# FederalReserve

13.4K

Luna_Star

#FedRateDecisionApproaches

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

- Reward

- 5

- 10

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

🏦📊 #FedKeepsRatesUnchanged | Policy Update

The U.S. Federal Reserve has decided to keep interest rates unchanged, signaling a cautious stance as it assesses inflation trends and economic conditions. Markets are closely watching forward guidance for clues on the future path of monetary policy. 👀💵

🔍 Market Implications:

📈 Short-term stability across risk assets

💱 Focus shifts to Fed commentary and data dependency

🌐 Potential impact on USD, equities, and crypto sentiment

💡 Macro decisions like this often set the tone for market direction. Stay informed and manage risk using Gate.io’s rea

The U.S. Federal Reserve has decided to keep interest rates unchanged, signaling a cautious stance as it assesses inflation trends and economic conditions. Markets are closely watching forward guidance for clues on the future path of monetary policy. 👀💵

🔍 Market Implications:

📈 Short-term stability across risk assets

💱 Focus shifts to Fed commentary and data dependency

🌐 Potential impact on USD, equities, and crypto sentiment

💡 Macro decisions like this often set the tone for market direction. Stay informed and manage risk using Gate.io’s rea

- Reward

- 3

- Comment

- Repost

- Share

#FedRateDecisionApproaches FedRateDecisionApproaches 🚨

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

BTC-5,31%

- Reward

- 14

- 18

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#FedRateDecisionApproaches FedRateDecisionApproaches 🚨

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

BTC-5,31%

- Reward

- 1

- Comment

- Repost

- Share

#FederalReserveRateCutsAndPersonnelChanges

Markets are closely watching the Federal Reserve as expectations grow around potential rate cuts alongside possible personnel changes within the central bank.

Together, these factors could reshape policy direction, market sentiment, and risk appetite in the months ahead.

🏦 What’s Driving the Focus

Rate Cut Expectations: Cooling inflation and softer economic data are increasing speculation about policy easing

Leadership & Personnel Shifts: Any changes in key Fed positions may influence future policy tone

Forward Guidance: Markets are highly sensitive

Markets are closely watching the Federal Reserve as expectations grow around potential rate cuts alongside possible personnel changes within the central bank.

Together, these factors could reshape policy direction, market sentiment, and risk appetite in the months ahead.

🏦 What’s Driving the Focus

Rate Cut Expectations: Cooling inflation and softer economic data are increasing speculation about policy easing

Leadership & Personnel Shifts: Any changes in key Fed positions may influence future policy tone

Forward Guidance: Markets are highly sensitive

- Reward

- 10

- 6

- Repost

- Share

BabaJi :

:

2026 GOGOGO 👊View More

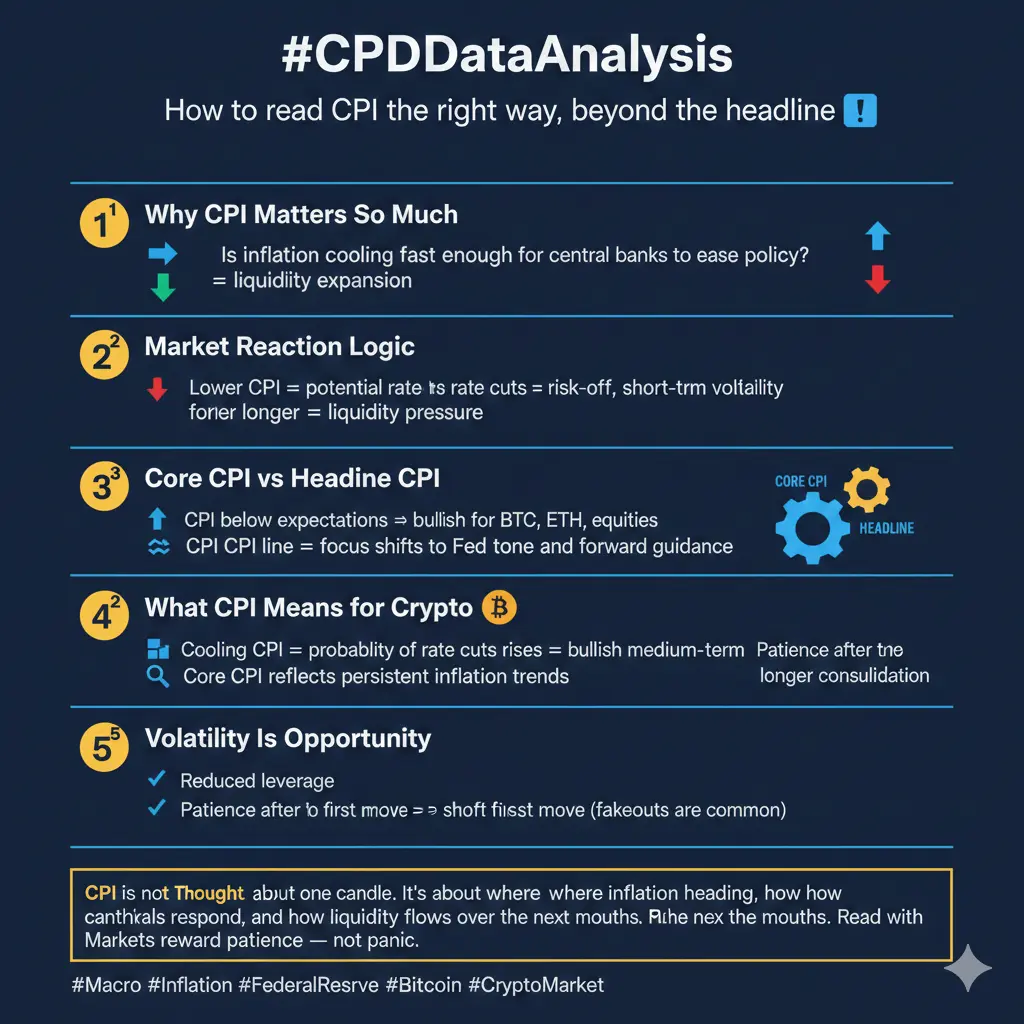

#CPIDataAnalysis

The Consumer Price Index (CPI) goes beyond being an economic indicator; it serves as a significant market trigger. Each CPI release can alter expectations regarding inflation, interest rates, liquidity, and ultimately affect risk assets such as cryptocurrencies and stocks.

Here's a guide to interpreting CPI beyond its headline figures 👇

1️⃣ Importance of CPI

CPI measures the pace at which prices rise for everyday goods and services, crucially addressing:

➡️ Is inflation slowing down sufficiently for central banks to ease policies?

A lower CPI may signal potential rate cuts a

The Consumer Price Index (CPI) goes beyond being an economic indicator; it serves as a significant market trigger. Each CPI release can alter expectations regarding inflation, interest rates, liquidity, and ultimately affect risk assets such as cryptocurrencies and stocks.

Here's a guide to interpreting CPI beyond its headline figures 👇

1️⃣ Importance of CPI

CPI measures the pace at which prices rise for everyday goods and services, crucially addressing:

➡️ Is inflation slowing down sufficiently for central banks to ease policies?

A lower CPI may signal potential rate cuts a

- Reward

- 7

- 2

- Repost

- Share

Next Federal Reserve interest rate decision will be announced at 3:00 AM on January 29th, Beijing time!

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

- Reward

- 8

- 3

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

Next Federal Reserve interest rate decision will be announced at 3:00 AM on January 29th, Beijing time!

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

The market currently expects rates to remain unchanged, with the probability of a cut under 5%!

According to the latest CME "FedWatch" data, the chance of a 25 basis point rate cut at the January 27–28 meeting is about 5%, with a 95% probability of holding rates steady.

Polymarket predictions show a 2.1% chance of a 25 basis point cut in January, 97.4% chance of no change, and a 29.6% chance of a cumulative 25 basis point cut in March.

At the start of the year, don’t rely solely on rate cuts

- Reward

- like

- Comment

- Repost

- Share

#FOMCMeeting 🚨🌟👑🔥🔥

🔥 The FOMC meeting just delivered a🚨 market-shaking moment traders won’t forget. Every word, pause, and projection sent instant ripples🪙 through stocks, bonds, and crypto as expectations flipped in real time. Rates may have stayed steady, but the tone didn’t—signals hinted at a tighter path than markets were pricing in, triggering fast volatility and sharp positioning shifts. Insiders are calling this a “setup meeting”—the kind that quietly sets the stage for a powerful next move. Eyes locked on the Fed… the real reaction may only be starting. ⚡📊

🔥🚀🚨🚨🌟

#FOMC #F

🔥 The FOMC meeting just delivered a🚨 market-shaking moment traders won’t forget. Every word, pause, and projection sent instant ripples🪙 through stocks, bonds, and crypto as expectations flipped in real time. Rates may have stayed steady, but the tone didn’t—signals hinted at a tighter path than markets were pricing in, triggering fast volatility and sharp positioning shifts. Insiders are calling this a “setup meeting”—the kind that quietly sets the stage for a powerful next move. Eyes locked on the Fed… the real reaction may only be starting. ⚡📊

🔥🚀🚨🚨🌟

#FOMC #F

BTC-5,31%

- Reward

- 8

- 4

- Repost

- Share

I_am_ready :

:

Christmas to the Moon! 🌕View More

🇺🇸 All Eyes on Fed Chair Powell. 👀

The Fed Chair Jerome Powell, speaks today, and global markets are on edge.

With growing expectations of rate cuts and the looming U.S. government shutdown, this isn’t just a speech it’s a potential market catalyst.

The market is waiting to hear Jerome Powell’s music,and what he plays today will set the tempo for Q4.

💵 Dollar Index #DXY is rising from last 4 days

💱 #USDINR awaiting cues

💰 #Gold Silver tightening range

🪙 #Crypto bracing for volatility

Stocks, commodities, currencies all watching.

The tone Powell sets today could define Q4.

#JeromePo

The Fed Chair Jerome Powell, speaks today, and global markets are on edge.

With growing expectations of rate cuts and the looming U.S. government shutdown, this isn’t just a speech it’s a potential market catalyst.

The market is waiting to hear Jerome Powell’s music,and what he plays today will set the tempo for Q4.

💵 Dollar Index #DXY is rising from last 4 days

💱 #USDINR awaiting cues

💰 #Gold Silver tightening range

🪙 #Crypto bracing for volatility

Stocks, commodities, currencies all watching.

The tone Powell sets today could define Q4.

#JeromePo

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

28.09K Popularity

64.64K Popularity

368.53K Popularity

46.67K Popularity

62.53K Popularity

18.95K Popularity

26.32K Popularity

19.93K Popularity

92.72K Popularity

38.04K Popularity

33.09K Popularity

26.45K Popularity

17.45K Popularity

23.97K Popularity

196.82K Popularity

News

View MoreTokyo and Hong Kong jointly report massive cash robbery cases, with 2 virtual currency exchange shop employees already detained

4 m

Bhutan Sovereign Wealth Fund transferred approximately 100 BTC to QCP Capital before the market downturn

6 m

SoSoValue's high-performance Layer 1 order book SoDEX is officially fully open, with 150 million $SOSO incentives to rebuild on-chain transactions.

9 m

Bhutan Sovereign Wealth Fund sold over 25,000 Ethereum during the dip this morning to reduce leverage

10 m

"Federal Reserve Mouthpiece": Trump jokes that he will sue WASH if interest rates are not cut

22 m

Pin