BitcoinEyes

No content yet

BitcoinEyes

Hey everyone, I’m Felix

Most people know me now as the guy helping crypto newbies turn into affiliate earners Gate and the creation of my first brand Bitcoin Eyes

But truth is ... I didn’t start in affiliate or crypto at all.

For over 5 years I was a pure Web2 marketer: creating content, designing visuals, running campaigns, posting daily. I was fast and decent at execution, but I was just “doing tasks”. I wasn’t really a marketer in the full sense ...no real networking, no side income streams, no big picture leverage.

After 1 years I jumped into Web3 with Atok App. That’s where I met people

Most people know me now as the guy helping crypto newbies turn into affiliate earners Gate and the creation of my first brand Bitcoin Eyes

But truth is ... I didn’t start in affiliate or crypto at all.

For over 5 years I was a pure Web2 marketer: creating content, designing visuals, running campaigns, posting daily. I was fast and decent at execution, but I was just “doing tasks”. I wasn’t really a marketer in the full sense ...no real networking, no side income streams, no big picture leverage.

After 1 years I jumped into Web3 with Atok App. That’s where I met people

BTC-4,36%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

I DON'T care if crypto prices have crashed overnight.

In fact, I'm only happy about it.

Because if you're in this market for the long term, this is exactly the moment you should be excited about.

You see, most people panic when prices drop.

But that’s because they never understood what they were investing in.

They were chasing narratives, influencers, and short-term pumps.

I’m not one of them.

I’m a long-term believer who’s been through enough cycles to know what’s coming next.

→ When others panic-sell, I accumulate.

→ When others lose conviction, I double down.

Because I know that:

• Institut

In fact, I'm only happy about it.

Because if you're in this market for the long term, this is exactly the moment you should be excited about.

You see, most people panic when prices drop.

But that’s because they never understood what they were investing in.

They were chasing narratives, influencers, and short-term pumps.

I’m not one of them.

I’m a long-term believer who’s been through enough cycles to know what’s coming next.

→ When others panic-sell, I accumulate.

→ When others lose conviction, I double down.

Because I know that:

• Institut

- Reward

- 1

- Comment

- Repost

- Share

"44 Harsh Truths About the Game of Life" - Chris x Naval

To be honest, I've never read Naval Ravikant's book "To Be Prosperous and Happy,"

but I've heard his name a lot in recent years.

Initially, I intended to just watch a few minutes to get a feel for it and then move on, but after watching the intro, I automatically sat through almost the entire video.

It felt like he could read my inner conflicts and those of many young people who are struggling but don't know how to name them.

He doesn't use empty platitudes or motivational slogans; instead, he brutally dissects distorted thinking about m

To be honest, I've never read Naval Ravikant's book "To Be Prosperous and Happy,"

but I've heard his name a lot in recent years.

Initially, I intended to just watch a few minutes to get a feel for it and then move on, but after watching the intro, I automatically sat through almost the entire video.

It felt like he could read my inner conflicts and those of many young people who are struggling but don't know how to name them.

He doesn't use empty platitudes or motivational slogans; instead, he brutally dissects distorted thinking about m

- Reward

- 1

- Comment

- Repost

- Share

BTC update Monday: There are a few system issues we need to pay attention to:

- Long-term BTC liquidity (2 years) is in the 50k range; however, I don't think it will fall to this level in the next few days or weeks, but rather it will reach this level around October or November 2026 (this is just my personal opinion).

- I myself warned about the 4-year cycle ending at the 125k range back in October 2025, and the downtrend started from that point, not just now.

- The 74k range is close to the cost of production, and according to past data, BTC will continue to test this area in the next few day

- Long-term BTC liquidity (2 years) is in the 50k range; however, I don't think it will fall to this level in the next few days or weeks, but rather it will reach this level around October or November 2026 (this is just my personal opinion).

- I myself warned about the 4-year cycle ending at the 125k range back in October 2025, and the downtrend started from that point, not just now.

- The 74k range is close to the cost of production, and according to past data, BTC will continue to test this area in the next few day

BTC-4,36%

- Reward

- 1

- Comment

- Repost

- Share

✋ PATIENCE > POSITIONING: Why now is NOT the time to catch the knife 📉

The hardest part of trading isn't the analysis—it's the emotional discipline to do nothing. As $BTC slides, the "buy the dip" itch starts to kick in.

But look at the cold, hard data:

* D1 Trend: Bearish 🔴

* H4 Trend: Bearish 🔴

* H1 Trend: Following suit 🔴

When multiple timeframes align, the market is sending a clear message. Don't fight the trend.

⚠️ The "Bounce" Trap

Yes, $BTC might see a relief rally. But in a dominant downtrend, these are usually:

1️⃣ Technical corrections to reset RSI/indicators.

2️⃣ Liquidity hu

The hardest part of trading isn't the analysis—it's the emotional discipline to do nothing. As $BTC slides, the "buy the dip" itch starts to kick in.

But look at the cold, hard data:

* D1 Trend: Bearish 🔴

* H4 Trend: Bearish 🔴

* H1 Trend: Following suit 🔴

When multiple timeframes align, the market is sending a clear message. Don't fight the trend.

⚠️ The "Bounce" Trap

Yes, $BTC might see a relief rally. But in a dominant downtrend, these are usually:

1️⃣ Technical corrections to reset RSI/indicators.

2️⃣ Liquidity hu

- Reward

- 1

- Comment

- Repost

- Share

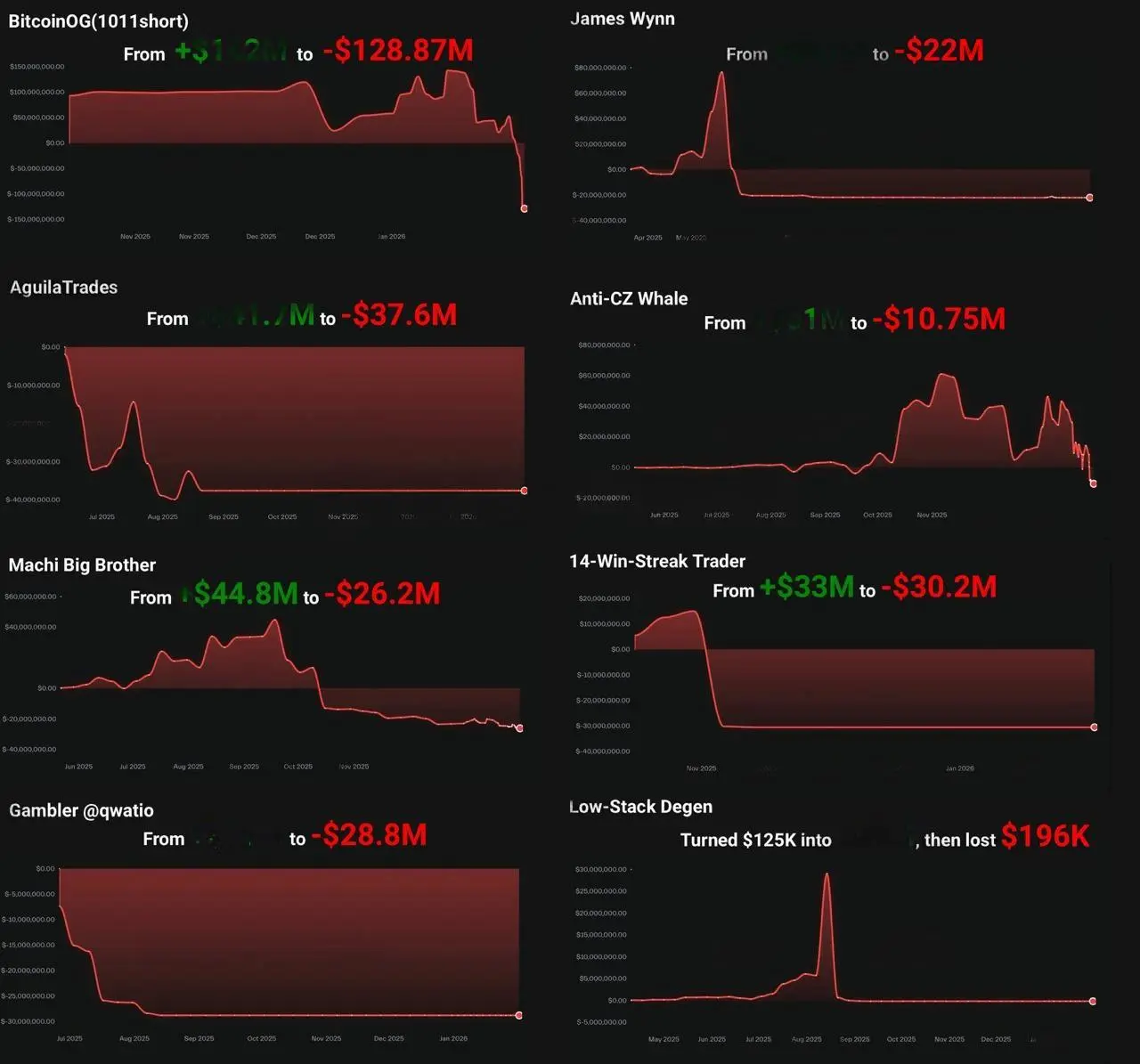

The market doesn't care about your past wins. 📉💀

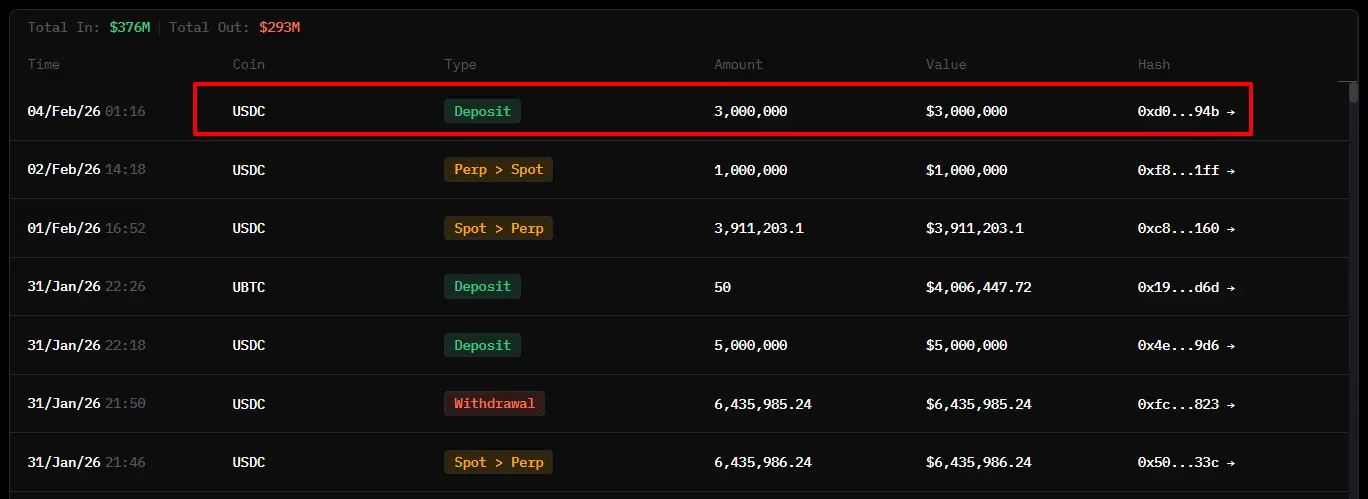

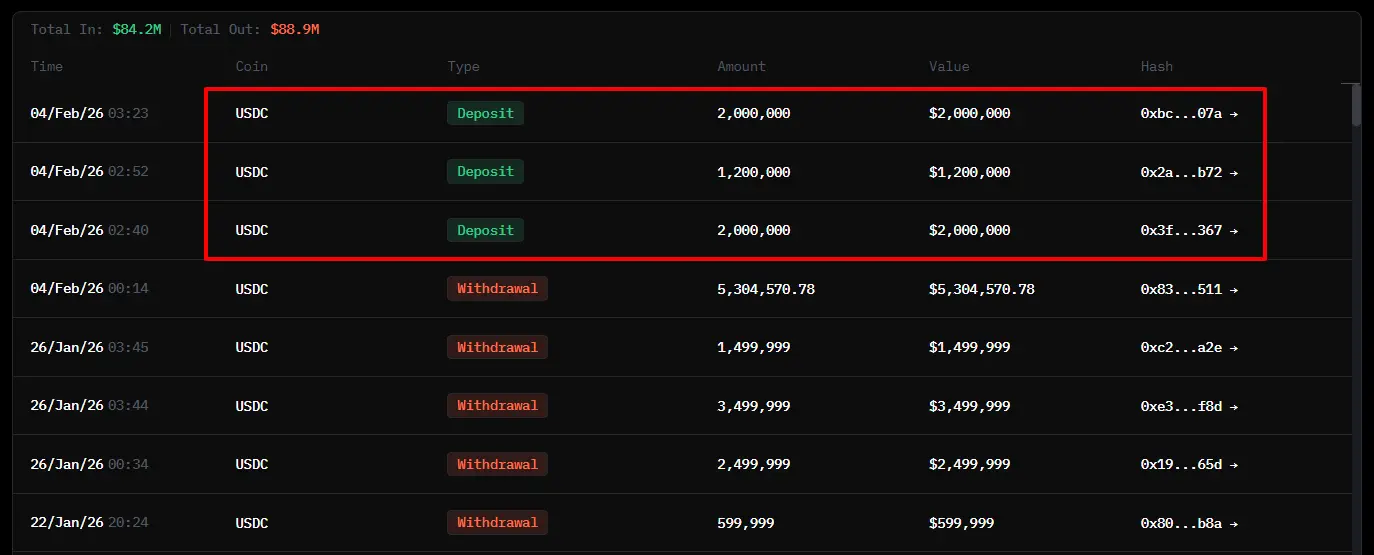

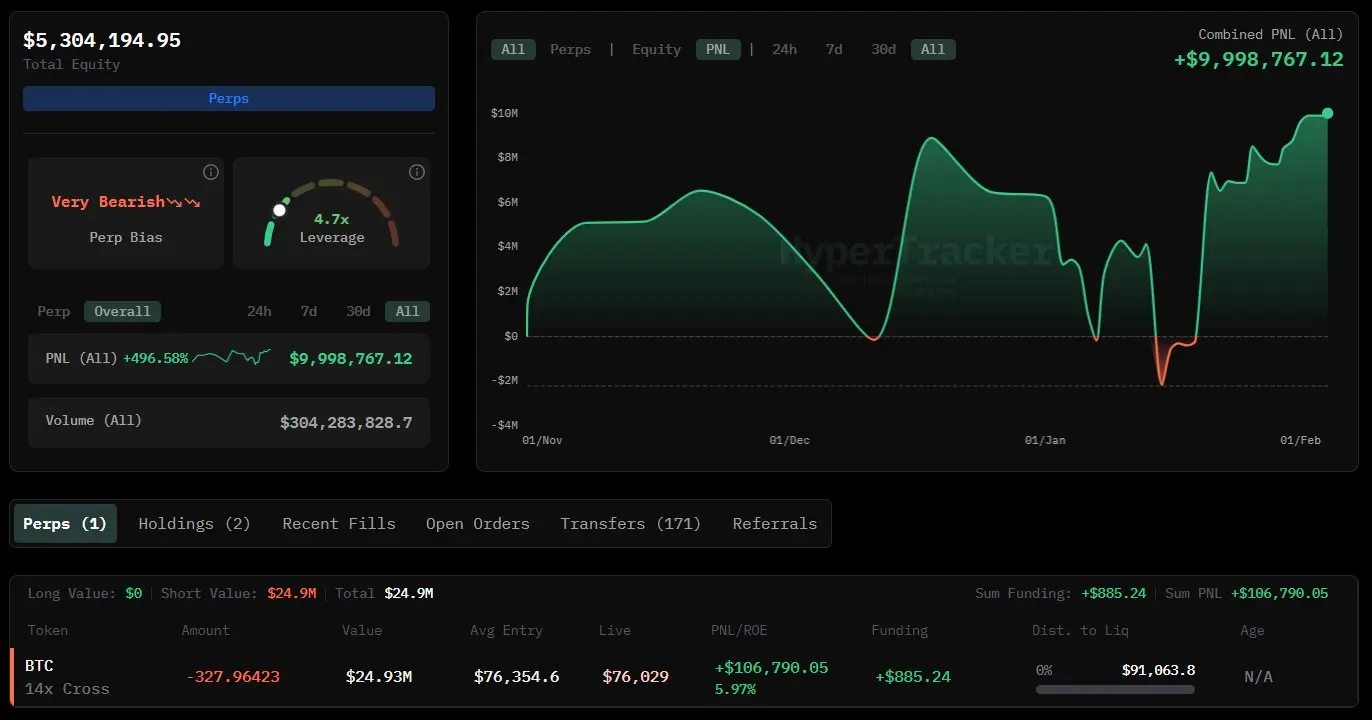

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

BTC-4,36%

- Reward

- 2

- 2

- Repost

- Share

BitcoinEyes :

:

2026 GOGOGO 👊View More

🟠 Bitcoin (BTC) is trading in the $74,000–$78,000 range, currently testing the key $74k–$76k support zone.

• Holding above this level opens room for a technical rebound

• A clean break increases downside risk toward $70k–$72k

🐋 Whales accumulating quietly amid extreme fear - classic pre-recovery signal.

🏛 Long-term: SEC–CFTC Project Crypto (clearer classification, tokenization) supports future institutional inflows, despite current noise.

💸 High downtrend volume amplifies fee impact on short-term trades. Pros focus on low-cost structures (rebates) to maintain edge, hold longer, and compou

• Holding above this level opens room for a technical rebound

• A clean break increases downside risk toward $70k–$72k

🐋 Whales accumulating quietly amid extreme fear - classic pre-recovery signal.

🏛 Long-term: SEC–CFTC Project Crypto (clearer classification, tokenization) supports future institutional inflows, despite current noise.

💸 High downtrend volume amplifies fee impact on short-term trades. Pros focus on low-cost structures (rebates) to maintain edge, hold longer, and compou

BTC-4,36%

- Reward

- 3

- Comment

- Repost

- Share

The Whales’ POV: "Profit-taking time—cashing out for Lunar New Year!" 🧧💸

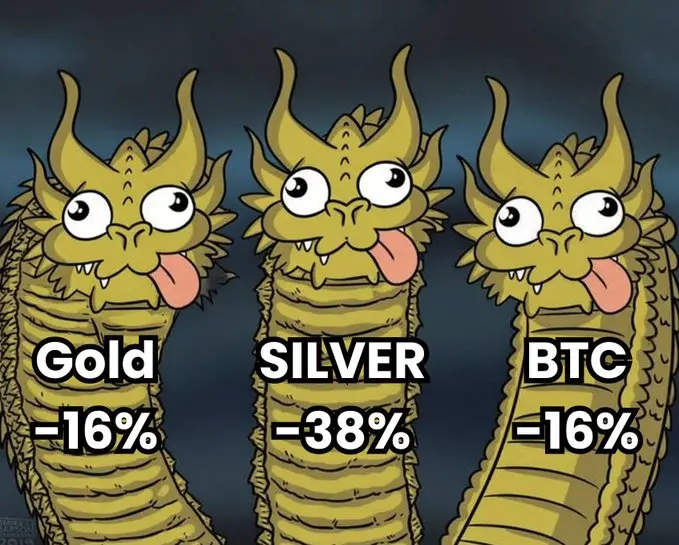

⚠️ MARKET UPDATES: GLOBAL SELL-OFF IN PROGRESS 🚨

🇺🇸 US Markets: Futures are bleeding. Nasdaq futures are down over 1.6%, signaling a rough opening bell tomorrow.

🌏 Asia Markets: Opening in deep red across the board. $SHCOMP, $ASX, $HSI, and $N225 are all sliding. South Korea’s $KOSPI is down 4%+, with KOSPI 200 futures hitting -5%, triggering a temporary trading halt (Sidecar).

Commodities & Crypto: 🛢️ Oil: Futures plummeted over 5%. 📉 Precious Metals: Gold down 3.5%. Silver dropped another 8% following last Frida

⚠️ MARKET UPDATES: GLOBAL SELL-OFF IN PROGRESS 🚨

🇺🇸 US Markets: Futures are bleeding. Nasdaq futures are down over 1.6%, signaling a rough opening bell tomorrow.

🌏 Asia Markets: Opening in deep red across the board. $SHCOMP, $ASX, $HSI, and $N225 are all sliding. South Korea’s $KOSPI is down 4%+, with KOSPI 200 futures hitting -5%, triggering a temporary trading halt (Sidecar).

Commodities & Crypto: 🛢️ Oil: Futures plummeted over 5%. 📉 Precious Metals: Gold down 3.5%. Silver dropped another 8% following last Frida

BTC-4,36%

- Reward

- 1

- Comment

- Repost

- Share

Covid Crash: $1.2B liquidated

FTX Collapse: $1.6B liquidated

Random Weekend “Volatility”: $2.6B liquidated No global crisis.

No black swan.

Just perfectly normal market behaviour.

FTX Collapse: $1.6B liquidated

Random Weekend “Volatility”: $2.6B liquidated No global crisis.

No black swan.

Just perfectly normal market behaviour.

- Reward

- 1

- Comment

- Repost

- Share

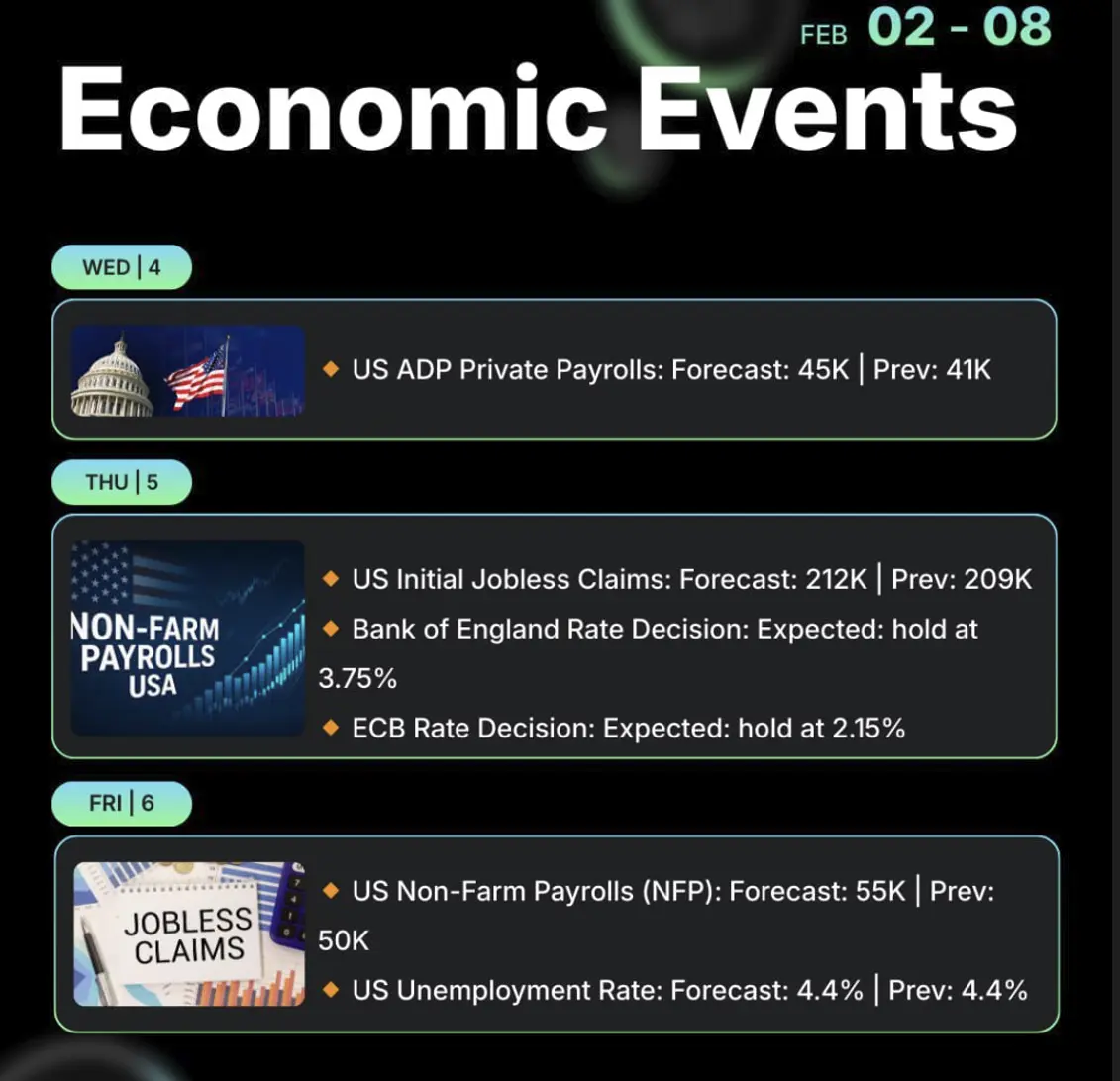

📅 ECONOMIC CALENDAR | WEEK AHEAD (US TIME)

Markets turn their focus to US labor data, alongside ECB & BoE rate decisions, while awaiting a potential US Supreme Court ruling on tariffs.

🇺🇸 Wed (Feb 4)

🔸 US ADP Private Payrolls: Forecast: 45K | Prev: 41K

🇺🇸 Thu (Feb 5)

🔸 US Initial Jobless Claims: Forecast: 212K | Prev: 209K

🔸 Bank of England Rate Decision: Expected: hold at 3.75%

🔸 ECB Rate Decision: Expected: hold at 2.15%

🇺🇸 Fri (Feb 6)

🔸 US Non-Farm Payrolls (NFP): Forecast: 55K | Prev: 50K

🔸 US Unemployment Rate: Forecast: 4.4% | Prev: 4.4%

Markets turn their focus to US labor data, alongside ECB & BoE rate decisions, while awaiting a potential US Supreme Court ruling on tariffs.

🇺🇸 Wed (Feb 4)

🔸 US ADP Private Payrolls: Forecast: 45K | Prev: 41K

🇺🇸 Thu (Feb 5)

🔸 US Initial Jobless Claims: Forecast: 212K | Prev: 209K

🔸 Bank of England Rate Decision: Expected: hold at 3.75%

🔸 ECB Rate Decision: Expected: hold at 2.15%

🇺🇸 Fri (Feb 6)

🔸 US Non-Farm Payrolls (NFP): Forecast: 55K | Prev: 50K

🔸 US Unemployment Rate: Forecast: 4.4% | Prev: 4.4%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

The 10-Day Growth Plan is here. Complete a 1 USDT trade to enter the lucky draw with a 100% chance of winning. Daily prizes include GT tokens, lucky bags, and the iPhone 17 Pro Max. Kickstart your wealth growth journey here. https://www.gate.com/campaigns/3977?ref=BTCNEYES&ref_type=132&utm_cmp=eVXX22F1

GT-6,75%

- Reward

- 3

- 1

- Repost

- Share

DrAmaniSooJP :

:

amazing sharing, thx ya...- Reward

- 2

- Comment

- Repost

- Share

Preserving capital > Preserving hope. 🧵

I exited my positions just before the market turned red. It’s not a "win" to celebrate—honestly, it feels heavy. I see many still holding on, whispering "it’ll bounce soon."

But the market doesn't care about our feelings.

1/ The Brutal Truth of Trading If you have capital, you have a way out. If you’re out of cash, you’re out of the game. There is no "next time" if your account is at zero.

2/ Against the Grain When I exited, the sentiment was moon-ish. I got called "weak hands" and "too early." I get it—I’ve been there. But price follows flow and patter

I exited my positions just before the market turned red. It’s not a "win" to celebrate—honestly, it feels heavy. I see many still holding on, whispering "it’ll bounce soon."

But the market doesn't care about our feelings.

1/ The Brutal Truth of Trading If you have capital, you have a way out. If you’re out of cash, you’re out of the game. There is no "next time" if your account is at zero.

2/ Against the Grain When I exited, the sentiment was moon-ish. I got called "weak hands" and "too early." I get it—I’ve been there. But price follows flow and patter

BTC-4,36%

- Reward

- 1

- Comment

- Repost

- Share

🧵 The AI Bubble: Why the math doesn't add up (yet).

Is AI the future? Probably. Is it a bubble? Historically speaking, yes. 📉

1. The "Dot-Com" Trap Belief in a tech shift doesn't guarantee immediate ROI. Like the late 90s, valuations assume infrastructure and mass adoption that aren't fully here yet. The vision is right; the timing is expensive.

2. Circular Valuations Big Tech is pouring billions into each other. Nvidia’s growth creates expectations for its clients (MSFT, GOOG, OpenAI). If their revenue doesn't scale to match those trillion-dollar valuations, the house of cards wobbles.

3. W

Is AI the future? Probably. Is it a bubble? Historically speaking, yes. 📉

1. The "Dot-Com" Trap Belief in a tech shift doesn't guarantee immediate ROI. Like the late 90s, valuations assume infrastructure and mass adoption that aren't fully here yet. The vision is right; the timing is expensive.

2. Circular Valuations Big Tech is pouring billions into each other. Nvidia’s growth creates expectations for its clients (MSFT, GOOG, OpenAI). If their revenue doesn't scale to match those trillion-dollar valuations, the house of cards wobbles.

3. W

- Reward

- 1

- Comment

- Repost

- Share

The market has finally liquidated this #BitcoinOG(1011short), with total liquidations reaching $522M.

He went from a profit of $142M+ to a loss of $128.87M.

The account has been fully wiped — balance at zero.

He went from a profit of $142M+ to a loss of $128.87M.

The account has been fully wiped — balance at zero.

- Reward

- 1

- Comment

- Repost

- Share