Around 0.0266, you can set a short position at a high level.. Boldly copy the robot below to increase profits and reduce risks. Recommended leverage is 1~2x. Take profit at 50%~300%. Once you make a profit, you should exit to avoid losing it back. Please follow me, thank you.

US23.36%

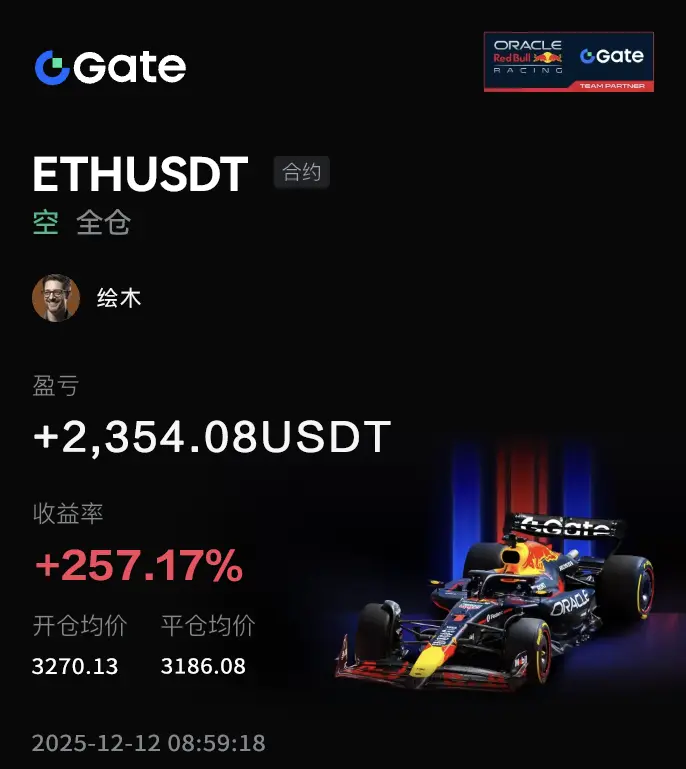

[The user has shared his/her trading data. Go to the App to view more.]