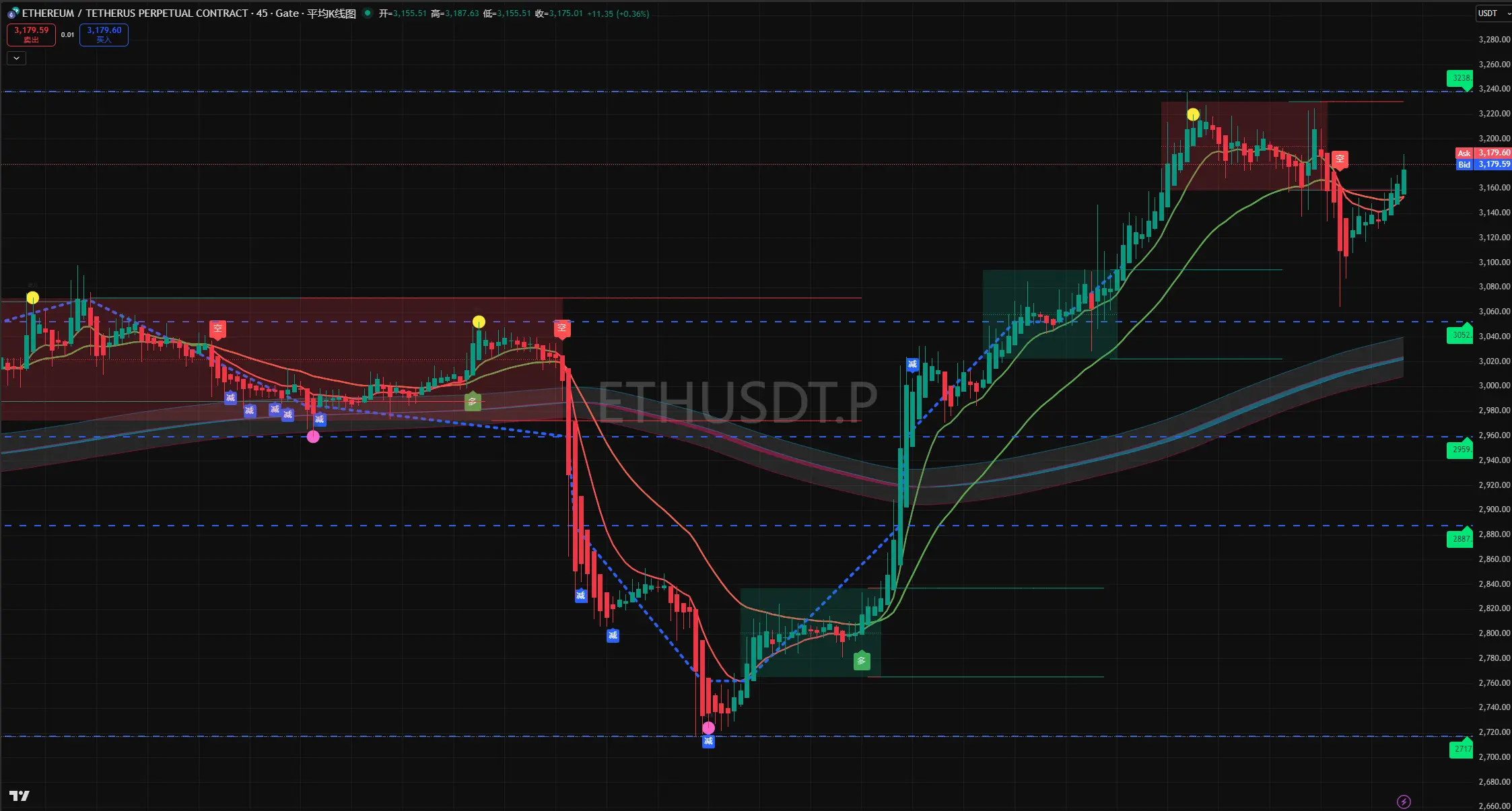

On December 7, 2025, ETH showed a weak consolidation trend. Although the Fusaka upgrade provided some bullish support, short-term bearish signals have emerged. Bulls and bears are fiercely contesting the $3,000 level. The core technical analysis from Wan Laoda is as follows:

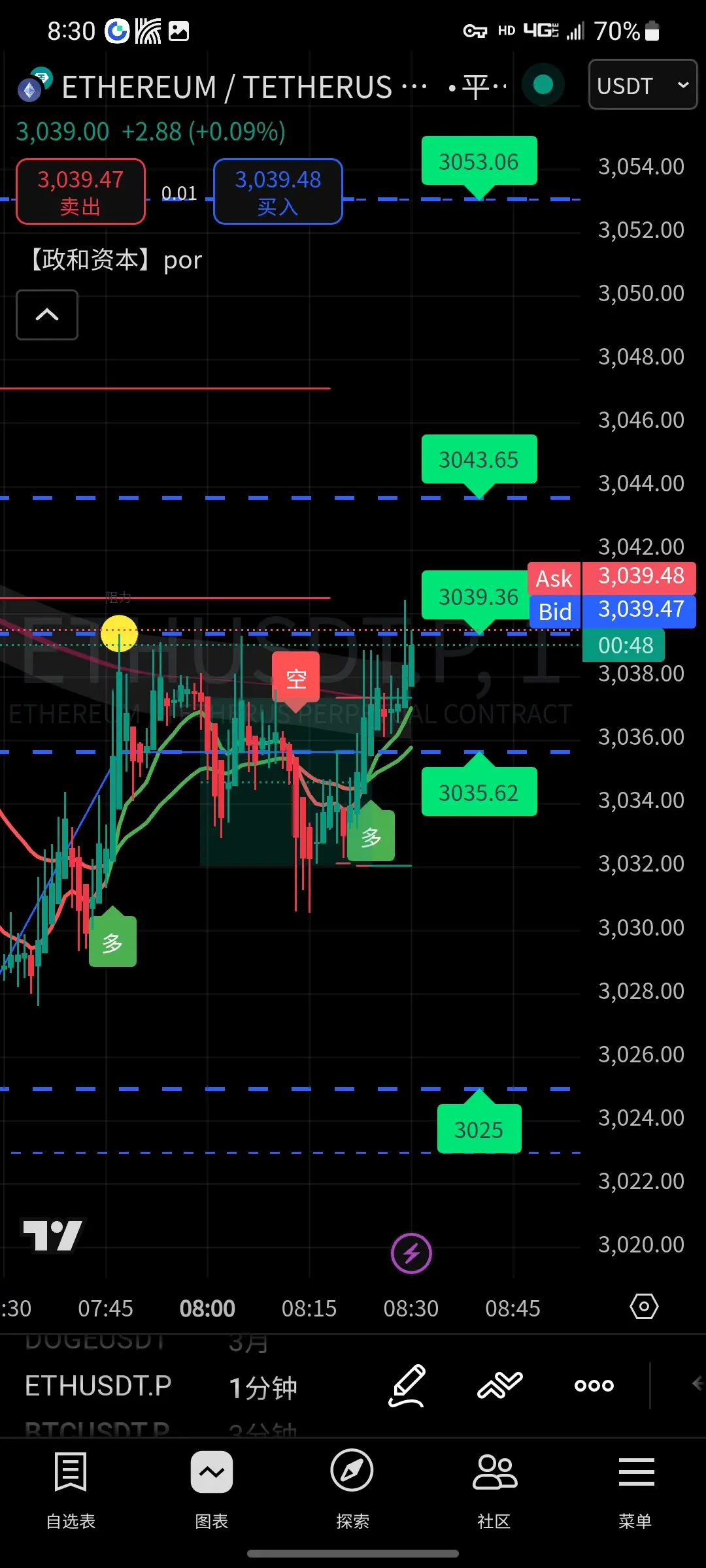

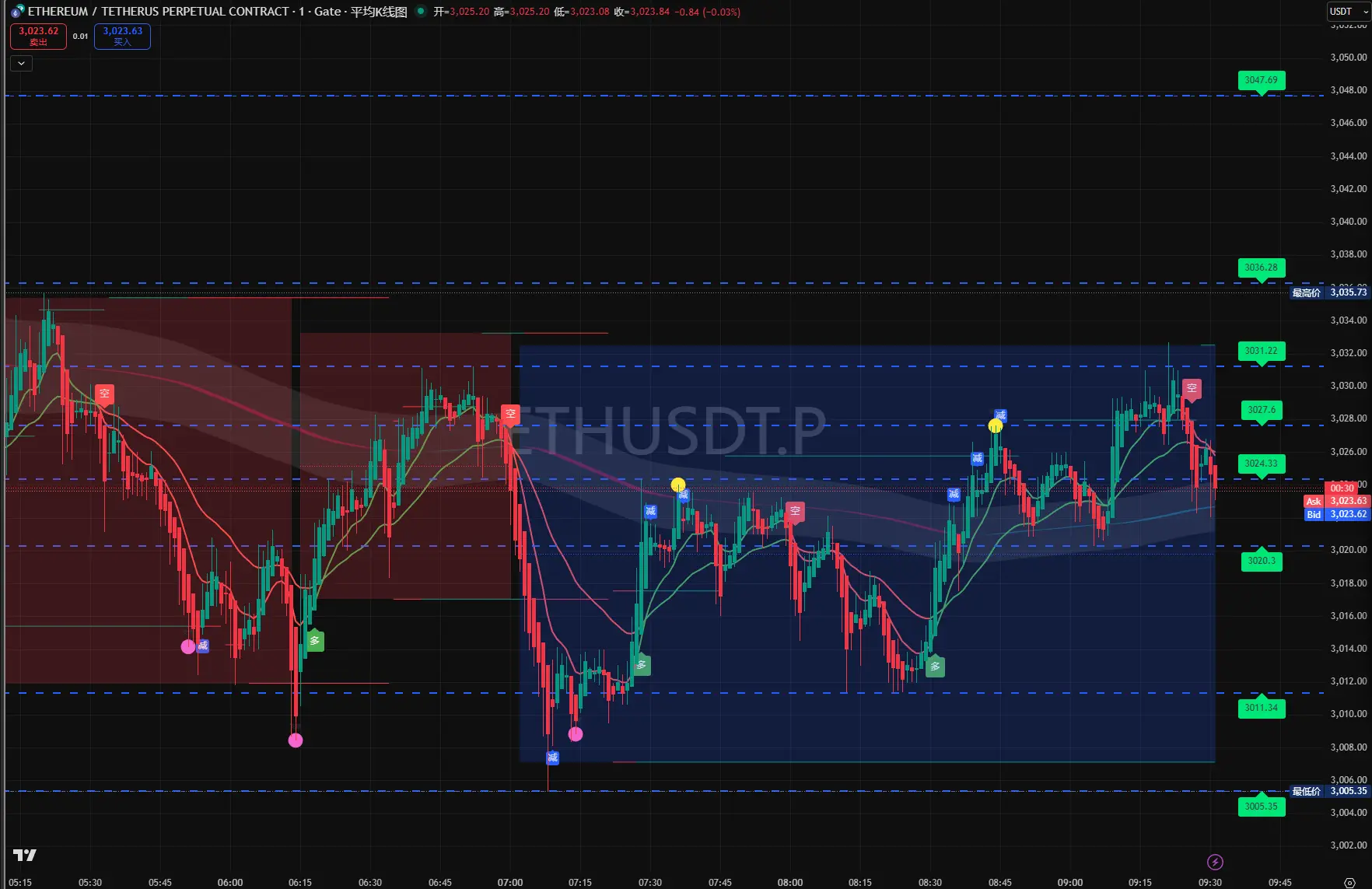

1. Price and Key Levels: At 7:55 AM, the price was approximately $3,037.48, with a 24-hour high around $3,070 and a low around $3,010. Short-term resistance is focused at $3,070, with stronger resistance in the $3,150 - $3,200 range. On the support side, the $3,025 - $3,050 range forms short-term support, while core suppor

View Original