PLovers

No content yet

PLovers

$BTC Bitcoin (BTC) is a peer-to-peer cryptocurrency that aims to function as a means of exchange that is independent of any central authority. BTC can be transferred electronically in a secure, verifiable, and immutable way.

Launched in 2009, BTC is the first virtual currency to solve the double-spending issue by timestamping transactions before broadcasting them to all of the nodes in the Bitcoin network. The Bitcoin Protocol offered a solution to the Byzantine Generals' Problem with a blockchain network structure, a notion first created by Stuart Haber and W. Scott Stornetta in 1991.

Bitcoin

Launched in 2009, BTC is the first virtual currency to solve the double-spending issue by timestamping transactions before broadcasting them to all of the nodes in the Bitcoin network. The Bitcoin Protocol offered a solution to the Byzantine Generals' Problem with a blockchain network structure, a notion first created by Stuart Haber and W. Scott Stornetta in 1991.

Bitcoin

BTC1,28%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

TLDR

XRP is down 1.61% to $1.41 in 24h, underperforming a Bitcoin market that rose 1.22%, primarily driven by altcoin underperformance in a risk-averse, Bitcoin-dominant market.

Primary reason: Negative beta to Bitcoin as capital remains defensive, with Bitcoin dominance at 58.3% and extreme fear sentiment (index 11) suppressing altcoin appetite.

Secondary reasons: No clear coin-specific catalyst was visible in the provided data; the move looks more consistent with broader altcoin weakness.

Near-term market outlook: If XRP holds above the $1.40 support, it could consolidate; a break below risk

XRP is down 1.61% to $1.41 in 24h, underperforming a Bitcoin market that rose 1.22%, primarily driven by altcoin underperformance in a risk-averse, Bitcoin-dominant market.

Primary reason: Negative beta to Bitcoin as capital remains defensive, with Bitcoin dominance at 58.3% and extreme fear sentiment (index 11) suppressing altcoin appetite.

Secondary reasons: No clear coin-specific catalyst was visible in the provided data; the move looks more consistent with broader altcoin weakness.

Near-term market outlook: If XRP holds above the $1.40 support, it could consolidate; a break below risk

XRP0,42%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🔥 Relief Rally for $BTC Before the Next Big Move?

After weeks of heavy pressure, Bitcoin might be preparing for a short-term bounce. While $BTC has moved in sync with struggling tech stocks, a well-known analyst now sees signs of a possible relief rally forming.

According to the latest technical outlook, Bitcoin has shifted from a bearish breakdown into a bullish consolidation pattern - often a signal that buyers are slowly accumulating during fear-driven markets.

So what could happen next?

▪ Potential rebound toward $80K–$85K resistance zone

▪ Break above that could open room to $90K–$95K

After weeks of heavy pressure, Bitcoin might be preparing for a short-term bounce. While $BTC has moved in sync with struggling tech stocks, a well-known analyst now sees signs of a possible relief rally forming.

According to the latest technical outlook, Bitcoin has shifted from a bearish breakdown into a bullish consolidation pattern - often a signal that buyers are slowly accumulating during fear-driven markets.

So what could happen next?

▪ Potential rebound toward $80K–$85K resistance zone

▪ Break above that could open room to $90K–$95K

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

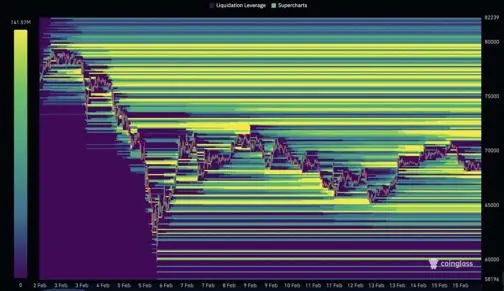

$BTC just triggered a heavy leverage reset as price slipped under $67K, wiping out over $300M in liquidations within 24H. Longs got cleared and open interest cooled off a classic volatility shakeout.

Price is now trading inside the $65K–$67K demand pocket where bids are stacked. If this zone holds, downside liquidity gets absorbed and momentum can rotate upward. Above $69K–$72K sits a thick liquidity band acting as a magnet. A strong reclaim of $69K could ignite a fast short squeeze toward $72K. Next move loading.

#MarketRebound #BTC

Price is now trading inside the $65K–$67K demand pocket where bids are stacked. If this zone holds, downside liquidity gets absorbed and momentum can rotate upward. Above $69K–$72K sits a thick liquidity band acting as a magnet. A strong reclaim of $69K could ignite a fast short squeeze toward $72K. Next move loading.

#MarketRebound #BTC

BTC1,28%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

🔥 MASSIVE UPDATE:

🇺🇸 THE Federal Reserve IS SET TO PUMP $16 BILLION INTO THE ECONOMY THIS WEEK.

LIQUIDITY IS COMING 💥🚀

$BTC

#BTCFellBelow$69,000Again #MarketRebound #TrumpCanadaTariffsOverturned #BTC100kNext? #fed

🇺🇸 THE Federal Reserve IS SET TO PUMP $16 BILLION INTO THE ECONOMY THIS WEEK.

LIQUIDITY IS COMING 💥🚀

$BTC

#BTCFellBelow$69,000Again #MarketRebound #TrumpCanadaTariffsOverturned #BTC100kNext? #fed

BTC1,28%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

💸 Robert Kiyosaki: “I’ll Keep Buying BTC$BTC While Everyone Panics”

The bestselling author of Rich Dad Poor Dad, Robert Kiyosaki, warns that a massive stock market crash is inevitable and he’s ready for it. In his portfolio:

• Gold & Silver (physical)

• Ethereum

• Bitcoin

Kiyosaki plans to keep buying BTC$BTC, especially during panic-selling periods, when most investors dump their assets. His reasoning? Bitcoin’s supply is capped at 21M coins, and market crashes are the best time to get rich, as quality assets are sold at a discount.

“This crash could make you richer than you’ve ever dreamed

The bestselling author of Rich Dad Poor Dad, Robert Kiyosaki, warns that a massive stock market crash is inevitable and he’s ready for it. In his portfolio:

• Gold & Silver (physical)

• Ethereum

• Bitcoin

Kiyosaki plans to keep buying BTC$BTC, especially during panic-selling periods, when most investors dump their assets. His reasoning? Bitcoin’s supply is capped at 21M coins, and market crashes are the best time to get rich, as quality assets are sold at a discount.

“This crash could make you richer than you’ve ever dreamed

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

$68K BTC$BTC Tension Explodes Soon - Who Will Be Liquidated First? 😁

Bitcoin is stuck around $68K, Bollinger Bands are tightening, and RSI is nearly 34.7 - the market is coiling up. Last week, spot Bitcoin ETFs saw net outflows of $360M, while Ethereum-linked products lost $161M.

Meanwhile, Solana and XRP funds gained $13M and $7.6M, respectively. Overall, investors withdrew roughly $3.7B from digital ETPs over the past four weeks.

Derivatives market positioning points to asymmetric risk. A 10% rise in Bitcoin could trigger about $4.3B in short liquidations, whereas a similar 10% drop could l

Bitcoin is stuck around $68K, Bollinger Bands are tightening, and RSI is nearly 34.7 - the market is coiling up. Last week, spot Bitcoin ETFs saw net outflows of $360M, while Ethereum-linked products lost $161M.

Meanwhile, Solana and XRP funds gained $13M and $7.6M, respectively. Overall, investors withdrew roughly $3.7B from digital ETPs over the past four weeks.

Derivatives market positioning points to asymmetric risk. A 10% rise in Bitcoin could trigger about $4.3B in short liquidations, whereas a similar 10% drop could l

- Reward

- like

- Comment

- Repost

- Share

$BTC HISTORIC SETUP: Will Bitcoin Break This Two-Month Curse?

Bitcoin is currently closing both January and February in the red — and history says this is rare territory.

Looking back across previous cycles, BTC has never finished both months negative in the same calendar year. Typically, if January stumbles, February rebounds. If February slips, January already delivered strength. That seasonal rhythm has held for over a decade.

But 2026 is testing that pattern.

If this streak breaks, it could signal a shift in momentum — or set the stage for an explosive March reversal as mean reversion kick

Bitcoin is currently closing both January and February in the red — and history says this is rare territory.

Looking back across previous cycles, BTC has never finished both months negative in the same calendar year. Typically, if January stumbles, February rebounds. If February slips, January already delivered strength. That seasonal rhythm has held for over a decade.

But 2026 is testing that pattern.

If this streak breaks, it could signal a shift in momentum — or set the stage for an explosive March reversal as mean reversion kick

BTC1,28%

- Reward

- like

- Comment

- Repost

- Share

🚨 Key Events This Week - What $BTC and Markets Are Watching

The week opens with Presidents’ Day in the U.S., meaning banks and federal institutions are closed. Lower liquidity conditions can often lead to sharper and less predictable price swings - especially in crypto.

📅 Main Catalysts

Wednesday - FOMC Minutes

Markets will analyze how the Federal Reserve reached its recent rate pause decision. Any shift in tone could impact rate expectations and risk appetite.

Friday - U.S. Advance GDP (q/q) + Core PCE

Core PCE remains the Fed’s preferred inflation gauge. A softer print could strengthen th

The week opens with Presidents’ Day in the U.S., meaning banks and federal institutions are closed. Lower liquidity conditions can often lead to sharper and less predictable price swings - especially in crypto.

📅 Main Catalysts

Wednesday - FOMC Minutes

Markets will analyze how the Federal Reserve reached its recent rate pause decision. Any shift in tone could impact rate expectations and risk appetite.

Friday - U.S. Advance GDP (q/q) + Core PCE

Core PCE remains the Fed’s preferred inflation gauge. A softer print could strengthen th

- Reward

- like

- Comment

- Repost

- Share

🔴 ICP$ICP/USDT Long Setup

✅ ICP$ICP has successfully broken out of its symmetrical triangle formation, backed by strong trading volume. The Ichimoku Cloud is providing solid support, reinforcing bullish momentum. This breakout points to the potential for a powerful upward move ahead.

#TradingSetup$ICP

✅ ICP$ICP has successfully broken out of its symmetrical triangle formation, backed by strong trading volume. The Ichimoku Cloud is providing solid support, reinforcing bullish momentum. This breakout points to the potential for a powerful upward move ahead.

#TradingSetup$ICP

ICP-3,08%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

🔴 $5B worth of short positions are stacking up overhead.

Most of the long positions have already been wiped out.

The stage is set for the shorts.

#Liquidation

Most of the long positions have already been wiped out.

The stage is set for the shorts.

#Liquidation

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

3 Altcoins to Watch This Week: Arbitrum, Injective, Bitcoin Cash

Altcoin structure remains fragile, but several charts are sitting at key inflection points.

1⃣ ARB$ARB

Trading near $0.113. Structure is clearly bearish.

🔹 Support: $0.107 → ATL $0.094

🔹 Resistance: $0.125 / $0.144

Failure below $0.107 opens room toward $0.094. Bulls need a strong daily close above $0.144 to flip structure. Until then, downside risk dominates.

2⃣ INJ$INJ

Now at $3.13 after rejection from $5.92.

🔹 Support: $3.03 → $2.65

🔹 Resistance: $3.27 / $3.66

High BTC correlation (0.98) increases risk. If BTC$BTC weakens,

Altcoin structure remains fragile, but several charts are sitting at key inflection points.

1⃣ ARB$ARB

Trading near $0.113. Structure is clearly bearish.

🔹 Support: $0.107 → ATL $0.094

🔹 Resistance: $0.125 / $0.144

Failure below $0.107 opens room toward $0.094. Bulls need a strong daily close above $0.144 to flip structure. Until then, downside risk dominates.

2⃣ INJ$INJ

Now at $3.13 after rejection from $5.92.

🔹 Support: $3.03 → $2.65

🔹 Resistance: $3.27 / $3.66

High BTC correlation (0.98) increases risk. If BTC$BTC weakens,

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Bitcoin TLDR

🔹 Bitcoin mining difficulty decreased by 11%, potentially boosting profitability and altering mining dynamics for operators.

🔹 Brazil proposes a bill to create a strategic reserve of one million Bitcoin, integrating it into their economy.

🔹 Dormant Bitcoin wallets awaken, moving 7,068 BTC, sparking market interest with increased whale activity in 2026.

🔹 Institutional Bitcoin purchases via ETFs counter retail sell-offs, stabilizing the market amidst volatile trading behavior.

📉 In the last 24 hours, Bitcoin's price moved -2.27% to $68.66k and trading volume moved -15.55% to $

🔹 Bitcoin mining difficulty decreased by 11%, potentially boosting profitability and altering mining dynamics for operators.

🔹 Brazil proposes a bill to create a strategic reserve of one million Bitcoin, integrating it into their economy.

🔹 Dormant Bitcoin wallets awaken, moving 7,068 BTC, sparking market interest with increased whale activity in 2026.

🔹 Institutional Bitcoin purchases via ETFs counter retail sell-offs, stabilizing the market amidst volatile trading behavior.

📉 In the last 24 hours, Bitcoin's price moved -2.27% to $68.66k and trading volume moved -15.55% to $

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

🚨 Monday Crypto Pulse: Weekly Web3 Digest

Another week in crypto. Markets flirted with extreme fear. $BTC was declared “dead” - again. Banks kept positioning. I’ve gathered the most important developments from the past week so let’s break it down and highlight what actually matters.

🔹 $BTC dipped below $67K after the $125K October peak. ~$295M liquidations. Fear & Greed Index at 9 (extreme fear). Derivatives still show ~4% premium on 90-day futures - not a classic bottom signal.

🔹 ETF Outflows Continue

Nearly $500M left BTC & ETH ETFs last week. Three consecutive weeks of outflows.

🔹 Min

Another week in crypto. Markets flirted with extreme fear. $BTC was declared “dead” - again. Banks kept positioning. I’ve gathered the most important developments from the past week so let’s break it down and highlight what actually matters.

🔹 $BTC dipped below $67K after the $125K October peak. ~$295M liquidations. Fear & Greed Index at 9 (extreme fear). Derivatives still show ~4% premium on 90-day futures - not a classic bottom signal.

🔹 ETF Outflows Continue

Nearly $500M left BTC & ETH ETFs last week. Three consecutive weeks of outflows.

🔹 Min

BTC1,28%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

71000 touched three times

Each time it was around 70,000

This is not about breaking through

It’s about washing out

Shaking out the weak hands

The magnitude of each pullback is getting smaller

Indicating strong buying power below

That bullish candlestick over the weekend was not a trap

It’s smart money positioning in advance

The US stock market is closed on Monday

Even during the worst liquidity, it didn’t drop back

This is a strong signal

Not weak

Gold surged to a historical high of 5100

The dollar is weakening

This combination indicates one thing

The market is betting on liquidity easing

Fund

Each time it was around 70,000

This is not about breaking through

It’s about washing out

Shaking out the weak hands

The magnitude of each pullback is getting smaller

Indicating strong buying power below

That bullish candlestick over the weekend was not a trap

It’s smart money positioning in advance

The US stock market is closed on Monday

Even during the worst liquidity, it didn’t drop back

This is a strong signal

Not weak

Gold surged to a historical high of 5100

The dollar is weakening

This combination indicates one thing

The market is betting on liquidity easing

Fund

BTC1,28%

- Reward

- like

- Comment

- Repost

- Share

💼 BlackRock ramps up stake in Bitmine by 166%

According to Q4 filings, BlackRock’s position in Tom Lee’s Bitmine rose to $246M. For the long-term ETH$ETH story, this is optimistic - institutions are picking up assets on the dip. But keep in mind: these numbers are from the end of the year.

What Larry Fink did after Bitmine lost $8B on ETH$ETH and shares fell 34% - we’ll only know in a couple of months.

That will show how serious BlackRock’s bet on Ethereum really is.

#ETH #ETHBlockchain #ETHFoundation

$ETH

According to Q4 filings, BlackRock’s position in Tom Lee’s Bitmine rose to $246M. For the long-term ETH$ETH story, this is optimistic - institutions are picking up assets on the dip. But keep in mind: these numbers are from the end of the year.

What Larry Fink did after Bitmine lost $8B on ETH$ETH and shares fell 34% - we’ll only know in a couple of months.

That will show how serious BlackRock’s bet on Ethereum really is.

#ETH #ETHBlockchain #ETHFoundation

$ETH

ETH-0,71%

- Reward

- 1

- Comment

- Repost

- Share

Technical Analysis: BTC 1-Hour Chart

Current Price: Bitcoin is currently trading at approximately $68,767.61.

Resistance Levels: Immediate resistance is observed near the upper Bollinger Band at $71,145.22, indicating a potential ceiling for upward movement.

Further resistance is noted around the 7-period EMA at $68,743.36.

Support Levels: Key support is identified around the middle Bollinger Band at $69,541.84. A stronger support level is seen near the 99-period EMA at $68,906.56, which could act as a crucial floor.

Key Levels:

Potential entry: 68,900 (Near 99-period EMA support).

Take profit

Current Price: Bitcoin is currently trading at approximately $68,767.61.

Resistance Levels: Immediate resistance is observed near the upper Bollinger Band at $71,145.22, indicating a potential ceiling for upward movement.

Further resistance is noted around the 7-period EMA at $68,743.36.

Support Levels: Key support is identified around the middle Bollinger Band at $69,541.84. A stronger support level is seen near the 99-period EMA at $68,906.56, which could act as a crucial floor.

Key Levels:

Potential entry: 68,900 (Near 99-period EMA support).

Take profit

BTC1,28%

- Reward

- like

- Comment

- Repost

- Share