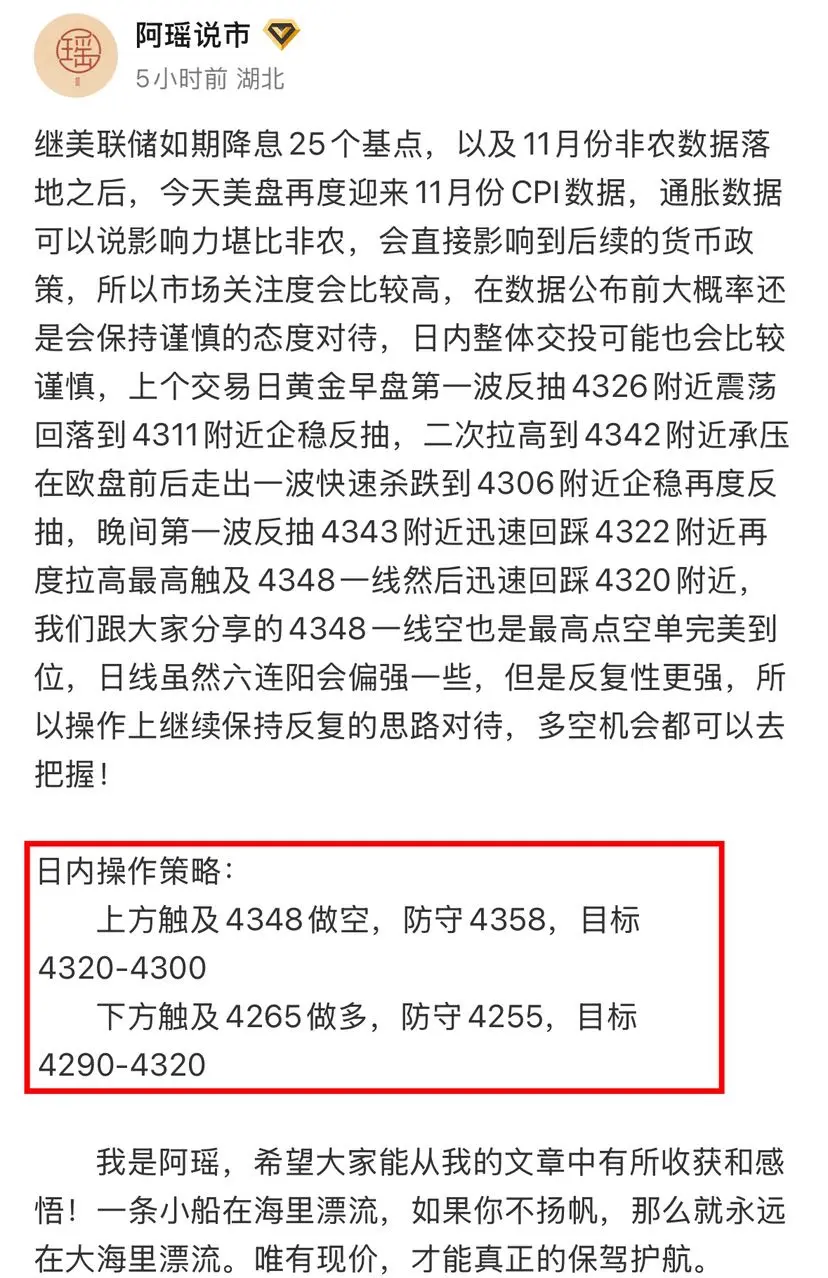

Following the Federal Reserve's expected 25 basis point rate cut and the release of November non-farm payroll data, today the US market once again received November CPI data. Inflation data can be said to have an influence comparable to non-farm payrolls and will directly impact subsequent monetary policy decisions. Therefore, market attention will be quite high. Before the data is announced, it is likely that the market will remain cautious, and overall trading during the day may also be cautious. In the previous trading day, gold experienced an initial rebound around 4326, fluctuated and fel

View OriginalSwingTradingWangQingy

No content yet

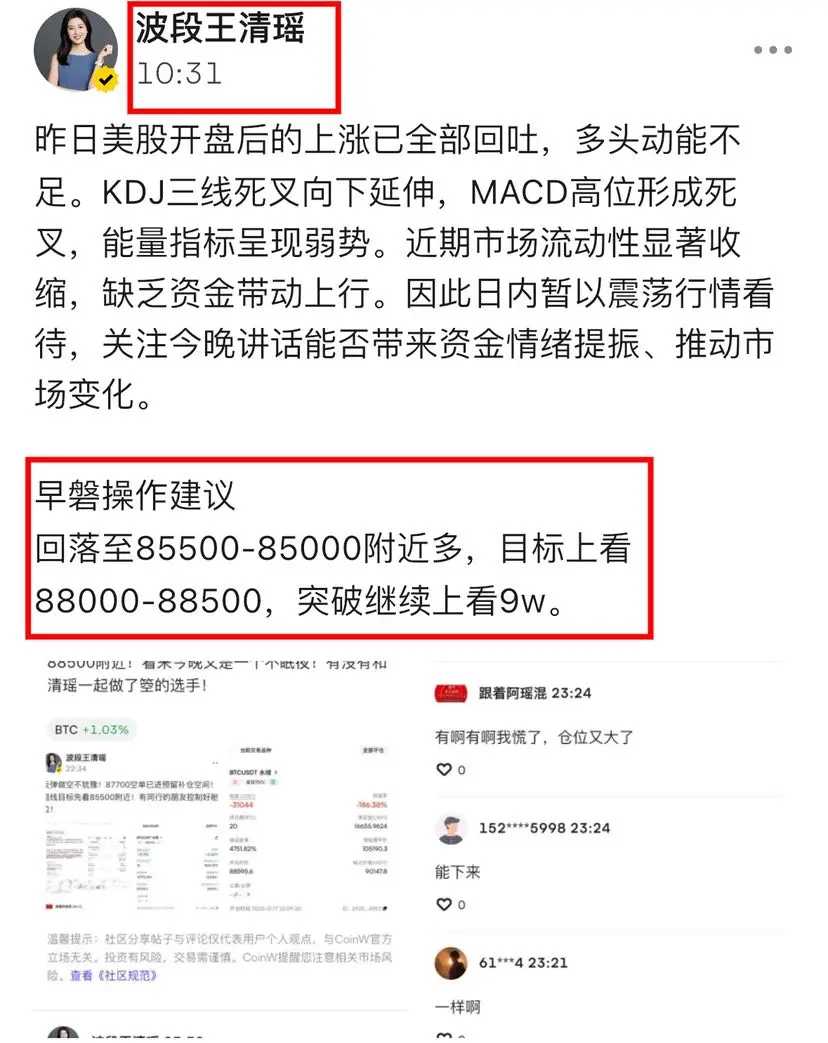

SwingTradingWangQingy

The value of this post speaks for itself! Just a few minutes before the news, I advised everyone to go long! Early Pan's analysis was also very clear that short-term trading is not suitable for short positions! After the data release, the market was very strong, with two large bullish candles helping us take profits! All long positions are closed, waiting for the US and EU to pass before re-entering the market!

View Original

- Reward

- like

- 1

- Repost

- Share

TigerArmy :

:

Sister Yao, the information you posted is a bit delayed.Long, long, whether it's gold or Bitcoin, we've been shouting long all day! All cash out! The strategy was given in advance, and after a day, it's summarized in two words: awesome!

BTC1.21%

- Reward

- like

- Comment

- Repost

- Share

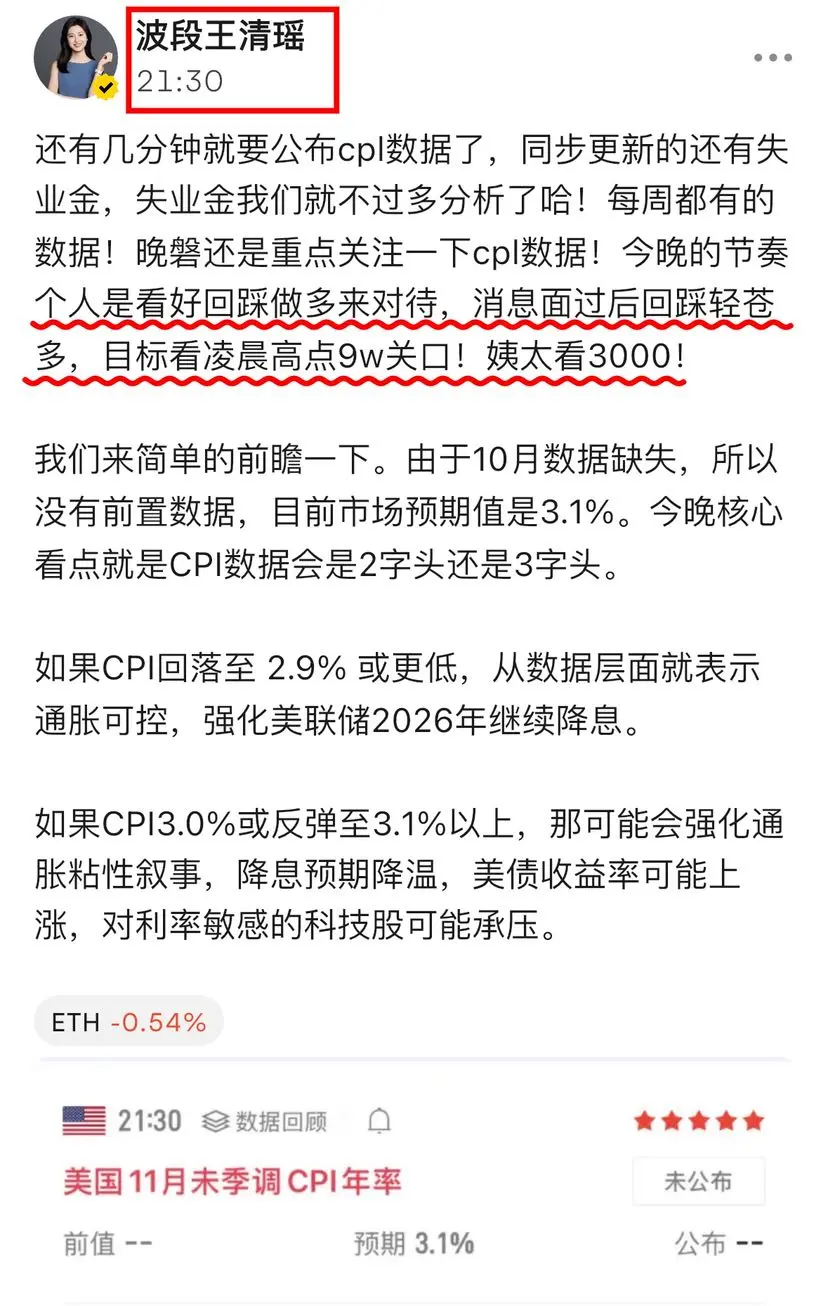

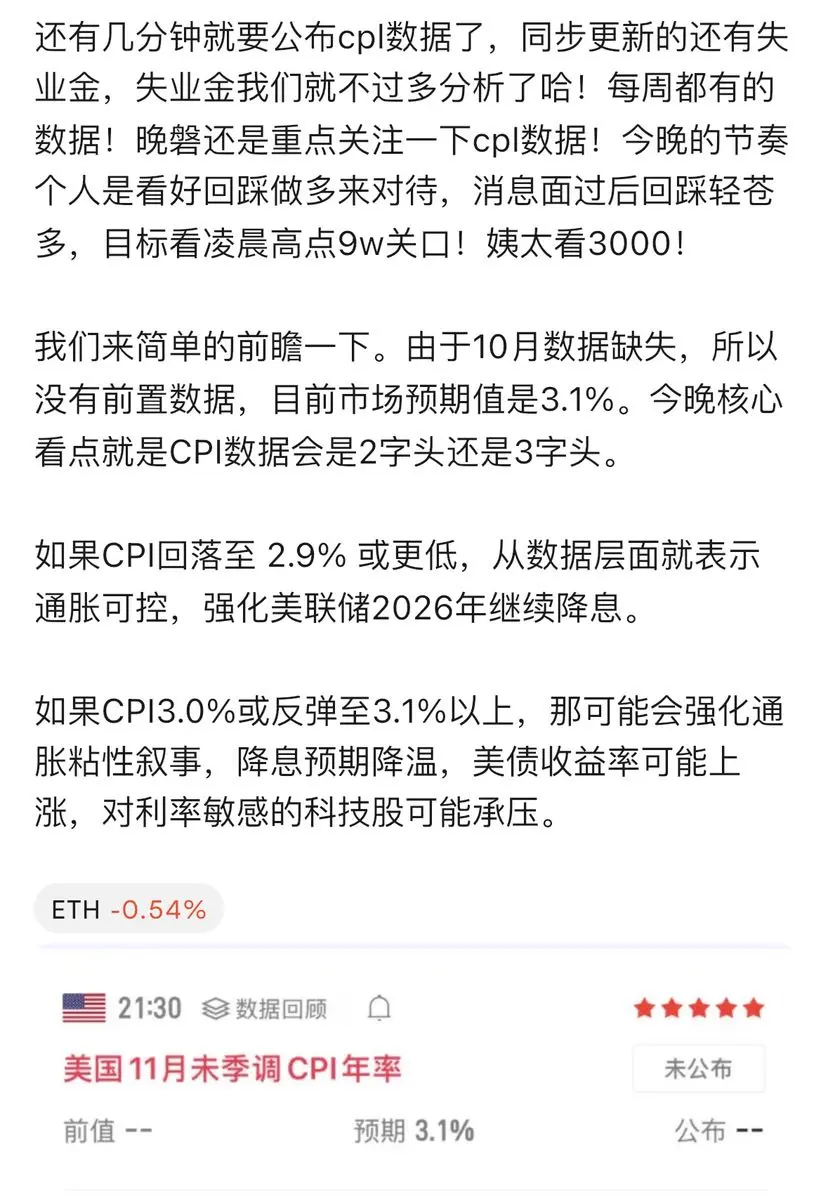

There are a few minutes left before the CPI data is announced. The unemployment benefits update is also synchronized, but we won't analyze it in detail here! It's weekly data! Tonight, I still focus on the CPI data! Personally, I am optimistic about a pullback and a long position, expecting a rebound after the news, with a target of the early morning high of 90,000 points! Auntie Tai targets 3,000!

Let's do a simple preview. Due to missing October data, there is no prior data available. Currently, the market expectation is 3.1%. The key focus tonight is whether the CPI will be in the 20s or 30

Let's do a simple preview. Due to missing October data, there is no prior data available. Currently, the market expectation is 3.1%. The key focus tonight is whether the CPI will be in the 20s or 30

ETH4.04%

- Reward

- 3

- Comment

- Repost

- Share

Early bullish strategy realized! A thousand-point space is given. Tonight, with the CPL data release, all long traders should control their positions, and short-term traders should be cautious and observe more. When the data shows good levels, I will notify everyone!

View Original

- Reward

- like

- Comment

- Repost

- Share

The Bank of Japan will hold a monetary policy meeting today and tomorrow, with the results announced on the 19th! My personal judgment is that the probability of a rate hike is very high, which is also the main negative factor suppressing risk assets recently! The market has already partially priced in this expectation last night, and with the CPI data to be released at 21:30 tonight, the recent market is likely to be particularly volatile and very interesting!

Let's break down the core impact logic of these two pieces of news:

1. Monetary Policy Meeting Logic

Previously, many institutions bor

View OriginalLet's break down the core impact logic of these two pieces of news:

1. Monetary Policy Meeting Logic

Previously, many institutions bor

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Mingbao :

:

Did not do goldSolana (SOL) has recently experienced an unfavorable price trend, failing to hold the 132 level, followed by a rapid decline, and is currently consolidating below 130. In the short term, if it breaks below 130, the price may continue to decline towards 120.

From a technical perspective, SOL has broken below 130 and 128, and is also below the 100-hour moving average, indicating a short-term bearish outlook. On the SOL/USD hourly chart, a downtrend line is forming, with resistance around 131. If the price rebounds and wants to continue higher, it needs to break through this resistance level.

The

From a technical perspective, SOL has broken below 130 and 128, and is also below the 100-hour moving average, indicating a short-term bearish outlook. On the SOL/USD hourly chart, a downtrend line is forming, with resistance around 131. If the price rebounds and wants to continue higher, it needs to break through this resistance level.

The

SOL1.33%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 2

- Repost

- Share

LiderVitria :

:

The year is still going to be amazing, it’s not over yetView More

Years of personal experience in the crypto circle, online professional strategies

First, either build your own foundation or find a reliable teacher to learn from.

Second, set up strict defenses. The stop-loss price for long positions must be placed below key support levels, and the stop-loss price for short positions must be placed above key resistance levels, to truly serve as a defense.

Third,合理配置仓位可以达到事半功倍的效果,更容易实现“小亏大赚”的盈利增长模式。

Fourth, control your emotions, minimize emotional commands, and avoid frequent mistakes and compounding errors.

Fifth, entering the market is important, exiting is

View OriginalFirst, either build your own foundation or find a reliable teacher to learn from.

Second, set up strict defenses. The stop-loss price for long positions must be placed below key support levels, and the stop-loss price for short positions must be placed above key resistance levels, to truly serve as a defense.

Third,合理配置仓位可以达到事半功倍的效果,更容易实现“小亏大赚”的盈利增长模式。

Fourth, control your emotions, minimize emotional commands, and avoid frequent mistakes and compounding errors.

Fifth, entering the market is important, exiting is

- Reward

- 1

- Comment

- Repost

- Share

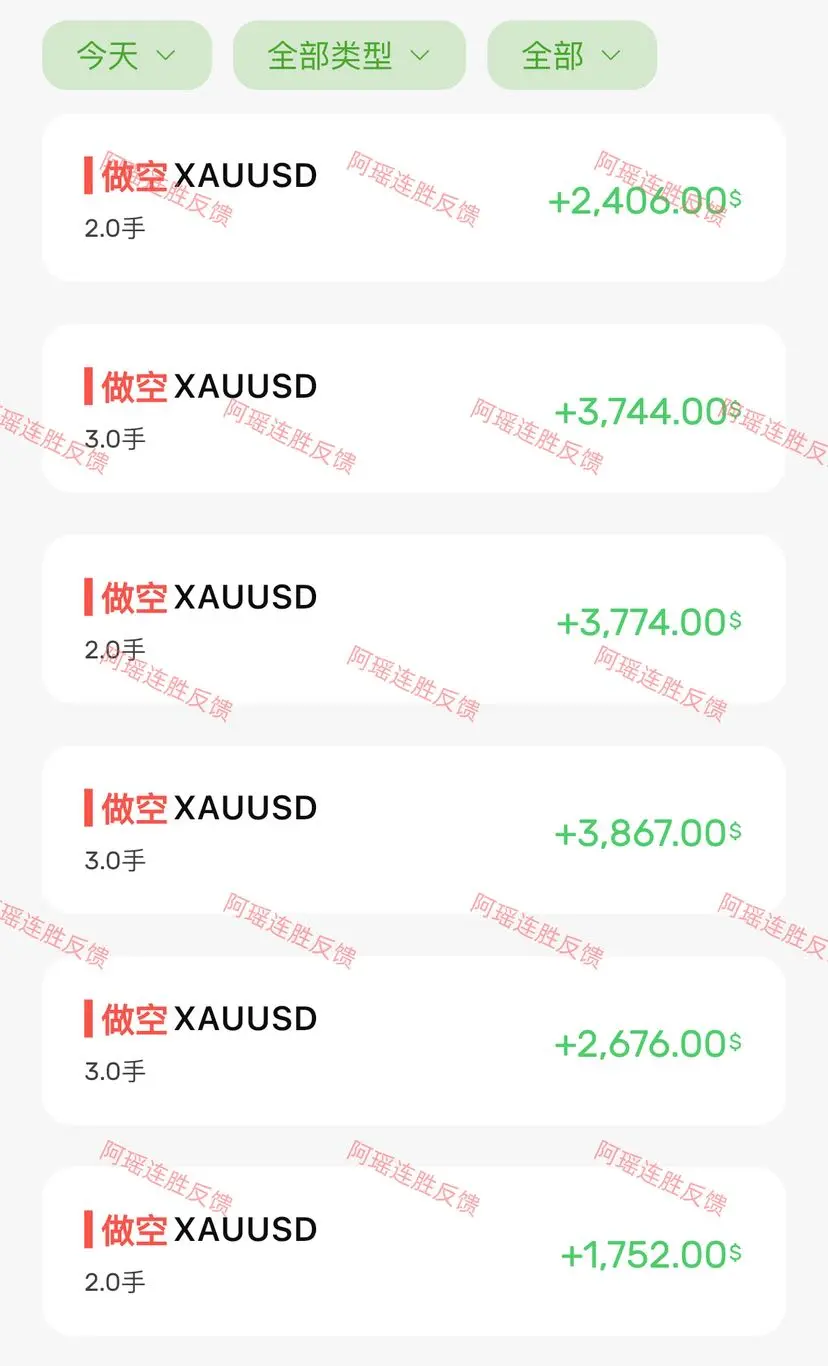

Early Pan's most empty thoughts are once again realized! Congratulations to Qingyao's fans and friends for securing today's thousand-point space opening red! The overnight short position is still held! Preparing to reach 85,000!

CPL plus the small notebook's interest rate hike! There are still many bearish news, and as long as the short positions are well-controlled, profits can be made! The afternoon trading strategy still revolves around shorting at high points! Boldly short around 87,500 during the rebound, and enter simultaneously near 3,980 for the concubine! Keep the position size under

View OriginalCPL plus the small notebook's interest rate hike! There are still many bearish news, and as long as the short positions are well-controlled, profits can be made! The afternoon trading strategy still revolves around shorting at high points! Boldly short around 87,500 during the rebound, and enter simultaneously near 3,980 for the concubine! Keep the position size under

- Reward

- 1

- Comment

- Repost

- Share

sol this month's bottom-fishing range is locked in:

First, set a "top": look at the 45-day moving average. When there's a death cross and the two lines open downward, it indicates a bearish major trend. Currently, it is slightly below the Bollinger middle band, which is at 148.5. Why has sol been unable to break through 148.5 despite multiple rebounds, only reaching a high of 146 and then stalling? This is the reason. In the future, only a break and stabilization above 148.5 will reverse the major trend to bullish.

sol is currently trading between the 10, 15, 20-day Bollinger middle and lower

First, set a "top": look at the 45-day moving average. When there's a death cross and the two lines open downward, it indicates a bearish major trend. Currently, it is slightly below the Bollinger middle band, which is at 148.5. Why has sol been unable to break through 148.5 despite multiple rebounds, only reaching a high of 146 and then stalling? This is the reason. In the future, only a break and stabilization above 148.5 will reverse the major trend to bullish.

sol is currently trading between the 10, 15, 20-day Bollinger middle and lower

SOL1.33%

- Reward

- like

- Comment

- Repost

- Share