# Stablecoins

1.06M

User_any

#Stablecoins

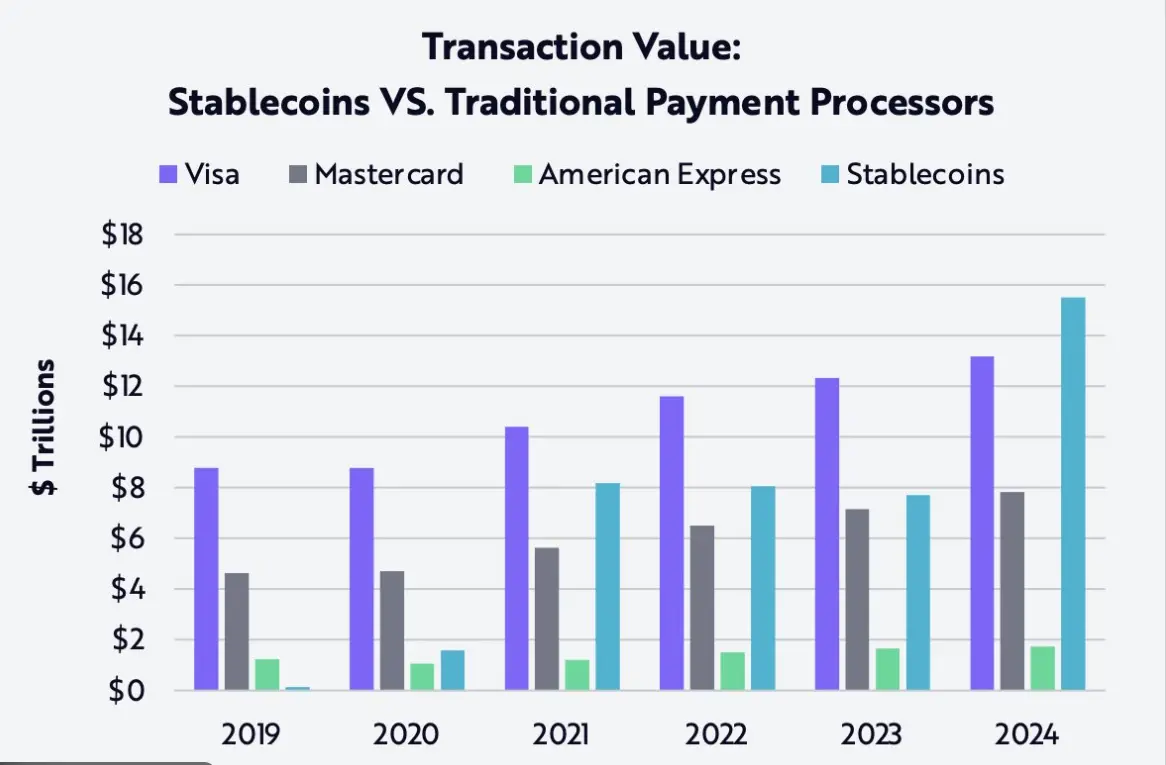

✨In 2025, the stablecoin market capitalization grew by 49%, from $205 billion to $310-318 billion. USDT stood out with approximately $187 billion (a 36% increase), and USDC with approximately $75 billion (a 73% increase). Total transaction volume reached $33-35 trillion; USDC led in institutional adoption. A market capitalization of $1 trillion is projected for 2026 (40% compound annual growth). Thanks to regulatory clarity, stablecoins are becoming indispensable to traditional finance in cross-border payments, tokenization, and everyday spending (card spending approximately $18

✨In 2025, the stablecoin market capitalization grew by 49%, from $205 billion to $310-318 billion. USDT stood out with approximately $187 billion (a 36% increase), and USDC with approximately $75 billion (a 73% increase). Total transaction volume reached $33-35 trillion; USDC led in institutional adoption. A market capitalization of $1 trillion is projected for 2026 (40% compound annual growth). Thanks to regulatory clarity, stablecoins are becoming indispensable to traditional finance in cross-border payments, tokenization, and everyday spending (card spending approximately $18

USDC-0,03%

- Reward

- 26

- 72

- Repost

- Share

not_queen :

:

2026 GOGOGO 👊View More

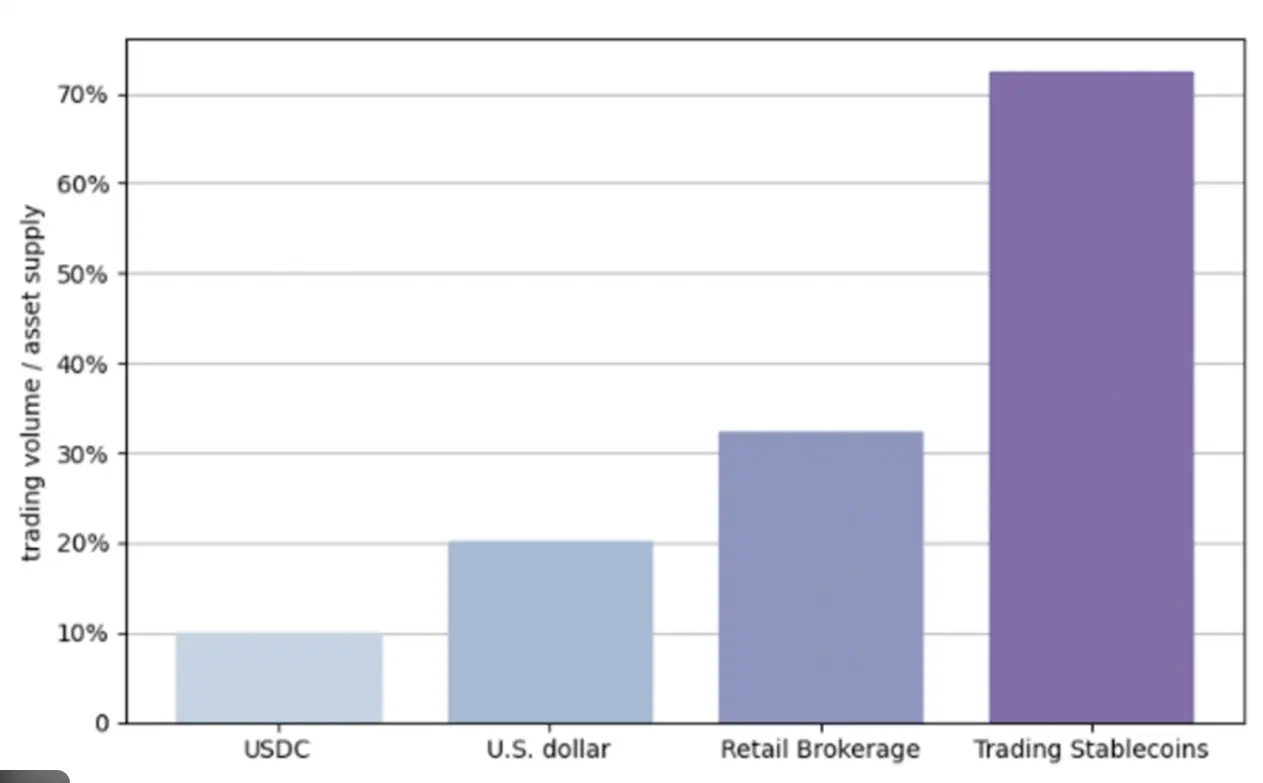

🔥 $35 TRILLION MOVED… BUT ONLY 1% USED FOR REAL PAYMENTS?! 🔥

According to McKinsey & Artemis Analytics, stablecoins transferred over $35 trillion on-chain last year — yet only ~$380B was used for real-world payments like remittances, payroll, or suppliers.

That’s just 0.02% of global payments.

So what does this really mean? 👇

🐂 BULL CASE: “This Is Just the Beginning”

Bulls argue this data is bullish, not bearish:

Stablecoins already dominate on-chain settlement & liquidity

They’re becoming the backbone of crypto markets, not consumer wallets (yet)

Payments adoption usually comes after infr

According to McKinsey & Artemis Analytics, stablecoins transferred over $35 trillion on-chain last year — yet only ~$380B was used for real-world payments like remittances, payroll, or suppliers.

That’s just 0.02% of global payments.

So what does this really mean? 👇

🐂 BULL CASE: “This Is Just the Beginning”

Bulls argue this data is bullish, not bearish:

Stablecoins already dominate on-chain settlement & liquidity

They’re becoming the backbone of crypto markets, not consumer wallets (yet)

Payments adoption usually comes after infr

- Reward

- 18

- 15

- Repost

- Share

BabaJi :

:

2026 GOGOGO 👊View More

#StablecoinPaymentChainPlasmaProgress

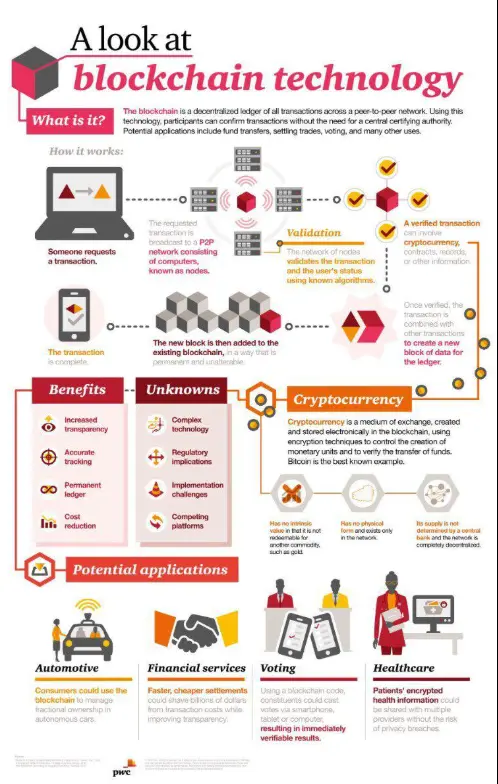

The development of Plasma-based payment chains for stablecoins is making steady progress, aiming to deliver faster, cheaper, and more scalable transactions for everyday payments.

This evolution highlights the growing focus on real-world crypto utility beyond speculation.

🔗 What’s Advancing

Plasma frameworks improve scalability by moving transactions off-chain while keeping main-chain security

Stablecoin transfers become near-instant with lower fees

Designed for high-frequency payments and merchant adoption

Reduced network congestion on main blockchains

💡

The development of Plasma-based payment chains for stablecoins is making steady progress, aiming to deliver faster, cheaper, and more scalable transactions for everyday payments.

This evolution highlights the growing focus on real-world crypto utility beyond speculation.

🔗 What’s Advancing

Plasma frameworks improve scalability by moving transactions off-chain while keeping main-chain security

Stablecoin transfers become near-instant with lower fees

Designed for high-frequency payments and merchant adoption

Reduced network congestion on main blockchains

💡

- Reward

- 8

- 9

- Repost

- Share

QueenOfTheDay :

:

2026 GOGOGO 👊View More

Double the Rewards, Half the Stress. 💎

Why choose between a "safe" 4.4% APR and the "moonshot" potential of new projects? With GUSD on Gate, you get both.

✅ 4.4% Fixed APR (The Foundation)

✅ Launchpool Access (The Upside)

✅ Minimal Volatility (The Peace of Mind)

Turn your $GUSD into a dual-earning engine today. ⚙️

#Crypto #Stablecoins #GUSD #Earn #Gateio $GT

Why choose between a "safe" 4.4% APR and the "moonshot" potential of new projects? With GUSD on Gate, you get both.

✅ 4.4% Fixed APR (The Foundation)

✅ Launchpool Access (The Upside)

✅ Minimal Volatility (The Peace of Mind)

Turn your $GUSD into a dual-earning engine today. ⚙️

#Crypto #Stablecoins #GUSD #Earn #Gateio $GT

GT-2,32%

- Reward

- 1

- Comment

- Repost

- Share

#TheWorldEconomicForum 🌍

Davos 2026: Where Global Leaders Shaped the Future 🌐

The WEF 2026 Summit tackled the big issues:

🌱 Climate change

🌍 Geopolitical tensions

💻 Digital transformation

Key takeaway for crypto:

🚀 Stablecoins get a regulatory boost

🏦 Asset tokenization to democratize markets

🇺🇸 Trump reinforces US as the “Crypto Capital of the World”

Result?

More institutional adoption

A safer, more accessible crypto ecosystem

Potential market cap growth across the board

💭 Your take: Is this the year crypto truly goes mainstream?

#Crypto #Davos2026 #Stablecoins #Tokenization

Davos 2026: Where Global Leaders Shaped the Future 🌐

The WEF 2026 Summit tackled the big issues:

🌱 Climate change

🌍 Geopolitical tensions

💻 Digital transformation

Key takeaway for crypto:

🚀 Stablecoins get a regulatory boost

🏦 Asset tokenization to democratize markets

🇺🇸 Trump reinforces US as the “Crypto Capital of the World”

Result?

More institutional adoption

A safer, more accessible crypto ecosystem

Potential market cap growth across the board

💭 Your take: Is this the year crypto truly goes mainstream?

#Crypto #Davos2026 #Stablecoins #Tokenization

TRUMP-3,39%

- Reward

- 2

- Comment

- Repost

- Share

Lawmakers in the United States are seeking to amend financial laws to encourage the use of digital assets in payments.

The new proposal aims to eliminate taxes on small routine transactions using stablecoins (#Stablecoins ) with a maximum limit of $200, provided they are linked to the dollar, and it also includes flexible treatment of mining returns (#Mining ).

#FOMCWatch #USChinaDeal

$SOL

$BTC

$ETH

View OriginalThe new proposal aims to eliminate taxes on small routine transactions using stablecoins (#Stablecoins ) with a maximum limit of $200, provided they are linked to the dollar, and it also includes flexible treatment of mining returns (#Mining ).

#FOMCWatch #USChinaDeal

$SOL

$BTC

$ETH

- Reward

- 1

- Comment

- Repost

- Share

🔮 #2026CryptoOutlook | What’s Next for the Crypto Market?

As we move closer to 2026, the crypto market is entering a new phase — less hype, more real adoption. The focus is shifting from short-term speculation to long-term infrastructure and institutional growth.

📌 Key Themes to Watch in 2026:

1️⃣ Bitcoin stays at the core

With ETFs, institutional inflows, and post-halving dynamics, Bitcoin is expected to remain the market’s anchor. Volatility will stay, but BTC’s role as a macro asset continues to strengthen.

2️⃣ Stablecoins go mainstream

Stablecoins are no longer just trading tools. In 202

As we move closer to 2026, the crypto market is entering a new phase — less hype, more real adoption. The focus is shifting from short-term speculation to long-term infrastructure and institutional growth.

📌 Key Themes to Watch in 2026:

1️⃣ Bitcoin stays at the core

With ETFs, institutional inflows, and post-halving dynamics, Bitcoin is expected to remain the market’s anchor. Volatility will stay, but BTC’s role as a macro asset continues to strengthen.

2️⃣ Stablecoins go mainstream

Stablecoins are no longer just trading tools. In 202

- Reward

- 7

- 6

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#CLARITYBillDelayed

What the Delay of the CLARITY Bill Means for Crypto, DeFi & Stablecoins

The delay of the Digital Asset Market Clarity Act (CLARITY Bill) has once again placed the U.S. crypto industry in a waiting phase — highlighting how critical regulatory certainty has become for digital assets, DeFi protocols, and stablecoins.

The CLARITY Bill was introduced to finally end years of confusion by defining how cryptocurrencies are classified, which regulators oversee them, and how stablecoins and platforms should operate. Its goal is simple but powerful: replace regulation-by-enforcement w

What the Delay of the CLARITY Bill Means for Crypto, DeFi & Stablecoins

The delay of the Digital Asset Market Clarity Act (CLARITY Bill) has once again placed the U.S. crypto industry in a waiting phase — highlighting how critical regulatory certainty has become for digital assets, DeFi protocols, and stablecoins.

The CLARITY Bill was introduced to finally end years of confusion by defining how cryptocurrencies are classified, which regulators oversee them, and how stablecoins and platforms should operate. Its goal is simple but powerful: replace regulation-by-enforcement w

DEFI-6,46%

- Reward

- 4

- 4

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

JUST IN: Trump-Affiliated World Liberty Financial Files for Federal US Bank Charter.

The narrative has shifted overnight from "adoption" to "integration." World Liberty Financial has officially applied to the Office of the Comptroller of the Currency (OCC) for a national trust bank license. This is not just another crypto project launch; it is a direct attempt to bring stablecoin issuance under the same federal regulatory umbrella as traditional banking.

This move fundamentally changes the risk profile for on-chain assets. While Bitcoin consolidates near $90,800, the infrastructure for a regul

The narrative has shifted overnight from "adoption" to "integration." World Liberty Financial has officially applied to the Office of the Comptroller of the Currency (OCC) for a national trust bank license. This is not just another crypto project launch; it is a direct attempt to bring stablecoin issuance under the same federal regulatory umbrella as traditional banking.

This move fundamentally changes the risk profile for on-chain assets. While Bitcoin consolidates near $90,800, the infrastructure for a regul

- Reward

- 3

- 6

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

🔮 The Future of Crypto: Big Tech Enters the Chain

We’re entering a new chapter in crypto — and this time, it’s not just Ethereum or Solana in the spotlight.

The next wave is being led by corporate giants. Companies like Circle, Tether, Robinhood, and Stripe aren’t just participating in crypto — they’re building the rails for it. And it’s going to change everything. 👇

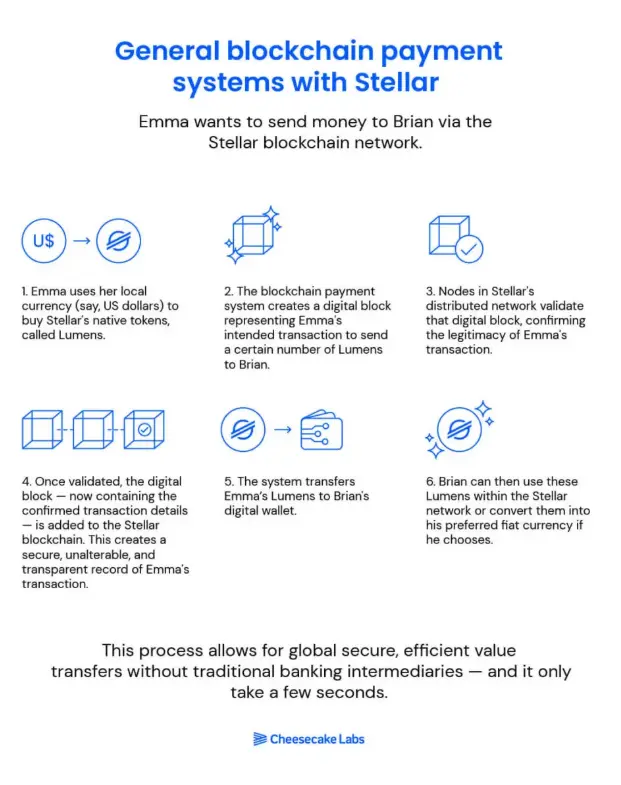

🚀 The New Blockchain Order🔹 Circle → ARK Blockchain• Fees in USDC• 3,000 TPS• Fixed, business-friendly costs

🔹 Tether → Plasma & Stable• Plasma for fast, zero-fee transfers• Stable for private P2P payments

🔹 Robinhood → Robi

We’re entering a new chapter in crypto — and this time, it’s not just Ethereum or Solana in the spotlight.

The next wave is being led by corporate giants. Companies like Circle, Tether, Robinhood, and Stripe aren’t just participating in crypto — they’re building the rails for it. And it’s going to change everything. 👇

🚀 The New Blockchain Order🔹 Circle → ARK Blockchain• Fees in USDC• 3,000 TPS• Fixed, business-friendly costs

🔹 Tether → Plasma & Stable• Plasma for fast, zero-fee transfers• Stable for private P2P payments

🔹 Robinhood → Robi

- Reward

- 1

- 2

- Repost

- Share

LittleQueen :

:

😊😊😊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

75.51K Popularity

49.4K Popularity

39.96K Popularity

14.7K Popularity

30.48K Popularity

23.92K Popularity

18.14K Popularity

87.91K Popularity

58.23K Popularity

28.24K Popularity

18.02K Popularity

7.04K Popularity

264.83K Popularity

27.35K Popularity

167.61K Popularity

News

View MorePin