Before you blindly participate in any public fund, please read this article first.

ICO is the hottest topic on crypto Twitter right now—everyone is talking about it.

Everyone thinks they’ve discovered the next MegaETH or Plasma.

But most people are missing a critical point:

Only a small number of these ICOs actually make money. That’s always been the reality of the crypto market.

One project pioneers a new model and finds success.

Then ten other teams rush to copy it, expecting the same outcome. But this kind of success is rarely repeatable—most of them fail.

Now, every team wants to launch an ICO just because MegaETH and Plasma are trending.

They figure it’s better for you to pay to “get in” than to hand you an airdrop.

But those two projects succeeded because they were meticulously planned before execution.

So, before you invest in any ICO, consider these key points.

1. The Product Is What Matters

Ignore all the flashy pitch decks and influencer hype.

Ask yourself one straightforward question:

Does this product solve a real, current problem? Is there genuine innovation? Why do they need a token at all?

If the product only exists as a “future story” or depends on a pile of assumptions, that’s a serious risk.

Strong ICOs typically have something real and functioning—not just empty promises or testnet numbers.

If they can’t clearly explain what the product does in one sentence, that’s your first red flag.

2. The Team Is Crucial

The strength of the project hinges on the team behind it.

Review their track record:

Have they built products in crypto or other industries before?

Relevant experience is a major plus—it means they’ve navigated this landscape before.

An anonymous team isn’t necessarily a dealbreaker,

but they must deliver exceptional results to earn trust.

When the market shifts, strong teams adapt quickly.

Weak teams vanish as soon as the hype fades. This is the reality of the attention economy.

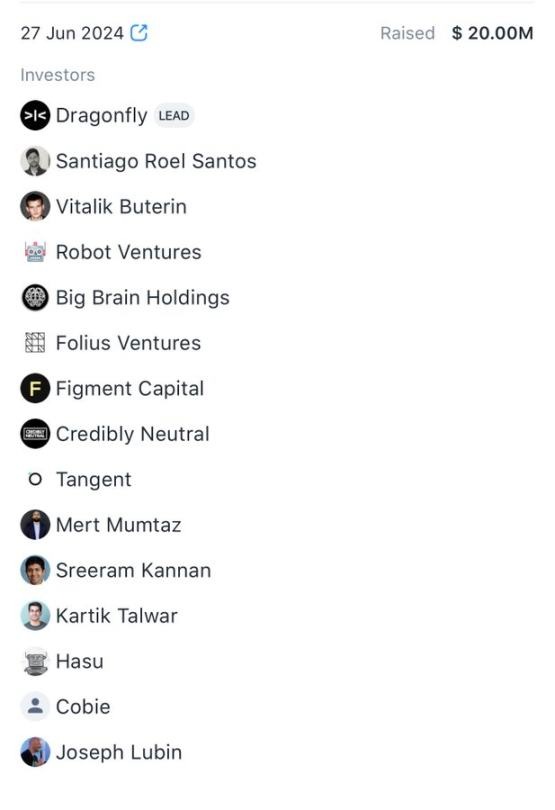

3. Investors and Valuation

Who is backing this project? Are top VCs involved, or just third-tier funds?

How much have they raised? What’s the current valuation? This is more important than most realize.

If insiders and early investors got in at rock-bottom valuations, you might end up as their exit liquidity.

Solid ICOs have a sound valuation rationale, even without hype.

Weak ICOs rely solely on buzz and vanity metrics to justify their price.

4. Focus on Genuine Data, Not Surface Metrics

Is there real revenue? What are the active user numbers and total value locked (TVL)?

What matters most is data quality—any number can be faked.

If testnet data can be inflated easily, it’s worthless.

Dashboards full of fake activity won’t magically turn into real users overnight. Monad is a prime example.

Assess whether user demand is authentic and organic—are people using the product without incentives,

or are they just hoping for a future airdrop?

5. Marketing and Storytelling Matter

Marketing is far more important than most people think.

MegaETH’s marketing was a masterclass.

The team controlled every aspect and owned the narrative.

Everyone was talking about MegaETH.

In Web3, attention is everything.

If no one is paying attention to an ICO before launch, don’t expect miracles after—just look at Monad.

Great projects know how to communicate their story from day one.

Weak projects hide behind trendy buzzwords: “We’re building the next Web3 ChatGPT+Nvidia+prediction market…” Sure, the story sounds good.

6. Token Terms and Valuation

Read the terms carefully:

- Token unlock schedule

- Vesting periods

- Circulating supply

- Fully diluted valuation (FDV) at launch

Understanding the complete tokenomics is essential. If you can’t grasp it, use AI tools for analysis.

If the ICO structure heavily favors insiders and puts all the risk on retail, walk away.

Fair launch doesn’t mean cheap—it means the interests of the team and participants are aligned.

7. Market Environment Is Key

This is the factor most often overlooked.

In a true bull market, even a decent project can reach a $500 million to $1 billion fully diluted valuation on narrative alone.

Right now, even the hottest projects are often capped at $100 million to $300 million valuations.

This directly affects your risk and reward profile.

The same project can have vastly different outcomes in different market cycles.

Timing isn’t everything, but it is never irrelevant.

Final Thoughts

ICOs are not free money—they never were.

This wave will create a few winners and leave a long trail of hard lessons.

Don’t buy just because everyone else is, or because your favorite influencer is shilling it.

Don’t assume every hyped project today will become the next MegaETH.

Statement:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [Ola Ξlixir]. If you have any concerns about this reprint, please contact the Gate Learn team, and we will address the issue promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, do not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?