#WhenisBestTimetoEntertheMarket

#WhenIsBestTimeToEnterTheMarket? 🚨🔥💎

Crypto fam, the million-dollar question right now: "Is THIS the dip to buy? Should I wait for lower? Or just sit in stables/fiat?"

Market's bleeding—Extreme Fear everywhere, liquidations flying, FUD at max—but history shows these moments often become legendary entry points for patient winners.

Today: Full deep-dive masterclass with fresh data (Feb 18, 2026), technicals, macro, on-chain, psychology, and clear action plan. No hype, just real talk to help you decide smart. Let's break it down! 🧵

1️⃣ What "Best Time to Enter" Really Means

It's NOT about nailing the exact bottom (almost nobody does that consistently).

It's about spotting when risk-reward is heavily in your favor: low downside probability, high upside potential over months/years, and strong conviction in fundamentals.

Right now drivers:

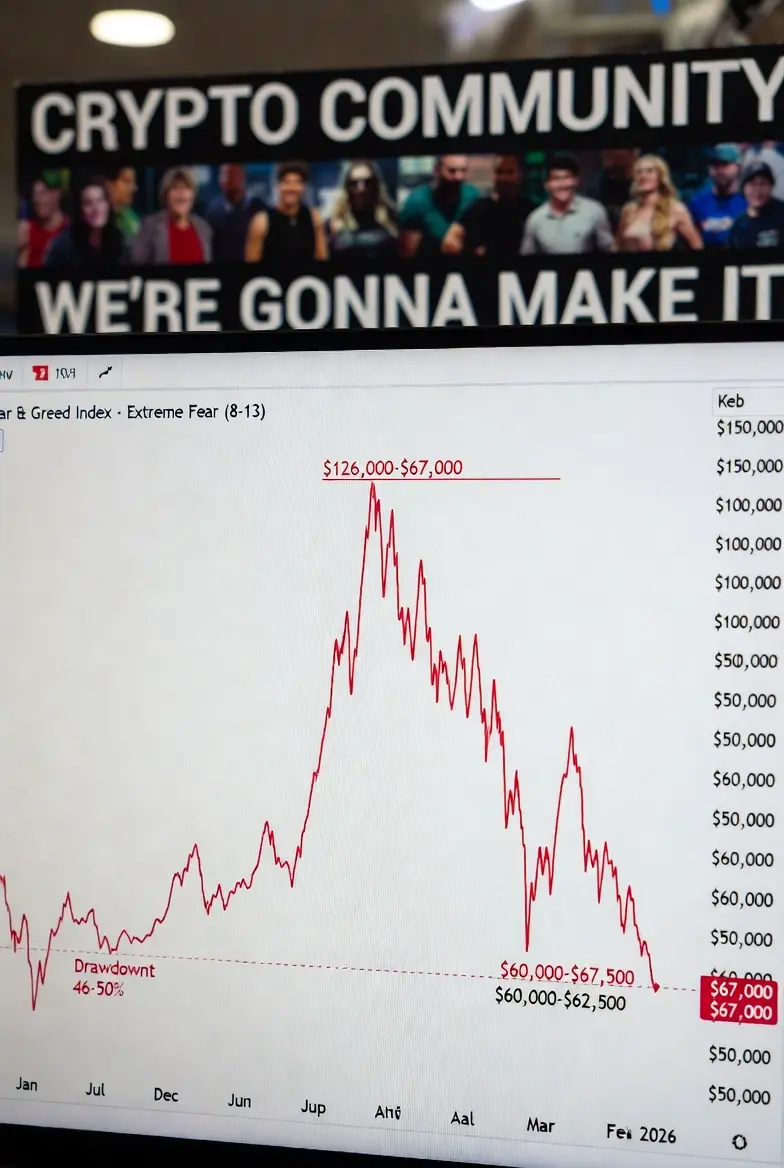

Price — BTC ~$67,000–$67,500 (down ~2% today, range-bound after early-Feb low ~$60K–$66K)

Sentiment — Fear & Greed Index Extreme Fear 8–13 (near historic lows like Feb 6 at ~5)

Cycle — Post-2024 halving bull run peaked ~$126,000 (Oct 2025), now healthy ~46–50% correction

Macro — USD strength, rate uncertainty, equities correlation dragging risk assets

On-chain — Long-term holders holding (some strain), but no full capitulation yet

2️⃣ Live Market Snapshot (Feb 18, 2026 – Raw & Real)

Bitcoin Price: ~$67,000–$67,500 (volatile session, today's low ~$66,800–$67,000)

Recent ATH: ~$126,000+ (Oct 2025)

Drawdown: 46–50% from peak (early Feb touched ~$60K zone)

Total Crypto Market Cap: ~$1.35T–$1.4T

Fear & Greed: Extreme Fear (8–13 range, capitulation territory)

24h Volume: High from leverage flush-outs & panic selling

This is classic "blood in the streets" — panic max, but often the prelude to big relief bounces or cycle continuation.

3️⃣ Historical Lessons – Corrections Are Normal (and Healthy)

Bitcoin's brutal but rewarding:

2017 peak → ~84% crash (2018 bottom)

2021 peak → ~77% crash (2022 ~$15K bottom)

Current ~50% drawdown? Mid-cycle shakeout, NOT full bear wipeout. Extreme Fear historically = strong buy zones for long-term holders (see 2022 end, late 2018).

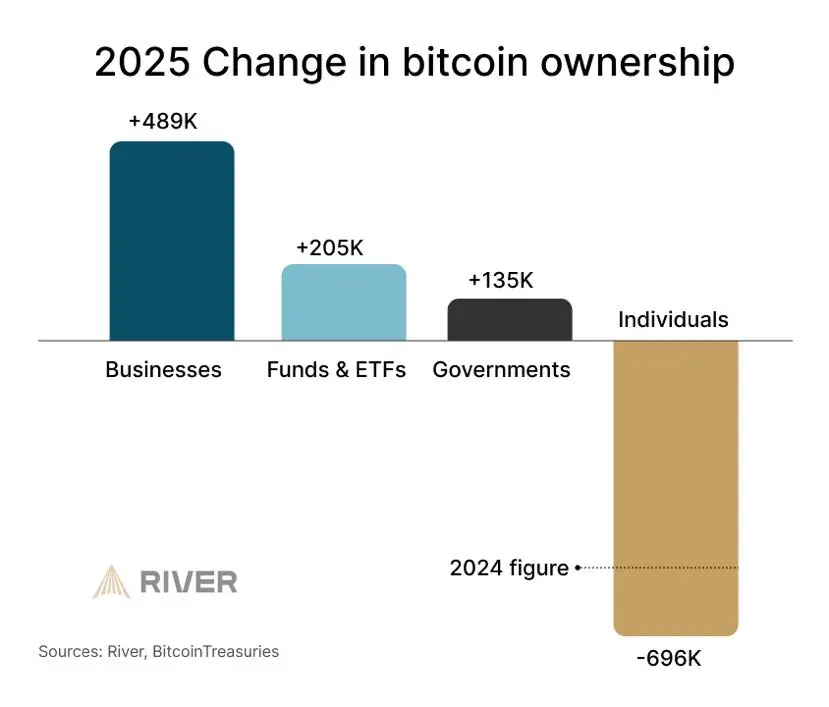

Halving cycle + institutional era still playing out—supply shock intact, adoption growing.

4️⃣ Macro & Big-Picture Reality Check

Strong USD + potential higher yields = pressure on BTC & risk assets

Fed/inflation data crucial (recent cooler prints helped bounces)

Equities/tech correlation high (~90%+) — if Nasdaq rebounds, crypto follows

Institutional flows: ETFs net buyers long-term, corporates (e.g., MicroStrategy-style) accumulating, but short-term deleveraging hitting hard

Fundamentals solid despite short-term pain.

5️⃣ Technicals – Where to Look for Entries

Key Support Zones (Buy-the-Dip Signals):

$65K–$67K (current make-or-break hold area)

$60K–$62K (early Feb low – strong psychological + historical support)

Oversold indicators flashing: RSI low, possible bullish divergence, volume spikes on green candles

Green flags to buy: Support holds + reversal patterns + Fear & Greed stays <15–20

Ultimate low-risk strategy: Dollar-Cost Averaging (DCA) — buy fixed amounts on every 5–10% dip. Removes emotion, lowers average cost beautifully.

6️⃣ When to WAIT (Red Flags – Protect Your Capital) ⚠️

Break below $65K with heavy volume → deeper test of $60K or $55K possible

Macro worsens (recession signals, equities tank hard)

No higher-low formation — still in "falling knife" mode

Short-term traders: Demand confirmation (higher low + strong volume + bullish candle) before jumping in.

Rule #1: Never catch a falling knife without proof it's turning!

7️⃣ Pro Risk Management – Survive to Thrive

Only invest what you can truly afford to lose (volatility is savage right now)

No all-ins — keep 30–50% in cash/USDT for lower entries

Diversify smart: 50–70% BTC/ETH, rest in high-conviction alts

Stops: Use them, but not too tight (wicks hunt stops)

Tools to watch: Glassnode on-chain metrics, macro calendars, whale alerts

Mindset shift: In Extreme Fear, become greedy. In Extreme Greed, become fearful.

8️⃣ Realistic Scenarios – What's Next?

Bullish Relief Bounce (40–50% probability): Support holds → quick pump to $70K–$75K+ (trigger: ETF inflows return, macro cools, equities stabilize)

Base Case – Sideways Grind (30–40% probability): $65K–$72K range for weeks/months, slow accumulation phase

Bearish Deeper Correction (10–20% probability): Macro shock → retest $55K–$60K (possible if recession fears spike)

Black Swan (Low prob): Global panic → sub-$50K (prepare, but unlikely base case)

9️⃣ My Clear Verdict – Time to Act?

Extreme Fear + ~50% drawdown from ATH + strong cycle fundamentals = classic opportunity window for long-term believers targeting 2026–2028 highs ($100K–$150K+ realistic in next leg).

If you're a HODLer: Start DCA now — these levels will look cheap in hindsight.

If short-term trader: Wait for clear reversal confirmation (don't force it).

Ultimate truth: The "best time" isn't one magic day—it's discipline + data + patience stacked together. This correction is painful, but it's part of the bull market journey. The next leg up is coming—stronger than before. Diamond hands win.

Crypto community, tag friends panicking right now!

Your move: Buying the dip, waiting for lower, holding strong, or something else? Drop your plan below 👇

#WhenIsBestTimeToEnterTheMarket? 🚨🔥💎

Crypto fam, the million-dollar question right now: "Is THIS the dip to buy? Should I wait for lower? Or just sit in stables/fiat?"

Market's bleeding—Extreme Fear everywhere, liquidations flying, FUD at max—but history shows these moments often become legendary entry points for patient winners.

Today: Full deep-dive masterclass with fresh data (Feb 18, 2026), technicals, macro, on-chain, psychology, and clear action plan. No hype, just real talk to help you decide smart. Let's break it down! 🧵

1️⃣ What "Best Time to Enter" Really Means

It's NOT about nailing the exact bottom (almost nobody does that consistently).

It's about spotting when risk-reward is heavily in your favor: low downside probability, high upside potential over months/years, and strong conviction in fundamentals.

Right now drivers:

Price — BTC ~$67,000–$67,500 (down ~2% today, range-bound after early-Feb low ~$60K–$66K)

Sentiment — Fear & Greed Index Extreme Fear 8–13 (near historic lows like Feb 6 at ~5)

Cycle — Post-2024 halving bull run peaked ~$126,000 (Oct 2025), now healthy ~46–50% correction

Macro — USD strength, rate uncertainty, equities correlation dragging risk assets

On-chain — Long-term holders holding (some strain), but no full capitulation yet

2️⃣ Live Market Snapshot (Feb 18, 2026 – Raw & Real)

Bitcoin Price: ~$67,000–$67,500 (volatile session, today's low ~$66,800–$67,000)

Recent ATH: ~$126,000+ (Oct 2025)

Drawdown: 46–50% from peak (early Feb touched ~$60K zone)

Total Crypto Market Cap: ~$1.35T–$1.4T

Fear & Greed: Extreme Fear (8–13 range, capitulation territory)

24h Volume: High from leverage flush-outs & panic selling

This is classic "blood in the streets" — panic max, but often the prelude to big relief bounces or cycle continuation.

3️⃣ Historical Lessons – Corrections Are Normal (and Healthy)

Bitcoin's brutal but rewarding:

2017 peak → ~84% crash (2018 bottom)

2021 peak → ~77% crash (2022 ~$15K bottom)

Current ~50% drawdown? Mid-cycle shakeout, NOT full bear wipeout. Extreme Fear historically = strong buy zones for long-term holders (see 2022 end, late 2018).

Halving cycle + institutional era still playing out—supply shock intact, adoption growing.

4️⃣ Macro & Big-Picture Reality Check

Strong USD + potential higher yields = pressure on BTC & risk assets

Fed/inflation data crucial (recent cooler prints helped bounces)

Equities/tech correlation high (~90%+) — if Nasdaq rebounds, crypto follows

Institutional flows: ETFs net buyers long-term, corporates (e.g., MicroStrategy-style) accumulating, but short-term deleveraging hitting hard

Fundamentals solid despite short-term pain.

5️⃣ Technicals – Where to Look for Entries

Key Support Zones (Buy-the-Dip Signals):

$65K–$67K (current make-or-break hold area)

$60K–$62K (early Feb low – strong psychological + historical support)

Oversold indicators flashing: RSI low, possible bullish divergence, volume spikes on green candles

Green flags to buy: Support holds + reversal patterns + Fear & Greed stays <15–20

Ultimate low-risk strategy: Dollar-Cost Averaging (DCA) — buy fixed amounts on every 5–10% dip. Removes emotion, lowers average cost beautifully.

6️⃣ When to WAIT (Red Flags – Protect Your Capital) ⚠️

Break below $65K with heavy volume → deeper test of $60K or $55K possible

Macro worsens (recession signals, equities tank hard)

No higher-low formation — still in "falling knife" mode

Short-term traders: Demand confirmation (higher low + strong volume + bullish candle) before jumping in.

Rule #1: Never catch a falling knife without proof it's turning!

7️⃣ Pro Risk Management – Survive to Thrive

Only invest what you can truly afford to lose (volatility is savage right now)

No all-ins — keep 30–50% in cash/USDT for lower entries

Diversify smart: 50–70% BTC/ETH, rest in high-conviction alts

Stops: Use them, but not too tight (wicks hunt stops)

Tools to watch: Glassnode on-chain metrics, macro calendars, whale alerts

Mindset shift: In Extreme Fear, become greedy. In Extreme Greed, become fearful.

8️⃣ Realistic Scenarios – What's Next?

Bullish Relief Bounce (40–50% probability): Support holds → quick pump to $70K–$75K+ (trigger: ETF inflows return, macro cools, equities stabilize)

Base Case – Sideways Grind (30–40% probability): $65K–$72K range for weeks/months, slow accumulation phase

Bearish Deeper Correction (10–20% probability): Macro shock → retest $55K–$60K (possible if recession fears spike)

Black Swan (Low prob): Global panic → sub-$50K (prepare, but unlikely base case)

9️⃣ My Clear Verdict – Time to Act?

Extreme Fear + ~50% drawdown from ATH + strong cycle fundamentals = classic opportunity window for long-term believers targeting 2026–2028 highs ($100K–$150K+ realistic in next leg).

If you're a HODLer: Start DCA now — these levels will look cheap in hindsight.

If short-term trader: Wait for clear reversal confirmation (don't force it).

Ultimate truth: The "best time" isn't one magic day—it's discipline + data + patience stacked together. This correction is painful, but it's part of the bull market journey. The next leg up is coming—stronger than before. Diamond hands win.

Crypto community, tag friends panicking right now!

Your move: Buying the dip, waiting for lower, holding strong, or something else? Drop your plan below 👇