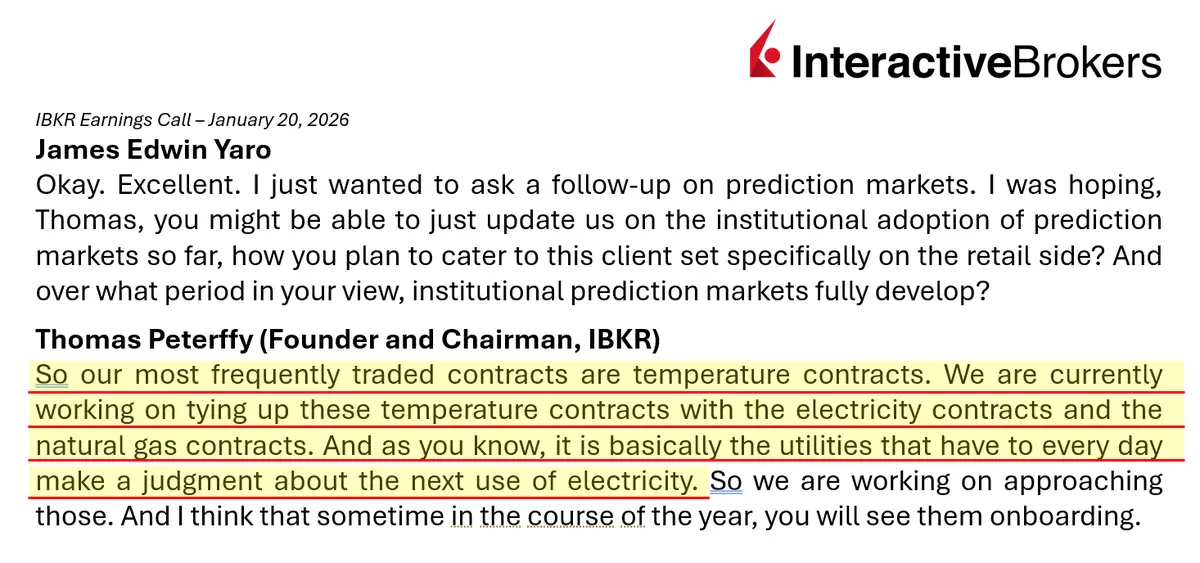

To everyone who said prediction markets are just sports, here’s the CEO of a $110b company:\n\n1. Weather and temperature contracts are the most frequently traded\n2. Utilities will soon hedge electricity and natural gas contracts using these markets\n\nPrediction markets are already institutional\n\nYou’re just not paying close enough attention

- Reward

- like

- Comment

- Repost

- Share

WSJ and NYT will give you emotional opinion pieces on Greenland.

Prediction markets will give you unbiased odds.

1. US takes control of a part of Greenland by 2029 = 42%

2. Trump acquires Greenland before 2027 = 20%

3. Greenland acquired for $600b to $899b = 17%

4. Trump invades Greenland in 2026 = 11%

Prediction markets will give you unbiased odds.

1. US takes control of a part of Greenland by 2029 = 42%

2. Trump acquires Greenland before 2027 = 20%

3. Greenland acquired for $600b to $899b = 17%

4. Trump invades Greenland in 2026 = 11%

- Reward

- like

- Comment

- Repost

- Share

every single financial innovation since 2020 was driven directly or indirectly by crypto

directly:

> stablecoins

> tokenization

> perpetual futures

> prediction markets

> nakamoto consensus

> automated market makers

indirectly:

> instant bank settlement

banks were forced to match 24x7 and T+0 expectations

> embedded finance

wallets trained users to expect financial actions inside any app

> bnpl

exchanges normalized instant risk-based credit at checkout

> ai underwriting

defi lending introduced real-time collateral and liquidation engines

> open-banking payments

defi composability prov

directly:

> stablecoins

> tokenization

> perpetual futures

> prediction markets

> nakamoto consensus

> automated market makers

indirectly:

> instant bank settlement

banks were forced to match 24x7 and T+0 expectations

> embedded finance

wallets trained users to expect financial actions inside any app

> bnpl

exchanges normalized instant risk-based credit at checkout

> ai underwriting

defi lending introduced real-time collateral and liquidation engines

> open-banking payments

defi composability prov

DEFI-8,01%

- Reward

- like

- Comment

- Repost

- Share

Pretty cool to see NYSE doubling down on tokenization.

1. 24x7 trading of US stocks and ETFs

2. Fractional shares

3. Instant on-chain settlement

4. Stablecoin-based funding

How many more years before NYSE perps?

1. 24x7 trading of US stocks and ETFs

2. Fractional shares

3. Instant on-chain settlement

4. Stablecoin-based funding

How many more years before NYSE perps?

- Reward

- 2

- 1

- 1

- Share

GateUser-1a2345c1 :

:

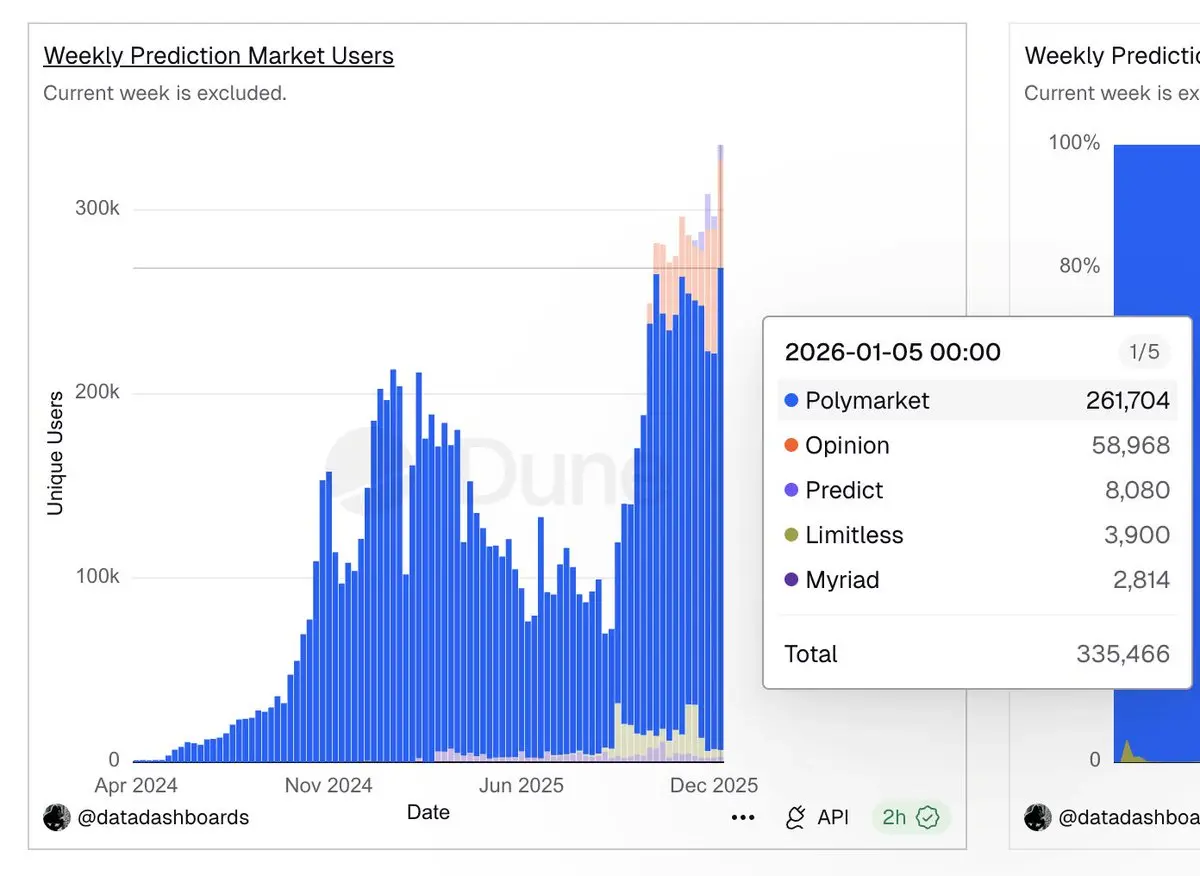

Hold tight 💪Prediction Market Weekly Update

Notional Volume

1. @Kalshi $2.01b

2. @Opinionlabsxyz $1.60b

3. @Polymarket $1.50b

4. @PredictProtocol $109m

5. @ForecastEx $32m

6. @Trylimitless $9.0m

7. @MyriadMarkets $1.8m

Total $5.26b

WoW -0.7%

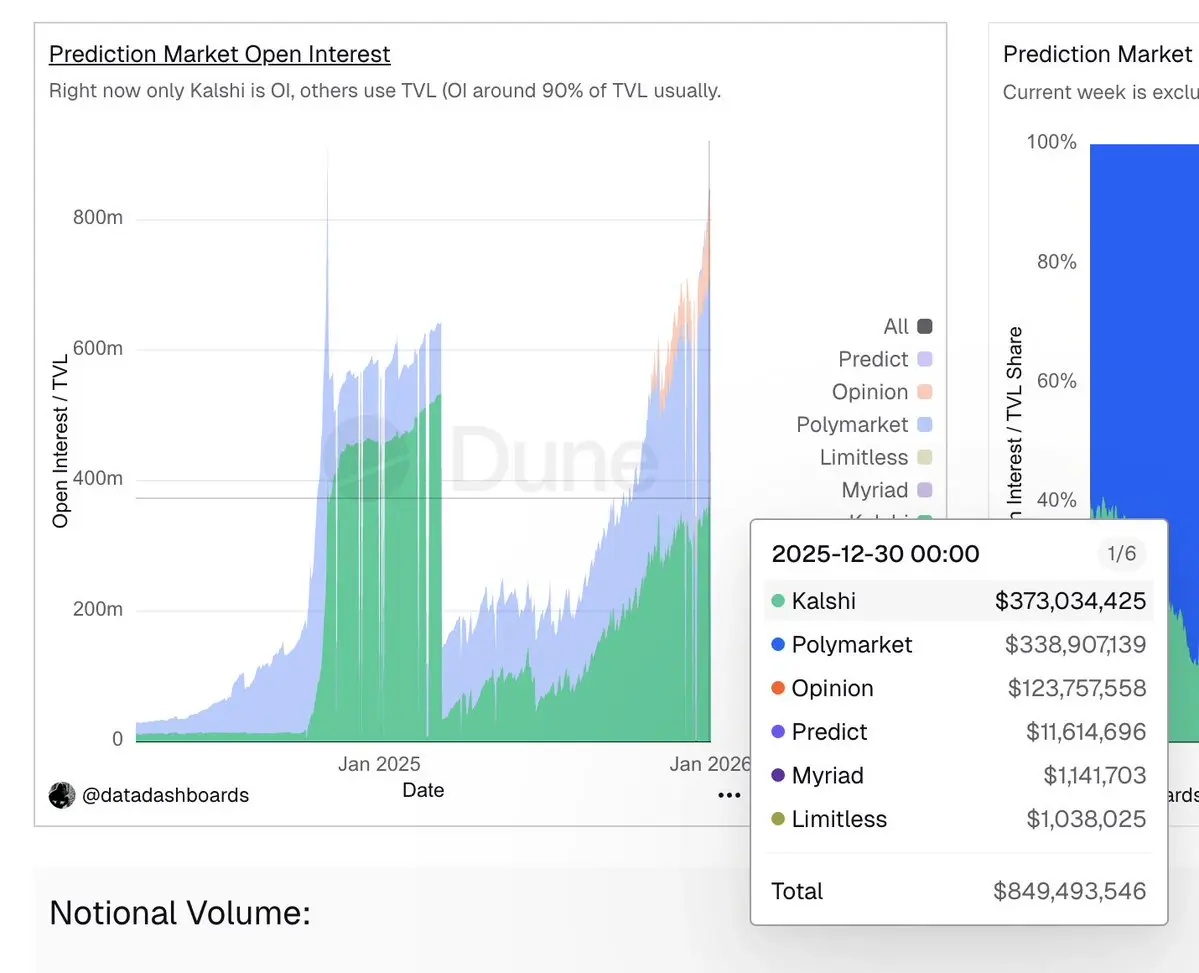

Open Interest

1. @Kalshi $356m

2. @Polymarket $287m

3. @Opinionlabsxyz $132m

4. @PredictProtocol $21.9m

5. @ForecastEx $3.6m

6. @MyriadMarkets $0.75m

7. @Trylimitless $0.69m

Total $801m

WoW +19.6%

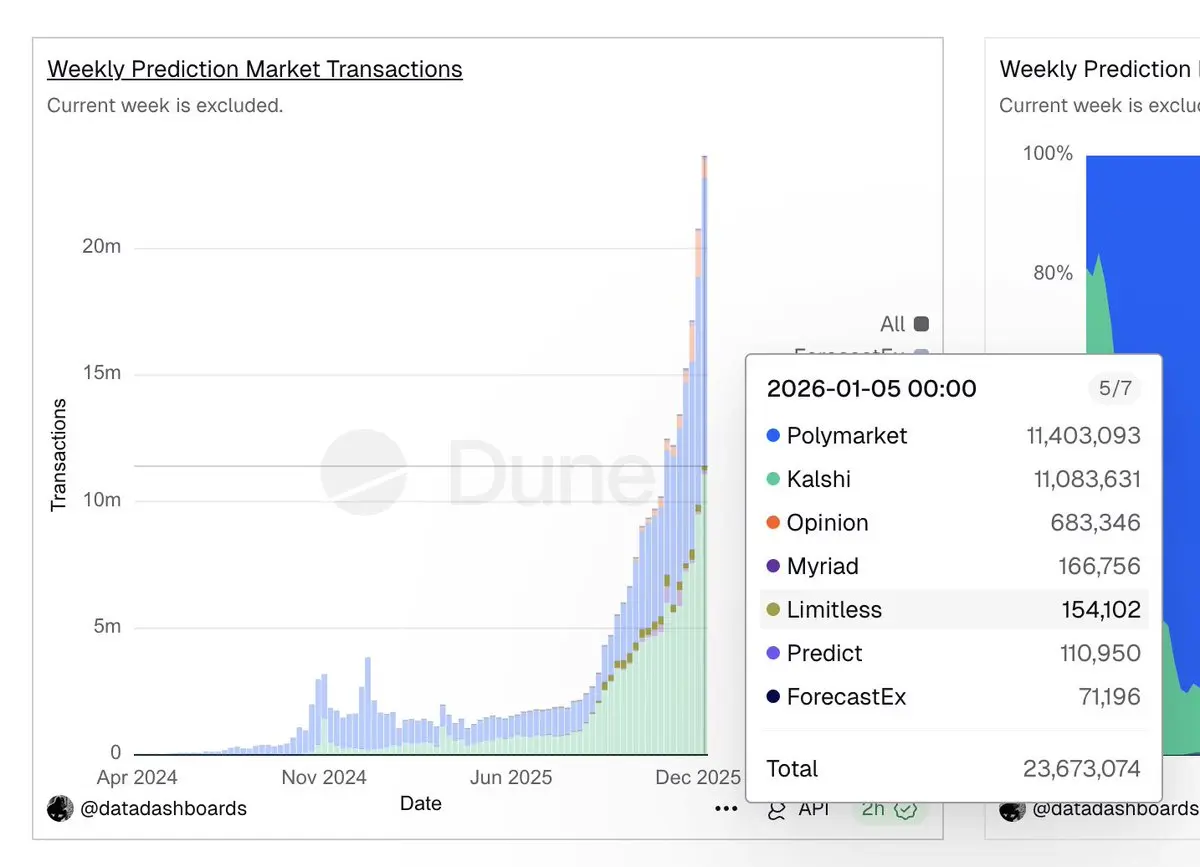

Transactions

1. @Polymarket 11.40m

2. @Kalshi 11.08m

3. @Opinionlabsxyz 683k

4. @MyriadMarkets 167k

5. @Trylimitless 154k

6. @PredictProtocol 111k

7. @ForecastEx 71k

Total

Notional Volume

1. @Kalshi $2.01b

2. @Opinionlabsxyz $1.60b

3. @Polymarket $1.50b

4. @PredictProtocol $109m

5. @ForecastEx $32m

6. @Trylimitless $9.0m

7. @MyriadMarkets $1.8m

Total $5.26b

WoW -0.7%

Open Interest

1. @Kalshi $356m

2. @Polymarket $287m

3. @Opinionlabsxyz $132m

4. @PredictProtocol $21.9m

5. @ForecastEx $3.6m

6. @MyriadMarkets $0.75m

7. @Trylimitless $0.69m

Total $801m

WoW +19.6%

Transactions

1. @Polymarket 11.40m

2. @Kalshi 11.08m

3. @Opinionlabsxyz 683k

4. @MyriadMarkets 167k

5. @Trylimitless 154k

6. @PredictProtocol 111k

7. @ForecastEx 71k

Total

- Reward

- like

- Comment

- Repost

- Share

These Iran markets have:

• Date ladders

• Conditional chains

• Cross-event dependencies

Exactly the kind of structure where advanced order types and cross-market routing matter.

Prediction markets are becoming a quant playground.

• Date ladders

• Conditional chains

• Cross-event dependencies

Exactly the kind of structure where advanced order types and cross-market routing matter.

Prediction markets are becoming a quant playground.

- Reward

- like

- Comment

- Repost

- Share

Hey @grok, reply with what you think the annual trading volume for prediction markets will be in 2026.

- Reward

- like

- Comment

- Repost

- Share

Interesting

- Reward

- like

- Comment

- Repost

- Share

everyone on the timeline

> omg AI is insane, we’re 4x more productive now, SWE is dead

same people in private forums and dms

> hiring a react dev, will pay $20k commission if he joins

> omg AI is insane, we’re 4x more productive now, SWE is dead

same people in private forums and dms

> hiring a react dev, will pay $20k commission if he joins

- Reward

- like

- Comment

- Repost

- Share

Weak men react emotionally to Venezuela and Iran

Strong men analyze the chess board unemotionally by studying history

Spengler and Durant are probably the most useful sources to understand this period of the American empire

Strong men analyze the chess board unemotionally by studying history

Spengler and Durant are probably the most useful sources to understand this period of the American empire

- Reward

- like

- Comment

- Repost

- Share

on an instinctual level, do you believe the universe is

- Reward

- like

- Comment

- Repost

- Share

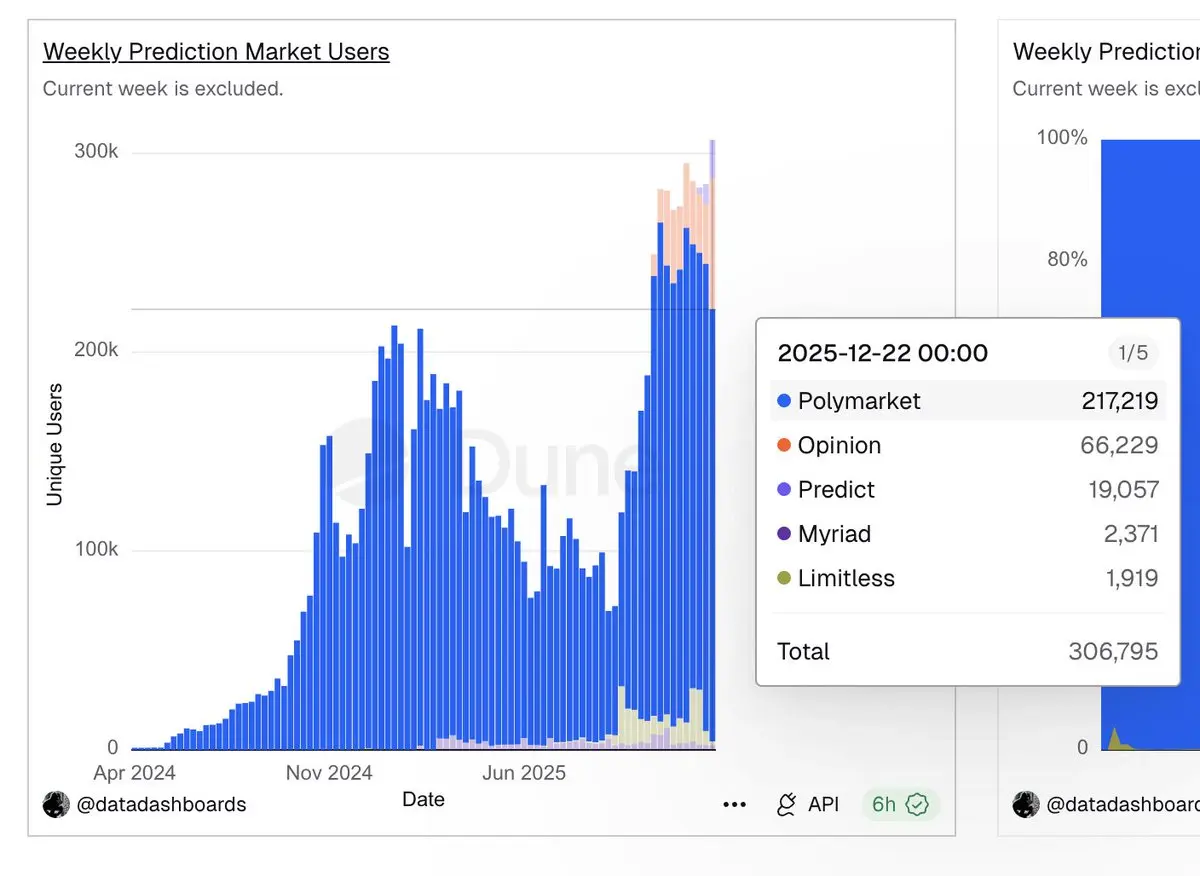

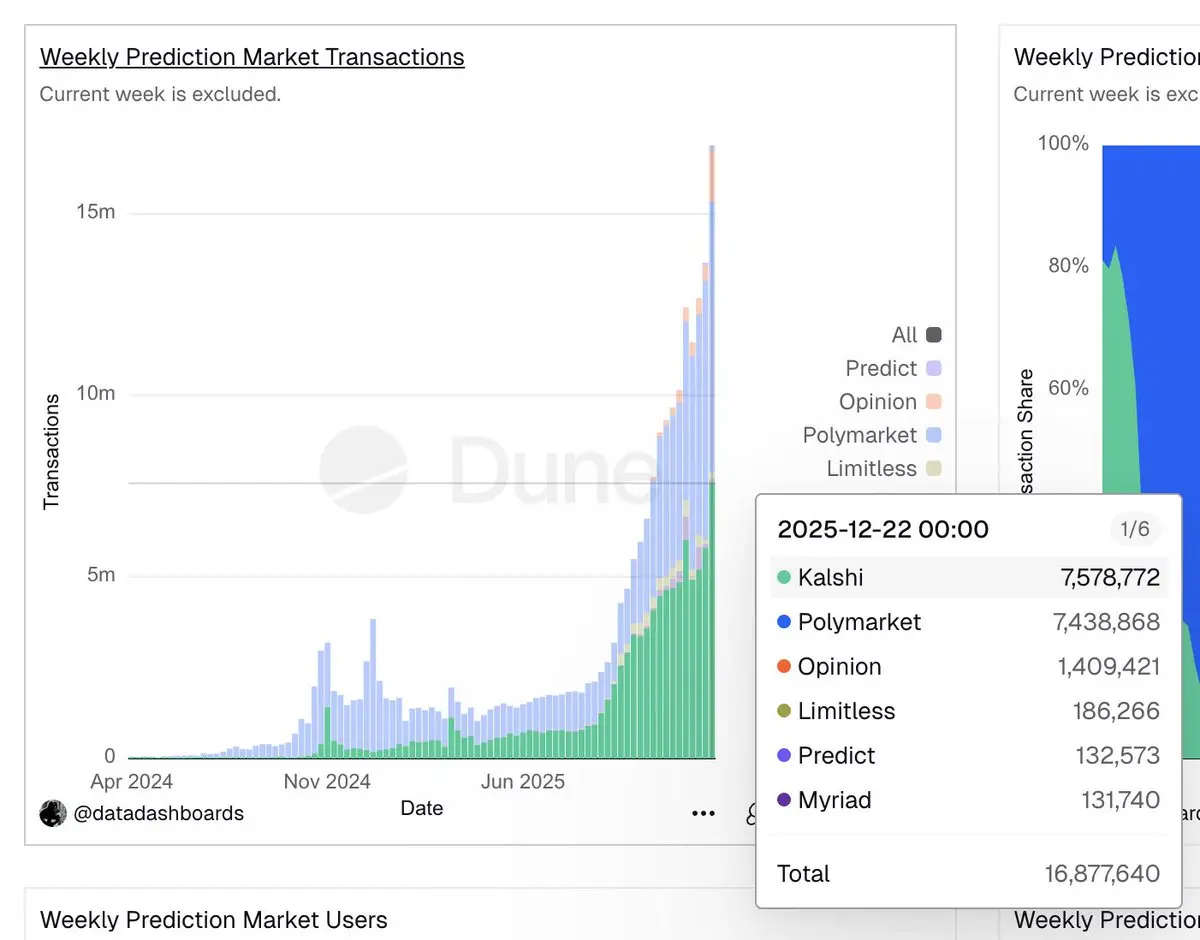

Prediction Market Weekly Update

Notional Volume

1. @Kalshi $1.7b

2. @Opinionlabsxyz $1.6b

3. @Polymarket $1.09b

4. @predictdotfun $57m

5. @MyriadMarkets $3.13m

6. @Trylimitless $2.4m

Total $4.5b

WoW +12.5%

Open Interest

1. @Kalshi $373m

2. @Polymarket $338m

3. @Opinionlabsxyz $123m

4. @predictdotfun $11.61m

5. @MyriadMarkets $1.14m

6. @Trylimitless $1.03m

Total $849m

WoW +12%

Transactions

1. @Kalshi 7.57m

2. @Polymarket 7.4m

3. @Opinionlabsxyz 1.4m

4. @Trylimitless 186k

5. @predictdotfun 132k

6. @MyriadMarkets 131k

Total 16.8m

WoW +23%

Users

1. @Polymarket 217k

2. @Opinion

Notional Volume

1. @Kalshi $1.7b

2. @Opinionlabsxyz $1.6b

3. @Polymarket $1.09b

4. @predictdotfun $57m

5. @MyriadMarkets $3.13m

6. @Trylimitless $2.4m

Total $4.5b

WoW +12.5%

Open Interest

1. @Kalshi $373m

2. @Polymarket $338m

3. @Opinionlabsxyz $123m

4. @predictdotfun $11.61m

5. @MyriadMarkets $1.14m

6. @Trylimitless $1.03m

Total $849m

WoW +12%

Transactions

1. @Kalshi 7.57m

2. @Polymarket 7.4m

3. @Opinionlabsxyz 1.4m

4. @Trylimitless 186k

5. @predictdotfun 132k

6. @MyriadMarkets 131k

Total 16.8m

WoW +23%

Users

1. @Polymarket 217k

2. @Opinion

- Reward

- like

- Comment

- Repost

- Share

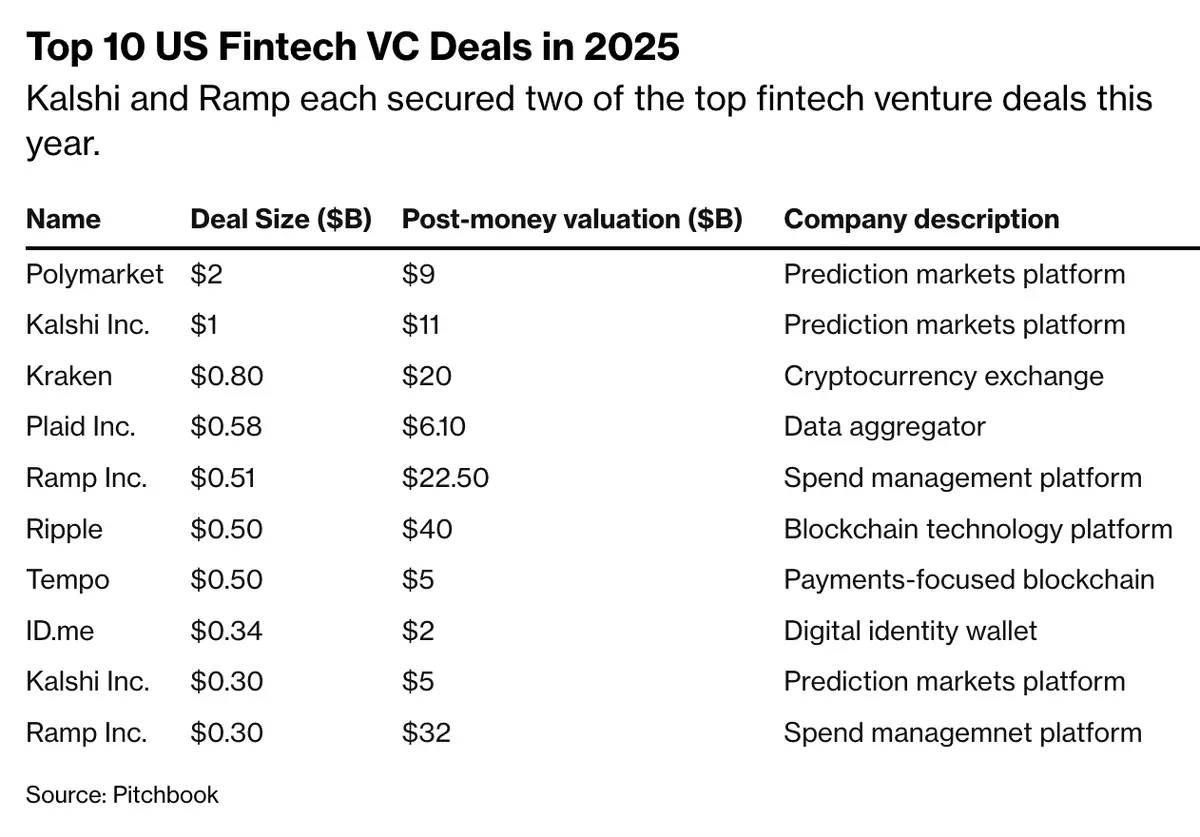

Top 10 US Fintech VC Deals 2025

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More97.11K Popularity

15.06K Popularity

386.52K Popularity

3.1K Popularity

1.5K Popularity

Pin