# Cryptoanalysis

17.8K

YemenBit

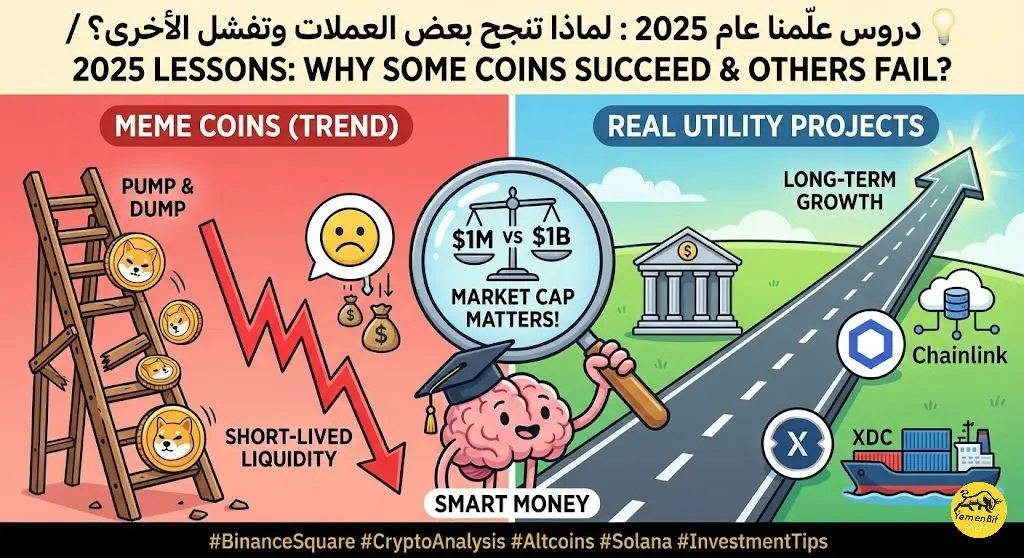

💡 Lessons taught to us in 2025: Why do some coins succeed and others fail?

Have you ever wondered why some profits vanished in 2025 while others' portfolios doubled? The secret isn't luck, but in choosing the right 'foundation'.

In the cryptocurrency market, a strong rally isn't always an indicator of ongoing success. 2025 has taught us clear lessons that survival belongs to projects with "real value".

🔍 Summary of the strategy to distinguish projects

📍 1. "Meme" coins versus real utility

We have seen coins that rely mainly on "trends" and social media, but their liquidity faded within week

View OriginalHave you ever wondered why some profits vanished in 2025 while others' portfolios doubled? The secret isn't luck, but in choosing the right 'foundation'.

In the cryptocurrency market, a strong rally isn't always an indicator of ongoing success. 2025 has taught us clear lessons that survival belongs to projects with "real value".

🔍 Summary of the strategy to distinguish projects

📍 1. "Meme" coins versus real utility

We have seen coins that rely mainly on "trends" and social media, but their liquidity faded within week

- Reward

- 2

- 1

- Repost

- Share

mared_007 :

:

Bullish market at its peak 🐂#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats – What This Means for Markets and Crypto Going Forward

In a development that has caught many investors by surprise, former President Trump has officially withdrawn planned tariffs on several European nations that were set to take effect on February 1. This move comes after months of uncertainty around global trade, which has been creating volatility across equities, commodities, and risk-sensitive assets, including cryptocurrencies.

Immediate Market Implications:

The withdrawal of EU tariffs provides a clear boost to market sentimen

In a development that has caught many investors by surprise, former President Trump has officially withdrawn planned tariffs on several European nations that were set to take effect on February 1. This move comes after months of uncertainty around global trade, which has been creating volatility across equities, commodities, and risk-sensitive assets, including cryptocurrencies.

Immediate Market Implications:

The withdrawal of EU tariffs provides a clear boost to market sentimen

BTC-0,71%

- Reward

- 4

- 3

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH-0,62%

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

$ADA 📈 Cardano (ADA) Market Outlook: Breaking the Consolidation?

Hello Gate.io Community! 👋

Today, let’s take a look at Cardano ($ADA). After a period of sideways movement, ADA is showing signs of a potential trend reversal on the 4-hour time frame. The price action is currently hovering near a multi-week resistance zone, and the RSI (Relative Strength Index) suggests that momentum is gradually building up.

Key Technical Levels to Monitor:

📍 Major Support: $0.65 - $0.70. This level has acted as a strong floor during recent pullbacks. As long as ADA stays above $0.70, the bullish structure

Hello Gate.io Community! 👋

Today, let’s take a look at Cardano ($ADA). After a period of sideways movement, ADA is showing signs of a potential trend reversal on the 4-hour time frame. The price action is currently hovering near a multi-week resistance zone, and the RSI (Relative Strength Index) suggests that momentum is gradually building up.

Key Technical Levels to Monitor:

📍 Major Support: $0.65 - $0.70. This level has acted as a strong floor during recent pullbacks. As long as ADA stays above $0.70, the bullish structure

ADA-0,97%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊🚨 #BTCMarketAnalysis – Bitcoin Update

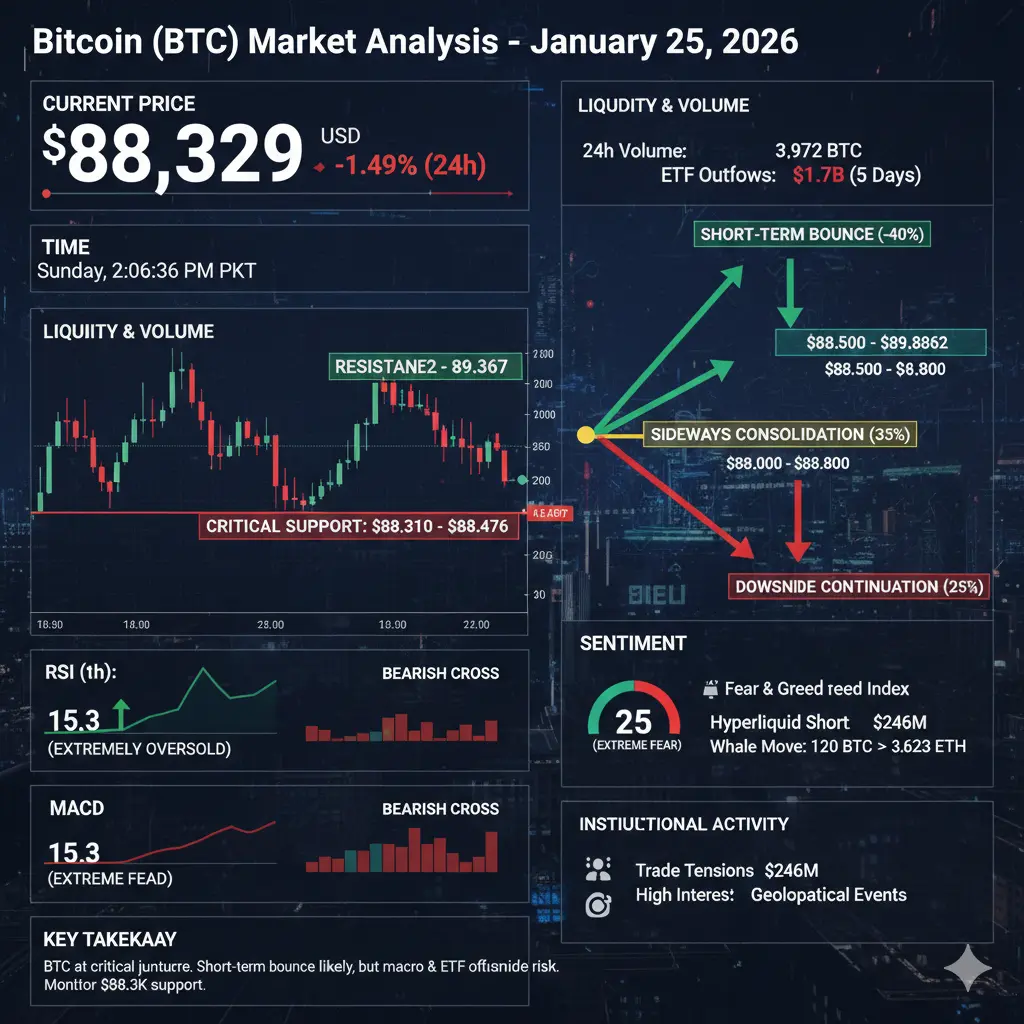

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-0,71%

- Reward

- 1

- Comment

- Repost

- Share

🚀 #RIVERUp50xinOneMonth

RIVER’s Breakout — Real Move or Excessive Risk?

Overview:

RIVER exploded from a few dollars → $60s, fueled by strategic capital, hype & speculative flow.

What RIVER Is:

Cross-chain stablecoin & liquidity protocol (satUSD).

Collateralize on one chain, mint on another without bridges.

Token powers governance, staking, rewards & fee incentives.

Key Rally Drivers:

✅ Strategic Backing – Justin Sun & others pumped $8M into ecosystem growth.

✅ Innovation Narrative – Cross-chain liquidity solves real DeFi friction.

✅ Volume & Momentum – Massive trading volumes, especially in d

RIVER’s Breakout — Real Move or Excessive Risk?

Overview:

RIVER exploded from a few dollars → $60s, fueled by strategic capital, hype & speculative flow.

What RIVER Is:

Cross-chain stablecoin & liquidity protocol (satUSD).

Collateralize on one chain, mint on another without bridges.

Token powers governance, staking, rewards & fee incentives.

Key Rally Drivers:

✅ Strategic Backing – Justin Sun & others pumped $8M into ecosystem growth.

✅ Innovation Narrative – Cross-chain liquidity solves real DeFi friction.

✅ Volume & Momentum – Massive trading volumes, especially in d

- Reward

- 1

- Comment

- Repost

- Share

🚀 $CYBER Spot Analysis: Identifying the Reversal Floor for a Long-Term Move

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

CYBER-0,22%

- Reward

- like

- Comment

- Repost

- Share

⚖️ Bitcoin vs Gold — A Shift Toward Safety in Uncertain Markets

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run.

While BTC remains a powerful long-term digital asset, short-term momentum is slowing due to:

Reduced liquidity

Slower ETF inflows

Profit-taking

Persistently high global interest rates

Volatility remains elevated — opportunities exist for skilled traders, but downside risks increase if key support levels fail.

🏆 Gold: The Classic Safe Haven

Gold is trading near 5,033, maintaining strength as investors rotate towa

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run.

While BTC remains a powerful long-term digital asset, short-term momentum is slowing due to:

Reduced liquidity

Slower ETF inflows

Profit-taking

Persistently high global interest rates

Volatility remains elevated — opportunities exist for skilled traders, but downside risks increase if key support levels fail.

🏆 Gold: The Classic Safe Haven

Gold is trading near 5,033, maintaining strength as investors rotate towa

BTC-0,71%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin vs Gold: A Shift Toward Safety in Uncertain Markets

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run. While BTC remains a powerful long-term digital asset, short-term momentum is weakening due to reduced liquidity, slower ETF inflows, profit-taking, and persistently high global interest rates. Price volatility remains elevated, creating opportunities for skilled traders—but also increasing downside risk if key support levels fail.

In contrast, Gold is trading near 5033, showing sustained strength as investors rotate

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run. While BTC remains a powerful long-term digital asset, short-term momentum is weakening due to reduced liquidity, slower ETF inflows, profit-taking, and persistently high global interest rates. Price volatility remains elevated, creating opportunities for skilled traders—but also increasing downside risk if key support levels fail.

In contrast, Gold is trading near 5033, showing sustained strength as investors rotate

BTC-0,71%

- Reward

- 4

- 7

- Repost

- Share

Badarmo00 :

:

hı everbody how are you todayView More

📉 SOMIUSDT | Short scenario on the table

Price is struggling around the 0.29 – 0.30 range after a strong rise.

There are attempts to go higher, but no continuation.

This tells us: momentum is weakening, the market is at a decision point.

🔍 Technical side:

No persistence above 0.30

RSI has dropped below 50

Price is moving sideways–downward trend

This setup keeps the controlled short scenario on the table.

📌 Important levels

Close above 0.300 – 0.305 → Scenario invalidates

Below 0.285 → Movement may accelerate

0.26 – 0.24 range → Main support / profit zones

⚠️ It’s especially important to say

View OriginalPrice is struggling around the 0.29 – 0.30 range after a strong rise.

There are attempts to go higher, but no continuation.

This tells us: momentum is weakening, the market is at a decision point.

🔍 Technical side:

No persistence above 0.30

RSI has dropped below 50

Price is moving sideways–downward trend

This setup keeps the controlled short scenario on the table.

📌 Important levels

Close above 0.300 – 0.305 → Scenario invalidates

Below 0.285 → Movement may accelerate

0.26 – 0.24 range → Main support / profit zones

⚠️ It’s especially important to say

- Reward

- 6

- 8

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

68.03K Popularity

42.57K Popularity

35.58K Popularity

13.54K Popularity

28.73K Popularity

20.49K Popularity

16.9K Popularity

86.06K Popularity

45.87K Popularity

26.68K Popularity

16.52K Popularity

5.52K Popularity

262.27K Popularity

26.61K Popularity

184.41K Popularity

News

View Morea16z Crypto: The security focus of public chains like BTC and ETH should be on protocols and governance, and there is no need to blindly follow switching to quantum-resistant attack solutions.

8 m

Michael Saylor releases Bitcoin Tracker information again; increased holdings data may be disclosed next week.

41 m

OCC: The procedural review of WLFI's application for a banking license will remain non-political

1 h

Alchemy Pay obtains Nebraska MTL license, expanding the compliant map in the United States to 14 states

1 h

Data: In 2025, stablecoins on Ethereum generated approximately $5 billion in revenue, with the supply increasing by about $50 billion.

2 h

Pin