Gate Launchpad Phase 5: How Kodiak (KDK) Redefines Token Participation with Full Unlock

As New Token Launches Prioritize Capital Efficiency

With the Launchpad mechanism becoming more sophisticated, the market focus has shifted beyond merely securing new tokens to ensuring capital is used efficiently during participation. Long-term lockups and linear vesting often introduce uncertainty, reducing capital flexibility during the wait and increasing allocation costs.

Gate Launchpad’s fifth phase features Kodiak (KDK) and introduces a 100% one-time unlock distribution model. Participants gain full access to their assets immediately after token allocation, making this design especially attractive to users who prioritize short- and medium-term planning and capital efficiency.

Join Gate Launchpad Phase 5 to subscribe for Kodiak (KDK) now: https://www.gate.com/launchpad/2362

USDT × GUSD: Making Waiting More Rewarding

This Launchpad phase also introduces USDT and GUSD as eligible assets. In addition to providing flexible stablecoin options, GUSD offers yield backed by U.S. Treasury RWA, ensuring your funds are not simply locked away during the subscription period.

For participants, this means earning stable returns while still having the opportunity to acquire new tokens during the allocation period. Launchpad thus evolves from a single transaction into a holistic asset allocation process.

KDK Launchpad: Key Parameters at a Glance

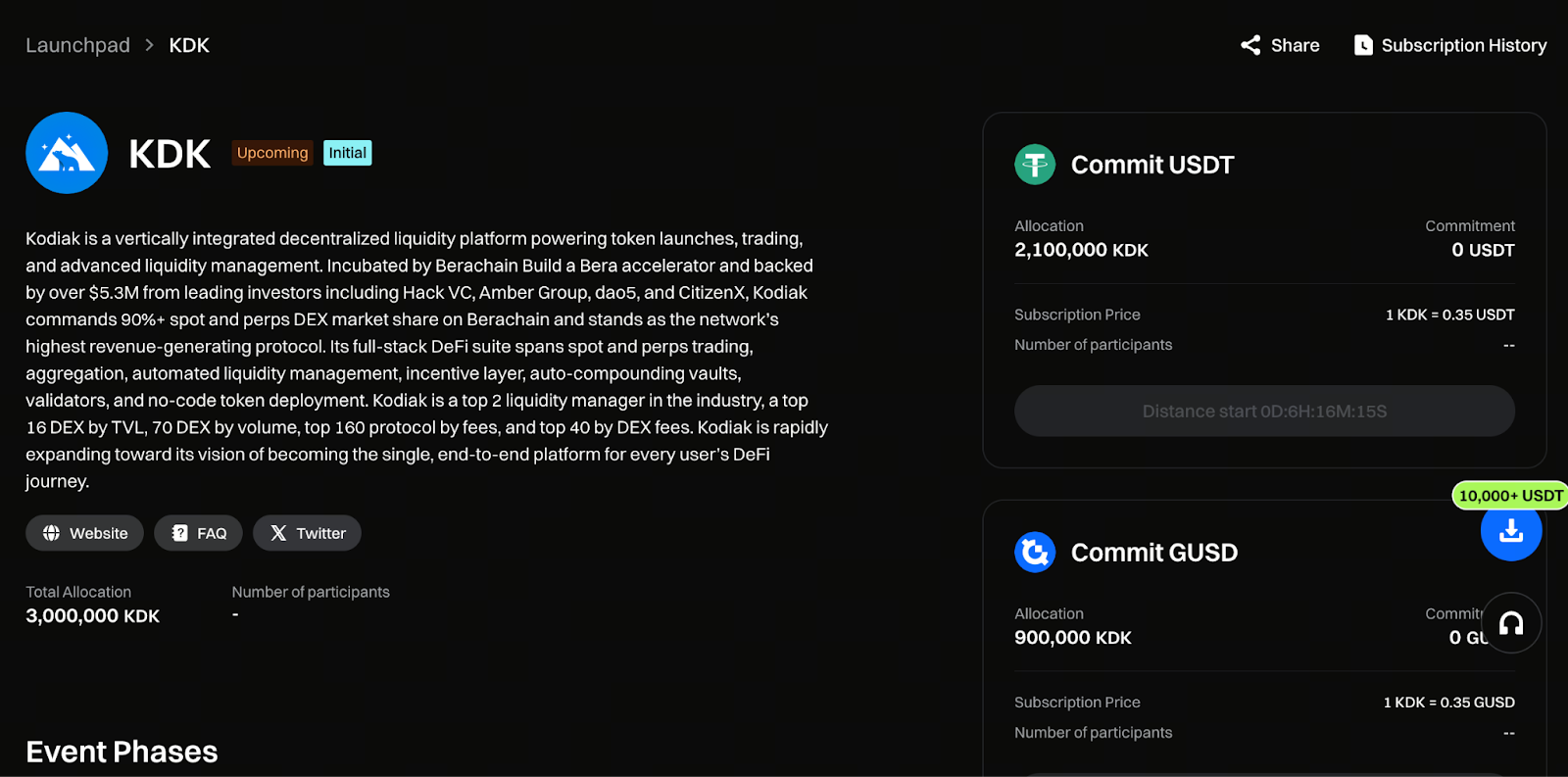

The main participation criteria for this Kodiak (KDK) Launchpad phase are:

- Project Name: Kodiak

- Token Symbol: KDK

- Total Subscription Volume: 3,000,000 KDK

- USDT Subscription Pool: 2,100,000 KDK

- GUSD Subscription Pool: 900,000 KDK

- Subscription Price: 1 KDK = 0.35 USDT / 0.35 GUSD

- Minimum Participation Amount: 10 USDT or 10 GUSD

- Subscription Period: December 19, 2025, 08:00 – December 21, 2025, 08:00 (UTC)

Cap Mechanism for Predictable Allocation

To prevent any single account from monopolizing resources, this Launchpad phase sets a clear individual allocation cap. Each user can receive up to 30,000 KDK, with separate caps for the USDT and GUSD pools. This enhances fairness and allows participants to assess their potential allocation ratios in advance, reducing uncertainty.

Allocation Logic Focused on Ongoing Participation

Unlike models that only consider the final committed amount, the Kodiak (KDK) Launchpad bases allocation on the average hourly locked amount. The system records locked balances hourly over the 48-hour subscription period and calculates the average. Users who subscribe early and maintain stable locked positions have a better chance in the final allocation, making strategic participation a key advantage.

Transparent Locking and Refund Process

During the subscription period, your USDT or GUSD will be temporarily locked and cannot be redeemed early. Once allocation is complete, the system deducts funds based on your actual KDK allocation and automatically refunds the remainder to your spot account. If your final allocation is below the minimum distribution unit, no tokens are distributed and your full committed amount is refunded, ensuring a transparent and predictable process.

Key Timeline Overview

The schedule for this Launchpad phase is as follows:

- Token Distribution Completion: By December 22, 2025, 08:00 (UTC)

- Spot Trading Opens: December 23, 2025, 14:00 (UTC)

- Trading Pair: KDK/USDT

- Unlock Method: 100% one-time unlock

Post-Launchpad Extended Allocation Options

After completing your subscription, you can allocate funds to Earn USDT for a chance to participate in a bonus program with up to 200% APY. This approach turns Launchpad into the starting point for ongoing wealth management and capital allocation, rather than a one-off event.

Kodiak (KDK) Project Overview

Kodiak is a vertically integrated decentralized liquidity platform supporting token issuance, trading, and advanced liquidity management. Incubated by the Berachain “Build a Bera” accelerator, Kodiak is backed by Hack VC, Amber Group, dao5, and CitizenX, with total funding exceeding $5.3 million. Currently, Kodiak commands over 90% of the spot and perpetual DEX market share in the Berachain ecosystem and is steadily advancing toward becoming a one-stop DeFi infrastructure provider.

How to Participate and Risk Reminder

You can join this Launchpad phase via Gate Web or App, choosing USDT or GUSD after completing identity verification. Please note that Launchpad projects are early-stage blockchain initiatives and involve market, technical, and liquidity risks. The platform does not guarantee prices. Make sure you fully understand the project and assess your risk tolerance before participating.

Gate User Agreement: https://www.gate.com/legal/user-agreement

Summary

Gate Launchpad Phase 5 Kodiak (KDK) redefines token subscription participation with one-time unlocking, dual-asset participation, and average lock allocation. For users who want to avoid long-term lockup and value capital flexibility and efficiency, this structure offers a clearer and more controllable strategic entry point. Launchpad is no longer just about securing quotas—it becomes a core part of broader asset allocation strategy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution