From start to giving up, why I stopped doing Web3 payments.

2025-12-23 09:51

The Year of the New Token's Demise

2025-12-23 08:41

Trending Topics

View More1.71K Popularity

14.43K Popularity

10.53K Popularity

5.43K Popularity

92.31K Popularity

Hot Gate Fun

View More- MC:$3.86KHolders:21.12%

- MC:$3.61KHolders:20.00%

- MC:$3.64KHolders:10.00%

- MC:$3.63KHolders:10.00%

- MC:$3.94KHolders:21.44%

Pin

The Speed of Life and Death in the Cold Winter of Bitcoin Mining: MARA Analysis and Investment Insights

Author: Yilan, Source: LD Capital

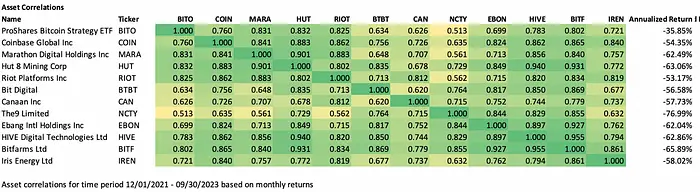

The main business of listed blockchain concept stocks is divided into mining, mining machine sales, chip manufacturing, digital asset management, blockchain technology provision, payment and trading platforms, etc., due to the difference in business models, they have different degrees of BTC leverage effect, which means that their stock price fluctuations are usually more violent than the Bitcoin spot market and the amplification factor is different, among which, mining stocks (Mara, Riot, BTBT, etc.) are more effective BTC price amplifiers than mining machine stocks or other business model stocks, FOR EXAMPLE, MARA HAS A HIGHER CORRELATION AND PRICE ELASTICITY WITH BTC PRICES THAN COIN (COIN VS. MARA correlation 0.76 vs. 0.83, annualized standard deviation 92% vs. 170%).

Price correlation and standard deviation by mining stock and BITO (BITO fits BTC price)

Source: Trend Research

Source:Trend Research

The price of Mara rose 100% in the rally from June 15 to July 13, while BTC only rose 30%, but Mara also fell 55% in the subsequent correction of BTC (in addition to the reasons for BTC’s decline, EPS-0.13 was far less than expected after the release of the second quarter earnings report on August 8, and -0.07 was also driven by the downward price), and BTC fell 12%. Looking at it this way, Mara’s amplification factor for the BTC price in this year’s market is close to 300%, although the annualized standard deviation is only 170%.

MARA vs. How much the BTC price went up or down

Source:TradingView

History of Mara EPS

Source: Yahoo

This article mainly analyzes the operating status and investment risks of Marathon Digital (MARA), and compares with other mining companies to determine whether Mara is the target with the strongest shorting trend.

I. Investment logic

Marathon’s main business is self-operated bitcoin mining. The strategy is to (finance) purchase mining rigs to deploy mining farms, pay for the cash operating costs of production and hold Bitcoin as a long-term investment. The difference between the business model of buying mining rigs and hoarding coins (Mara, Hut 8, Riot) and the production and sale of mining rigs (Cannan) is that R&D expenditure is small, but capital expenditure is large, and income is not resilient, and can only rely on improving BTC mining efficiency and BTC appreciation to make profits, higher debt ratio, greater leverage, so the revenue of mining listed companies and bitcoin price correlation is stronger, price fluctuations are more violent, and the bear market faces the potential threat of insolvency.

Graphical representation of Marathon’s financial position in fiscal 2022

Source: Yahoo

In terms of revenue, in fiscal 2022, Marathon produced 4144 BTC, with income of 117mln, but the income could not cover the expenditure at all, the annual mining energy and other expenses were 72mln, mining machine depreciation and amortization was 78mln, plus personnel, maintenance and other operating expenses were 630mln, and the net loss was 687mlm. Therefore, the business model of financing the purchase of Bitcoin mining machines is a great test of the cash flow management ability of enterprises in the bear market.

In terms of mining efficiency and operations, Marathon’s launch hashrate in the second quarter increased by 54% from 11.5 EH/s at the end of last year to 17.7 EH/s. Increased Bitcoin production by increasing hash rates faster and improving run times (2,926 BTC were produced in the second quarter, or about 3.3% of the Bitcoin network’s rewards during the period). On the operational side, the company’s high debt profile (22Q4 insolvency) has impacted the health of the balance sheet. Although Q1 and Q2 due to the recovery of coin prices and the increase in computing power put into production, mining efficiency, the stock price performance is better. However, the BTC price continued to be depressed in 23Q3 and is expected to remain depressed until at least next year, so Marathon prepaid most of the convertible bonds in September this year to reduce the adverse impact of loan interest on cash flow, and the total remaining principal amount of the note is still $331 million.

Although the revenue situation improved due to the increase in the efficiency of mining BTC due to increased computing power, Marathon recorded a loss of $21.3 million, or a loss of $0.13 per share, in the three months ended June 30, 2023, compared to a net loss of $212.6 million in the same period last year, a loss of $1.94 per share, but still not profitable, and the huge electricity bill and mine deployment expenses continued to weaken Marathon’s balance sheet in the face of tight cash flow.

Source: Hashrate Index

Source: Hashrate Index

From Marathon’s cash flow, it can be seen that the source of cash is completely from financing, in Q4 2022, the company’s operating cash flow is -92mln, investment cash flow is -22mln, financing cash flow is 163mln, resulting in the company also has a net cash flow of 48mln to cope with the interest tax in the next quarter, etc., the cash flow brought by financing comes entirely from the additional issuance of common shares, and the continuous issuance of shares, the market may reduce the valuation of the company, As a result, Marathon faces higher capital costs when raising funds in the future. In addition, issuing more common shares may result in lower earnings per share (EPS) as earnings are distributed to more shareholders, which will also negatively affect Marathon’s valuation.

As of the end of the second quarter of 2023, Marathon still held cash and cash equivalents worth 113mln, including 12,538 BTC, and the cash expenditure of interest on Marathon in 2023Q2 reached 3mln, which is almost the same as its available net cash flow on books (Marathon’s available net cash flow is only 3mln, which is the remaining net cash flow after the issuance of 163mln and 65mln worth of common shares in Q1 and Q2, respectively), It can be seen that too much cash is used in operations and investments, and no new cash is generated, so Marathon needs to continue to sell BTC to cover operating expenses in addition to actively repaying to reduce the interest burden, and Marathon did sell 63% of the BTC produced in 2023Q2, totaling $23.4 million.

Source: Capital IQ

Marathon deployed and installed the new S19 miner in early August, and the installed hash rate in China has reached the target of 23EH/s. The newly installed mine is in City Garden, Texas, and the hosting provider says it’s close to launch. Marathon’s joint venture in Abu Dhabi has already begun calculating hash rates and generating Bitcoin. However, at a cost of $0.12/kwh, the currently deployed mining rig is only just breakeven even if it starts at the current BTC price, and even has a slight loss (just calculate the variable cost of electricity costs).

And the overall investment cost of mine construction remains high, and the valuation of the mine farm in 2021 can even reach 1 million US dollars / MW, and the unit price of buying mining rigs is between 55–105 US dollars / T. Under the double blow of falling currency prices and rising electricity costs, the early asset input depreciated more, and the income also decreased significantly, making it difficult for many mining companies to sustain.

Marathon plans to continue expanding its leadership in Bitcoin mining in the coming quarters. But in fact, such an expansion in a bear market raises more concerns about its cash flow position, and whether it can continue to raise funds determines whether its expansion plan can be carried out smoothly (the practice of issuing additional equity will reduce its value per share).

The market downturn can negatively affect companies with significant debt, especially in a high-interest rate environment, Marathon’s liabilities put an additional interest burden on cash flow, so Marathon chose to prepay most of its convertible bonds to cope with the current low currency price and operating pressures caused by the BTC halving next year (Marathon’s $417 million convertible notes were converted at a discount of about 21%, This saved Marathon approximately $101 million in cash, excluding transaction costs. The transaction added approximately $0.55 per share to existing shareholders. while increasing Marathon’s financial/financing options. As debt burdens decrease, companies are better equipped to respond to short-term turbulence.

In the bear market, the decline in currency prices, mining machine orders, mining capital expenditures and debt have brought great pressure to the company’s operations, in addition, fierce competition among miners and rising energy prices have further aggravated the survival crisis of mining enterprises. Even though 63% of the total Q2 output of BTC has been sold, Marathon’s CEO revealed in the Q2 call that it will continue to sell BTC to keep the company running.

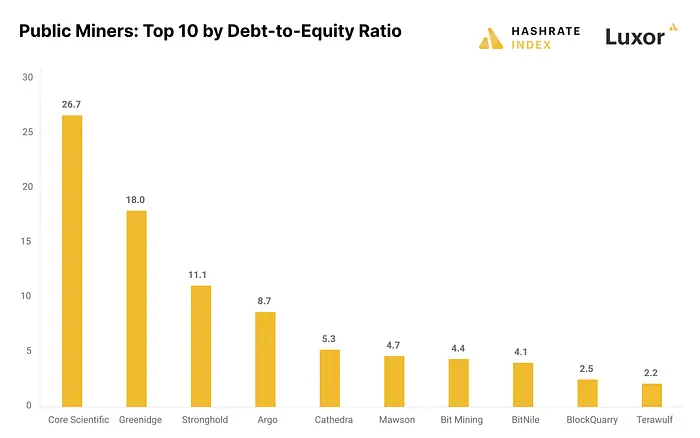

Mining stocks face severe challenges in the bear market, and the strong correlation and high elasticity characteristics of BTC also lead to greater downward pressure on its price in the bear market, due to the highly leveraged operating model, the single source of income of mining listed companies also have the threat of bankruptcy. Many bitcoin mining listed companies took out a lot of loans during the bull market in 2021, resulting in a very negative impact on their profitability during the subsequent bear market, in fact, Core Scientific, which has the largest borrowing amount and the highest debt-to-asset ratio among mining companies, has sought bankruptcy protection and debt restructuring at the end of 2022, and throughout 2022 before bankruptcy, Core Scientific was selling BTC to cope with its mining machine purchase costs, self-operated mining farm construction expenses, Large-scale deployment of operating costs such as electricity and loan interest, but ultimately declared bankruptcy due to its aggressive 2022 expansion plan (more than 320,000 mining rigs deployed by the end of 2022, resulting in a loss of $53,000 per day in photovoltaic costs) and the impact of the Celsius incident.

Bitcoin prices and network difficulty diverge significantly, and the market rewards miners for their future hash power in bull markets, becoming an important narrative for miners to raise funds in bull markets, but in bear markets, as the price of Bitcoin falls, the growth of hash power makes the miner economic situation very challenging, because miners must buy their previously signed mining orders when the price of BTC drops significantly and the hashrate continues to grow. Miners have already paid for the rig’s capital expenditure, so from their perspective, it makes sense to continue executing on the growth plan as long as their marginal mining costs remain positive. This trend has further exacerbated the sharp drop in hash prices since the beginning of the year.

As the price of bitcoin plummeted, the valuation of most mining stocks has fallen significantly, and some mining companies are raising funds by selling BTC, issuing common shares, and significantly diluting the equity of existing shareholders, and raising funds by issuing additional shares makes raising additional equity very dilutive and raising debt capital expensive. With money tight, miners are also looking for alternative solutions, such as offering escrow services for higher revenue streams, selling equipment for more cash, and even considering mergers and acquisitions. Miners that were conservative during the bull market and did not overleverage now have the opportunity to take an opportunistic approach, i.e. miners with good cash flow management or the opportunity to buy up other rivals who are struggling with debt at low prices.

In the case of MARA’s poor debt-to-capital ratio (i.e., when the probability of bankruptcy increases), the upside correlation with BTC may decrease. If Mara’s recent debt treatment allows her balance sheet to survive healthily into the BTC bull market, based on the current broader market situation (continue to decline), Marathon’s debt to equity situation (too high debt), valuation situation (P/B still has a large downside, MC/hashrate is higher than peers), the investment recommendation is to sell strongly within 12 months, with PB as 1 as the bearish target, and the target stock price is around $3. At the current price of $8, that’s an overvaluation of 166%. However, based on its highest price elasticity, it can earn swing gains when rebounding and obtain better returns than buying BTC. There are two scenarios that can cause stock prices to rise: acquisitions and a short-term rally in the BTC bear market.

II. Company background and business introduction

Marathon Digital Holdings, Inc. and its subsidiaries (the “Company” or “Marathon”) is a digital asset technology company focused on the blockchain ecosystem and the generation or “mining” of digital assets. The company was incorporated in Nevada on February 23, 2010, as Verve Ventures, Inc. In October 2012, the company began operating an intellectual property license and changed its name to Marathon Patent Group, Inc. In 2017, the company purchased digital asset mining equipment and built a data center in Canada for mining digital assets. However, the company ceased operations in Canada in 2020 and consolidated all operations into the United States at that time. The company has since expanded its bitcoin mining activities in the United States and internationally. The Company changed its name to Marathon Digital Holdings, Inc. on March 1, 2021. As of June 30, 2023, the Company’s main business focuses on Bitcoin mining and ancillary opportunities in the Bitcoin ecosystem. The strategy is to hold Bitcoin as a long-term investment after paying for the cash operating costs of production. Holding Bitcoin is a strategy as a store of value, backed by a robust and publicly open source architecture that is not tied to any country’s monetary policy, and therefore serves as a store of value outside of government control. Marathon believes that due to Bitcoin’s limited supply, it also offers additional opportunities to appreciate as it continues to be adopted. It is also possible to explore opportunities to participate in other businesses related to the Bitcoin mining business as favorable market conditions and opportunities arise.

Subsidiary businesses are businesses that are related to the Bitcoin ecosystem but are not directly related to mining themselves. Ancillary business directly related to mining may include, but is not limited to, managing third-party owners’ bitcoin mining facilities, providing consulting and consulting services to third parties seeking to establish and operate bitcoin mining facilities, and joint ventures that conduct bitcoin mining projects within the United States and within international law, such as the Company’s project in Abu Dhabi (United Arab Emirates). Marathon will also seek to participate in Bitcoin-related projects, including but not limited to the development of immersive technologies, hardware, firmware, mining pools and sidechains using blockchain cryptography, and may also participate in power-generating projects such as generating electricity from renewable energy resources or methane gas capture for use by Bitcoin mining projects.

History

On February 23, 2010, the company was incorporated in Nevada as Verve Ventures, Inc.

On December 7, 2011, the Company changed its name to American Strategic Minerals Corporation to engage in the exploration and potential development of uranium and vanadium minerals.

In June 2012, the company terminated its mining business and began investing in real estate in Southern California;

In October 2012, the company changed its name to Marathon Patent Group, Inc. and started the intellectual property licensing business.

2017.11.1, the company entered into a merger agreement with Global Bit Ventures, Inc. (“GBV”) to focus on mining pan-blockchain; This node is an important symbol of Marathon Digital’s transformation from the brink of bankruptcy to the gradual development of a leading mining company. Marathon acquired GBV’s own 1,300 Bitmain S9 miners and 1,000 graphics miners. After familiarizing himself with the process, Marathon purchased another 1,400 S9s and rented a 2 MW site for mining operations. Not long after that, the crypto market entered a bear market, and Marathon terminated his partnership with GBV.

From September 30, 2019 to December 23, 2020, the company purchased pan-blockchain mines by signing contracts;

Effective March 1, 2021, the company changed its name to Marathon Digital Holdings, Inc.

Important events in 2022

Significant crypto market developments and their impact on companies 2022 was a challenging year for the crypto industry as a whole, as macroeconomic conditions, including the high inflation and interest rate hike environment relative to recent years, led to a weakening of the stock market and widespread “risk aversion” sentiment, which negatively impacted the price of Bitcoin. In addition, the macro challenging environment in 2022 was further impacted by a series of unexpected black swan events that impacted the entire industry, including:

The collapse of the $LUNA-UST de-anchor in the second quarter of 2022 led to the bankruptcy of important players in the digital asset space, including Three Arrows Capital, Voyager and Celsius;

The collapse of FTX in the fourth quarter of 2022 led to additional credit-related bankruptcies and a significant decrease in the price of Bitcoin and Bitcoin mining equipment. The impact of these black swan events on Marathon’s operating results includes impairment of prepayments.

Impairment of Bitcoin mining equipment and advances to suppliers: In the fourth quarter of 2022, the fair value of Bitcoin mining equipment decreased significantly. As a result, the Company assessed whether impairment provisions were required for Bitcoin mining equipment (held as a fixed asset) and advances to suppliers (as liquid assets, representing deposits for future deliveries of mining equipment). Marathon made impairment provisions for both Bitcoin mining equipment and advance payments to suppliers, totaling approximately $332,933,000.

Digital Assets — Impairments and Book Value Declines: Marathon experienced impairments of $173,215,000, realized and unrealized losses of $85,017,000 on digital assets in investment funds, and $14,460,000 on digital assets held on the consolidated balance sheet during 2022.

Decrease in total profit: Marathon’s operational profitability decreased due to the drop in the price of Bitcoin and delays in expanding its business. Total profit for the year was a loss of $33,673,000, compared to a gain of $116,768,000 in the same period last year, a decrease of $150,441,000.

Direct Impact of Supplier Bankruptcy Filing: On September 22, 2022, Compute North filed for restructuring under Chapter 11 of the U.S. Bankruptcy Code. As a result, the Company recorded an impairment provision of $39,000,000 in the third quarter of 2022. In the fourth quarter of 2022, the Company estimated that an additional $16,674,000 in deposits may have been impaired and therefore recorded an additional impairment provision.

Digital assets as collateral — Fair value decline and additional collateral requirements: On November 9, 2022, the price of Bitcoin fell to a new annual low due to concerns about financial instability in the industry due to the FTX crash. Accordingly, the Company was required to provide an additional 1,669 bitcoins (each valued at $16,213) as collateral for its outstanding borrowings under Silvergate Bank’s Term Loan and Revolving Credit (RLOC) facility, for a total collateral balance of 9,490 bitcoins (or approximately $153,861,000 in fair value). As of November 9, 2022, the Company’s total Bitcoin holdings were 11,440 BTC, of which 1,950 (approximately $31,615,000) were unrestricted. In November and December 2022, the Company repaid its $5,000,000 RLOC borrowing. These repayments enable the Company to reduce its Bitcoin used as collateral to approximately 4,416 BTC (fair value of approximately $73,074,000) through December 31, 2022.

Impact of bankruptcy and FTX collapse on Marathon’s main lenders: Prior to the termination of the lending facility on March 8, 2023, Silvergate Bank was a lender to the Marathon Term Loan and RLOC facilities, under which Marathon has the right to borrow up to $200,000,000, provided that sufficient bitcoin is used as collateral. On March 1, 2023, Silvergate Bank filed with the SEC disclosures regarding its troubled financial condition, including doubts about its continued continued as a going concern, and notified it of the delay in filing its Form 10-K due to a significant reduction in customer deposits and insufficient capital. This has led crypto business customers to abandon the bank, creating both credit gaps and reputational risks for crypto customers. On March 8, 2023, Silvergate announced its intention to cease operations and voluntarily liquidate the bank. On February 6, 2023, Marathon provided Silvergate Bank with the required 30-day notice stating Marathon’s intention to repay the outstanding balance of its Term Loan facility and Marathon’s intention to terminate the Term Loan facility. Marathon and Silvergate Bank later agreed to terminate the RLOC facility. On March 8, 2023, the Company repaid Term Loan and terminated its RLOC facility with Silvergate Bank.

Signature Bank Closure: On March 12, 2023, Signature Bank was closed by its state-licensed authority, the New York State Department of Financial Services. On the same day, the FDIC was appointed to take over and transferred all deposits and nearly all of Signature Bank’s deposits and nearly all of its assets to Signature Bridge Bank, a full-service bank operated by the FDIC. The company automatically became a customer of Signature Bridge Bank in this action. As of March 12, 2023, the Company held approximately $142,000,000 in cash deposits at Signature Bridge Bank. Normal banking resumed on 13 March 2023.

Important events in 2023

On 27 January 2023, the Company and FS Innovation, LLC (“FSI”) entered into a shareholders’ agreement (the “Agreement”) regarding the formation of Abu Dhabi Global Market Company (the “ADGM Entity”) for the purpose of jointly (a) establishing and operating a mining facility for one or more Digital Assets; and (b) mining digital assets (collectively, the “Business”). ADGM Entity’s initial project will include two digital asset mining sites of 250 MW in Abu Dhabi, ADGM Entity’s initial equity ownership will be 80% of FSI and 20% of Marathon, and capital contributions will be made in accordance with these proportions, including cash and in-kind, totalling approximately US$4,060,000 over the 2023 development period. FSI will appoint four directors to join the board of directors of ADGM Entity, while the company will appoint one director. Unless otherwise required by applicable law, digital assets mined by ADGM Entity will be distributed monthly to the Company and FSI in proportion to its equity interest in ADGM Entity. The agreement contains market provisions on financial and tax matters. The Agreement will be terminated earlier by written agreement of the parties, liquidation of the ADGM Entity, or shareholders having a full outstanding equity interest in the ADGM Entity. The agreement contains market provisions for shareholders’ transfer of shares, pre-emptive rights and certain incidental and accompanying interests in the sale of the ADGM Entity. In addition, the agreement contains a five-year restrictive covenant that includes provisions prohibiting Marathon from competing with businesses or FSI’s or certain parties in the UAE, and FSI’s business with Marathon in the United States. ”

On September 20, 2023, Marathon has completed a previously announced transaction agreement for the previously announced 1.00% convertible senior notes due 2026 privately negotiated with certain holders. On average, these transactions are about 21% off face value, saving the company about $101 million in cash before deducting transaction costs.

In total, Marathon converted the aggregate principal amount of $417 million of the notes held by holders into a total of 31.7 million newly issued Marathon common shares. As a result, the company reduced its long-term convertible debt by approximately 56% and saved approximately $101 million in cash before deducting transaction costs. The total remaining principal amount of the Notes is $331 million.

III. Financial analysis

The business model based on the appreciation of BTC and increased mining efficiency led Marathon to start negative growth in revenue after entering a bear market in the crypto market after 2021.

In 2022, Marathon revenue was $117,753,000, compared to $159,163,000 in 2021. The decrease in revenue of $41,410,000 was mainly due to a $77,286,000 decrease in revenue due to the decline in the price of Bitcoin in 2022, partially offsetting the increase of $44,570,000 due to increased annual production. In 2022, revenue also fell by $8,694,000 as the company stopped operating mining pools, including third parties. Despite the overall annual increase in production, the Company experienced significant production stagnation in the second and third quarters due to the aforementioned delays in exiting Hardin and King Mountain Electrification. Production in the third quarter was down 50% from the same period last year. Marathon’s best production quarters for 2022 are Q1 and Q4.

Source:Bitcointreasuries.net

As of December 31, 2022, it held approximately 12,232 BTC on its balance sheet with a book value of $190,717,000. Of these, approximately 4,416 bitcoins ($68,875,000 book value) were used as collateral for borrowing and were classified as restricted digital assets. The remaining 7,816 bitcoins, with a book value of $121,842,000, are unrestricted holdings and are classified as digital assets.

For the first time in the first quarter of 2023, Marathon’s BTC balance decreased by 766 coins in response to a deteriorating balance sheet.

Q2 2023 revenue was $81.8 million, up from $24.9 million in Q2 2022, as a 314% increase in Bitcoin production more than offset a 14% decline in average Bitcoin prices in the same period of the year. Marathon sold 63% of the BTC produced in the second quarter (1,843 BTC), recording a loss of $21.3 million, or $0.13 per share, in the three months ended June 30, 2023, compared to a net loss of $212.6 million or $1.94 per share in the same period last year.

Bitcoin sales proceeds were $23.4 million as the company sold 63% of the bitcoin generated during the quarter to cover operating costs. In addition, due to the general increase in the price of Bitcoin during the current year, the book value impairment of digital assets decreased by $8.4 million. In addition, there is no longer a loss of $79 million in digital asset investment funds and a $54 million gain on the sale of equipment compared to the same period last year, which also contributes to this year’s comparison.

Adjusted EBITDA was $25.6 million, compared to a loss of $167.1 million in the year-ago quarter. In addition to these gains and lower impairments, gross profit before depreciation and amortization increased to $26.5 million, up from $8.2 million in the year-ago quarter.

Production highlights in the second quarter of 2023

Bitcoin production: Q2–23 2926, Q2–22 707, up 314%, Q2–23 2926, Q1–23 2195, up 33%.

Average daily Bitcoin production: Q2–23 32.2, Q2–22 7.8, up 314%, Q2–23 32.2, Q1–23 24.4, up 32%.

Operating/Start-up hash rate (EH/s)1: Q2–23 17.7 EH/s, Q2–22 0.7 EH/s, up 2429%, Q2–23 17.7 EH/s, Q1–23 11.5 EH/s, up 54%.

Average operating hash rate (EH/s)1: Q2–23 12.1 EH/s, not applicable in the same period last year, Q2–23 12.1 EH/s, Q1–23 6.9 EH/s, up 75%.

Installation hash rate (EH/s)1: Q2–23 21.8 EH/s, not applicable in the same period last year, Q2–23 21.8 EH/s, Q1–23 15.4 EH/s, up 42%.

Although the commissioning of mining equipment has led to a significant improvement in mining efficiency compared to the same period last year, the BTC price is still at a low level and aggressive expansion has led to Marathon’s excessive operating expenses and is still on the verge of danger.

Marathon’s total profit was -$33.67 million in fiscal 2022, compared to $117 million in the same period in fiscal 2021, a decrease of $150 million.

Marathon’s cost of revenue for fiscal 2022, including energy, custody and other costs, totaled $72.71 million, compared to $27.49 million for the same period in 2021. The $45.23 million increase was mainly due to higher production costs, which increased production costs by $30 million per bitcoin mined, an early exit from Hardin resulting in an acceleration cost of $18.21 million, and the cost impact of higher bitcoin production on costs of $5.56 million. These increased costs were partially offset by an $8.69 million decrease in revenue costs for third-party mining pools decommissioned in 2022. Cost of Revenue – Depreciation and amortization increased by $63,805,000 to $78.71 million in 2022 compared to $14.9 million for the same period in 2021. This was primarily due to Marathon’s exit from Hardin, an acceleration of depreciation related to MT facilities, an increase of $36,032,000, and an increase of $27,773,000 in depreciation costs associated with additional mining rigs in operation.

Source: Capital IQ, Marathon 10-K

Marathon recorded a net loss of $687 million in 2022, compared to a net loss of $37.09 million for the same period in 2021. Losses increased by $649 million, mainly due to a total decrease of $318 million in the book value of Marathon’s digital assets and a total impairment of $333 million in prepayments to vendors for bitcoin mining equipment and suppliers.

Adjusted EBITDA was -$534 million, compared to $162 million for the same period in 2021. Depreciation and amortization of $86.64 million, legal reserves of $26.13 million, and general and administrative expenses, excluding an increase of $18.57 million in non-cash stock-based compensation costs. These were partially offset by proceeds from the sale of excavation equipment of $83.88 million and an increase of $1.57 million in nonoperating income.

Source:Capital IQ, Marathon 10-Q

2023Q2 Marathon recorded a net loss of $19.13 million, compared to a net loss of $21.26 million in the same period last year. The improvement in net loss of approximately 91% was primarily due to favorable differences in proceeds on the sale of digital assets and impairment of digital assets, as well as favorable differences related to digital asset impairment and losses of digital assets within investment funds, partially offset by lower total profit margins.

Marathon’s adjusted EBITDA was $25.63 million in 2023Q2, compared to -$167 million in the year-ago quarter, and the increase in adjusted EBITDA was primarily due to the positive impact of digital asset sales ($23.35 million) and lower digital asset impairment ($12.32 million). Adjusted EBITDA also benefited from the absence of several expenses recorded in the year-ago quarter, including the loss of digital assets within the Digital Asset Fund and the gain on the sale of Digital Assets and the loss of accounts receivable from digital asset loans, which were partially offset by lower total margin (excluding depreciation and amortization) and higher management and administrative expenses excluding equity compensation.

Reanalyze the impact of Marathon mining rig deployment on cost and profit. Currently, the mining rigs are hosted by third parties, and Marathon pays them a fee.

McCamey, Texas — Approximately 63,000 S19j Pros are currently deployed and operating at the site, with another 4,000 S19j Pros scheduled for delivery and deployment in 2023. Marathon’s contract for the facility expires in August 2027.

Garden City, Texas — Approximately 28,000 S19 XPs are currently installed at the location and are currently awaiting final regulatory approval for power. Marathon’s current expansion plans include the deployment of 19 MW of immersion units by 2023, provided by new capacity and replacement air-cooled units for immersion. The contract for the facility expires in July 2027.

ELLENDALE, North Dakota — Approximately 57,000 S19 XPs are expected to be deployed at the site in the first half of 2023. Electrification is expected to begin by the end of the first quarter of 2023. The contract for the location expires in July 2027.

Jamestown, North Dakota — Approximately 5,600 S19 XPs are currently deployed and operating at the site, with plans to deploy an additional 10,400 air-cooled units in the first quarter of 2023. In addition to the installation of these air-cooled units, the Company plans to deploy 768 immersion units at the site in the second quarter of 2023. The contract expires in August 2026 for immersion deployments and December 2027 for air-cooled equipment.

GRANBURY, Texas — Approximately 12,500 S19j Pros and 4,400 XPs are currently deployed and powered up at the facility. There are currently no plans to expand the facility.

COSHOCTON, OH — Approximately 2,800 S19 Pros are currently deployed and operating at this facility. Marathon’s contract for the facility expires in June 2023 and does not intend to extend the contract beyond that termination date.

Plano, TX — Approximately 345 S19 Pros are currently deployed and operating at the facility. There are currently no plans to expand the facility, and the contract for the facility expires in June 2027.

Kearney, Nebraska — Approximately 2,300 S19 J Pros are currently deployed and operating at the site. The company plans to deploy an additional 1,300 MicroBT devices at the site in 2023.

South Sioux City (SD) — Approximately 660 S19 Pros are currently deployed at the site. The Company’s contract for the facility expired in early 2023 and it exited the facility. On 27 January 2023, Marathon and FSI signed an agreement to establish an Abu Dhabi Global Market Company for the purpose of jointly (a) establishing and operating one or more digital asset mining facilities; and (b) mining digital assets. ADGM’s first project will include two digital asset mining sites in Abu Dhabi totaling 250 MW of immersion equipment with an initial equity ratio of 80% vested in FSI and 20% vested in Marathon. The facility is expected to be operational in the second half of 2023.

Source: ASIC Miner Value data retrieved on 7th OCT

Marathon put into production in the first quarter of this year mostly S19 XPs, from the perspective of the profitability of each mining machine, the current profit of S19 XPs is small, $0.08 per day. So the increase in hash power may not fundamentally improve Marathon’s profitability this year.

Since miner profit = Bitcoin reward x BTC price — cost of electricity — hashrate price; Therefore, the price of bitcoin market, the cost of electricity and the price of hash rate are crucial to Marathon’s profitability.

· Bitcoin rewards

Bitcoin rewards were heavily affected by the halving event. Bitcoin halving is a phenomenon that occurs every four years or so on the Bitcoin network, and halving is also an important part of the Bitcoin protocol, which is used to control the overall supply and reduce the risk of inflation of digital assets using a proof-of-work consensus algorithm. At a predetermined block height, the mining reward is halved, hence the term “halving”. For Bitcoin, the reward is initially set at 50 Bitcoin currency rewards per block. Since its inception, the Bitcoin blockchain has undergone three halvings, as follows: (1) on November 28, 2012, at a block height of 210,000; (2) on July 9, 2016, at a block height of 420,000; and (3) on May 11, 2020, at a block height of 630,000, when the reward was reduced to the current 6.25 bitcoins per block. The next halving of the Bitcoin blockchain is expected to occur around March 2024, with a block height of around 840,000. This process will be repeated until the total Bitcoin currency reward issued reaches 21,000,000 and the theoretical supply of new Bitcoin is exhausted, which is expected to occur in about 2140. The Bitcoin halving in 2024 will reduce mining rewards and jeopardize the profitability of miners with razor-thin margins. Only a significant increase in the price of BTC can see a significant improvement in earnings.

· Cost of electricity

In terms of electricity costs, mining costs vary greatly across countries, with European countries facing the highest fees due to rising electricity prices. The impact of higher energy prices on U.S. miners is smaller than in Europe, but it has also exacerbated electricity cost pressures on U.S. miners. Texas’ electricity price of $0.12/kwh is 34% lower than the average U.S. electricity price of $0.18/kwh, and even so, most models of mining rigs are difficult to achieve breakeven at current electricity and currency prices (this is without accounting for subsidies, and some mining farms may still be profitable under the advantages of subsidies).

Source:CoinGecko

· Network hash rate and difficulty

In general, the chance of a Bitcoin mining rig solving a block on the Bitcoin blockchain and earning a Bitcoin reward is a function of the hash rate of the mining rig relative to the hash rate of the global network (i.e., the sum of the computing power used to support the Bitcoin blockchain at a given time). As the demand for Bitcoin increases, the global network hashrate increases rapidly. In addition, with the deployment of more and more powerful mining equipment, Bitcoin’s network difficulty has increased. Network difficulty, a measure of how hard it is to solve a block on the Bitcoin blockchain, adjusts every 2016 blocks (roughly every two weeks) to ensure that the average time between each block remains around ten minutes. The high difficulty means that solving blocks and earning new Bitcoin rewards will require more computing power, which in turn makes the Bitcoin network more secure and limits the possibility of a miner or mining pool taking control of the network. Therefore, as new and existing miners deploy additional hashrates, the global network hashrate will continue to increase, meaning that if miners fail to deploy additional hashrates at a pace that keeps pace with the industry, then miners’ share of global network hashrates (and therefore the opportunity to earn Bitcoin rewards) will decline. It can be seen that due to the fierce competition among miners, at the beginning of 2022, the revenue per TH was $0.25/TH, and it has now dropped to about $0.06/TH.

Source:Glassnode

Marathon, as the largest listed mining company in the network’s computing power, has been continuously increasing its EH/s to remain competitive. Its operating hash rate increased from 13.2 EH/s in 22Q3 to 17.7 EH/s in 23Q2, and this year the goal is to reach 23.1 EH/s.

Marathon’s hashrate growth roadmap

Source: Marathon’s official website

Marathon operates hashrate growth

Source: Marathon Digital Holdings, Inc | INVESTOR PRESENTATION (IP)

Therefore, combined with Bitcoin rewards, BTC prices, electricity costs, and hashrate prices, if the halving is not accompanied by the rise in BTC prices, the reduction in electricity costs and rewards for miners will challenge their operations, which is not a good thing for mining enterprises with higher hashrates and more aggressive expansion.

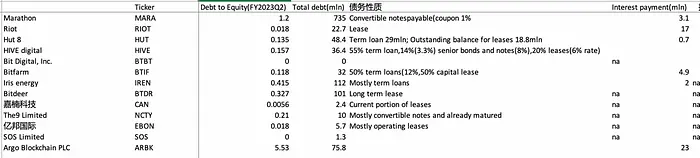

Here we focus on four dimensions, capital structure (debt-to-equity ratio), financing, and Capex (capital expenditure).

Marathon debt-to-equity ratio

Marathon债务权益比: total debt/common equity=783mln/386mln=2.03(FY2022);total debt/common equity=735mln/594mln=1.23(2023Q2)

Even after subtracting $414ml-worth of convertible bonds that were prepaid early this month, Marathon’s latest debt-to-equity ratio is 0.54

Financing: Total debt of 783mln was recorded at the end of 2022, most of which was an additional 747mln of convertible bonds issued in 2021, and 414mln was repaid in September 2023.

Source: Capital IQ

Cash flow from Marathon’s 2023Q2 financing activities was $410,655,000, primarily from $361,486,000 from the Company’s regular offering of common shares pursuant to the Company’s market price trading plan and $49,250,000 from borrowings issued under long-term loan agreements.

The maximum amount that Marathon can borrow for the year ending December 31, 2022 is $70,000,000. Total borrowings and repayments under the Revolving Credit Agreement were $120,000,000 during the year ended December 31, 2022, while there were no outstanding borrowings under the Revolving Credit Agreement as of December 31, 2022.

Cash flow from financing activities was $1,037,333,000, primarily from proceeds from the issuance of convertible bonds of $728,406,000 and the issuance of common shares of $312,196,000. For the year ended December 31, 2021, total borrowings and repayments were $77,500,000 under the Company’s 2021 revolving credit agreement, and as at December 31, 2021, there were no outstanding borrowings under the revolving credit agreement. Top of Form

Interest expense: An increase of $13,410,000 in interest expense on convertible bonds issued in November 2021, including $6,633,000 of higher interest associated therewith, and $3,664,000 amortization of debt issuance expenses and other interest expense primarily related to the Company’s term loans and revolving credit (“RLOC”) facilities. With current cash and cash equivalents, there is no pressure on Marathon to repay interest expense.

Marathon’s capital structure for fiscal year 2018–2022

Source: Capital IQ

During the 2018–2022 fiscal year, Marathon’s capital expenditures experienced significant changes from $5mln, $5,000, $83mln, $708mln to $525mln. Especially from 2021, capital expenditures increased significantly, which corresponded to the large financing that the company made that year. Moderate capital expenditure can improve a company’s productivity, drive innovation, and enhance market competitiveness. However, during market downturns, increases in a company’s fixed expenses, especially when accompanied by a significant decrease in revenue, often lead to significant pressure on cash flow.

Marathon’s capital expenditures for fiscal years 2018–2022

Source: Capital IQ

During the 2018–2022 fiscal year, Marathon’s capital expenditures experienced significant changes from $5mln, $5,000, $83mln, $708mln to $525mln. Especially from 2021, capital expenditures increased significantly, which corresponded to the large financing that the company made that year. Moderate capital expenditure can improve a company’s productivity, drive innovation, and enhance market competitiveness. However, during market downturns, increases in a company’s fixed expenses, especially when accompanied by a significant decrease in revenue, often lead to significant pressure on cash flow.

Marathon’s capital expenditures for fiscal years 2018–2022

Source: Capital IQ

Competitors (see valuation section for details, mainly looking at debt-to-equity ratio and CAPEX)

Riot’s debt-to-equity ratio = 22mln/1240mln=0.017 (2023Q2), well below Marathon’s 1.23 (Marathon’s debt-to-equity ratio that is not reflected in the latest earnings report is 0.54)

In fiscal years 2018–2022, Riot’s Capex was 20mln, 6.4mln, 41mln, 421mln, and 343mln, respectively. The Riot 23Q2 has a capex of 56mln

Hut 8 debt-to-equity ratio = 35mln/259mln=0.135 (FY2022), which is also well below Marathon’s 1.23 (Marathon’s debt-to-equity ratio is 0.54 when calculating debt not repaid in the latest financial report)

Canaan Technology Capex FY2018–2022

BTBT Capex for fiscal year 2018–2022

It can be seen that the level of debt-to-equity ratio has a decisive impact on the viability of a business in the case of a poor income environment, and a high historical Capex usually means that the debt-to-equity ratio will also be higher if debt repayment is not actively pursued. If Capex’s expenses have not contributed to the positive cash flow of B/S, it is regarded as a negative signal in such an external environment. Core Scientific, as the mining company with the highest debt-to-equity ratio, has declared bankruptcy at the end of 2022 and is currently undergoing bankruptcy restructuring.

IV. Valuation

Comps analysis

Source:Capital IQ, LD Capital

Source:Capital IQ, LD Capital

Combined with the financial liabilities of each company, the current debt-to-equity ratio is the best performance of Canaan Technology, Ebang International, Riot, with debt-to-equity ratios of 0.0056, 0.018 and 0.018, respectively; Marathon and Argo’s debts are greater than equity, and the debt-to-equity ratios are 1.2 and 5.5, respectively.

From the perspective of P/B, the most undervalued by the market are SOS limited (0.08), Ebang International (0.14), Canaan Technology (0.73), Iris energy (0.68), Bitdeer (0.98), HUT8 (1.22); However, greater than 0.5 of them can be considered as operationally sound and there is no threat of bankruptcy.

A PB below 1 indicates that the market has negative outlook expectations for the company (e.g., bankruptcy, greatly discounted equity value), investors may have a negative view of the company’s future performance, believe that the company’s net assets (i.e. book value) may be damaged in the future, and therefore buy the company’s shares at a price below book value, but it also means that if the company’s performance exceeds expectations, the rebound will be much stronger than similar targets.

Looking at the mining targets alone, combined with the debt-to-equity ratio and P/B value, the debt-to-equity ratio is Mara(1.2)> Hut 8(0.135)>Riot(0.018)>BTBT(0); P/B values BTBT(2.24)>Mara(2.21)>Riot(1.33)>Hut 8(1.22); The best performer was Hut 8, with healthy debt levels and the lowest P/B values. This is followed by Riot.

Marathon P/B longitudinal comparison

Source:Capital IQ

Looking at Marathon’s historical P/B data, 2.21 is still overvalued and has a lot of room for decline (but it has been halved from 5.15 at the end of July)

Hut 8 P/B longitudinal comparison

Riot PB 1.5

BTBT P/B 2.24

ARGO P/B 10.95 is overestimated

Valuation advice

Based on the higher P/B, unprofitable computing power growth, high debt equity, the investment recommendation for Marathon is to sell strongly within 12 months, during which BTC clearly rebounds to go long Mara to obtain greater leverage.

In the case of MARA’s poor debt-to-capital ratio (i.e., when the probability of bankruptcy increases), the upside correlation with BTC may decrease. If Mara’s recent debt treatment allows her balance sheet to survive healthily into the BTC bull market, based on the current broader market situation (continue to decline), Marathon’s debt to equity situation (too high debt), valuation situation (P/B still has a large downside, MC/hashrate is higher than peers), the investment recommendation is to sell strongly within 12 months, with PB as 1 as the bearish target, and the target stock price is around $3. At the current price of $8, that’s an overvaluation of 166%. However, based on its highest price elasticity, it can do short-term bands when rebounding the market, and can obtain better returns than buying BTC.

Five. Risk

The Altman Z-Score is used to assess a company’s financial health and bankruptcy risk, primarily to assess a company’s likelihood of bankruptcy within the next two years. The Z-score takes into account various financial ratios and provides a single numerical score divided into three distinct categories, each reflecting a different degree of bankruptcy risk.

Based on Marathon’s Altman Z-score, -0.47 has fallen to the “likely bankruptcy zone” (Z-score < 1.8 — likely bankruptcy; 1.81 < Z-score < 3 — unjudged zone; Z-score > 3 — healthy). The company’s Z-score for the past four years has been below 3 many times and recently dropped to -0.47.

Six. Summary

Mining stocks have the greatest price elasticity among crypto-related listed stocks, which means that their prices will continue to move significantly lower in the following bear market, but the phased rally will also be more pronounced in these targets.

The low price of coins in the bear market leads to the impairment of digital assets on the balance sheet and reduces revenue, and the cost expenditure cannot be reduced, which is a common situation faced by miners in the bear market. The aggressive expansion plan in 2021 led to a significant increase in the liabilities of mining companies Capex In the current revenue situation, many mining companies have been unable to make ends meet and have to sell BTC to cover operating expenses, focusing on the financial situation of mining companies such as Marathon has come to the conclusion that the market prices the negative earnings status quo and invests in lower PB, but Marathon’s financial situation is worse than Riot, and the P/B is still relatively high and there is room to continue to decline.

It is undeniable that the growth of hashrate has indeed brought a significant improvement in mining efficiency to Marathon, and if the financial situation is maintained, Marathon and others will get the fruits of the mining layout when they come to the bull market, superimposed on the reversal of the dilemma in which the stock price fell the most during the bear market than similar ones, and achieve a double click. However, based on its Altman-z score in the possible bankruptcy range, although the debt-to-equity swap reduces the leverage ratio to alleviate the debt crisis to a certain extent, the capex is too high, and the mining machine previously laid out is significantly unprofitable, and the general direction of the bear market needs to short Mara, but it can win a phased rebound.

The question of whether Mara is the strongest target for shorts, Argo seems to be more overvalued than Mara. But Mara is indeed the strongest target for shorting compared to Riot and Hut8, and Mara is less risky than BTBT, but the P/B value is more valued.

2024 will be a more difficult year for mining companies, with prices maintained and production halved leading to deeper losses (low currency prices leading to balance sheet impairment of currency prices reducing income and cost expenses cannot be reduced), which is a common situation faced by miners in bear markets. Generally speaking, miner clearance is an important signal at the beginning of the bull.