Trade High Volatility Without Futures? A Complete Guide to Gate ETF Leveraged Tokens

What Are Gate ETF Leveraged Tokens?

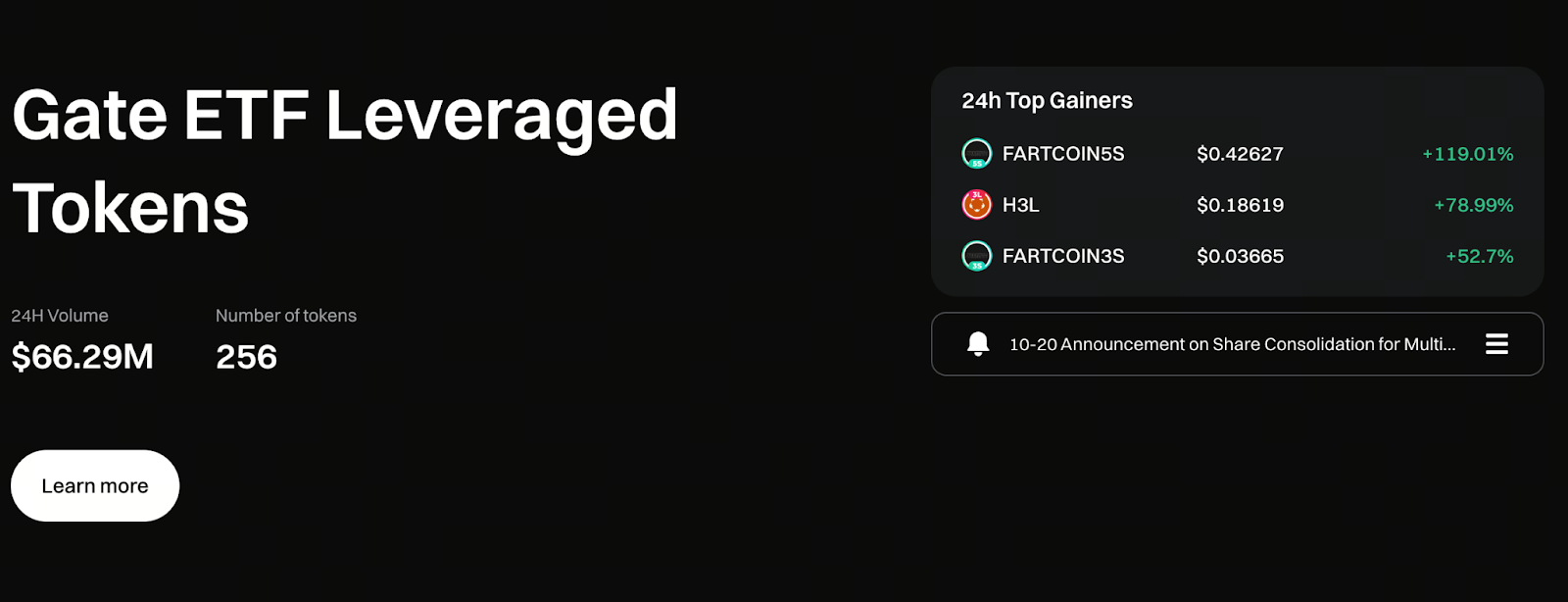

Image source: https://www.gate.com/leveraged-etf

Gate ETF Leveraged Tokens are tokenized products pegged to crypto assets, featuring an embedded leverage mechanism. Their core objective is clear: to let users capture leveraged price movements without trading contracts or facing the risk of liquidation.

Much like traditional ETFs, Leveraged Tokens have an independent net asset value (NAV) system. Unlike crypto derivatives, they require no margin, have no forced liquidation thresholds, and aren’t subject to sudden liquidations from short-term volatility.

For users, these tokens trade just like regular cryptocurrencies. For example:

- BTC3L (Bitcoin 3x Long)

- BTC3S (Bitcoin 3x Short)

How Do Gate ETF Leveraged Tokens Deliver Leverage?

At their core, Gate ETF Leveraged Tokens are backed by a portfolio of perpetual contract positions automatically managed by the system.

The platform uses algorithmic strategies to dynamically adjust contract exposures, ensuring the token maintains its target leverage (such as 3x). As the market moves up or down, the token’s NAV is proportionally amplified.

Key advantages include:

- No need for users to understand contract mechanics

- No manual rebalancing required

- No margin call pressure

The system handles all complex risk management and position controls behind the scenes.

Why Don’t Gate ETF Leveraged Tokens Get Liquidated?

This is the most common misconception about ETF Leveraged Tokens. “No liquidation” does not mean “no risk.”

The real distinction is:

- Contract trading: When the price hits the liquidation threshold, positions are liquidated

- ETF Leveraged Tokens: Use automatic deleveraging and rebalancing to limit risk exposure

In extreme market conditions, ETF Leveraged Tokens can experience significant NAV drawdowns, but unlike contracts, they won’t instantly drop to zero.

This makes them ideal for users who:

- Lack contract trading experience

- Don’t want to monitor the market constantly

- Want to limit extreme risk exposure

The Compounding Effect of ETF Leveraged Tokens in Trending Markets

The standout feature of Gate ETF Leveraged Tokens is their potential for significant compounding returns in sustained trending markets.

When prices move consistently in one direction:

- Each change in NAV compounds on the new base

- Leverage gains stack over time

This is why ETF Leveraged Tokens are often called “trend amplifiers.”

However, this benefit only applies in clear, directional trends.

What to Watch Out for in Sideways Markets

ETF Leveraged Tokens are not suitable for all market conditions.

In sideways or highly volatile markets, the automatic rebalancing mechanism can cause NAV “decay.” Even if the asset price returns to its starting point, the token’s NAV may end up lower than its initial value.

This means:

- ETF Leveraged Tokens are not for long-term holding

- They work best for short-term trend trading

- They aren’t suitable for “buy and hold” strategies

Understanding this is essential before trading Gate ETF Leveraged Tokens.

Which Trading Strategies Fit Gate ETF Leveraged Tokens?

In practice, ETF Leveraged Tokens are most commonly used in the following scenarios:

- Breakout markets with clear direction

- News-driven short-term trends

- Swing trading

- Hedging spot position risk

For example, if users hold substantial spot assets but are concerned about short-term pullbacks, they can use ETF Leveraged Tokens for directional hedging—no need to manage complex contract positions.

ETF Leveraged Tokens vs. Contract Trading: Key Differences

Gate ETF Leveraged Tokens are not a replacement for contracts; they serve a different role.

Contracts are better suited for:

- High-frequency trading

- Precision position management

- Professional traders

ETF Leveraged Tokens are ideal for:

- Simplifying operations

- Quickly capturing trends

- Reducing liquidation anxiety

Choosing between the two depends on your experience and risk tolerance.

The Role of Gate ETF Leveraged Tokens in the Crypto ETF Boom

As crypto ETFs gain mainstream traction, more users are learning about ETF structures and index investing.

Gate ETF Leveraged Tokens are built on this understanding:

- Retaining the “NAV + automatic management” features of ETFs

- Adding leverage to capture crypto’s higher volatility

They function more as “tradable ETF tools” than traditional long-term investment products.

Conclusion

Gate ETF Leveraged Tokens are not “guaranteed profit” products. But in clearly trending markets, they offer a simpler, more intuitive way to gain leveraged exposure.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution