# AltCoins

1.34M

Crypto_Exper

- Reward

- 1

- Comment

- Repost

- Share

🚨 HUGE ALERT!

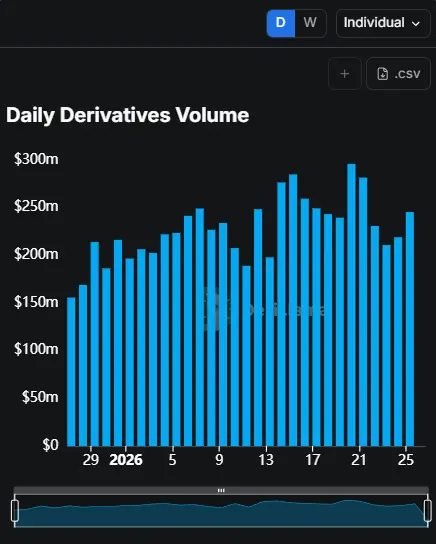

$SUI smashes the market with $249M in daily derivatives volume! 💥

Traders are watching closely as momentum builds — is this just the beginning? 📈

#SUI #CryptoTrading #Derivatives #CryptoNews #Altcoins #MarketWatch

$SUI smashes the market with $249M in daily derivatives volume! 💥

Traders are watching closely as momentum builds — is this just the beginning? 📈

#SUI #CryptoTrading #Derivatives #CryptoNews #Altcoins #MarketWatch

SUI-1,26%

- Reward

- 2

- 1

- Repost

- Share

GateUser-2bff1401 :

:

But watch out — SUI has ongoing unlocks (next big one ~Feb 1, 2026 ~43M tokens). High volume now, but supply dumps could cap the run?🚀 DMC on Fire! 🚀

DMC Price Update

💰 $0.0017306

📈 +154.09% in 24h

Strong momentum, explosive volume, and growing attention across the market. DMC is showing classic breakout behavior — early movers are already in profit while late entries should watch for pullbacks and confirmation.

⚠️ Always manage risk and wait for confirmation before chasing pumps.

🔍 Keep DMC on your watchlist — volatility = opportunity.

#DMC #CryptoMomentum #Altcoins #CryptoTrading #MarketUpdate

$DMC $PIPE

DMC Price Update

💰 $0.0017306

📈 +154.09% in 24h

Strong momentum, explosive volume, and growing attention across the market. DMC is showing classic breakout behavior — early movers are already in profit while late entries should watch for pullbacks and confirmation.

⚠️ Always manage risk and wait for confirmation before chasing pumps.

🔍 Keep DMC on your watchlist — volatility = opportunity.

#DMC #CryptoMomentum #Altcoins #CryptoTrading #MarketUpdate

$DMC $PIPE

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

🚀💎 $ASTER IS ON THE MOVE! 💎🚀

$ASTER /USDT is heating up! 🔥 Current price: $0.647 (+2.54% in the last period) 💹

📊 24h Action:

Low: $0.628 ⬇️

High: $0.668 ⬆️

Volume: ASTER 39.28M | USDT 25.42M 💰

💥 Key Levels:

Resistance: $0.668 – watch for the breakout! 💣

Support: $0.628 – safety net ready ✅

Short-term momentum is looking bullish, but $0.668 is the gatekeeper! 🛡️ Will ASTER smash through and keep climbing? 🌕

💡 Pro Tip:

Aggressive traders: Enter near $0.647 with tight stops ⚡

Conservative traders: Wait for a clean breakout above $0.668 💎

💎 This is the moment to watch ASTER! Don’t

$ASTER /USDT is heating up! 🔥 Current price: $0.647 (+2.54% in the last period) 💹

📊 24h Action:

Low: $0.628 ⬇️

High: $0.668 ⬆️

Volume: ASTER 39.28M | USDT 25.42M 💰

💥 Key Levels:

Resistance: $0.668 – watch for the breakout! 💣

Support: $0.628 – safety net ready ✅

Short-term momentum is looking bullish, but $0.668 is the gatekeeper! 🛡️ Will ASTER smash through and keep climbing? 🌕

💡 Pro Tip:

Aggressive traders: Enter near $0.647 with tight stops ⚡

Conservative traders: Wait for a clean breakout above $0.668 💎

💎 This is the moment to watch ASTER! Don’t

ASTER5,1%

- Reward

- like

- Comment

- Repost

- Share

🟣 Solana (SOL) Near Critical Retest of $119 — Key Levels to Watch

The broader crypto market remains under pressure, and Solana continues to trade deep in the red as selling momentum intensifies.

On Jan 25, well-known crypto analyst Ali Martinez highlighted that SOL is still facing downside pressure and may be heading toward a retest of its 2025 lows.

🔹 New Support Zone Emerging SOL appears to be in an extended correction phase. On-chain data suggests a potential new support zone around $119.

After rallying to $144.62 last week, Solana faced strong resistance near the $144 level and was repea

The broader crypto market remains under pressure, and Solana continues to trade deep in the red as selling momentum intensifies.

On Jan 25, well-known crypto analyst Ali Martinez highlighted that SOL is still facing downside pressure and may be heading toward a retest of its 2025 lows.

🔹 New Support Zone Emerging SOL appears to be in an extended correction phase. On-chain data suggests a potential new support zone around $119.

After rallying to $144.62 last week, Solana faced strong resistance near the $144 level and was repea

SOL1,91%

- Reward

- 1

- Comment

- Repost

- Share

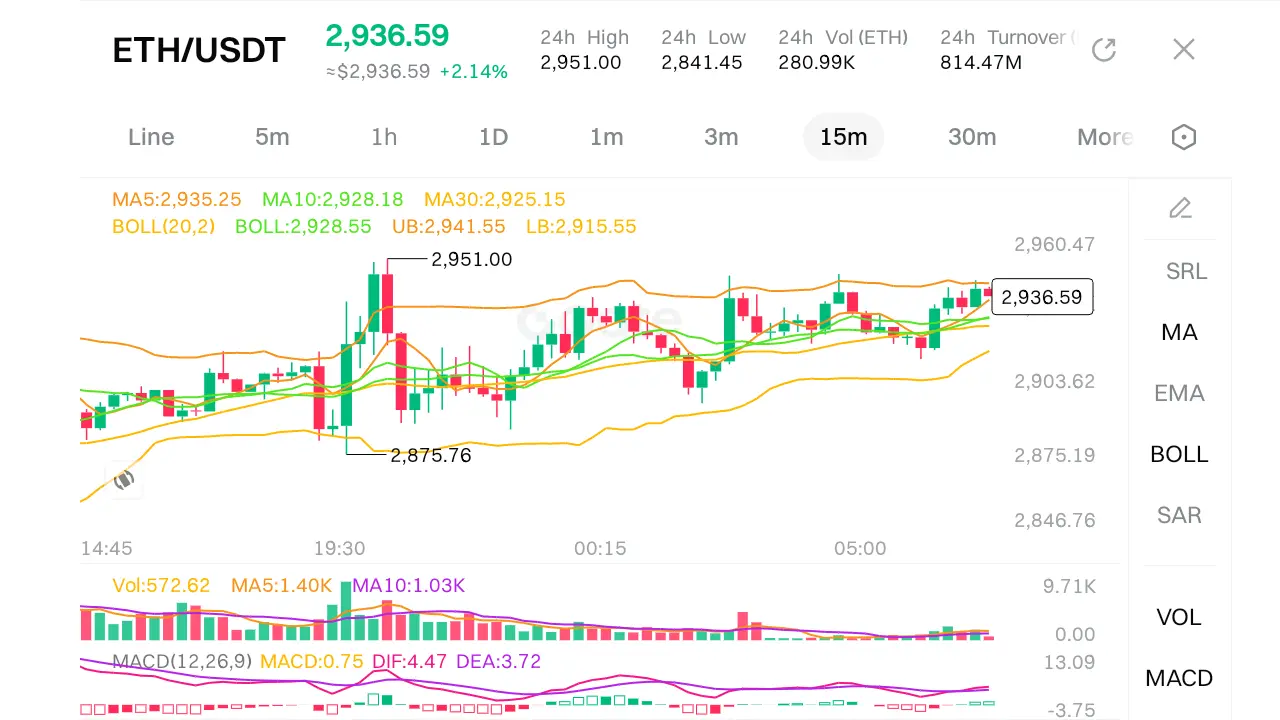

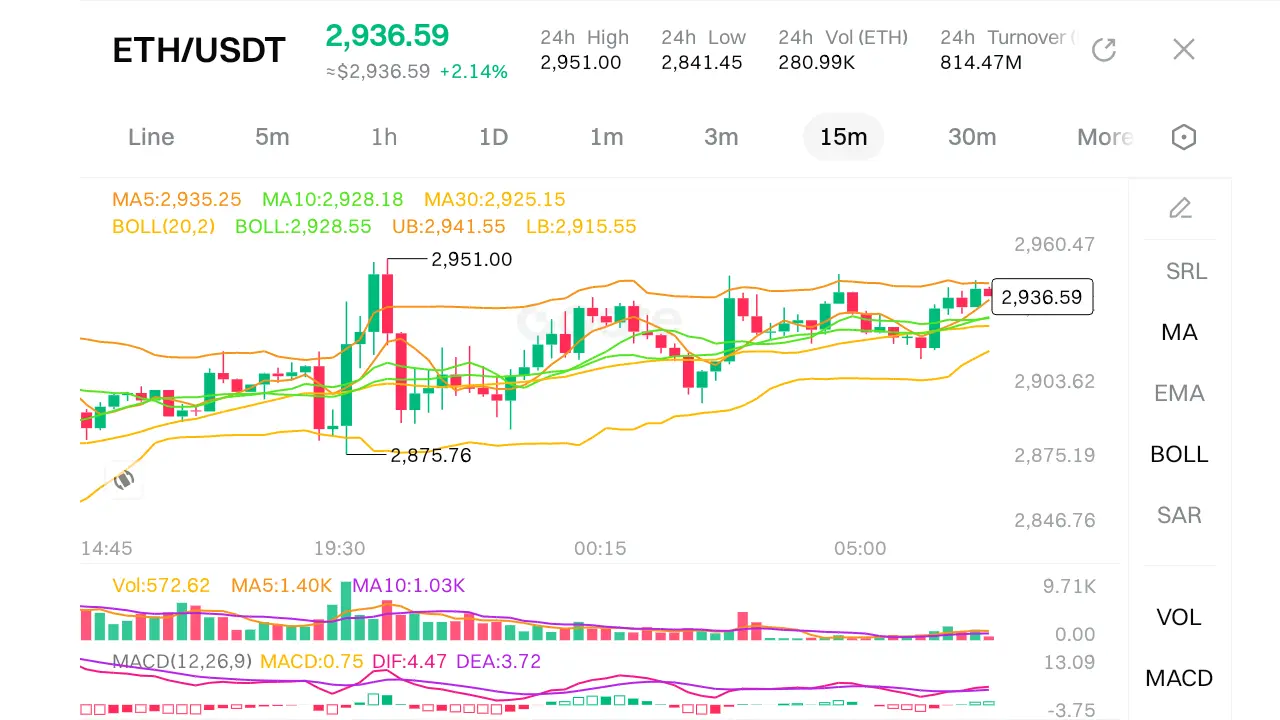

$ETH Ethereum Technical Analysis — Market Snapshot (Jan 27, 2026)

As of early January 27, 2026, Ethereum (ETH) is trading around $2,937, up +2.3% in the last 24 hours.

This bounce comes after a volatile week, where ETH declined roughly 9% (Jan 19–26) amid a broader market pullback.

The weakness was largely driven by:

Bitcoin dropping ~5.3%

Crypto fund outflows of $1.73B — the largest since Nov 2025

Despite the correction, ETH remains:

Well below ATH: $4,946 (Aug 24, 2025)

Far above ATL: $0.43 (Oct 2015)

📊 Market Stats

Market Cap: $354.5B

24h Volume: $27.9B

Circulating Supply: 120.7M ETH

Te

As of early January 27, 2026, Ethereum (ETH) is trading around $2,937, up +2.3% in the last 24 hours.

This bounce comes after a volatile week, where ETH declined roughly 9% (Jan 19–26) amid a broader market pullback.

The weakness was largely driven by:

Bitcoin dropping ~5.3%

Crypto fund outflows of $1.73B — the largest since Nov 2025

Despite the correction, ETH remains:

Well below ATH: $4,946 (Aug 24, 2025)

Far above ATL: $0.43 (Oct 2015)

📊 Market Stats

Market Cap: $354.5B

24h Volume: $27.9B

Circulating Supply: 120.7M ETH

Te

ETH2,45%

- Reward

- 1

- Comment

- Repost

- Share

$ETH Ethereum Technical Analysis — Market Snapshot (Jan 27, 2026)

As of early January 27, 2026, Ethereum (ETH) is trading around $2,937, up +2.3% in the last 24 hours.

This bounce comes after a volatile week, where ETH declined roughly 9% (Jan 19–26) amid a broader market pullback.

The weakness was largely driven by:

Bitcoin dropping ~5.3%

Crypto fund outflows of $1.73B — the largest since Nov 2025

Despite the correction, ETH remains:

Well below ATH: $4,946 (Aug 24, 2025)

Far above ATL: $0.43 (Oct 2015)

📊 Market Stats

Market Cap: $354.5B

24h Volume: $27.9B

Circulating Supply: 120.7M ETH

Techn

As of early January 27, 2026, Ethereum (ETH) is trading around $2,937, up +2.3% in the last 24 hours.

This bounce comes after a volatile week, where ETH declined roughly 9% (Jan 19–26) amid a broader market pullback.

The weakness was largely driven by:

Bitcoin dropping ~5.3%

Crypto fund outflows of $1.73B — the largest since Nov 2025

Despite the correction, ETH remains:

Well below ATH: $4,946 (Aug 24, 2025)

Far above ATL: $0.43 (Oct 2015)

📊 Market Stats

Market Cap: $354.5B

24h Volume: $27.9B

Circulating Supply: 120.7M ETH

Techn

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

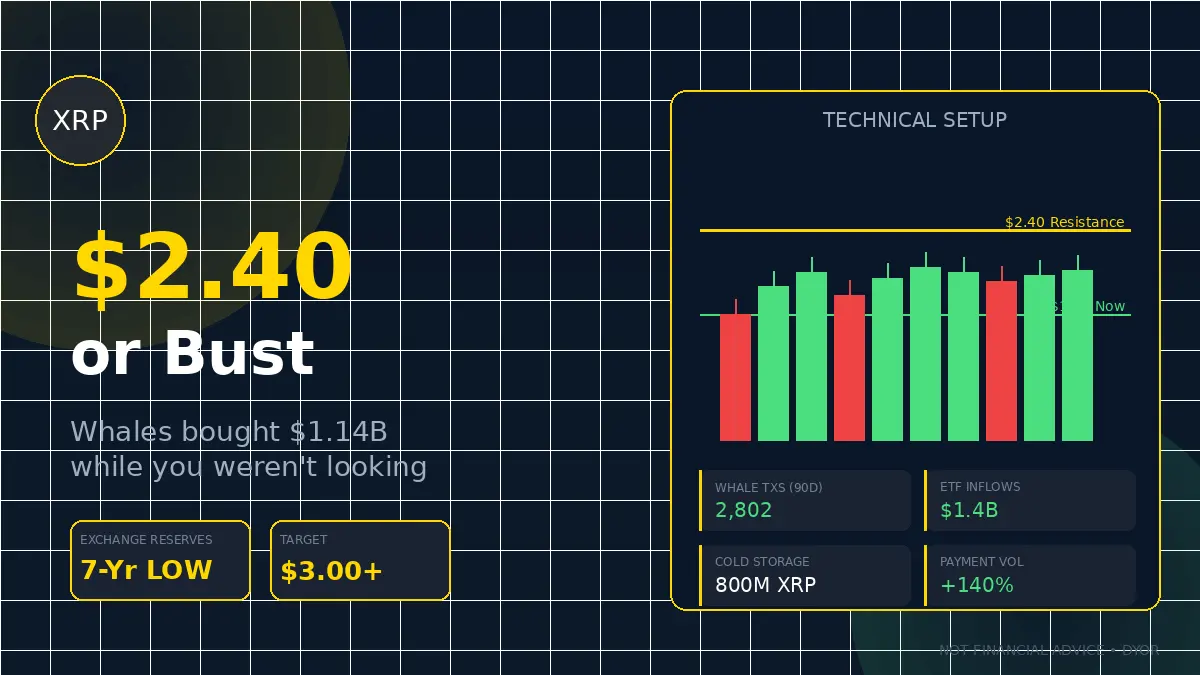

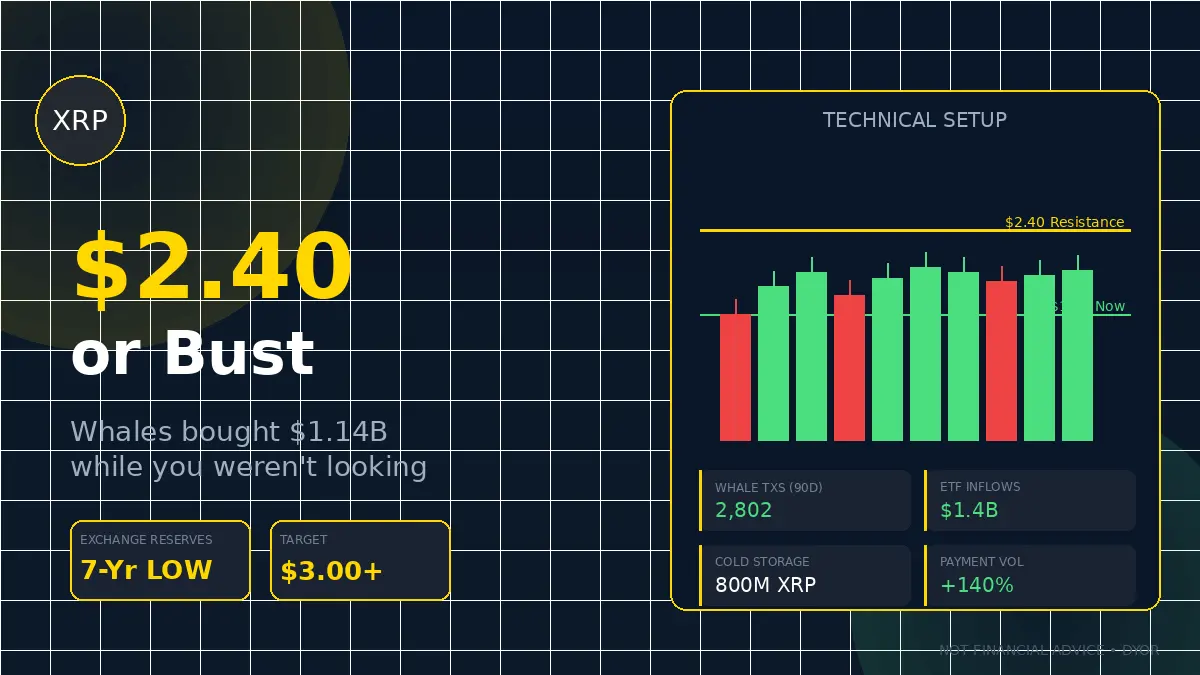

2026 GOGOGO 👊🚨 $XRP Update – Re-Accumulation in Progress 🚨

$XRP: $1.92 💎

Whales moved $1.14B in January 🐋

Exchange reserves hit 7-year low 📉

800M tokens moved to cold storage ❄️

📊 The Strange Part:

Retail: OUT (-94% active addresses) 👀

Institutions: IN (+140% payment volume) 🏦

Price: Still 48% below ATH, stuck at $1.92

📈 Next 2 Weeks Decide Everything:

Break $2.40 → $3.00+ 🚀

Rejection → $2.00, maybe $1.80 ⚠️

Volume $2.50-$2.75 = ghost town 👻

Crack it → fast move to $3.20

🎯 My Play:

DCA between $1.90–$2.10 💰

Scale if we confirm above $2.50 ⚡

Risk management below $1.80 🛡️

Conviction: 7/10 b

$XRP: $1.92 💎

Whales moved $1.14B in January 🐋

Exchange reserves hit 7-year low 📉

800M tokens moved to cold storage ❄️

📊 The Strange Part:

Retail: OUT (-94% active addresses) 👀

Institutions: IN (+140% payment volume) 🏦

Price: Still 48% below ATH, stuck at $1.92

📈 Next 2 Weeks Decide Everything:

Break $2.40 → $3.00+ 🚀

Rejection → $2.00, maybe $1.80 ⚠️

Volume $2.50-$2.75 = ghost town 👻

Crack it → fast move to $3.20

🎯 My Play:

DCA between $1.90–$2.10 💰

Scale if we confirm above $2.50 ⚡

Risk management below $1.80 🛡️

Conviction: 7/10 b

XRP-0,47%

- Reward

- 1

- Comment

- Repost

- Share

🚨 $XRP Update – Re-Accumulation in Progress 🚨

$XRP: $1.92 💎

Whales moved $1.14B in January 🐋

Exchange reserves hit 7-year low 📉

800M tokens moved to cold storage ❄️

📊 The Strange Part:

Retail: OUT (-94% active addresses) 👀

Institutions: IN (+140% payment volume) 🏦

Price: Still 48% below ATH, stuck at $1.92

📈 Next 2 Weeks Decide Everything:

Break $2.40 → $3.00+ 🚀

Rejection → $2.00, maybe $1.80 ⚠️

Volume $2.50-$2.75 = ghost town 👻

Crack it → fast move to $3.20

🎯 My Play:

DCA between $1.90–$2.10 💰

Scale if we confirm above $2.50 ⚡

Risk management below $1.80 🛡️

Conviction: 7/10 bull

$XRP: $1.92 💎

Whales moved $1.14B in January 🐋

Exchange reserves hit 7-year low 📉

800M tokens moved to cold storage ❄️

📊 The Strange Part:

Retail: OUT (-94% active addresses) 👀

Institutions: IN (+140% payment volume) 🏦

Price: Still 48% below ATH, stuck at $1.92

📈 Next 2 Weeks Decide Everything:

Break $2.40 → $3.00+ 🚀

Rejection → $2.00, maybe $1.80 ⚠️

Volume $2.50-$2.75 = ghost town 👻

Crack it → fast move to $3.20

🎯 My Play:

DCA between $1.90–$2.10 💰

Scale if we confirm above $2.50 ⚡

Risk management below $1.80 🛡️

Conviction: 7/10 bull

XRP-0,47%

- Reward

- 2

- Comment

- Repost

- Share

🚀 $BMT Alert — Range High Squeeze!

BMTUSDT is tight near $0.02277, just below the 24h high $0.02295. Compression is 🔥 — breakout incoming!

💰 Trade Plan (Long)

Entry: $0.02270–$0.02280

Target 1: $0.02320

Target 2: $0.02350

Stop Loss: $0.02250

⚡ Why Watch:

Range highs = breakout zone. Risk is tight below support. Higher probability move: UP.

#CryptoTrading #BMT #Altcoins

BMTUSDT is tight near $0.02277, just below the 24h high $0.02295. Compression is 🔥 — breakout incoming!

💰 Trade Plan (Long)

Entry: $0.02270–$0.02280

Target 1: $0.02320

Target 2: $0.02350

Stop Loss: $0.02250

⚡ Why Watch:

Range highs = breakout zone. Risk is tight below support. Higher probability move: UP.

#CryptoTrading #BMT #Altcoins

BMT-0,96%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

59.71K Popularity

21.32K Popularity

16.86K Popularity

7.26K Popularity

5.92K Popularity

6.49K Popularity

5.21K Popularity

5.3K Popularity

70.69K Popularity

113.39K Popularity

79.98K Popularity

22.88K Popularity

47.31K Popularity

41.72K Popularity

195K Popularity

News

View More"Commander of the Air Force" once again recorded 83 million in total network TOP 1 liquidation, then reversed and opened a $49 million BTC long position.

3 m

Bitwise Invest Advisor: The average age of silver investors may be lower than that of Bitcoin, and that's the problem.

3 m

NVIDIA invests $2 billion in CoreWeave to accelerate data center development

14 m

"Lightning Reverse" whale closes ETH short position, adds to short BTC with unrealized loss of $330,000

14 m

Aleo in collaboration with Circle launches the privacy stablecoin USDCx on the mainnet, open to institutional users

17 m

Pin