Post content & earn content mining yield

placeholder

十一

【$KAIA Signal】Long + Volume Breakout

$KAIA Strong breakout after a 31% volume increase, price action shows active absorption by major players, with signs of short sellers being squeezed.

🎯 Direction: Long

🎯 Entry: 0.0715 - 0.0730

🛑 Stop Loss: 0.0680 ( Rigid Stop Loss )

🚀 Target 1: 0.0780

🚀 Target 2: 0.0830

$KAIA The hourly chart shows a strong bulldozer-style rally, with trading volume surging to $121 million, and open interest rising to $112 million, confirming the entry of major funds rather than just short covering. After the breakout, there was no deep retracement, indicating that

$KAIA Strong breakout after a 31% volume increase, price action shows active absorption by major players, with signs of short sellers being squeezed.

🎯 Direction: Long

🎯 Entry: 0.0715 - 0.0730

🛑 Stop Loss: 0.0680 ( Rigid Stop Loss )

🚀 Target 1: 0.0780

🚀 Target 2: 0.0830

$KAIA The hourly chart shows a strong bulldozer-style rally, with trading volume surging to $121 million, and open interest rising to $112 million, confirming the entry of major funds rather than just short covering. After the breakout, there was no deep retracement, indicating that

KAIA27,99%

- Reward

- like

- Comment

- Repost

- Share

⚠️ ETH Market Quick Read ⚠️

📉 Key support below: 2880–2800

Hold → Potential for oscillation and rebound

Break below → Downtrend may accelerate

📍 After support is lost, watch:

2600 → 2400 → 2220

📈 Rebound conditions:

Stabilization within the 2880–2800 range

Resistance above: 3050–3080

Target after breakout: 3160–3200

Monthly strong resistance: 3450

📌 Conclusion:

Currently in a critical structural decision period,

No pessimism unless support is broken, no hesitation if support is broken.

Operate around key price levels, avoid emotional chasing.

📉 Key support below: 2880–2800

Hold → Potential for oscillation and rebound

Break below → Downtrend may accelerate

📍 After support is lost, watch:

2600 → 2400 → 2220

📈 Rebound conditions:

Stabilization within the 2880–2800 range

Resistance above: 3050–3080

Target after breakout: 3160–3200

Monthly strong resistance: 3450

📌 Conclusion:

Currently in a critical structural decision period,

No pessimism unless support is broken, no hesitation if support is broken.

Operate around key price levels, avoid emotional chasing.

ETH-0,15%

- Reward

- like

- Comment

- Repost

- Share

#GateTradFi1gGoldGiveaway

📢📢📢📢📢📢📢Did you hear? 📢📢📢📢📢 Gate TradFi is giving away gold every 10 minutes.

📢📢📢📢📢📢📢Did you hear? 📢📢📢📢📢 Gate TradFi is giving away gold every 10 minutes.

- Reward

- 4

- 7

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

GOHAN

GOHAN

Created By@MG_X

Subscription Progress

0.00%

MC:

$0

Create My Token

#GoldandSilverHitNewHighs A "metal storm" is sweeping through the markets. As we step into 2026, the two ancient havens of the economic world—gold and silver—are experiencing a remarkable era, fueled by technological transformation and global uncertainties.

Markets are now testing levels once considered dreams. Gold is testing resistances at $4,800 and $4,900 per ounce, standing on the doorstep of the $5,000 mark. In the Turkish market, gram gold has begun its journey toward 7,000 TL. Silver, the real surprise of this rally, has surpassed $95 per ounce, stepping out of the shadow of being "gol

Markets are now testing levels once considered dreams. Gold is testing resistances at $4,800 and $4,900 per ounce, standing on the doorstep of the $5,000 mark. In the Turkish market, gram gold has begun its journey toward 7,000 TL. Silver, the real surprise of this rally, has surpassed $95 per ounce, stepping out of the shadow of being "gol

- Reward

- 3

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs 📈 A New Precious Metals Era: Historic Milestones in Early 2026

Gold and silver have shattered price ceilings once thought unreachable. As of January 2026, silver crossed $100 per ounce for the first time ever, while gold neared the unprecedented $5,000 level, setting fresh all‑time records in global commodity markets. These moves have captivated investors and analysts alike — and they’re still unfolding.

🪙 Silver’s Meteoric Rise: From “Little Brother” to Market Leader

Silver’s rally has been particularly remarkable — a more than 200% surge over the past year — drive

Gold and silver have shattered price ceilings once thought unreachable. As of January 2026, silver crossed $100 per ounce for the first time ever, while gold neared the unprecedented $5,000 level, setting fresh all‑time records in global commodity markets. These moves have captivated investors and analysts alike — and they’re still unfolding.

🪙 Silver’s Meteoric Rise: From “Little Brother” to Market Leader

Silver’s rally has been particularly remarkable — a more than 200% surge over the past year — drive

- Reward

- 1

- 16

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

1-24 Saturday BTC Market Analysis

Yesterday's strategy was perfectly executed during the day. In the evening, the price surged to the target level of around 91195, then faced resistance and pulled back, with a retracement of nearly 2000 points. The overall rhythm closely aligned with expectations, once again confirming the operational logic of the current cycle structure.

In the short term, after continuous upward movement, momentum has significantly weakened. The validity of the upper resistance zone has been further confirmed, and it is expected that it will be difficult to break through eff

Yesterday's strategy was perfectly executed during the day. In the evening, the price surged to the target level of around 91195, then faced resistance and pulled back, with a retracement of nearly 2000 points. The overall rhythm closely aligned with expectations, once again confirming the operational logic of the current cycle structure.

In the short term, after continuous upward movement, momentum has significantly weakened. The validity of the upper resistance zone has been further confirmed, and it is expected that it will be difficult to break through eff

BTC-0,19%

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketWatch

Recent market volatility has intensified, revealing a growing divergence between bullish and bearish participants. This environment is no longer defined by simple trend continuation; instead, it reflects a classic regime transition where price action becomes erratic as capital rotates and markets reassess macro and micro catalysts. Volatility itself is not directional; it is a symptom of uncertainty and repositioning.

My stance remains constructively bullish over the medium to long term while tactically cautious in the short term. This caution is not due to a lack of belief

Recent market volatility has intensified, revealing a growing divergence between bullish and bearish participants. This environment is no longer defined by simple trend continuation; instead, it reflects a classic regime transition where price action becomes erratic as capital rotates and markets reassess macro and micro catalysts. Volatility itself is not directional; it is a symptom of uncertainty and repositioning.

My stance remains constructively bullish over the medium to long term while tactically cautious in the short term. This caution is not due to a lack of belief

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#NextFedChairPredictions As 2026 unfolds, global markets are increasingly focused on a single critical question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This decision goes far beyond politics — it represents the steering wheel of the world’s most influential central bank. Every asset class, from U.S. bonds to emerging markets and cryptocurrencies, is positioned around expectations tied to this outcome.

Recent speculation suggests Kevin Warsh has emerged as a leading contender, with market-implied odds reportedly

Recent speculation suggests Kevin Warsh has emerged as a leading contender, with market-implied odds reportedly

- Reward

- 4

- Comment

- Repost

- Share

#PrivacyCoinsDiverge

This Is a Structural Shift — Not a Temporary Trade

Looking at the crypto market in early 2026, one divergence stands out clearly:

While Bitcoin and Ethereum struggle under regulatory pressure, liquidity tightening, and macro uncertainty, privacy-focused assets are quietly holding their ground — and in several cases, outperforming.

This does not look like a random altcoin rotation.

It looks like a market response to the world outside crypto.

Privacy coins are no longer legacy artifacts from an earlier era.

They are becoming functional tools for a new environment — one defin

This Is a Structural Shift — Not a Temporary Trade

Looking at the crypto market in early 2026, one divergence stands out clearly:

While Bitcoin and Ethereum struggle under regulatory pressure, liquidity tightening, and macro uncertainty, privacy-focused assets are quietly holding their ground — and in several cases, outperforming.

This does not look like a random altcoin rotation.

It looks like a market response to the world outside crypto.

Privacy coins are no longer legacy artifacts from an earlier era.

They are becoming functional tools for a new environment — one defin

- Reward

- like

- Comment

- Repost

- Share

#IranTradeSanctions Iran’s trade sanctions story in early 2026 has escalated from a long-running geopolitical tool into a wide-ranging force reshaping global economics and diplomacy. What began as targeted penalties tied to nuclear concerns and regional behavior has morphed into one of the most complex cross-border legislative and diplomatic challenges in recent decades. The multifaceted sanctions now not only restrict Tehran’s access to capital and technology, but also place pressure on Iran’s entire network of trading partners and global supply chains.

A dramatic recent development came when

A dramatic recent development came when

- Reward

- 3

- Comment

- Repost

- Share

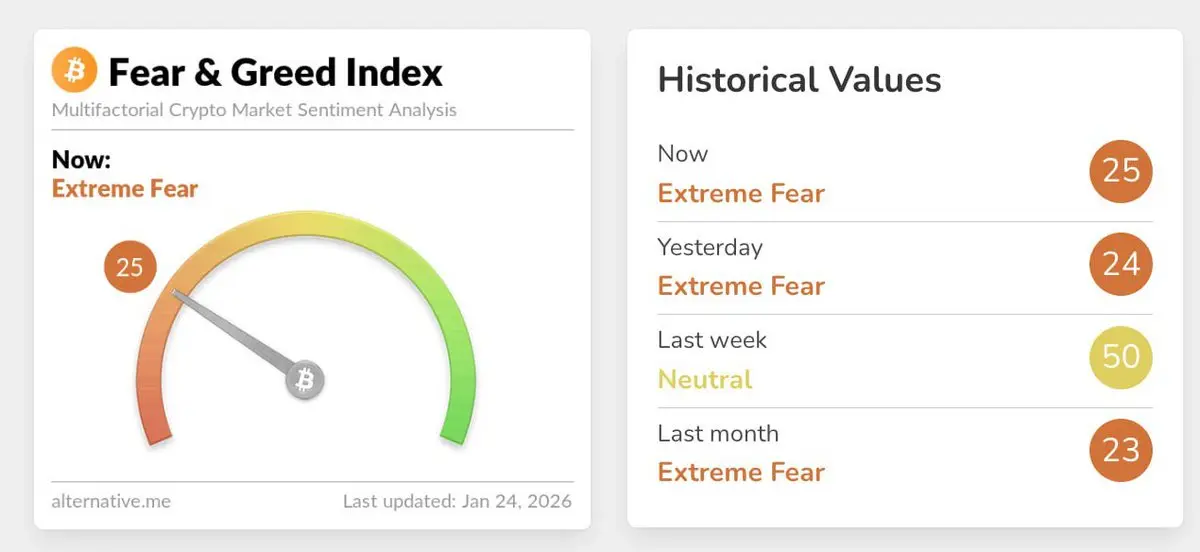

Today’s Cryptocurrency Fear and Greed Index is 25, and the market remains in a "Extreme Fear" state. On January 24, according to Alternative data, the Cryptocurrency Fear and Greed Index rose to 25 (yesterday the index was 24, "Extreme Fear"), indicating that the market is still in a "Extreme Fear" state.

View Original

- Reward

- like

- Comment

- Repost

- Share

hududururururryrur really urururuir really enjoyed even explain exactly everything else was expecting even explain 😂 serious 🤣 everything 😂😂

- Reward

- like

- Comment

- Repost

- Share

CSD

财神到

Created By@002whl

Listing Progress

0.00%

MC:

$3.43K

Create My Token

#IranTradeSanctions 💥 The United States’ threat to impose a 25% tariff on countries trading with Iran has sent ripples across global trade, geopolitics, and financial markets. While enforcement remains uncertain, the perception of risk alone is enough to drive volatility across equities, commodities, and digital assets. Market participants are reacting not just to policy announcements, but to the potential structural implications of disrupted trade flows.

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

- Reward

- 3

- 2

- Repost

- Share

xiaoXiao :

:

2026 Go Go Go 👊View More

$PI Started mining Pi in November 2019. I changed phones several times, and the coins mined were only enough to buy a phone. Starting from March 2025, I began building a position on the exchange to buy Pi, with the highest entry price at $2.7. I kept buying as the price kept falling, and then... nothing more happened...

PI-1,74%

- Reward

- 3

- 3

- Repost

- Share

zhypi678 :

:

Not bad, you even dug up a bunch of slightly green bananas! Others haven't even dug up a single hair.View More

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

🌈 #GateLiveStreamingInspiration - Jan.24

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Moonbirds announced that the BIRB token will undergo TGE on January 28. Is market attention on NFT projects heating up?

🔹 U.S. crypto mining stocks strengthened, with IREN up over 8%, signaling a rebound in sector sentiment?

🔹 Jin10 data: The U.S. dollar index fell below the 98 level, down 0.30% intraday.

🔹 Eric Trump stated that USD1’s market capitalization has surpassed PYUSD. What impact could this have on the cr

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Moonbirds announced that the BIRB token will undergo TGE on January 28. Is market attention on NFT projects heating up?

🔹 U.S. crypto mining stocks strengthened, with IREN up over 8%, signaling a rebound in sector sentiment?

🔹 Jin10 data: The U.S. dollar index fell below the 98 level, down 0.30% intraday.

🔹 Eric Trump stated that USD1’s market capitalization has surpassed PYUSD. What impact could this have on the cr

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More35.42K Popularity

18.77K Popularity

13.55K Popularity

3.33K Popularity

9.94K Popularity

News

View MorePi App Studio launches new features for 2026: payment integration and more convenient app creation options

4 m

Cyber Hornet applies for S&P Crypto 10 ETF, which may become the first S&P-linked spot cryptocurrency basket ETF

10 m

a16z Crypto General Partner Arianna Simpson announces departure to establish a new fund

21 m

Market Report: Top 5 cryptocurrencies by decline on January 24, 2026, with The Sandbox experiencing the largest drop.

23 m

Crypto Fear Index rises to 25, the market remains in the "Extreme Fear" zone

29 m

Pin