IntoTheBlock

No content yet

IntoTheBlock

Risk curation is quickly becoming foundational to DeFi infrastructure.

Join our next webinar to learn how curation works, why it’s essential, and how it strengthens on-chain markets.

Join our next webinar to learn how curation works, why it’s essential, and how it strengthens on-chain markets.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Supervised loans are a cornerstone of institutional DeFi.

Here’s what they are, how they work, and why they matter 👇

Here’s what they are, how they work, and why they matter 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Our next webinar will unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

Sign up below 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

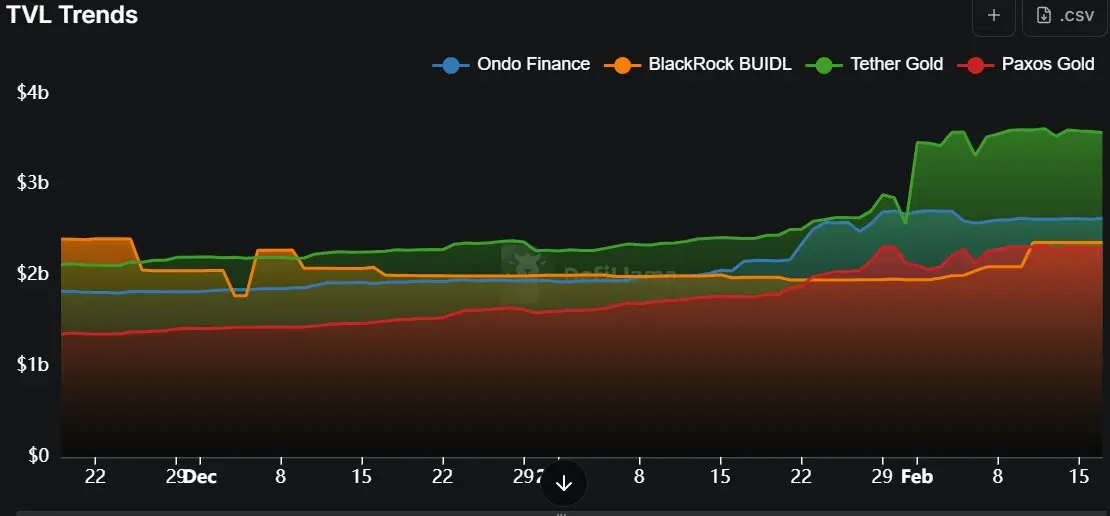

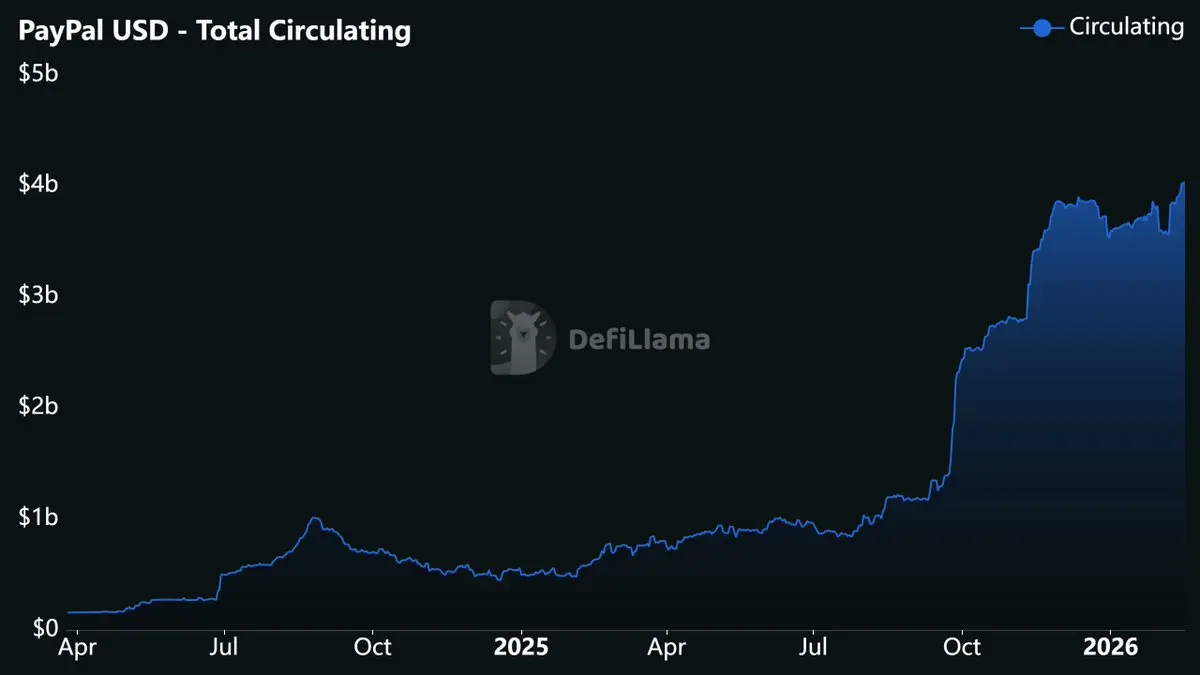

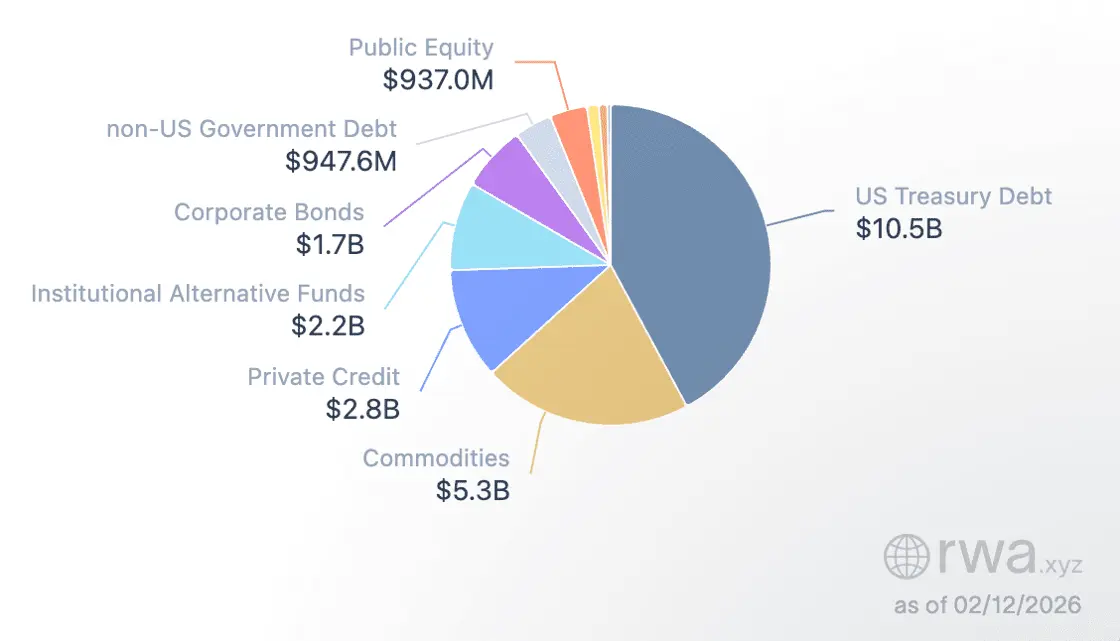

This week: tokenization is gaining momentum in markets, and we’re unpacking what’s happening with DeFi rates 👇

DEFI-6,15%

- Reward

- like

- Comment

- Repost

- Share

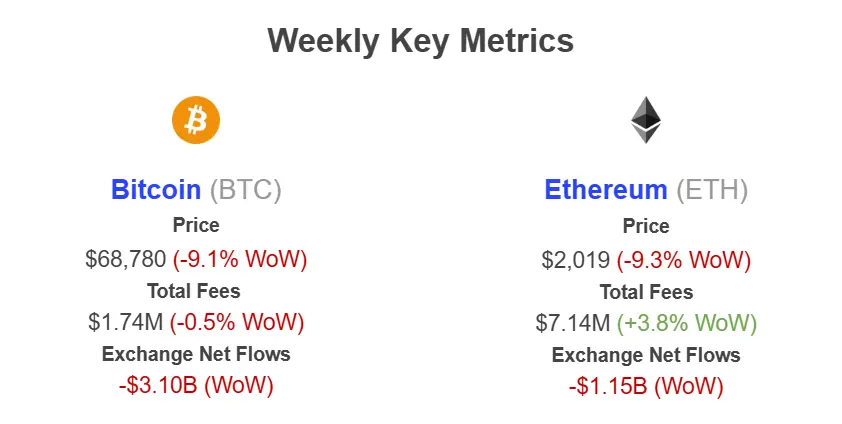

Both Bitcoin and Ether saw significant outflows from exchange wallets this week, hinting at ongoing accumulation amid price weakness.

BTC-0,92%

- Reward

- like

- Comment

- Repost

- Share

DeFi has moved from “Can we build it?” to “Can we run it safely at scale?” and a key part of that move is risk curation.

In our next webinar, we’ll unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

In our next webinar, we’ll unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

- Reward

- like

- Comment

- Repost

- Share

DeFi apps don’t become successful in isolation.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

- Reward

- like

- Comment

- Repost

- Share

DeFi apps don’t become successful in isolation.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

In this week\'s newsletter, we break down the recent market crash and key risks to watch. Catch up on it here👇

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More213.88K Popularity

852.81K Popularity

46.83K Popularity

88.13K Popularity

454.4K Popularity

Pin