Gate Ventures Weekly Crypto Recap (December 15, 2025)

TL;DR

- Macro: The Fed cut rates by another 25 bps, signaling a dovish stance with potential balance sheet expansion, while maintaining a constructive economic outlook.

- Key data this week includes U.S. employment, CPI, New York and Philadelphia Fed manufacturing indices, and the BoJ interest rate decision.

- Major Assets: BTC declined 2.47% WoW, while ETH remained broadly flat (+0.05%), pushing the ETH/BTC ratio up 2.6% to 0.0347.

- Flows & Sentiment: ETF inflows remained supportive, with $286.6M into BTC ETFs and $208.9M into ETH ETFs. However, market sentiment stayed weak, with the Fear & Greed Index at 16 (Extreme Fear).

- Top 30 Performance: The top-30 assets fell 1.46% on average. Mantle, Zcash, and Monero were among the few gainers, with Mantle outperforming (+17.9%) following a strategic AI trading partnership involving Bybit, Mantle, and Almanak.

- New Token: RAVE launched at $0.18 (market cap: $44.7M), surged to $0.61 (market cap: $235.1M) on high-profile mentions, and has since retraced to around $0.28 (market cap: ~$68M), supported by listings on Gate, Bitget, and Aster.

- Solana moves closer to 1M TPS with the Firedancer mainnet rollout.

- Coinbase standardizes wrapped assets, adopting Chainlink CCIP as its exclusive bridging solution.

- ERC-8092 proposed, introducing a cross-chain associated accounts standard for Ethereum.

Macro Overview

The Fed cut interest rates by 25 bps again, with dovish signals of balance sheet expansion and positive economic outlook.

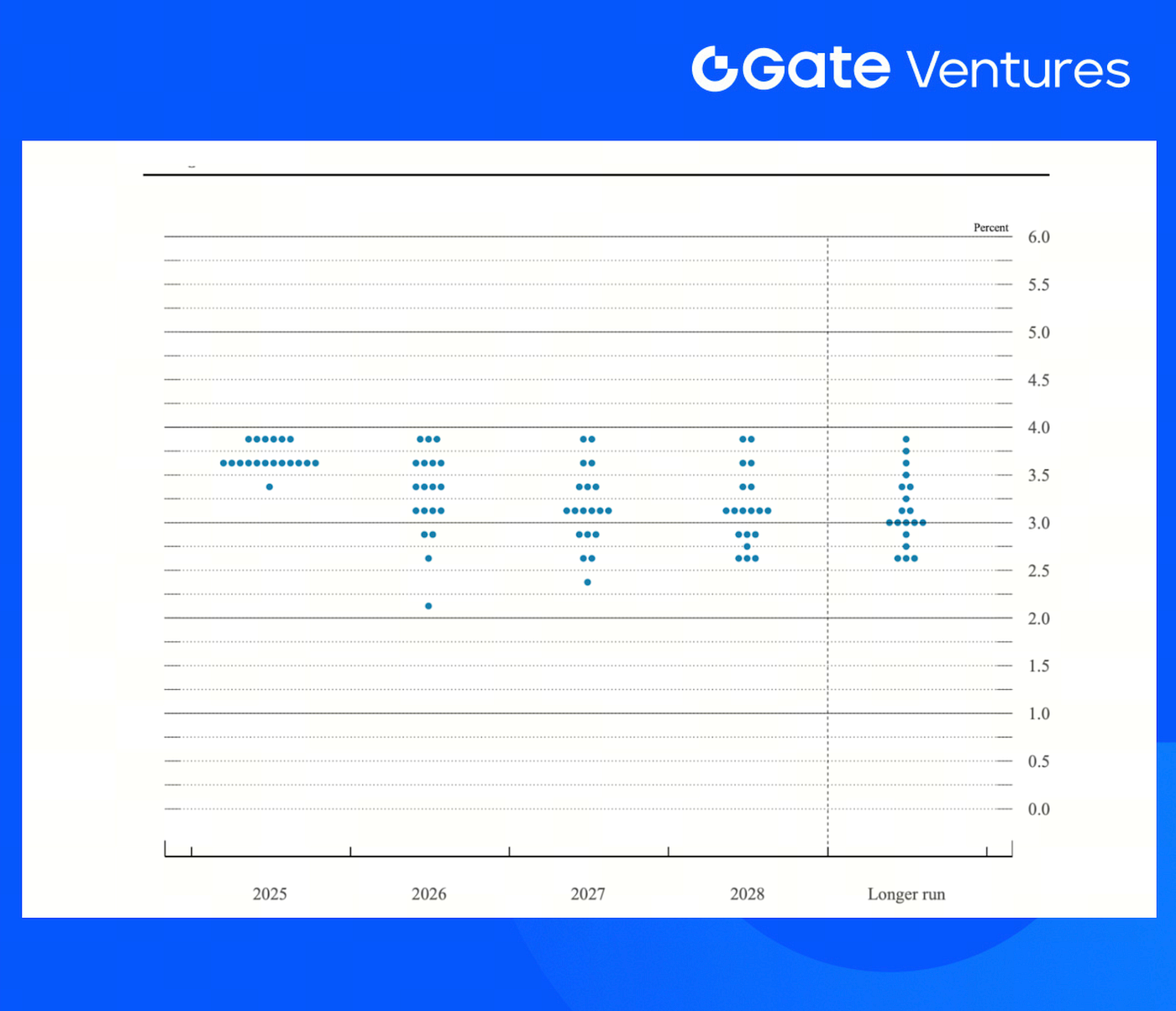

As expected by the market, the Federal Reserve cut interest rates by another 25 basis points. The decision was not unanimous, with the number of officials opposing further rate cuts increased, reflecting growing divisions within the Fed over the additional rate cuts. According to the latest dot plot, 12 officials now support further rate cuts, an increase of one from the previous meeting, while seven prefer no further cuts, and three even project a shift toward rate hikes. When asked by reporters about the possibility of “pausing rate cuts,” Fed Chair Jerome Powell stated that with this latest cut to 3.5%-3.75%, the federal funds rate has entered “a broad range of estimates of neutral.” The Fed will now monitor the economic outlook and remain ready to adjust policy as needed.

Powell noted that current inflation is primarily concentrated in tariff-related areas, while inflation outside of tariffs remains moderate. He attributed next year’s expected rebound in economic growth to a temporary slowdown in activity caused by the government shutdown in 2025Q4, which is likely to be offset by stronger growth in 2026Q1. Powell also pointed out that nonfarm payroll data may have been overstated, suggesting weaker actual employment conditions. Productivity gains driven by AI could also help suppress inflation. Powell’s tone was not overly hawkish, which helped ease market concerns. The Fed announced short-term T-bill purchases to maintain ample reserves. The decision to expand the balance sheet again aims to prevent liquidity risks, which the market has interpreted as dovish.

This week’s incoming data includes the US employment data, CPI, New York and Philadelphia Manufacturing Index and Japan BoJ Interest Rate Decision. For the US side, the delayed US employment report for October including payrolls will be out on Tuesday, alongside with retail sales numbers. US CPI inflation data will then be released on Thursday.The Bank of Japan is expected to hike rates on Friday as it continues its tentative monetary tightening. Accelerating economic growth, improved confidence and rising price pressures will be contributing to the BoJ’s decision this month. (1, 2)

December 2025 Fed Dot Plot

DXY

Following the interest cut, the US dollar further dropped last week, making its third consecutive weekly drop amid the prospects of future interest rate cuts next year. (3)

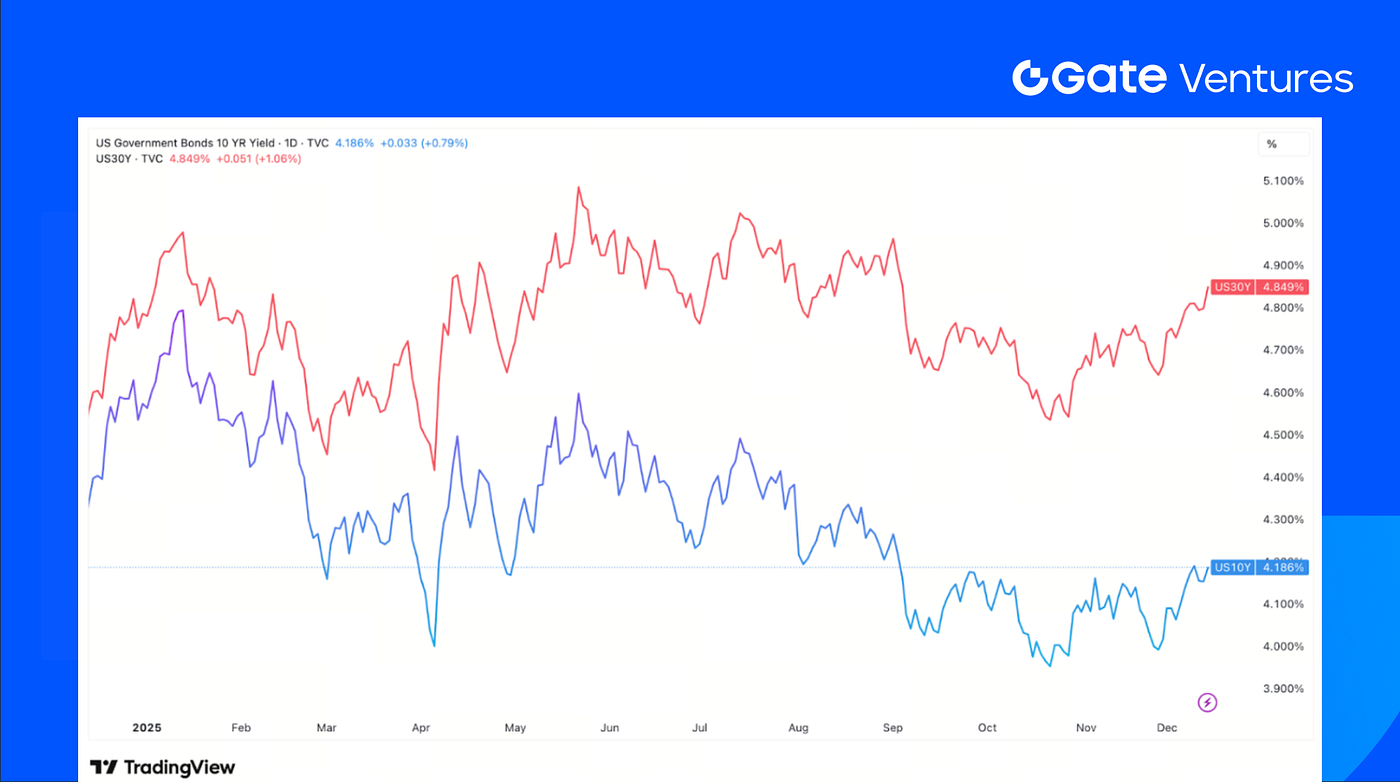

US 10-Year and 30-Year Bond Yields

The yield on the 10-year note finished December 12, 2025, at 4.19%. The 2-year note ended at 3.52%, and the 30-year note ended at 4.85%. The opposite movement between Fed interest rate cut and bond yield increase may indicate concerns over persistent inflation, US government debt burdens and increasing Japan bond borrowing cost. (4)

Gold

Last week, the gold price reached $4,300 again after two months of momentum accumulation, as investors weighed on the impact of global debt levels, inflation risks and shifting central bank policies. Other precious metals like silver also recorded price breakthroughs. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

Bitcoin declined 2.47% over the past week, while Ethereum showed relative resilience with a mild gain of 0.05%. The ETH/BTC ratio edged up by 2.6% to 0.0347, indicating modest ETH outperformance. (6)

On the flow side, Bitcoin ETFs recorded net inflows of $286.6M, while Ethereum ETFs saw $208.94M of inflows. Despite these supportive flows, overall market sentiment remains fragile, with the Fear & Greed Index still firmly in the “Extreme Fear” zone at a reading of 16. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market capitalization declined by 1.84% over the period. Excluding Bitcoin and Ethereum, the market fell by 1.35%, while the broader altcoin segment excluding the top-10 assets saw a pullback of 1.58%, highlighting continued weakness beneath the surface.

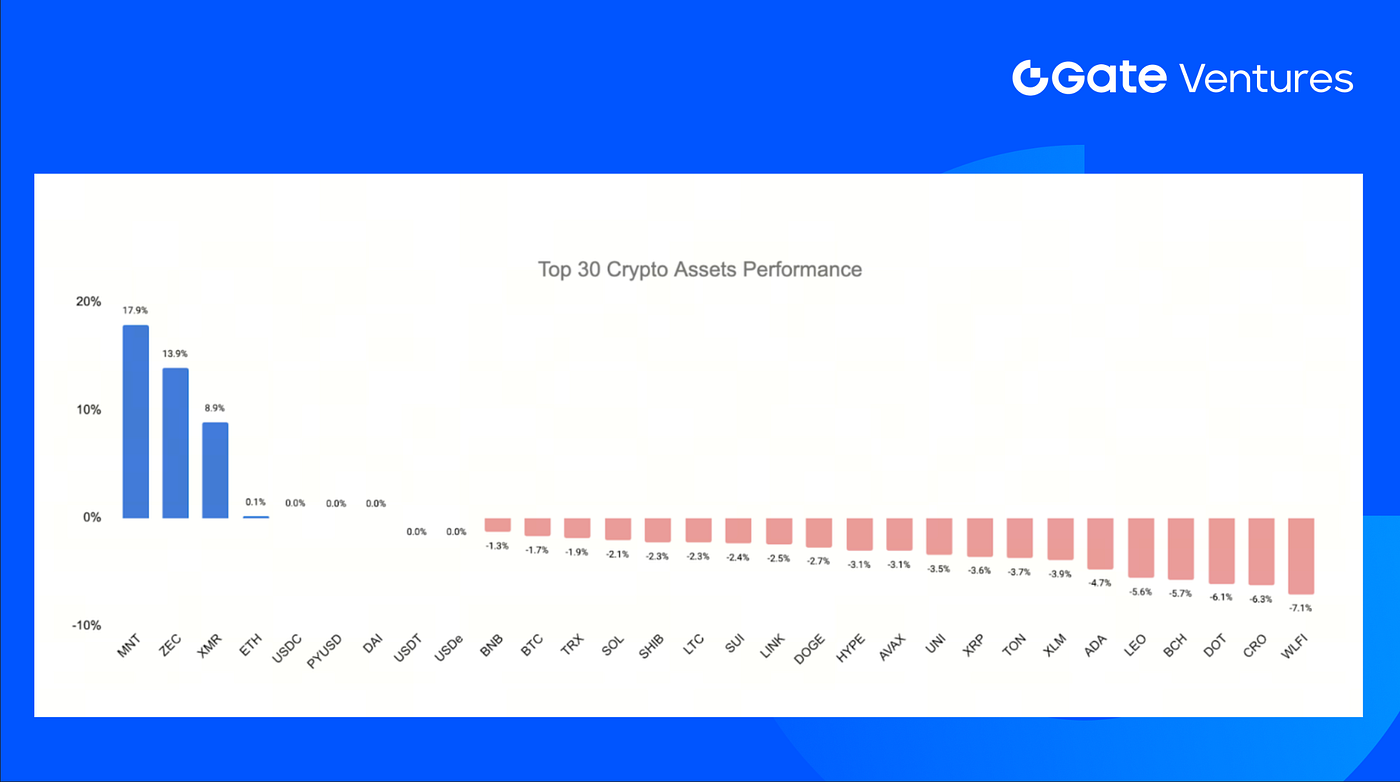

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Dec 15th 2025

Across the top 30 assets, the market still recorded an average decline of 1.46%, with Mantle, Zcash, and Monero among the few tokens posting gains.

Mantle outperformed sharply with a 17.9% rally, driven by the announcement of a strategic partnership between Bybit, Mantle, and AI-quant platform Almanak to deploy AI-driven trading strategies and liquidity directly on Mantle, strengthening its on-chain liquidity and execution narrative. (8)

4. New Token Launched

RaveDAO’s RAVE token is the native utility and governance asset of a Web3 entertainment-centric cultural protocol that bridges real-world music events with blockchain participation.

The project uses large-scale electronic music experiences and on-chain mechanics, such as NFT ticketing, staking, and community voting, to onboard fans into crypto.

The token debuted at $0.18 (mcap: $44.7M) and quickly gained traction after being mentioned by Aster, the World Liberty Financial team, and Donald Trump Jr. on X, which helped drive a rapid rally to an all-time high of $0.61 (mcap: $235.13M). Since then, the price has retraced and is now hovering around $0.28 (mcap: ~$68M), with liquidity supported by listings on Gate, Bitget, and Aster.

The Key Crypto Highlights

1. Solana takes step toward 1M TPS with Firedancer mainnet rollout

Jump Crypto’s Firedancer client has gone live on Solana mainnet, marking a major step toward improving validator diversity and network resilience. Built as a ground-up rewrite in C, Firedancer introduces a modular architecture designed to unlock significantly higher throughput, with prior demonstrations exceeding 1 million transactions per second on commodity hardware. Its adoption reduces Solana’s historical reliance on a narrow set of Rust-based clients and supports the network’s long-term roadmap toward higher performance, lower failure risk, and institutional-grade scalability. (9)

2. Coinbase standardizes wrapped asset with Chainlink CCIP as exclusive bridge

Coinbase selected Chainlink’s Cross-Chain Interoperability Protocol as the exclusive bridging solution for its wrapped assets, including cbBTC, cbETH and cbXRP, representing roughly $7 billion in value. By using CCIP’s audited token pool design, Coinbase aims to expand these assets across new blockchains while reducing bridge-related risk. The move strengthens Chainlink’s position as core interoperability infrastructure and aligns with Coinbase’s broader strategy to standardize secure cross-chain distribution for tokenized assets held 1:1 in custody. (10)

3. New ERC-8092 proposes cross-chain associated accounts standard for Ethereum

The Ethereum community has proposed ERC-8092, a draft standard defining how blockchain accounts can publicly declare, prove, and revoke associations using cryptographic signatures. The proposal addresses growing friction from managing multiple addresses across chains by enabling sub-account relationships, delegated authorization, and reputation aggregation. Leveraging EIP-712 signatures and compatibility with ERC-7930, the standard supports multiple signature schemes and cross-chain address types, positioning ERC-8092 as foundational identity infrastructure for an increasingly multi-chain Ethereum ecosystem. (11)

Key Ventures Deals

1. Cascade debuts unified-margin perps platform backed by $15M in funding

Cascade launched a 24/7 neo-brokerage offering perpetuals on crypto and U.S. stocks, supported by $15M raised to date from Polychain Capital, Variant, Coinbase Ventures and other investors. The platform introduces a single unified margin account with direct USD bank rails, targeting always-on trading and continuous settlement. As retail demand grows for cross-asset exposure without legacy brokerage constraints, Cascade positions perps as a software-native alternative to traditional market-hour-bound trading infrastructure. (12)

2. Pantera leads $15M round for Surf’s specialized crypto AI platform

Surf raised a $15M funding round led by Pantera Capital with Coinbase Ventures, Digital Currency Group and other investors to scale its crypto-native AI platform. Built to minimize hallucinations common in generalist models, Surf serves over 300,000 users across retail and institutional segments. As crypto markets grow more complex and real-time decisions carry higher financial risk, the investment reflects demand for domain-specific AI tools that deliver trusted, verifiable intelligence for traders and firms. (13)

3. LI.FI secures $29M Series A extension to to scale liquidity infrastructure and AI tooling

LI.FI raised a $29M Series A extension led by Multicoin with CoinFund and other investors, bringing total funding to $51.7M as lifetime volume surpassed $60B. The capital funds new products for AI agents, stablecoins, and an open intent marketplace. As multi-chain activity and agent-driven execution increase, the round reflects demand for abstracted liquidity rails that hide complexity while enabling scalable, cross-chain financial applications. (14)

Ventures Market Metrics

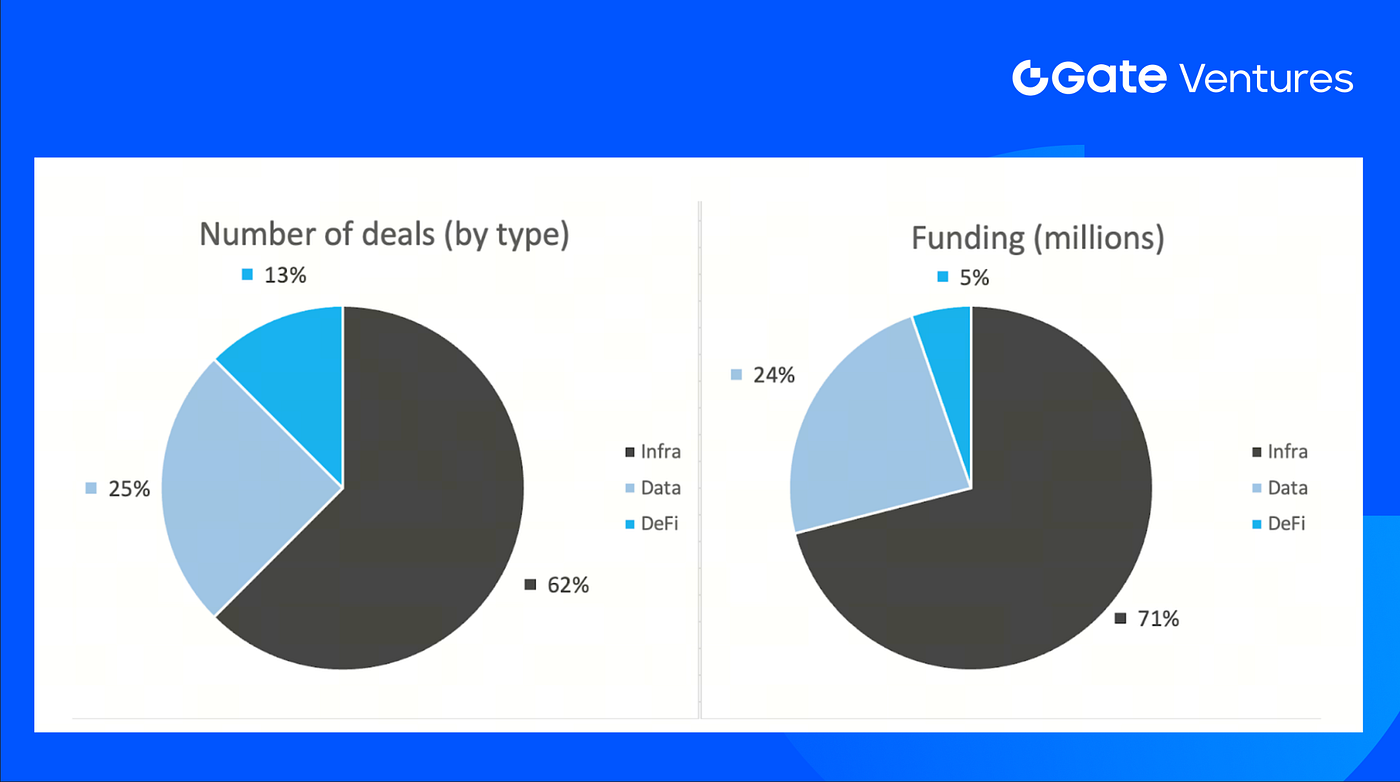

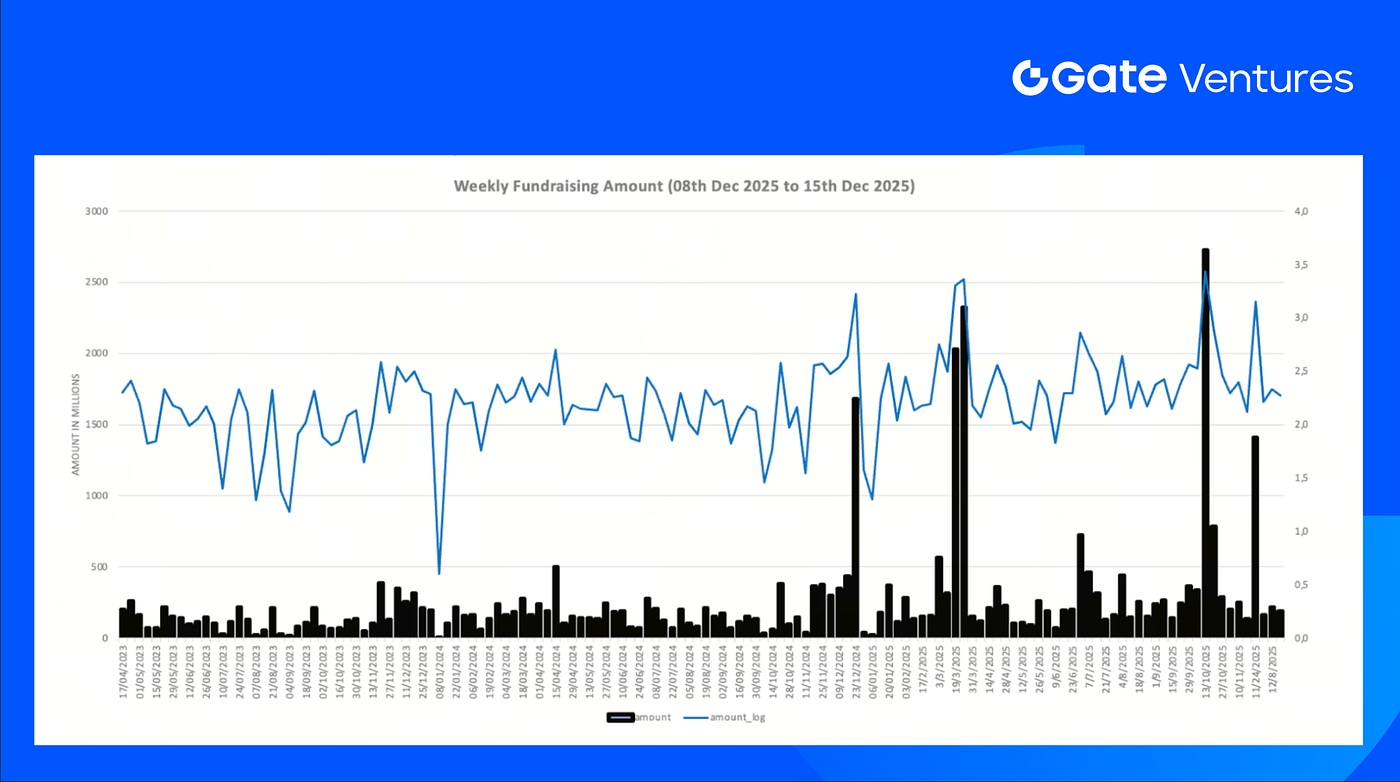

The number of deals closed in the previous week was 16, with Infra having 10 deals, representing 63% of the total number of deals. Meanwhile, Data had 4 (25%) and DeFi had 2 (13%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 15th Dec 2025

The total amount of disclosed funding raised in the previous week was $188M, no deals in the previous week didn’t public the raised amount. The top funding came from Infra sector with $134M. Most funded deals: LI.FI $29M, Real Finance $29M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 15th Dec 2025

Total weekly fundraising fell to $188M for the 2nd week of Dec-2025, a decrease of -13% compared to the week prior. Weekly fundraising in the previous week was up -131% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-15-december-2025.html

- Summary of Economic Projections, December 10, 2025, the Fedral Reserve, https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20251210.pdf

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Bybit x Mantle x Almanak Partnerships, https://www.prnewswire.com/apac/news-releases/bybit-mantle-and-almanak-partner-to-bring-ai-powered-quant-strategies-onchain-at-global-scale-302638002.html

- Solana takes step toward 1M TPS with Firedancer mainnet rollout,https://www.theblock.co/post/382411/jump-cryptos-firedancer-hits-solana-mainnet-as-the-network-aims-to-unlock-1-million-tps

- Coinbase standardizes wrapped asset with Chainlink CCIP as exclusive bridge,https://www.theblock.co/post/382230/coinbase-chainlink-ccip-wrapped-assets-exclusive-deal

- New ERC-8092 proposes cross-chain associated accounts standard for Ethereum,https://ethereum-magicians.org/t/erc-8092-associated-accounts/26858

- Cascade debuts unified-margin perps platform backed by $15M in funding,https://www.coindesk.com/business/2025/12/09/cascade-unveils-247-neo-brokerage-offering-perpetuals-on-cryptos-us-stocks

- Pantera leads $15M round for Surf’s specialized crypto AI platform,https://fortune.com/2025/12/10/exclusive-surf-an-ai-platform-raises-15-million/

- LI.FI secures $29M Series A extension to to scale liquidity infrastructure and AI tooling,https://www.theblock.co/post/382242/multicoin-joins-as-lead-investor-in-li-fis-29-million-series-a-extension-round

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)