#CLARITYActAdvances

🚨 CLARITY ACT BOMBSHELL: 90% Passage Odds by April – Institutional Floodgates About to Open! 🔥

🚀 Crypto Regulation 2026: U.S. CLARITY Act Momentum Surge – Ripple CEO Optimistic, Bull Run Catalyst Incoming!

💥 BREAKING: CLARITY Act Hits 90% Odds – March 1 Deadline Looms, Banks vs Crypto Yield Battle Escalates!

The CLARITY Act: Full 2026 Deep Dive & Market Implications

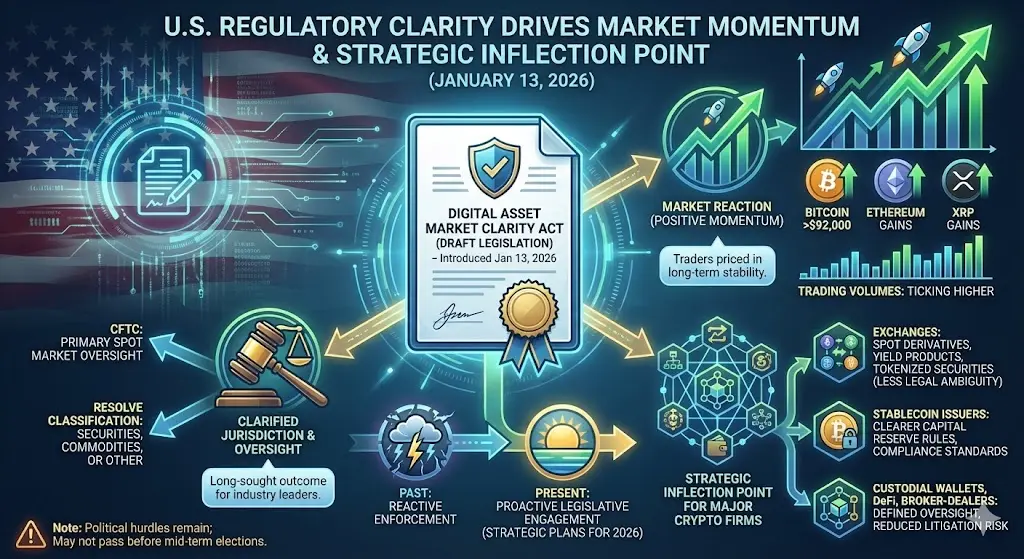

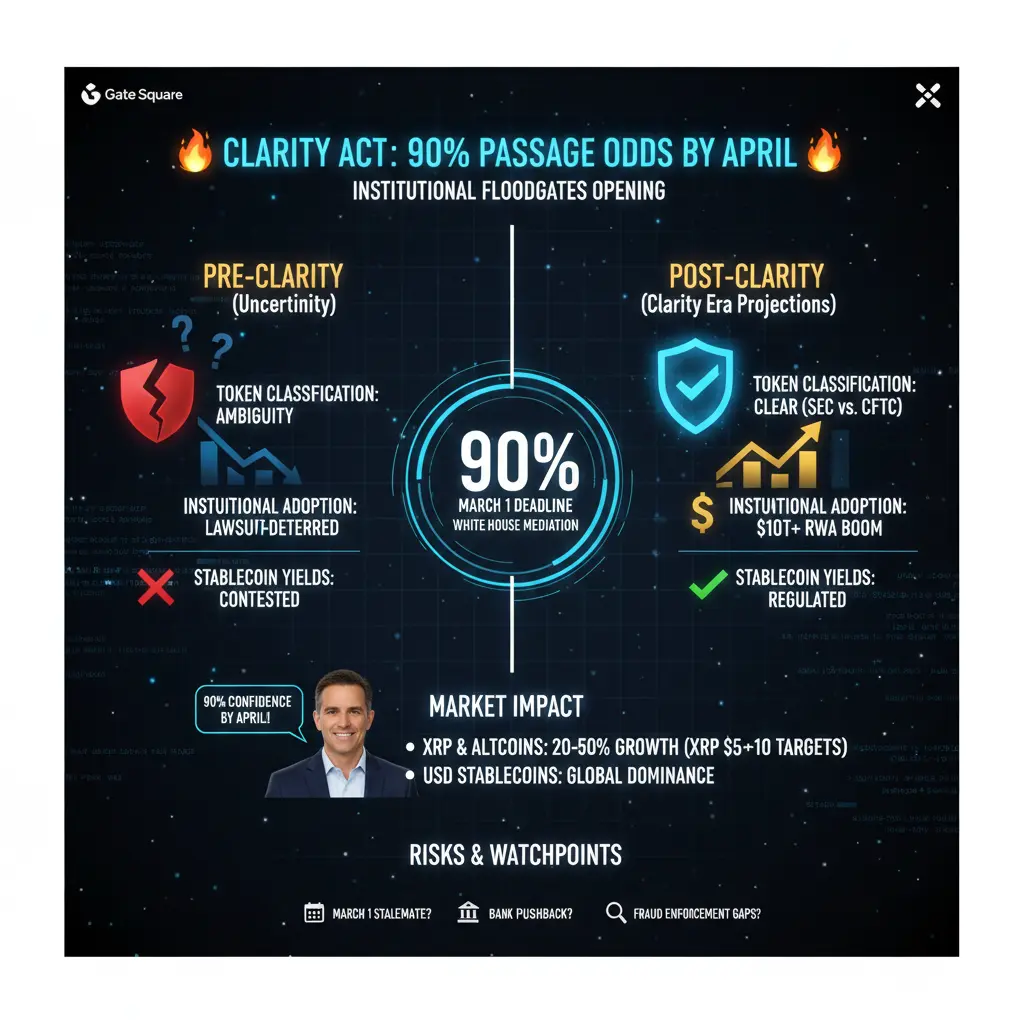

As of February 22, 2026, the Digital Asset Market Clarity Act of 2025 (CLARITY Act – H.R. 3633) stands as the single biggest U.S. crypto catalyst. After its bipartisan House victory (July 2025: 294–134 landslide), it’s deep in Senate negotiations following January stalling over stablecoin yields—banks oppose crypto incentives, the industry pushes back hard, and the White House is mediating for a March 1 compromise. Ripple CEO Brad Garlinghouse now predicts 90% odds of passage by April, exceeding prediction markets (~78%). SEC Chair Paul Atkins is fully supportive, tying the act into Project Crypto for token classification and SEC-CFTC harmonization.

1️⃣ Core Meaning & Legislative Scope

“The CLARITY Act is progressing through U.S. legislative and regulatory processes to bring clear crypto rules.”

Ends Gensler-era ambiguity: defines digital commodities (CFTC) vs securities (SEC).

House win massive; Senate Banking referral September 2025; January markups canceled after Coinbase threatened withdrawal over yield clauses.

White House intervention (Feb 19, 2026) set March 1 as make-or-break.

Senate Agriculture Committee already passed a companion bill treating BTC as a commodity.

Market impact: Passage = de-risking → XRP (non-security potential), altcoins, tokenized RWAs surge, analysts eye 20–50% sector growth; XRP $5–$10 targets floated.

Contrarian risk: Bank wins on yields → offshore stablecoin flight like MiCA’s $200M dip.

2️⃣ Key Features & Market Effects

“CLARITY Act = Proposed U.S. law providing clear crypto rules & guidance.”

SEC/CFTC Split: Clear roles for securities vs commodities.

DeFi & Sandbox Rules: Frameworks for innovation + insider trading safeguards.

Stablecoin Governance: Builds on GENIUS Act; avoids CBDC overreach.

Market Impact: Unlocks tokenized RWAs (~$10T projected by 2030), USD stablecoin dominance, reduces offshore migration.

EU Comparison: Less rigid than MiCA; bullish for compliant tokens, ETPs; enforcement gaps remain a risk.

3️⃣ Progress & Momentum

“Advances = Forward movement toward approval, building momentum & market confidence.”

Bipartisan House win, Senate companion bill, White House “close” statements = strong political momentum.

Industry optimism: Ripple bullish, Senate floor pledges rebuilding.

Market signal: Institutional FOMO → ETPs, stablecoin volumes, DeFi surge.

Prediction: 70%+ probability pre-midterm passage → regulated bull market.

Delays: BTC volatility may spike on stalling.

4️⃣ Strategic Implications

“CLARITY Act progress brings the U.S. closer to clear crypto regulations.”

Aligns with Atkins’ regulatory pivot + GENIUS rollout.

Reduces offshore exodus; positions U.S. ahead of EU MiCA.

Capital inflow: Potential $1T+ for programmable money, tokenized RWAs.

Risks: Lax fraud enforcement, midterm political shifts.

Contrarian view: Bank-friendly compromises could slow disruption.

5️⃣ Pre- vs. Post-CLARITY Market Comparison

Feature

Pre-CLARITY (Uncertainty Era)

Post-CLARITY (Clarity Era Projections)

Token Classification

Broad Howey ambiguity

Clear security vs commodity split

Institutional Adoption

Lawsuit-deterring

Floodgates for RWAs/ETPs

Stablecoin Yields

Court-contested

Regulated, predictable

Global Positioning

Lagging EU/Asia

U.S. digital finance leadership

Market Volatility

High, enforcement-driven

Stabilized via safe harbors

6️⃣ Global & Macro Implications

USD dominance reinforcement; counters de-dollarization.

Institutional boom: Regulated bull for compliant altcoins & ETPs.

Geopolitical edge: Positions U.S. for programmable money + tokenized assets vs China e-CNY and BRICS initiatives.

7️⃣ Risks & Watchpoints

March 1 Senate stalemate or midterm political volatility.

Bank pushback could reduce stablecoin yield benefits.

Enforcement gaps may allow illicit finance exploitation.

Market volatility: BTC/altcoins react to delays or partial compromises.

8️⃣ Strategic Outlook 2026

Key Trackers: March 1 White House outcome, Senate markup, XRP/altcoin reactions, SEC-CFTC updates.

Bullish Case: 90% passage by April → largest regulated crypto bull run in U.S. history.

Contrarian: Delays or bank wins → offshore stablecoin flows, volatility spikes.

Bottom Line: The CLARITY Act is a structural turning point for U.S. crypto markets — merging regulation, institutional adoption, and tokenized finance growth. Traders and investors should watch March 1, track Senate/White House signals, and prepare for altcoin & RWA positioning.

🚨 CLARITY ACT BOMBSHELL: 90% Passage Odds by April – Institutional Floodgates About to Open! 🔥

🚀 Crypto Regulation 2026: U.S. CLARITY Act Momentum Surge – Ripple CEO Optimistic, Bull Run Catalyst Incoming!

💥 BREAKING: CLARITY Act Hits 90% Odds – March 1 Deadline Looms, Banks vs Crypto Yield Battle Escalates!

The CLARITY Act: Full 2026 Deep Dive & Market Implications

As of February 22, 2026, the Digital Asset Market Clarity Act of 2025 (CLARITY Act – H.R. 3633) stands as the single biggest U.S. crypto catalyst. After its bipartisan House victory (July 2025: 294–134 landslide), it’s deep in Senate negotiations following January stalling over stablecoin yields—banks oppose crypto incentives, the industry pushes back hard, and the White House is mediating for a March 1 compromise. Ripple CEO Brad Garlinghouse now predicts 90% odds of passage by April, exceeding prediction markets (~78%). SEC Chair Paul Atkins is fully supportive, tying the act into Project Crypto for token classification and SEC-CFTC harmonization.

1️⃣ Core Meaning & Legislative Scope

“The CLARITY Act is progressing through U.S. legislative and regulatory processes to bring clear crypto rules.”

Ends Gensler-era ambiguity: defines digital commodities (CFTC) vs securities (SEC).

House win massive; Senate Banking referral September 2025; January markups canceled after Coinbase threatened withdrawal over yield clauses.

White House intervention (Feb 19, 2026) set March 1 as make-or-break.

Senate Agriculture Committee already passed a companion bill treating BTC as a commodity.

Market impact: Passage = de-risking → XRP (non-security potential), altcoins, tokenized RWAs surge, analysts eye 20–50% sector growth; XRP $5–$10 targets floated.

Contrarian risk: Bank wins on yields → offshore stablecoin flight like MiCA’s $200M dip.

2️⃣ Key Features & Market Effects

“CLARITY Act = Proposed U.S. law providing clear crypto rules & guidance.”

SEC/CFTC Split: Clear roles for securities vs commodities.

DeFi & Sandbox Rules: Frameworks for innovation + insider trading safeguards.

Stablecoin Governance: Builds on GENIUS Act; avoids CBDC overreach.

Market Impact: Unlocks tokenized RWAs (~$10T projected by 2030), USD stablecoin dominance, reduces offshore migration.

EU Comparison: Less rigid than MiCA; bullish for compliant tokens, ETPs; enforcement gaps remain a risk.

3️⃣ Progress & Momentum

“Advances = Forward movement toward approval, building momentum & market confidence.”

Bipartisan House win, Senate companion bill, White House “close” statements = strong political momentum.

Industry optimism: Ripple bullish, Senate floor pledges rebuilding.

Market signal: Institutional FOMO → ETPs, stablecoin volumes, DeFi surge.

Prediction: 70%+ probability pre-midterm passage → regulated bull market.

Delays: BTC volatility may spike on stalling.

4️⃣ Strategic Implications

“CLARITY Act progress brings the U.S. closer to clear crypto regulations.”

Aligns with Atkins’ regulatory pivot + GENIUS rollout.

Reduces offshore exodus; positions U.S. ahead of EU MiCA.

Capital inflow: Potential $1T+ for programmable money, tokenized RWAs.

Risks: Lax fraud enforcement, midterm political shifts.

Contrarian view: Bank-friendly compromises could slow disruption.

5️⃣ Pre- vs. Post-CLARITY Market Comparison

Feature

Pre-CLARITY (Uncertainty Era)

Post-CLARITY (Clarity Era Projections)

Token Classification

Broad Howey ambiguity

Clear security vs commodity split

Institutional Adoption

Lawsuit-deterring

Floodgates for RWAs/ETPs

Stablecoin Yields

Court-contested

Regulated, predictable

Global Positioning

Lagging EU/Asia

U.S. digital finance leadership

Market Volatility

High, enforcement-driven

Stabilized via safe harbors

6️⃣ Global & Macro Implications

USD dominance reinforcement; counters de-dollarization.

Institutional boom: Regulated bull for compliant altcoins & ETPs.

Geopolitical edge: Positions U.S. for programmable money + tokenized assets vs China e-CNY and BRICS initiatives.

7️⃣ Risks & Watchpoints

March 1 Senate stalemate or midterm political volatility.

Bank pushback could reduce stablecoin yield benefits.

Enforcement gaps may allow illicit finance exploitation.

Market volatility: BTC/altcoins react to delays or partial compromises.

8️⃣ Strategic Outlook 2026

Key Trackers: March 1 White House outcome, Senate markup, XRP/altcoin reactions, SEC-CFTC updates.

Bullish Case: 90% passage by April → largest regulated crypto bull run in U.S. history.

Contrarian: Delays or bank wins → offshore stablecoin flows, volatility spikes.

Bottom Line: The CLARITY Act is a structural turning point for U.S. crypto markets — merging regulation, institutional adoption, and tokenized finance growth. Traders and investors should watch March 1, track Senate/White House signals, and prepare for altcoin & RWA positioning.