# TraditionalFinanceAcceleratesTokenization

6.27K

HanssiMazak

#TraditionalFinanceAcceleratesTokenization How Blockchain is Redefining Global Capital Markets

Traditional finance is evolving faster than ever, and asset tokenization is leading this transformation. On February 3, 2026, banks, asset managers, and financial institutions are increasingly digitizing stocks, bonds, real estate, commodities, and other assets using blockchain technology. This shift, captured under #TraditionalFinanceAcceleratesTokenization, is not just a technological upgrade—it is fundamentally reshaping capital markets by improving efficiency, accessibility, and transparency.

Tok

Traditional finance is evolving faster than ever, and asset tokenization is leading this transformation. On February 3, 2026, banks, asset managers, and financial institutions are increasingly digitizing stocks, bonds, real estate, commodities, and other assets using blockchain technology. This shift, captured under #TraditionalFinanceAcceleratesTokenization, is not just a technological upgrade—it is fundamentally reshaping capital markets by improving efficiency, accessibility, and transparency.

Tok

DEFI-5,46%

- Reward

- like

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization 1️⃣ Excellent breakdown of how traditional finance is embracing tokenization. Clear, insightful, and perfectly explains why this shift is structural, not just a trend.

2️⃣ This thread explains tokenization in a very mature way. Great clarity on liquidity, settlement efficiency, and why institutions are moving fast.

3️⃣ Well-articulated view on how blockchain is reshaping capital markets. Tokenization truly feels like the bridge between TradFi and DeFi.

4️⃣ Strong analysis. The focus on regulatory compliance + innovation shows why institutions are comf

2️⃣ This thread explains tokenization in a very mature way. Great clarity on liquidity, settlement efficiency, and why institutions are moving fast.

3️⃣ Well-articulated view on how blockchain is reshaping capital markets. Tokenization truly feels like the bridge between TradFi and DeFi.

4️⃣ Strong analysis. The focus on regulatory compliance + innovation shows why institutions are comf

DEFI-5,46%

- Reward

- like

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization

#TraditionalFinanceAcceleratesTokenization

Traditional finance is no longer experimenting with tokenization. It is accelerating into it. What started as pilot programs and proof of concepts has now evolved into real capital deployment, regulatory engagement, and production level infrastructure. The message from banks, asset managers, and financial institutions is becoming clear. Tokenization is not a future trend. It is an active transformation of how value is issued, traded, and settled.

At its core, tokenization is the process of representing real

#TraditionalFinanceAcceleratesTokenization

Traditional finance is no longer experimenting with tokenization. It is accelerating into it. What started as pilot programs and proof of concepts has now evolved into real capital deployment, regulatory engagement, and production level infrastructure. The message from banks, asset managers, and financial institutions is becoming clear. Tokenization is not a future trend. It is an active transformation of how value is issued, traded, and settled.

At its core, tokenization is the process of representing real

ETH-2,36%

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

1000x VIbes 🤑View More

#TraditionalFinanceAcceleratesTokenization

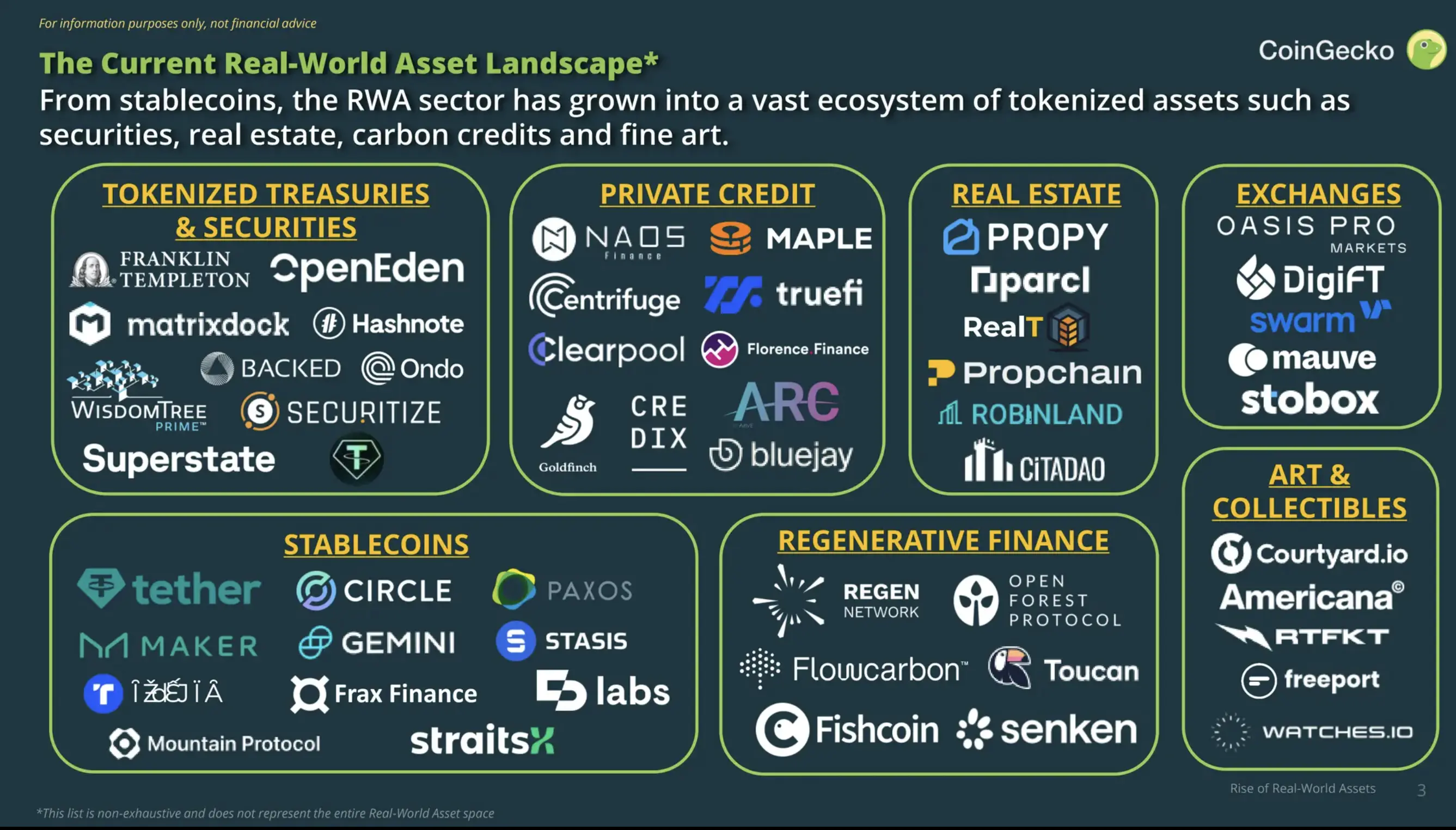

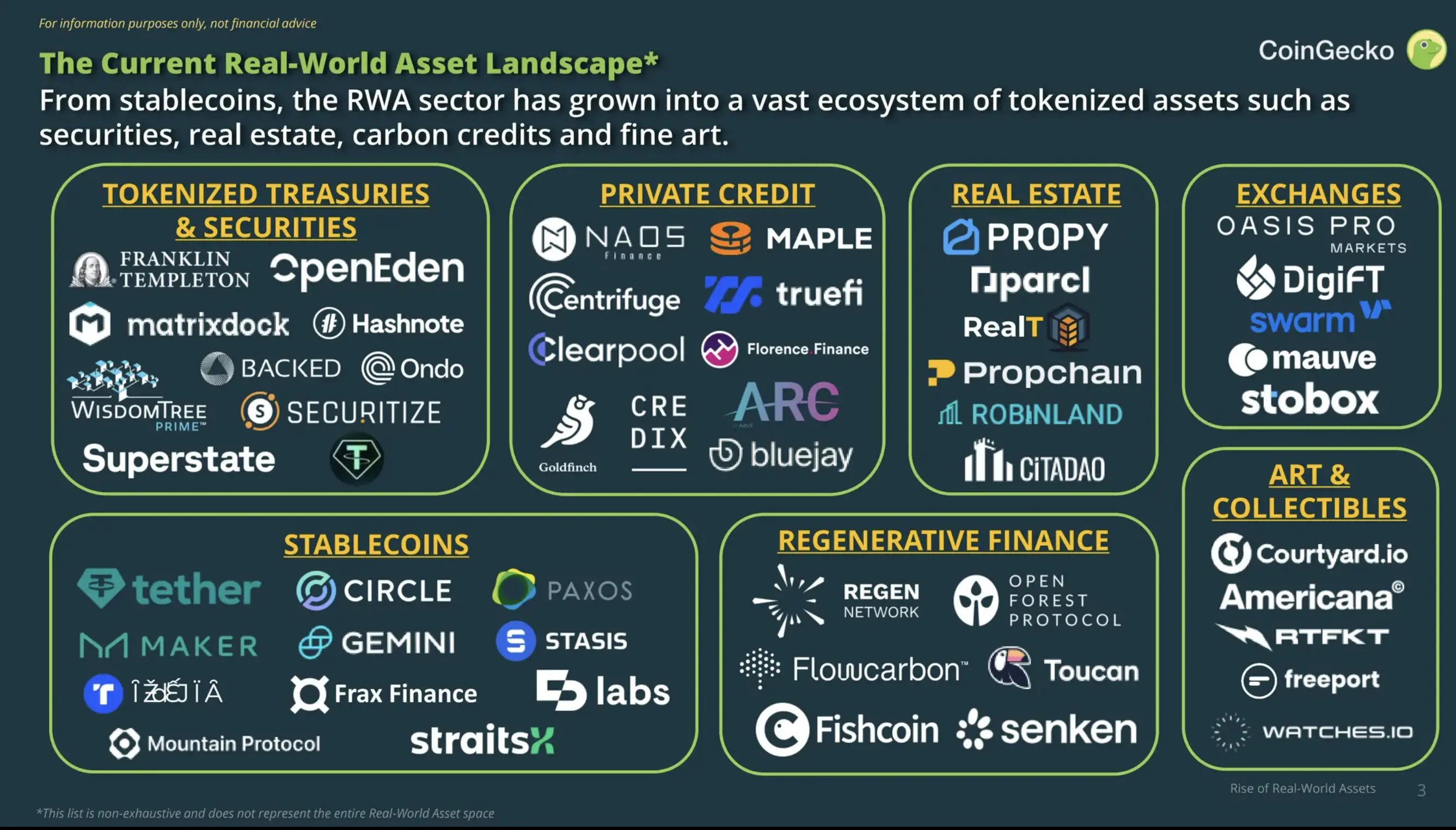

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

- Reward

- 1

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

Tokenization of real-world assets (RWAs) represents one of the most transformative trends bridging traditional finance (TradFi) and blockchain technology. It involves converting rights to physical or financial assets—such as real estate, bonds, treasuries, private credit, commodities, equities, or even art—into digital tokens on a blockchain. This process enables fractional ownership, faster settlement, enhanced transparency, and global accessibility while maintaining regulatory compliance through legal wrappers and off-chain structures.

As of early

- Reward

- 17

- 18

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TraditionalFinanceAcceleratesTokenization

Traditional finance is entering a new era, and tokenization is quickly becoming one of the most powerful forces driving this transformation.

Once viewed as an experimental concept tied closely to cryptocurrencies, tokenization has now gained serious traction among banks, asset managers, and financial institutions worldwide. As traditional finance accelerates its adoption of tokenized assets, the boundaries between legacy systems and blockchain-based infrastructure are beginning to blur.

Tokenization refers to the process of converting real-world asse

Traditional finance is entering a new era, and tokenization is quickly becoming one of the most powerful forces driving this transformation.

Once viewed as an experimental concept tied closely to cryptocurrencies, tokenization has now gained serious traction among banks, asset managers, and financial institutions worldwide. As traditional finance accelerates its adoption of tokenized assets, the boundaries between legacy systems and blockchain-based infrastructure are beginning to blur.

Tokenization refers to the process of converting real-world asse

- Reward

- 6

- 11

- Repost

- Share

CryptoRock :

:

DYOR 🤓View More

#TraditionalFinanceAcceleratesTokenization

The world of finance is witnessing a profound transformation as traditional financial institutions embrace tokenization. What was once a purely digital asset trend in crypto is now intersecting with conventional markets, reshaping the way value is created, transferred, and managed. Tokenization the process of converting physical and digital assets into blockchain-based tokens is no longer a futuristic concept; it is becoming a mainstream strategy for efficiency, liquidity, and accessibility.

Traditional finance, or TradFi, has historically been const

The world of finance is witnessing a profound transformation as traditional financial institutions embrace tokenization. What was once a purely digital asset trend in crypto is now intersecting with conventional markets, reshaping the way value is created, transferred, and managed. Tokenization the process of converting physical and digital assets into blockchain-based tokens is no longer a futuristic concept; it is becoming a mainstream strategy for efficiency, liquidity, and accessibility.

Traditional finance, or TradFi, has historically been const

- Reward

- 7

- 15

- Repost

- Share

AnnaCryptoWriter :

:

Hold tight 💪View More

Traditional Finance Meets Blockchain: Tokenization Is Reshaping Global Markets

Market Context:

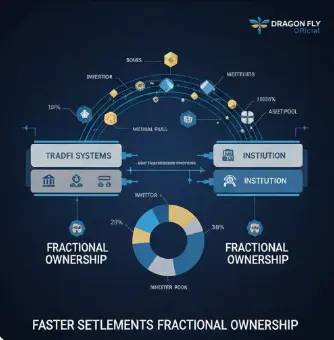

Major institutions like State Street, JPMorgan, and Goldman Sachs are no longer experimenting with blockchain—they’re actively launching digital asset platforms for tokenizing traditional financial products. From funds and bonds to treasuries, these assets are moving on-chain, enabling faster, cheaper, and more transparent financial transactions.

Analysis / Signal:

Tokenization is a systemic upgrade, not just a tech experiment. By digitizing assets, liquidity improves through fractional ownership, se

Market Context:

Major institutions like State Street, JPMorgan, and Goldman Sachs are no longer experimenting with blockchain—they’re actively launching digital asset platforms for tokenizing traditional financial products. From funds and bonds to treasuries, these assets are moving on-chain, enabling faster, cheaper, and more transparent financial transactions.

Analysis / Signal:

Tokenization is a systemic upgrade, not just a tech experiment. By digitizing assets, liquidity improves through fractional ownership, se

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

stay strong and HODLView More

#TraditionalFinanceAcceleratesTokenization

The evolution of traditional finance is accelerating at an unprecedented pace, and tokenization of assets is at the forefront of this transformation. On February 3, 2026, financial institutions are increasingly adopting blockchain-based solutions to digitize stocks, bonds, real estate, and commodities. This trend, captured under #TraditionalFinanceAcceleratesTokenization, is not merely a technological upgrade it is reshaping the very mechanics of global capital markets, improving efficiency, accessibility, and transparency.

Tokenization converts owne

The evolution of traditional finance is accelerating at an unprecedented pace, and tokenization of assets is at the forefront of this transformation. On February 3, 2026, financial institutions are increasingly adopting blockchain-based solutions to digitize stocks, bonds, real estate, and commodities. This trend, captured under #TraditionalFinanceAcceleratesTokenization, is not merely a technological upgrade it is reshaping the very mechanics of global capital markets, improving efficiency, accessibility, and transparency.

Tokenization converts owne

- Reward

- 5

- 3

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#TraditionalFinanceAcceleratesTokenization

Traditional financial institutions are accelerating their adoption of blockchain technology at an unprecedented pace, signaling a structural shift in how financial markets operate. Industry giants such as State Street, JPMorgan, and Goldman Sachs are actively developing and deploying digital asset platforms designed for asset tokenization, transforming conventional financial products into blockchain-based, digitally represented instruments. Tokenization enables fractional ownership of assets, faster settlement times, increased transparency, and impro

Traditional financial institutions are accelerating their adoption of blockchain technology at an unprecedented pace, signaling a structural shift in how financial markets operate. Industry giants such as State Street, JPMorgan, and Goldman Sachs are actively developing and deploying digital asset platforms designed for asset tokenization, transforming conventional financial products into blockchain-based, digitally represented instruments. Tokenization enables fractional ownership of assets, faster settlement times, increased transparency, and impro

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

17.42K Popularity

11.79K Popularity

8.32K Popularity

908 Popularity

4.85K Popularity

6.01K Popularity

18.71K Popularity

15.8K Popularity

13.14K Popularity

14.62K Popularity

11.57K Popularity

2.88K Popularity

85 Popularity

30.42K Popularity

224.7K Popularity

News

View MorePin