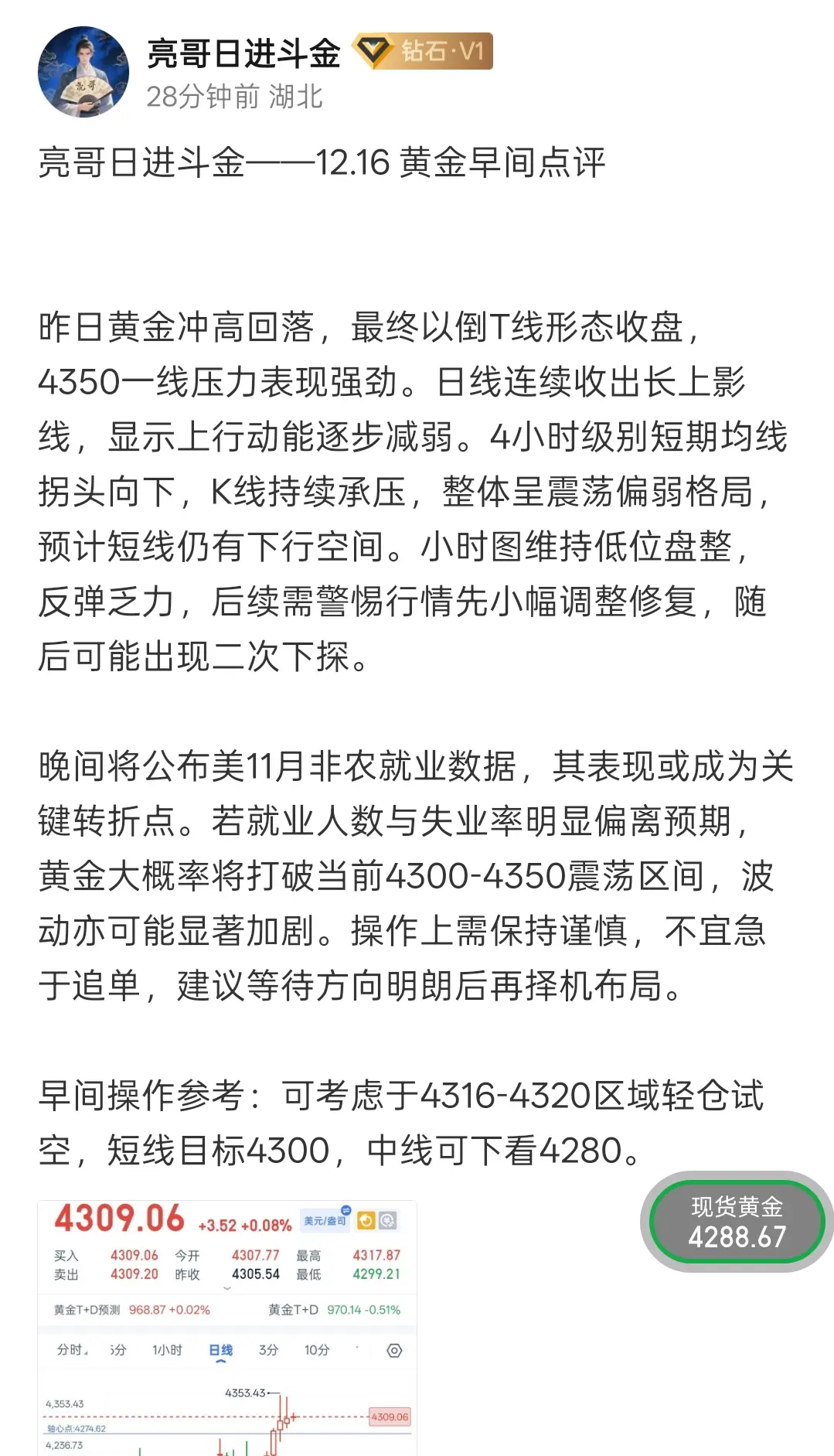

12.18 Thursday Brother Liang Daily Profit — Exclusive Analysis

Overnight gold closed with a bullish engulfing line. Previously, the strategy indicated to watch the previous high resistance at 4350. During the session, short positions at 4337 and 4346 were closed with profits, totaling 34 points.

The intraday gold trend broke the recent common upper shadow pattern, closing with a strong bullish body. The three Bollinger Bands on the daily chart remain upward, and if the price can break through the previous high, there is potential for further upward movement. Support levels below are solid, wit

View OriginalOvernight gold closed with a bullish engulfing line. Previously, the strategy indicated to watch the previous high resistance at 4350. During the session, short positions at 4337 and 4346 were closed with profits, totaling 34 points.

The intraday gold trend broke the recent common upper shadow pattern, closing with a strong bullish body. The three Bollinger Bands on the daily chart remain upward, and if the price can break through the previous high, there is potential for further upward movement. Support levels below are solid, wit