Crypto News

**關注我們以獲取最新的加密貨幣洞察!**

通過關注我們的頻道,在加密貨幣的世界中保持領先!獲取專家分析,實時市場更新。

謝謝。

置頂

Crypto News

使用平均成本法(DCA) (Dollar Cost Averaging) 的機器人在Gate上進行交易的指南

✅ 平均成本法(DCA)機器人是什麼?

DCA機器人是一個工具,可以讓您在預定的時間段或價格水平上分配資金購買(或出售)某個幣,以實現平均成本並降低錯誤入場時機的風險。

在Gate上,您可以使用DCA機器人根據策略自動進行買賣。

🛠 在Gate上設置DCA機器人

1. 登入Gate帳戶,完成KYC並最低充值10USDT

2. 選擇平台機器人 > 平均成本法(DCA)現貨

3. 設置DCA機器人策略:

確定您想要使用平均成本法(DCA)的幣種。

設置參數如:每次下單的數量、下單頻率、激活額外頭寸的價格、TP/STL比例、DCA次數、資金...

4. 啓動機器人並進行監控:機器人將根據設置自動執行命令,您只需監控性能並在需要時進行調整。

⚠️ 注意風險 & 必須控制的事項

機器人不保證利潤——加密市場波動很大,DCA只是降低風險的策略,並不能完全消除風險。

流動性、您選擇的交易對和交易費用非常重要—選擇具有良好交易量的交易對以使機器人有效運作。

根據解鎖代幣的日程和新聞動態進行跟蹤,因爲這些因素可能會對價格產生重大影響,即使您正在“自動購買”。

請提前確定機器人的資本使用水平,不要將全部資本投入到單一策略中。

請復制我下面的機器人$GT ,最低資金爲20$來支持我。

謝謝

#

✅ 平均成本法(DCA)機器人是什麼?

DCA機器人是一個工具,可以讓您在預定的時間段或價格水平上分配資金購買(或出售)某個幣,以實現平均成本並降低錯誤入場時機的風險。

在Gate上,您可以使用DCA機器人根據策略自動進行買賣。

🛠 在Gate上設置DCA機器人

1. 登入Gate帳戶,完成KYC並最低充值10USDT

2. 選擇平台機器人 > 平均成本法(DCA)現貨

3. 設置DCA機器人策略:

確定您想要使用平均成本法(DCA)的幣種。

設置參數如:每次下單的數量、下單頻率、激活額外頭寸的價格、TP/STL比例、DCA次數、資金...

4. 啓動機器人並進行監控:機器人將根據設置自動執行命令,您只需監控性能並在需要時進行調整。

⚠️ 注意風險 & 必須控制的事項

機器人不保證利潤——加密市場波動很大,DCA只是降低風險的策略,並不能完全消除風險。

流動性、您選擇的交易對和交易費用非常重要—選擇具有良好交易量的交易對以使機器人有效運作。

根據解鎖代幣的日程和新聞動態進行跟蹤,因爲這些因素可能會對價格產生重大影響,即使您正在“自動購買”。

請提前確定機器人的資本使用水平,不要將全部資本投入到單一策略中。

請復制我下面的機器人$GT ,最低資金爲20$來支持我。

謝謝

#

GT-7.95%

【當前用戶分享了他的交易卡片,若想瞭解更多優質交易資訊,請到App端查看】

- 讚賞

- 5

- 6

- 1

- 分享

Falcon_Official :

:

密切關注 🔍️查看更多

Micro Strategy 已額外購買855 BTC(比特幣),價值約75.3百萬美元(美元),購買價格約為每BTC$88,000。

目前他們持有713,502 BTC,這些比特幣的平均購買價格為每BTC$76,052。

目前他們持有713,502 BTC,這些比特幣的平均購買價格為每BTC$76,052。

BTC-6.42%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

🔹 Tether 報告2025年利潤為10.1億美元

🔹 美元供應量增加近$50 兆美元,總流通量超過$186 兆美元

🔹 總資產:192.9億美元

🔹 總USDT:186.5億美元

🔹 派息後剩餘儲備(:6.34億美元

🔹 儲備資產結構:

- 超過)兆美元直接和間接持有美國國債

- 17.45億美元貴金屬

- 8.43億美元比特幣

- 17.04億美元超額擔保貸款

🔹 Tether還擁有價值超過$141 兆美元的自有投資組合,由利潤資助,並不作為美元₮的擔保

此外,Tether持續擴展其資產負債表,並積極管理其儲備,以確保每一個USDT都能得到充分的支持。公司也在不斷優化其投資策略,增加多元化資產配置,提升整體財務穩健性。未來,Tether將持續追求透明度與安全性,為用戶提供穩定可靠的數字貨幣服務。

🔹 美元供應量增加近$50 兆美元,總流通量超過$186 兆美元

🔹 總資產:192.9億美元

🔹 總USDT:186.5億美元

🔹 派息後剩餘儲備(:6.34億美元

🔹 儲備資產結構:

- 超過)兆美元直接和間接持有美國國債

- 17.45億美元貴金屬

- 8.43億美元比特幣

- 17.04億美元超額擔保貸款

🔹 Tether還擁有價值超過$141 兆美元的自有投資組合,由利潤資助,並不作為美元₮的擔保

此外,Tether持續擴展其資產負債表,並積極管理其儲備,以確保每一個USDT都能得到充分的支持。公司也在不斷優化其投資策略,增加多元化資產配置,提升整體財務穩健性。未來,Tether將持續追求透明度與安全性,為用戶提供穩定可靠的數字貨幣服務。

BTC-6.42%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

儘管Kevin Warsh的資產具體數額未公開,但在2002年,他與億萬富翁Jane Lauder結婚,Jane Lauder是化妝品帝國Estée Lauder的孫女和繼承人。他妻子的淨資產公開約為$2.7億美元。#PreciousMetalsPullBack

查看原文

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

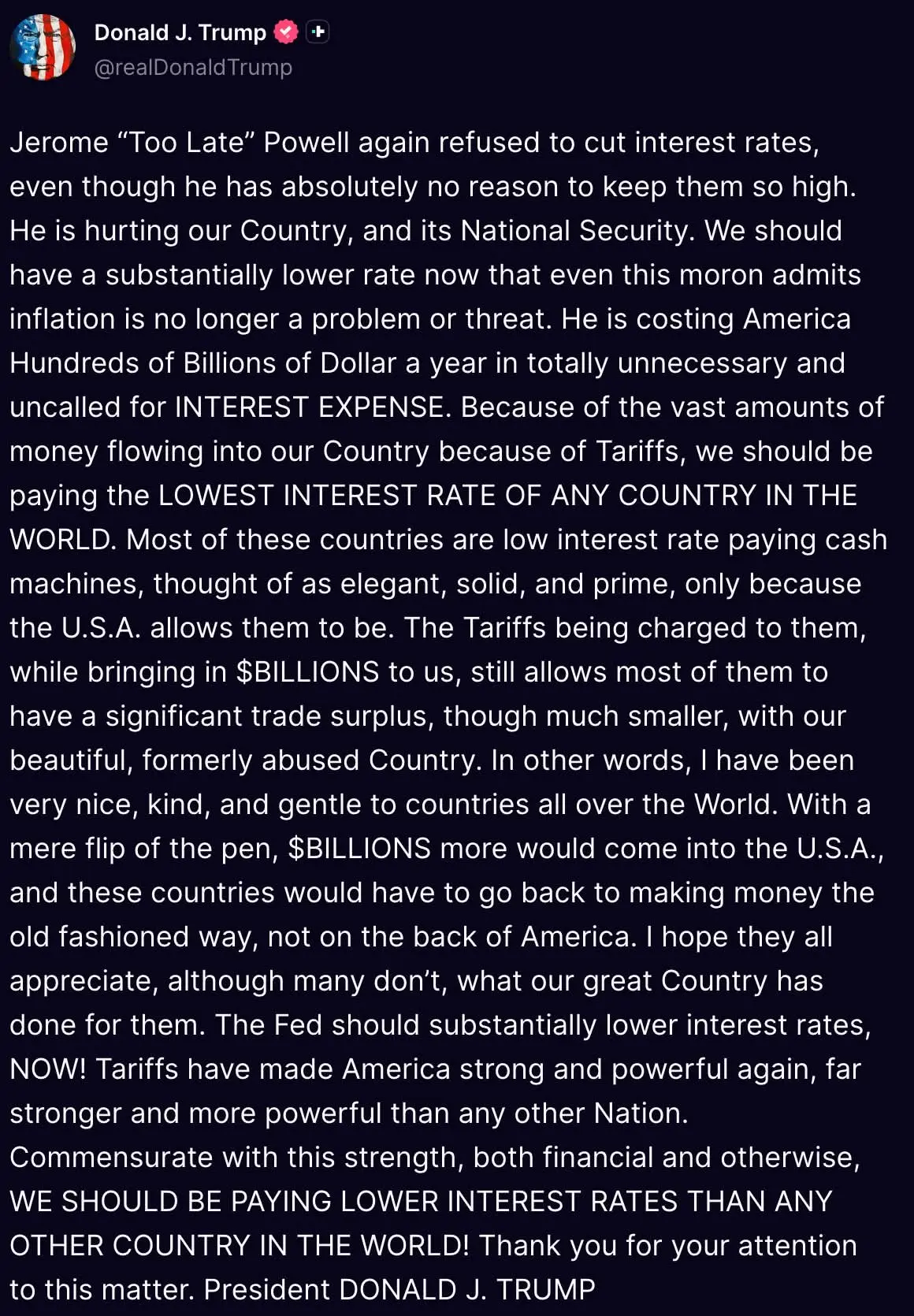

🇺🇸 川普總統批評聯準會主席,稱鮑威爾為「白痴」,要求立即降息

🔹 川普總統抨擊聯準會主席鮑威爾,稱他「白痴」,因為他拒絕降息,儘管通膨已不再是問題。

🔹 他說,高利率每年讓美國損失數千億美元不必要的利息,並損害經濟與國家安全。

🔹 多虧了關稅政策,資金大量湧入美國,因此美國應該擁有全球最低的利率。

查看原文🔹 川普總統抨擊聯準會主席鮑威爾,稱他「白痴」,因為他拒絕降息,儘管通膨已不再是問題。

🔹 他說,高利率每年讓美國損失數千億美元不必要的利息,並損害經濟與國家安全。

🔹 多虧了關稅政策,資金大量湧入美國,因此美國應該擁有全球最低的利率。

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

Tether 執行長 Paolo Ardoino 表示,Tether 正朝著成為未來全球最大「黃金中央銀行」之一的方向邁進,尤其是在美元角色可能削弱的背景下。

目前,Tether 持有約140噸黃金,價值超過230億美元,存放在瑞士的一個安全金庫中。

不僅持有黃金,Tether 還希望直接參與黃金買賣,類似於大型銀行如 JPMorgan 或 HSBC。該公司已招聘來自 HSBC 的黃金交易專家,以建立這一業務,旨在從價格差異中獲取額外利潤。目前,黃金穩定幣 (XAUT),佔全球黃金穩定幣市場份額的超過50%。#GoldBreaks$5,500

目前,Tether 持有約140噸黃金,價值超過230億美元,存放在瑞士的一個安全金庫中。

不僅持有黃金,Tether 還希望直接參與黃金買賣,類似於大型銀行如 JPMorgan 或 HSBC。該公司已招聘來自 HSBC 的黃金交易專家,以建立這一業務,旨在從價格差異中獲取額外利潤。目前,黃金穩定幣 (XAUT),佔全球黃金穩定幣市場份額的超過50%。#GoldBreaks$5,500

XAUT-3.23%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

Tether 正式推出 USA₮,一種與美元掛鈎且由聯邦監管的穩定幣,專為美國市場設計,符合 GENIUS 法案的法律框架,由美國國家認可的 Anchorage Digital Bank 發行。USA₮ 針對在美國受監管的金融機構和平台,具有合規、透明和銀行級監管標準。

USA₮ 與 USDT 有何不同:

USA₮:專為美國法律體系打造,受到聯邦全面監管,由美國銀行發行,適用於在美國註冊的機構、銀行和交易所。

USDT:為全球市場設計,主要在美國直接監管範圍之外運作,專注於國際市場、加密貨幣交易和跨境支付。

USA₮ 與 USDT 有何不同:

USA₮:專為美國法律體系打造,受到聯邦全面監管,由美國銀行發行,適用於在美國註冊的機構、銀行和交易所。

USDT:為全球市場設計,主要在美國直接監管範圍之外運作,專注於國際市場、加密貨幣交易和跨境支付。

查看原文

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

根據 PayPal 的調查,約有 40% 的美國商店已經允許客戶使用加密貨幣付款。

近 90% 的賣家表示他們曾被客戶詢問過這種付款方式,顯示需求正在增加。

加密貨幣在旅遊、酒店、數字商品和遊戲等行業的使用最為普遍。大型企業率先採用,但中小企業也逐漸加入。一些大型品牌如 Starbucks、Walmart、Home Depot 已經接受加密貨幣。

在已接受加密貨幣的商店中,這種方式約佔 26% 的營收,證明客戶如果有選擇的話,願意使用。使用加密貨幣最多的群體是千禧世代和 Z 世代。#GoldBreaksAbove$5,200

查看原文近 90% 的賣家表示他們曾被客戶詢問過這種付款方式,顯示需求正在增加。

加密貨幣在旅遊、酒店、數字商品和遊戲等行業的使用最為普遍。大型企業率先採用,但中小企業也逐漸加入。一些大型品牌如 Starbucks、Walmart、Home Depot 已經接受加密貨幣。

在已接受加密貨幣的商店中,這種方式約佔 26% 的營收,證明客戶如果有選擇的話,願意使用。使用加密貨幣最多的群體是千禧世代和 Z 世代。#GoldBreaksAbove$5,200

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

🇺🇸 美國比特幣公司 (ABTC),由特朗普總統家族支持並由埃里克·特朗普共同創立,已將持有的比特幣總量提升至5,843 BTC,並額外購買了416 BTC,繼續通過挖礦和直接在市場上購買來擴大儲備策略。

#CryptoRegulationNewProgress

#CryptoRegulationNewProgress

BTC-6.42%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

韓國中央銀行擔心如果發行與韓元掛鉤的穩定幣,民眾可能更容易將資金轉移出國並避開外匯管制。這可能使國家難以控制資金流動,並在市場波動時導致韓元失去穩定。

同時,韓國國會尚未就穩定幣的法律達成共識:

- 中央銀行希望只允許特定銀行發行,以便更容易控制。

- 加密貨幣企業則希望擴大發行權限,允許更多公司參與。

由於這些分歧,數字資產相關法案(數字資產基本法)被推遲,其他計劃如允許公司掛牌交易加密貨幣或推出加密ETF的計劃也因此延後。#ContentMiningRevampPublicBeta

查看原文同時,韓國國會尚未就穩定幣的法律達成共識:

- 中央銀行希望只允許特定銀行發行,以便更容易控制。

- 加密貨幣企業則希望擴大發行權限,允許更多公司參與。

由於這些分歧,數字資產相關法案(數字資產基本法)被推遲,其他計劃如允許公司掛牌交易加密貨幣或推出加密ETF的計劃也因此延後。#ContentMiningRevampPublicBeta

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

🔥 GameStop股票在Michael Burry透露他正在買入後上漲約6%,他強調這是長期價值投資,而非押注迷因股浪潮。

Burry表示他相信CEO Ryan Cohen和GameStop的策略,同時不期待通過空頭擠壓來獲取利潤。#ContentMiningRevampPublicBeta

查看原文Burry表示他相信CEO Ryan Cohen和GameStop的策略,同時不期待通過空頭擠壓來獲取利潤。#ContentMiningRevampPublicBeta

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

🇺🇸 BlackRock 的投資主管 Rick Reider 目前仍是下一任聯準會主席的頭號候選人,在 Polymarket 上的概率為 47%,其次是前聯準會理事 Kevin Warsh,概率為 29%,以及聯準會理事 Chris Waller,概率為 9%。

Rick Rieder 支持將聯準會利率降至約 3% 以刺激經濟增長和房市,同時認為比特幣是具有韌性、合法的資產,應該納入標準投資組合。#ContentMiningRevampPublicBeta

Rick Rieder 支持將聯準會利率降至約 3% 以刺激經濟增長和房市,同時認為比特幣是具有韌性、合法的資產,應該納入標準投資組合。#ContentMiningRevampPublicBeta

BTC-6.42%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

Tezos 剛剛推出了 Tallinn 升級,將產生區塊的時間縮短至 6 秒,比之前更快,且不需要進行 (硬分叉)。

這是自 2018 年推出以來,Tezos 第20次重大升級。Tallinn 主要帶來以下改進:

- 交易速度更快,延遲更低。

- 降低在 Tezos 上運行應用的資料存儲成本。

- 允許所有驗證者 (baker) 使用 BLS 簽名將多個簽名合併成一個,從而共同確認每個區塊。

新的地址壓縮機制能將存儲空間節省約 100 倍。

此次升級的目標是幫助 Tezos 處理更多交易,以支援實際應用。#GoldAndSilverHitRecordHighs

這是自 2018 年推出以來,Tezos 第20次重大升級。Tallinn 主要帶來以下改進:

- 交易速度更快,延遲更低。

- 降低在 Tezos 上運行應用的資料存儲成本。

- 允許所有驗證者 (baker) 使用 BLS 簽名將多個簽名合併成一個,從而共同確認每個區塊。

新的地址壓縮機制能將存儲空間節省約 100 倍。

此次升級的目標是幫助 Tezos 處理更多交易,以支援實際應用。#GoldAndSilverHitRecordHighs

XTZ-5.9%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

微策略又購買了2,932 BTC ( ~ 2.641億美元 ),成交價約為$90,061

目前他們持有712,647 BTC,平均買入價為$76,037

#ContentMiningRevampPublicBeta

目前他們持有712,647 BTC,平均買入價為$76,037

#ContentMiningRevampPublicBeta

BTC-6.42%

- 讚賞

- 1

- 留言

- 轉發

- 分享

🇨🇦 加拿大宣佈不追求與中國的自由貿易協議,原因是特朗普總統威脅徵收100%的關稅

總理馬克·卡尼(Mark Carney)強調,加拿大遵守USMCA與美國和墨西哥的協議,並且在未通知兩個夥伴之前,不會與任何國家簽署大型貿易協議。#GoldAndSilverHitRecordHighs

查看原文總理馬克·卡尼(Mark Carney)強調,加拿大遵守USMCA與美國和墨西哥的協議,並且在未通知兩個夥伴之前,不會與任何國家簽署大型貿易協議。#GoldAndSilverHitRecordHighs

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

🇺🇸🇨🇦 唐納德·特朗普總統:

加拿大正以系統性的方式自我毀滅。與中國的協議對他們來說是一場災難,並將被記入歷史,成為最糟糕的協議之一。他們的企業正大量轉移到美國。我希望加拿大能夠存活並且強勁發展。

...

中國正逐步全面控制曾經偉大的加拿大。看到這一切令人難過。我只希望他們讓冰球安靜地進行。#TrumpWithdrawsEUTariffThreats

查看原文加拿大正以系統性的方式自我毀滅。與中國的協議對他們來說是一場災難,並將被記入歷史,成為最糟糕的協議之一。他們的企業正大量轉移到美國。我希望加拿大能夠存活並且強勁發展。

...

中國正逐步全面控制曾經偉大的加拿大。看到這一切令人難過。我只希望他們讓冰球安靜地進行。#TrumpWithdrawsEUTariffThreats

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

熱門話題

查看更多7.96萬 熱度

6563 熱度

1947 熱度

2951 熱度

7465 熱度

置頂

#交易員說Gate廣場

跟單交易員訪談來襲!我們將採訪數位收益勝率優秀的交易員,分享他們在廣場記錄交易的體驗。

今天我們請到的是,在廣場分享操盤RIVER 取得10000USDT收益的 TX纏論量化實盤全自動。聽聽他使用Gate廣場記錄交易的心得吧!

更多關於明星交易員

https://www.gate.com/zh/announcements/article/49427Gate 廣場內容挖礦煥新公測進行中!

發帖互動帶交易,最高享 60% 手續費返佣!

參與教程

1️⃣ 報名公測:https://www.gate.com/questionnaire/7358

2️⃣ 用代幣組件 / 跟單卡片發帖,分享行情觀點

3️⃣ 與粉絲互動,促成真實交易

🎁 獎勵機制

• 基礎返佣:粉絲交易即得 10%

• 發帖 / 互動達標:每週再加 10%

• 排名加碼:周榜前 100 再享 10%

• 新 / 回歸創作者:返佣翻倍

活動詳情:https://www.gate.com/announcements/article/49475

加入 Gate 廣場,變身內容礦工,讓內容真正變成長期收益Gate 廣場“新星計劃”正式上線!

開啟加密創作之旅,瓜分月度 $10,000 獎勵!

參與資格:從未在 Gate 廣場發帖,或連續 7 天未發帖的創作者

立即報名:https://www.gate.com/questionnaire/7396

您將獲得:

💰 1,000 USDT 月度創作獎池 + 首帖 $50 倉位體驗券

🔥 半月度「爆款王」:Gate 50U 精美周邊

⭐ 月度前 10「新星英雄榜」+ 粉絲達標榜單 + 精選帖曝光扶持

加入 Gate 廣場,贏獎勵 ,拿流量,建立個人影響力!

詳情:https://www.gate.com/announcements/article/49672