# PreciousMetalsPullBack

7.67K

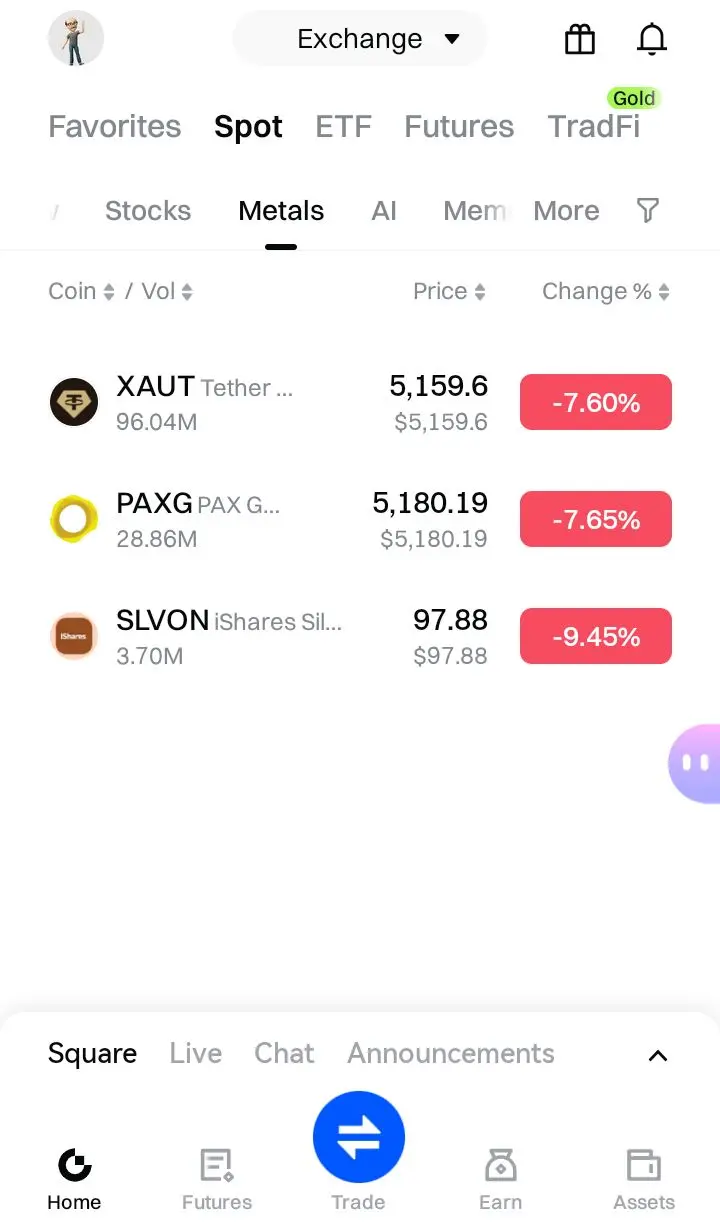

Risk assets fell overnight. Gold slid $300 to $5,155/oz, and silver dropped up to 8% to $108.23/oz. Are you buying the dip or cutting exposure? Share your Gate TradFi metals strategy!

Korean_Girl

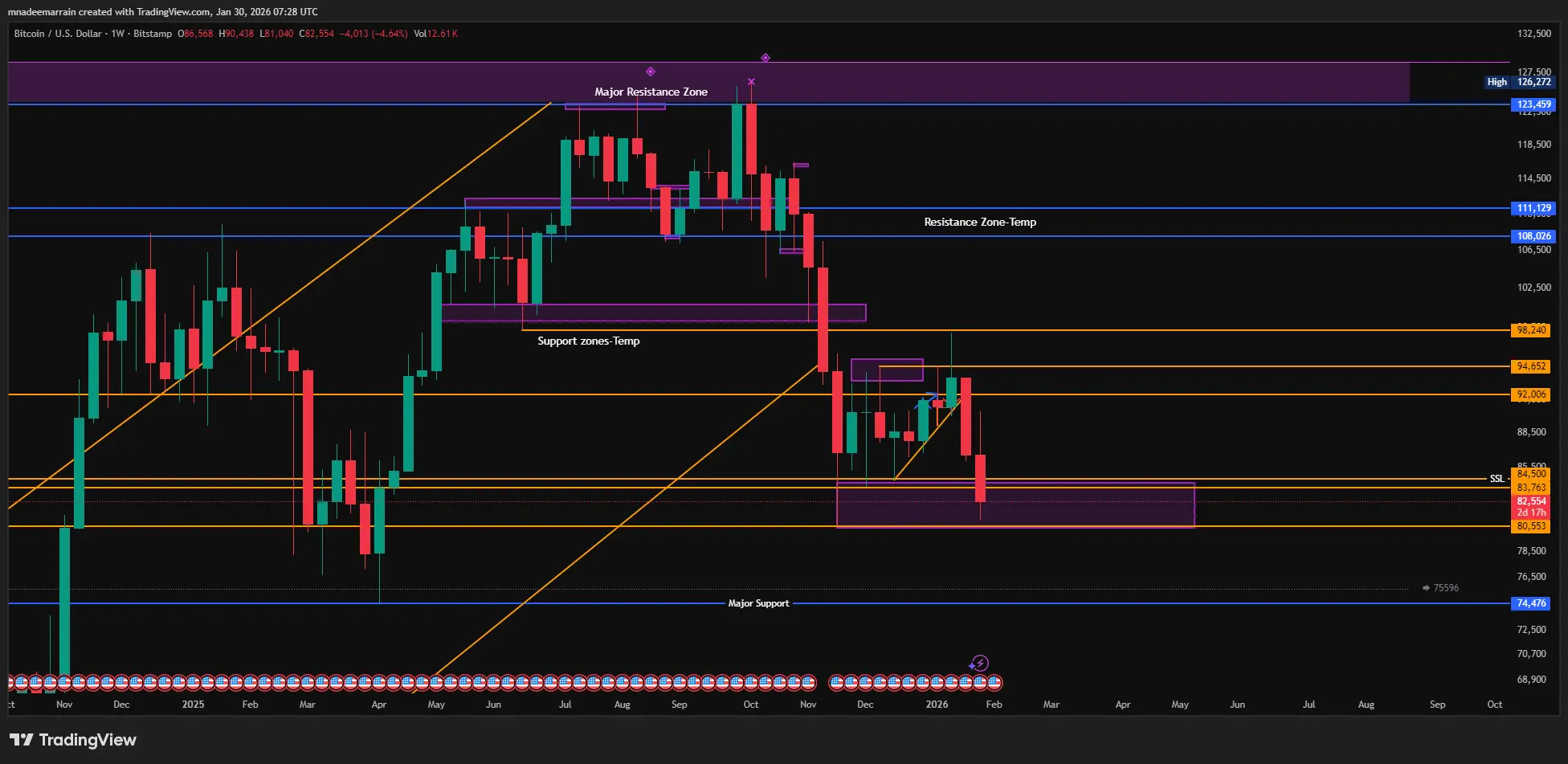

#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-6.13%

- Reward

- 6

- 3

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-6.13%

- Reward

- 8

- 14

- Repost

- Share

Discovery :

:

DYOR 🤓View More

#PreciousMetalsPullBack #贵金属行情下跌 #贵金属巨震 Markets reminded everyone of a brutal truth today: there is no such thing as a one-way trade.

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

- Reward

- 5

- 2

- Repost

- Share

ybaser :

:

very good information to readView More

#PreciousMetalsPullBack Bitcoin dropped 6.4% to $83,383 on January 29, 2026, due to five consecutive days of ETF outflows totaling $1.137 billion, capital rotation into surging precious metals (gold $5,600, silver $120), US rare earth tariff announcements spiking volatility above 40, and bearish options market positioning with 97% of calls out-of-the-money.

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

BTC-6.13%

- Reward

- like

- Comment

- Repost

- Share

$XAUT is trading around $5,133 after getting rejected hard near $5,637. Sellers are clearly in control and momentum is weak. This zone is critical — either buyers defend here for a bounce, or we see another sharp drop.

$XAUT #PreciousMetalsPullBack #CryptoMarketPullback #MiddleEastTensionsEscalate #TokenizedSilverTrend

$XAUT #PreciousMetalsPullBack #CryptoMarketPullback #MiddleEastTensionsEscalate #TokenizedSilverTrend

XAUT-8.2%

- Reward

- like

- Comment

- Repost

- Share

#PreciousMetalsPullBack The January 29-30, 2026 Market Rout: A Sharp Correction Amid Geopolitical Heat and Leverage Unwind

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

- Reward

- 2

- Comment

- Repost

- Share

#CryptoMarketPullback

Markets are cooling off after a strong run — and that’s completely normal. 📉

A crypto pullback doesn’t mean the trend is broken; it often means the market is resetting, shaking out weak hands, and building a healthier base.

For patient investors, pullbacks are moments to reassess, not panic. Smart money watches structure, support levels, and on-chain signals while emotions run high.

Corrections create opportunities. Discipline creates results. 🚀

#PreciousMetalsPullBack

#CryptoMarketPullback

Markets are cooling off after a strong run — and that’s completely normal. 📉

A crypto pullback doesn’t mean the trend is broken; it often means the market is resetting, shaking out weak hands, and building a healthier base.

For patient investors, pullbacks are moments to reassess, not panic. Smart money watches structure, support levels, and on-chain signals while emotions run high.

Corrections create opportunities. Discipline creates results. 🚀

#PreciousMetalsPullBack

#CryptoMarketPullback

- Reward

- 3

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#PreciousMetalsPullBack

Gate Square Daily | Jan 30

1️⃣ Market Moves: Global risk assets sold off, with U.S. equities, precious metals, and crypto all under pressure

2️⃣ Trade Update: Trump signals a potential 50% tariff on Canadian aircraft

3️⃣ Regulatory Voice: SEC Chair says now is the right time to allow crypto in 401(k) retirement plans

4️⃣ BTC Watch: Bitcoin hits its lowest level since last November; analysts warn of a pullback to $70,000

5️⃣ Central Bank Action: El Salvador’s central bank buys $50M in gold

Gate Square Daily | Jan 30

1️⃣ Market Moves: Global risk assets sold off, with U.S. equities, precious metals, and crypto all under pressure

2️⃣ Trade Update: Trump signals a potential 50% tariff on Canadian aircraft

3️⃣ Regulatory Voice: SEC Chair says now is the right time to allow crypto in 401(k) retirement plans

4️⃣ BTC Watch: Bitcoin hits its lowest level since last November; analysts warn of a pullback to $70,000

5️⃣ Central Bank Action: El Salvador’s central bank buys $50M in gold

BTC-6.13%

- Reward

- 4

- 4

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

Bitcoin is trading around $82,000. As I’ve been saying, the weekly 99 EMA is the strongest support. We’re seeing a clear breakdown attempt, but the weekly candle still has two days left to close. Confirmation only comes with a weekly close below this level.I’m still holding my short position. As I’ve said before, this is a short-side market for me. I added more shorts around the $97,000 area, as I mentioned multiple times. Since then, BTC is down nearly $16,000. I’m staying patient here. $72,000 is loading.As you know, I remain strongly bullish on gold and silver, while staying bearish on cry

- Reward

- 6

- 9

- Repost

- Share

xxx40xxx :

:

Thank you for the information🙏🙏🙏View More

#PreciousMetalsPullBack XAG / Silver

Sell-the-rally bias as price fails to hold post-bounce, confirms lower high below 116–118 supply, and trades firmly under declining EMAs, signaling continuation of short-term distribution.

Bias: SHORT

Entry: 111.0 – 113.0

Stop-Loss: 116.2

TP1: 107.5

TP2: 105.0

TP3: 102.8

As long as price remains below 116.2, downside follow-through is favored and rebounds lack conviction. Acceptance above that level invalidates the setup and shifts bias neutral.

Sell-the-rally bias as price fails to hold post-bounce, confirms lower high below 116–118 supply, and trades firmly under declining EMAs, signaling continuation of short-term distribution.

Bias: SHORT

Entry: 111.0 – 113.0

Stop-Loss: 116.2

TP1: 107.5

TP2: 105.0

TP3: 102.8

As long as price remains below 116.2, downside follow-through is favored and rebounds lack conviction. Acceptance above that level invalidates the setup and shifts bias neutral.

- Reward

- 1

- 1

- Repost

- Share

mrbui07 :

:

Happy New Year! 🤑Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

7.67K Popularity

24.02K Popularity

351.81K Popularity

31.7K Popularity

47.85K Popularity

157 Popularity

18.99K Popularity

7.76K Popularity

82.26K Popularity

29.53K Popularity

12.53K Popularity

26.81K Popularity

8.46K Popularity

15.82K Popularity

187.87K Popularity

News

View MoreGold prices plummet 8%, silver crashes 15%: Wash's news triggers a bullish sentiment in precious metals

2 m

Data: If BTC breaks through $86,618, the total liquidation strength of short positions on mainstream CEXs will reach $2.394 billion.

4 m

Data: If ETH breaks through $2,863, the total liquidation strength of short positions on mainstream CEXs will reach $1.399 billion.

4 m

Tech stocks plunge dragging down Bitcoin: Microsoft drops 11%, safe-haven sentiment sweeps through the crypto market

5 m

Gate ETF will list SENT3L/3S and PIPPIN3L/3S, participate in the new coin challenge and share 30,000 USDT

6 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889