Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

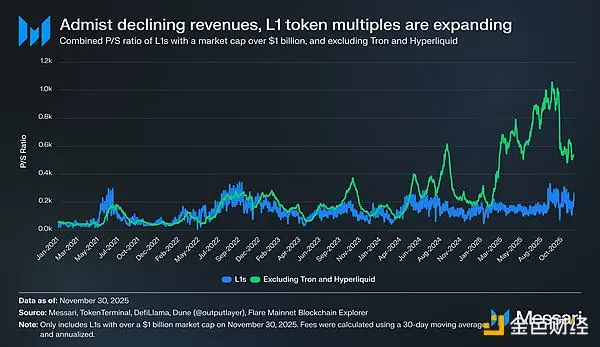

Can L1 tokens compete with Bitcoin in the cryptocurrency space?

Author: AJC, Research Manager at Messari; Source: X, @AvgJoesCrypto; Translated by: Shaw, Jinse Finance

Cryptocurrency Drives Industry Development

Refocusing on cryptocurrency is crucial because it remains the ultimate target where most of the industry’s capital is trying to invest. The total market capitalization of cryptocurrencies has reached $3.26 trillion. Of this, Bitcoin accounts for $1.80 trillion, or 55%. Of the remaining $1.45 trillion, about $0.83 trillion is concentrated in other Layer-1 protocol (L1) tokens. In total, approximately $2.63 trillion (about 81% of all crypto capital) is allocated to assets that the market already considers money or believes may acquire a monetary premium.

Given this, whether you are a trader, investor, capital allocator, or developer, it is critical to understand how the market allocates and withdraws monetary premiums. In the cryptocurrency sector,

金色财经_·9m ago

XRP Price Prediction: XRP ETF Attracts Nearly $1 Billion, So Why Has the Token Price Fallen Into the "Fear Zone"?

Within less than a month of its launch, the US spot XRP ETF has rapidly approached $1 billion in assets under management (AUM), with cumulative net inflows reaching $881.25 million and no single-day outflows recorded, making it one of the fastest-growing crypto investment products. However, in stark contrast to the robust institutional inflows, the market price of XRP continues to face downward pressure, currently trading near $2.09, down approximately 31% over the past two months. According to market analytics platform Santiment, social sentiment surrounding XRP has sharply turned negative, entering the "fear zone." This is similar to the scenario at the end of November when sentiment hit bottom and then rebounded by 22%, suggesting the market may be approaching a sentiment-driven turning point.

MarketWhisper·31m ago

YouTube King MrBeast Targets Finance: Cryptocurrency Exchanges May Become the Next Prey in His Business Empire

MrBeast (real name Jimmy Donaldson), the world's most-subscribed YouTube superstar, is expanding his vast business empire into the heart of fintech. The CEO of his holding company, Beast Industries, recently confirmed the launch of a financial services platform called "MrBeast Financial" and a mobile phone company called Beast Mobile. According to trademark application documents that have surfaced, the financial platform's scope of business clearly includes "cryptocurrency exchange" services. With revenues exceeding $400 million last year, Beast Industries is no longer satisfied with just content and consumer products, and is now seeking to leverage its massive influence over Gen Z to become a gateway to next-generation financial and digital asset services.

BTC-0.91%

MarketWhisper·45m ago

Central Banks' Gold Hoarding Trend Spreads: Is Bitcoin Becoming the Next National Strategic Reserve Asset?

Central banks around the world are stockpiling gold at an unprecedented pace, with net purchases reaching 53 tons in October 2025 alone—a new annual high. Poland, Brazil, and other countries are the main buyers. Meanwhile, Bitcoin is transitioning from a fringe asset to the national reserve stage: the United States, under executive order, has designated approximately 200,000 Bitcoins (worth about $17 billion) as a strategic national reserve asset; Texas has taken the lead by purchasing $10 million worth of Bitcoin as part of its state treasury reserves. This trend of reserve diversification, extending from traditional gold to digital gold, may be reshaping the global financial power structure for the coming decades.

BTC-0.91%

MarketWhisper·1h ago

The UK Registers Digital Assets: Why Is This Step So Significant?

While major economies around the world are still debating how to regulate cryptocurrencies, the UK has quietly made a key institutional move.

On December 3 local time, John McFall, Speaker of the House of Lords, officially announced that the “Property (Digital Assets, etc.) Act” had been approved. This means that, with the assent of King Charles, the bill has officially become law. From now on, under the legal framework of England and Wales, cryptocurrencies, stablecoins, and other digital assets are clearly recognized as a form of property.

A Key Leap from “Case Law Recognition” to “Codification”

This legislation is not created out of thin air, but is a confirmation and elevation of existing judicial practice. Previously, UK case law had already established the principle that digital assets constitute property through several court rulings. However, such case-by-case recognition has always lacked the clarity and stability of written law.

The core of this act is to incorporate the recommendations of the UK Law Commission in 2

BTC-0.91%

PANews·1h ago

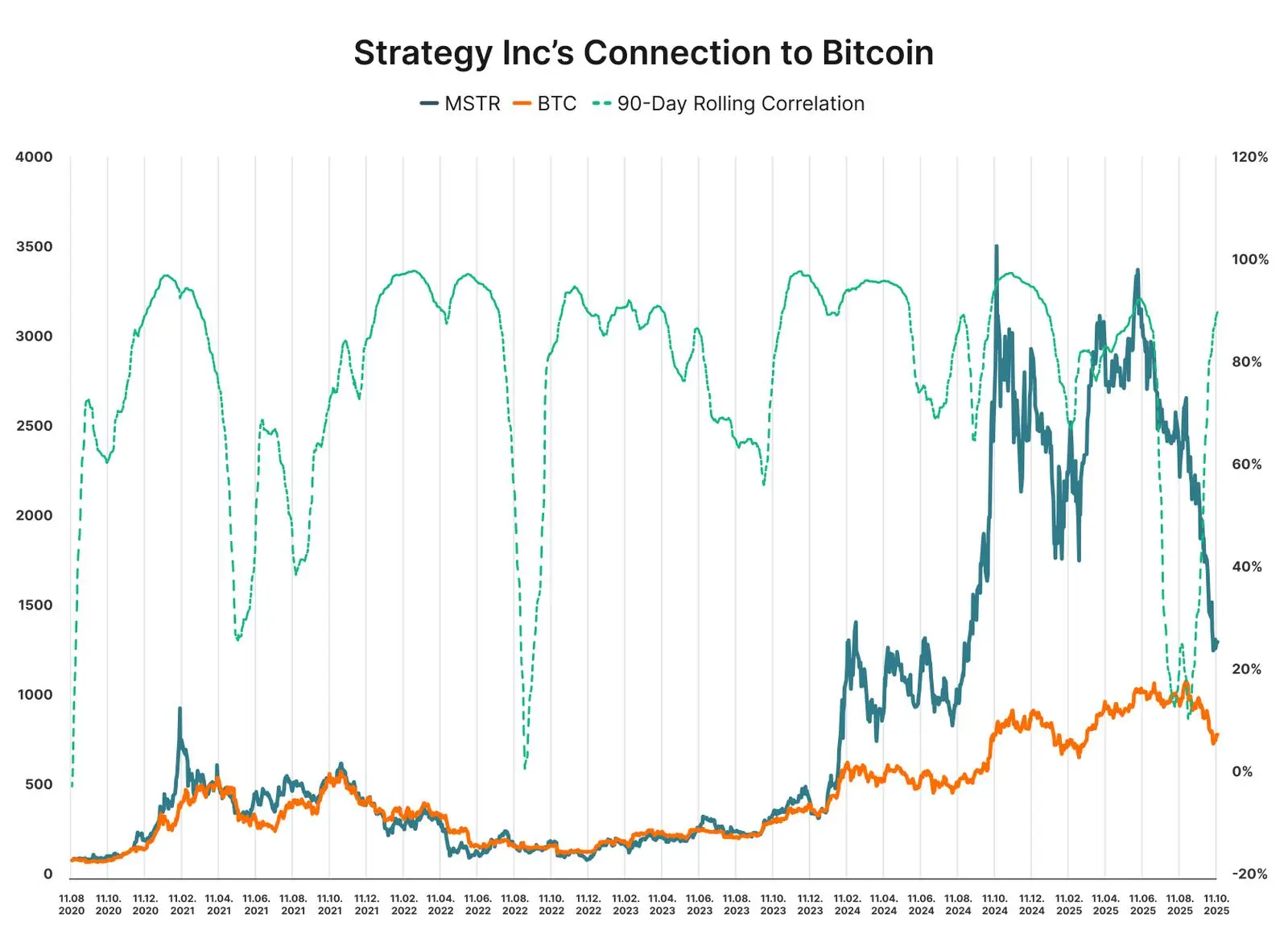

Who are the members of Strategy's "mysterious group of shareholders"?

Despite the significant decline in Strategy's stock price, its shareholder structure still reflects support from long-term capital, including many well-known institutional investors. The proportion of institutional holdings continues to grow, with the number of institutions increasing their positions being twice that of those reducing, indicating that market confidence remains and a rebound is expected in the future.

BTC-0.91%

MarsBitNews·1h ago

Life-and-Death Transformation in Bitcoin Mining: 70% of Leading Mining Companies Shift from "Mining Coins" to "Mining Computing Power," Hundreds of Billions in Capital Flow into AI

In November 2025, the Bitcoin mining industry faced a historic profitability crisis. The network-wide hashprice fell below $35 per petahash, while production costs rose to $44.8, resulting in an average miner payback period exceeding 1,200 days. In this life-or-death moment, the industry underwent dramatic changes: 70% of leading publicly listed mining companies began generating revenue from artificial intelligence infrastructure, raising over $6.6 billion in funding and signing GPU procurement contracts worth $15.5 billion. Meanwhile, miners led by Marathon Digital (MARA) were accumulating Bitcoin against the trend, with holdings valued at $5.6 billion. This signals Bitcoin mining’s transformation from a single-purpose energy consumer into a comprehensive high-performance computing service provider.

MarketWhisper·2h ago

CZ and Peter Schiff Debate Kicks Off: Who Will Lead the Future, Bitcoin or Gold?

On the main stage of Binance Blockchain Week 2025, a long-anticipated clash of ideas unfolded as scheduled. CZ and renowned economist and gold bull Peter Schiff engaged in a direct debate on the topic: “Bitcoin vs. Tokenized Gold—which is the better sound money?” CZ defended Bitcoin from the angles of verifiability, digital native utility, and provable scarcity, while Schiff argued that gold’s physical value and historical trust are irreplaceable, with tokenization merely representing its evolutionary form. This debate went far beyond a mere exchange of personal views; it profoundly revealed the core contradiction between traditional stores of value and digital native assets as they vie for influence over the future of finance, and provided investors with a clear framework to understand the fundamental differences between the two asset classes.

BTC-0.91%

MarketWhisper·2h ago

XRP News Today: $2 Psychological Support in Jeopardy—Can ETF Inflows Turn the Tide?

On December 4, XRP pulled back more than 4.5% after failing to break through the $2.20 resistance, closing at $2.097 and falling below the key 50-day and 200-day moving averages. However, there are positive signals from the fundamentals: the US spot XRP ETF has seen net inflows for 13 consecutive trading days, with the cumulative total approaching $900 million. Market analysis platform Santiment pointed out that current FUD (fear, uncertainty, doubt) sentiment around XRP has reached its highest level since October, similar to the situation after November 21, when a 22% rebound followed. Although the short-term technical outlook is weak, strong ETF demand and the potential “decoupling from Bitcoin” narrative are laying a bullish foundation for XRP in the mid to long term.

MarketWhisper·2h ago

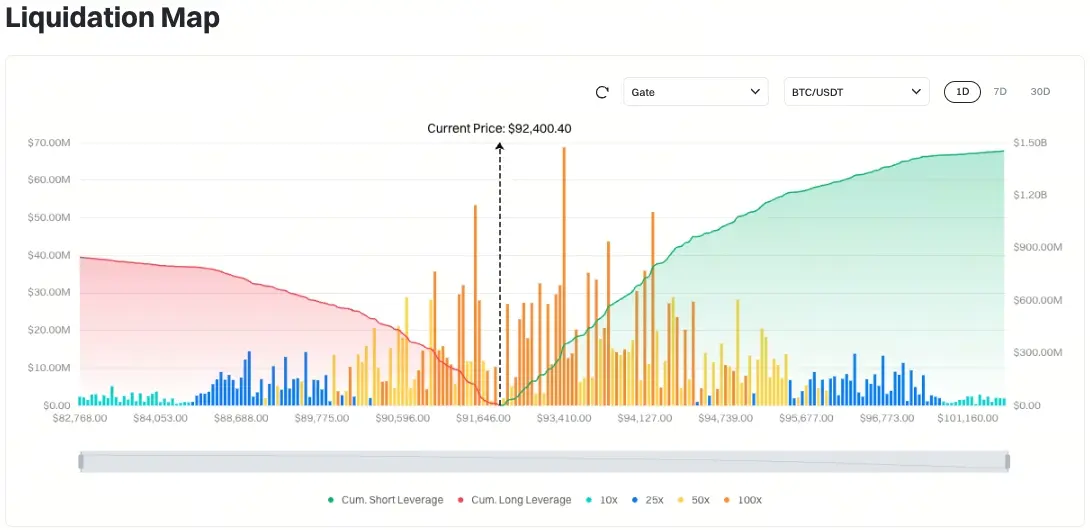

Bitunix Analyst: Market Tightens Before PCE Release, BTC 90K Zone Becomes the Battleground for Bulls and Bears

On December 5, the US will release September PCE inflation data, with the core PCE annual growth rate expected to be around 2.8%. If the data comes in below expectations, it will be favorable for the US dollar and risk assets; if it exceeds expectations, it may increase pressure for a rate cut. Market sentiment remains cautious, and the crypto market continues to fluctuate, with BTC hovering around $92,000. Before the data release, market volatility has decreased, with BTC mainly fluctuating between the $91,000 to $95,000 range.

BTC-0.91%

MarsBitNews·2h ago

The strategy is more important than miners for Bitcoin's price: JPMorgan

According to JPMorgan analysts, the "resilience" of Strategy plays a key role in Bitcoin's short-term price movements, even more important than the increased selling pressure from miners — even though Strategy, the world's largest bitcoin holder, has yet to sell any coins.

In a Wednesday report, the analysis team...

BTC-0.91%

TapChiBitcoin·3h ago

ChatGPT 2025 Prediction: XRP Aims for $15, Bitcoin to Challenge $230,000 by Year-End?

The latest version of ChatGPT has released data-driven price predictions for XRP, Bitcoin, and Solana through the end of 2025, warning that the market may experience significant volatility in the coming month. The AI outlines sharply contrasting dual-track scenarios for these three major assets: in an optimistic case, XRP could soar to $15, Bitcoin might aim for $230,000, and Solana’s bullish target could reach as high as $1,200. These forecasts are based on current market data, technical indicators, and the macroeconomic context. However, analysts caution that AI models cannot fully capture black swan events related to market sentiment, so investors should view these as scenarios for bullish and bearish speculation rather than definitive guides.

MarketWhisper·3h ago

JPMorgan: MicroStrategy's Bitcoin holding ratio is "safe," concept stocks more resilient than miners

A report issued by the JPMorgan analyst team led by Nikolaos Panigirtzoglou pointed out that the balance sheet resilience of MicroStrategy (MSTR), a leading Bitcoin concept stock, has a greater influence on Bitcoin's recent price trends than selling pressure from miners. The ratio of MicroStrategy's enterprise value to its Bitcoin holdings is currently 1.13, still above the safety threshold of 1.0, indicating that the company is unlikely to face pressure to sell Bitcoin to pay dividends or interest.

MarketWhisper·3h ago

Larry Fink Softens Crypto Stance: BlackRock CEO Admits Evolution on Bitcoin as IBIT Hits $70 Billion Milestone

In a candid admission at the New York Times DealBook Summit on December 3, 2025, BlackRock CEO Larry Fink declared that his views on cryptocurrencies have significantly evolved, marking a stark departure from his earlier skepticism.

BTC-0.91%

CryptoPulseElite·3h ago

Regulatory Breakthrough in the US: CFTC Approves Spot Crypto Trading on Futures Exchanges, Marking a Historic Moment and Opening a Legitimate Main Battlefield

The U.S. Commodity Futures Trading Commission (CFTC) announced on Thursday that it will allow spot cryptocurrency products to be listed and traded on futures exchanges registered with the agency. CFTC Acting Chair Caroline Pham called this a "historic moment," as it means spot crypto assets can be traded for the first time on "gold standard" exchanges with nearly a century of history, bringing U.S. investors the customer protections and market integrity they deserve. This move, driven by the Trump administration, is the latest development in regulators using their existing powers to delineate jurisdiction over the crypto sector. It marks a new stage in the mainstream U.S. financial system's acceptance of crypto assets and could reshape the global crypto trading landscape by guiding compliant capital back into the market.

MarketWhisper·3h ago

Charles Schwab to Launch Spot Bitcoin & Ethereum Trading in 2026: $12 Trillion Giant Enters Crypto

Charles Schwab, the largest U.S. brokerage with $12.1 trillion in client assets and 38 million active accounts, confirmed on December 3, 2025, that it will roll out direct spot Bitcoin (BTC) and Ethereum (ETH) trading directly inside its existing platform in the first half of 2026.

CryptoPulseElite·3h ago

BlackRock CEO's Evolution: From Cryptocurrency Skeptic to Bitcoin ETF King

Larry Fink, Chairman and CEO of the world's largest asset management company BlackRock, has publicly admitted that his "thought process on cryptocurrencies has evolved." Once a "proud skeptic," Fink has significantly changed his stance after his company's iShares Bitcoin Trust ETF became the largest Bitcoin ETF in the US with over $70 billion in assets under management. Fink not only recognizes the value of cryptocurrencies but also regards tokenization as a real opportunity to transform traditional finance. Meanwhile, market volatility and the establishment of regulatory frameworks remain key issues that the industry must address on its path to maturity.

BTC-0.91%

MarketWhisper·4h ago

$12 Trillion Giant Enters the Game! Charles Schwab to Launch Spot Bitcoin and Ethereum Trading in 2026—Is This the Biggest Threat Yet to US CEXs?

U.S. traditional financial giant Charles Schwab, which manages over $12 trillion in client assets, plans to launch spot trading services for Bitcoin and Ethereum in 2026. This move marks a shift in mainstream brokerage firms’ attitudes toward cryptocurrencies—from offering indirect exposure such as ETFs to providing direct trading on their core platforms—aimed at keeping tens of millions of existing clients within their ecosystem. Analysts point out that, with its zero-commission stock trading model, diversified revenue structure, and strong institutional reputation, Charles Schwab may pose a structural challenge to U.S.-based cryptocurrency exchanges like Coinbase that rely on trading fees for survival. An intense competition over price, trust, and market share is about to unfold.

MarketWhisper·4h ago

Gate Daily (December 5): CFTC approves spot cryptocurrency trading; Huaxia Bank issues $600 million RMB bonds

Bitcoin (BTC) rally stalls and consolidates, temporarily trading around $92,480 on December 5. The CFTC has approved US exchanges to conduct spot cryptocurrency trading, while the EU plans to enhance the European Securities and Markets Authority’s (ESMA) powers over cryptocurrencies and capital markets. Hua Xia Bank has issued $600 million in RMB bonds, sparking market discussions.

MarketWhisper·4h ago

Lion Group raised 9.98 million US dollars, allocating 8 million US dollars to the Bitcoin Treasury

Lion Group Holding Ltd. raises $9.98 million to purchase Bitcoin for its corporate reserve, reflecting optimism about current market conditions. CEO Wilson Wang emphasizes Bitcoin’s role in enhancing liquidity and supporting other digital asset investments.

TapChiBitcoin·4h ago

Musk predicts a 12-year Trump dynasty! War is inevitable in the next 5-10 years

Tesla CEO Elon Musk has recently sparked a series of controversial remarks. On November 22, during an internal video conference at DOGE (Department of Government Efficiency), he predicted that Trump and Vance would be in power for as long as 12 years. He later warned on the X platform that "war is inevitable, in 5 years, 10 years at most." According to three sources familiar with the matter, Musk told 150 current and former DOGE members that the United States is at the beginning of a "great 12-year span."

MarketWhisper·5h ago

Can the Bitcoin rebound continue? BlackRock CEO: Sovereign funds are quietly accumulating at $80,000

Larry Fink, CEO of BlackRock, the world’s largest asset management company, revealed that some sovereign wealth funds are “gradually” purchasing Bitcoin. Fink stated that they bought more Bitcoin at the $80,000 price level, emphasizing that this is not just a trade—there is intentionality behind holding it. He defined Bitcoin as a hedge against personal insecurity, financial instability, and long-term devaluation, and pointed out that the recent crash was caused by leveraged players rather than fundamental factors.

MarketWhisper·5h ago

CFTC historic approval! Spot cryptocurrency exchanges legalized, offshore funds returning

Caroline Pham, Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC), has issued a new announcement approving the trading of spot cryptocurrency products on federally regulated futures exchanges. This move aims to direct trading activities to U.S. exchanges rather than offshore exchanges that "lack basic safeguards." The approval was made based on the joint consultation results of the Trump Administration's Digital Asset Markets Working Group, the SEC, and the CFTC.

ETH-0.6%

MarketWhisper·5h ago

TD Cowen lowers Strategy target price to $500

According to DeepFlow TechFlow, on December 5, Decrypt reported that investment bank TD Cowen on Wednesday lowered the target price of Strategy, the world's largest Bitcoin holding company, from $535 to $500, citing increased stock price volatility and intensified shareholder dilution effects. Strategy recently announced it had raised $1.44 billion to build up cash reserves, mainly for paying preferred stock dividends, and indicated it might sell some of its Bitcoin holdings if necessary.

Strategy has issued $7.7 billion in preferred stock this year, but as its stock price has fallen about 24% in the past month, currently hovering near a 13-month low, the dilution effect has exceeded expectations. TD Cowen analysts believe that while building liquidity reserves is a prudent move, the company's high volatility requires lowering its earnings multiple from 9x to 5x.

Meanwhile

BTC-0.91%

DeepFlowTech·5h ago

ChatGPT warns of sharp Bitcoin volatility! XRP and SOL prices may change drastically in December

The latest version of ChatGPT has released data-driven AI predictions, warning that Bitcoin, XRP, and Solana may experience significant price volatility in December. In an optimistic scenario, Bitcoin could reach $230,000, while in a pessimistic scenario, it could drop to $75,000. For XRP, the optimistic prediction is $15, and the pessimistic prediction is $0.8. For Solana, the optimistic scenario targets $1,200, while the pessimistic scenario sees it falling to $70.

MarketWhisper·5h ago

2025 Review of Predictions by 10 Crypto Institutions: VanEck Accuracy Only 10%, Why Did Coinbase Get a “Perfect Score”?

Author: Deep Tide TechFlow

It's the end of the year again, and it’s foreseeable that major institutions’ 2026 crypto predictions and outlooks will be released one after another over the next month.

But before looking at the new predictions, why not first review what these institutions said last year; after all, anyone can make predictions, but accuracy is what truly matters.

Looking back to the end of 2024, market sentiment was high, BTC had just broken through $100,000, and most predictions were optimistic:

For example, BTC would hit $200,000, the stablecoin market would double, AI agents would ignite on-chain activity, crypto unicorns would flock to IPOs... Now a year has passed—did those predictions come true?

We selected some typical views from last year's various prediction reports by institutions and individuals for a detailed review, to see whose predictions were more accurate.

1. VanEck: Accuracy rate 10%, only pre

PANews·6h ago

BTC Chart Shows 3 Major Rejections With a Clear Signal Toward 6% Support

The chart shows three clear rejections near the 9 percent zone that form a strong pattern for traders.

A rising support trend near the 6 percent region creates a clear path for price movement in the chart.

The structure shows a clear reversal zone with repeated turning points that shape the next m

BTC-0.91%

CryptoNewsLand·6h ago

This Former Cash App Executive Is Sounding the Alarm on Bitcoin

The cryptocurrency has been warming up again this week, but a credible voice just poured cold water on it.

A Bitcoin Wake-up Call From Former Block Executive Mike Brock

“ Bitcoin will fail. Because it is a lie,” writes Mike Brock, a former executive at Jack Dorsey’s bitcoin firm, Block. His

BTC-0.91%

Coinpedia·8h ago

Most Bitcoin Indicators Flash Bearish As Price Moves Near 90K Levels

Bitcoin shows weak signals as several major on-chain indicators turn red and point to a soft outlook.

Liquidity data from the model shows reduced strength as price levels move between 60K and 120K zones.

Market activity shifts as stablecoin and demand readings show low support during the recent de

BTC-0.91%

CryptoNewsLand·8h ago

Empowering Your Crypto Assets to Grow: Loyal Miner Leads the BTC and DOGE Cloud Mining Trend

Press Release by Loyal Miner

With the crypto market continuing to grow in 2025, Bitcoin (BTC) and Dogecoin (DOGE) remain leading digital assets. For both newcomers and long-term investors, mining has re-emerged as an effective strategy for steadily building crypto wealth.

As the crypto market con

BitcoinInsider·8h ago

Myriad Moves: Bitcoin and Ethereum Recovery Odds Rise as Traders Flip Bullish

In brief

Myriad predictors have flipped bullish once more on the top crypto assets.

Predictors now heavily favor a Bitcoin move to $100K rather than a deep drop, while slightly favoring ETH's rise to $4,000 before $2,500.

Plus, predictors think it's unlikely that a major liquidation event

Decrypt·8h ago

Larry Fink Says He “Was Wrong About Crypto” as Bitcoin Demand Shifts

Larry Fink, CEO of BlackRock, reverses his stance on Bitcoin, now calling it a fear-driven asset influenced by security concerns and market tensions. He notes rising institutional interest and the significant volatility in Bitcoin prices.

BTC-0.91%

CryptoFrontNews·8h ago

BTC Looks for Rare December Surge to Overcome Strong Bear Market Risks

Bitcoin Defies Seasonality as December Shows Signs of Reversal

Bitcoin (BTC) begins December amid unusual market dynamics, breaking free from its historical trend of bearish December performance following negative Novembers. This year’s structural shifts—driven by liquidity movements, momentum,

CryptoBreaking·10h ago

Bitcoin Holds a 3-Year Pattern As 200DMA and 50DMA Map Market Cycles

The chart shows a steady Bitcoin rise from 16K to 125K within a three year rhythm without major shocks.

Events like COVID and the China ban and the Luna crash formed cycle lows that aligned with the same trend.

Bitcoin held a strong pattern where three years moved up then one year moved down witho

BTC-0.91%

CryptoNewsLand·11h ago

Malaysia Cracks Down on Bitcoin Miners Behind $1.1B Electricity Theft

In brief

Malaysia launched a special committee in November to target mining operations stealing power.

Around 14,000 illicit operations have been discovered in the country over the past five years.

Thailand also shut down a large mining operation linked to scam networks this week.

Decrypt's

BTC-0.91%

Decrypt·13h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27