#CryptoRelatedStocksRallyBroadly

🚀 #CryptoRelatedStocksRallyBroadly – 仮想通貨関連株の広範な上昇が2026年2月下旬に到来! 🚀

仮想通貨に関連する株式は現在、広範な上昇局面を迎えています — つまり、暗号通貨、ブロックチェーン、マイニング、取引所、デジタル資産に関わるほとんどの企業が、孤立した上昇ではなく、強い価格上昇を同時に見せているのです。

これは一時的な上昇ではなく、ビットコインの急激な回復と暗号市場全体のポジティブなセンチメントの変化に密接に追随した sector 全体の調整です。

最新の状況 (2026年2月26日現在):

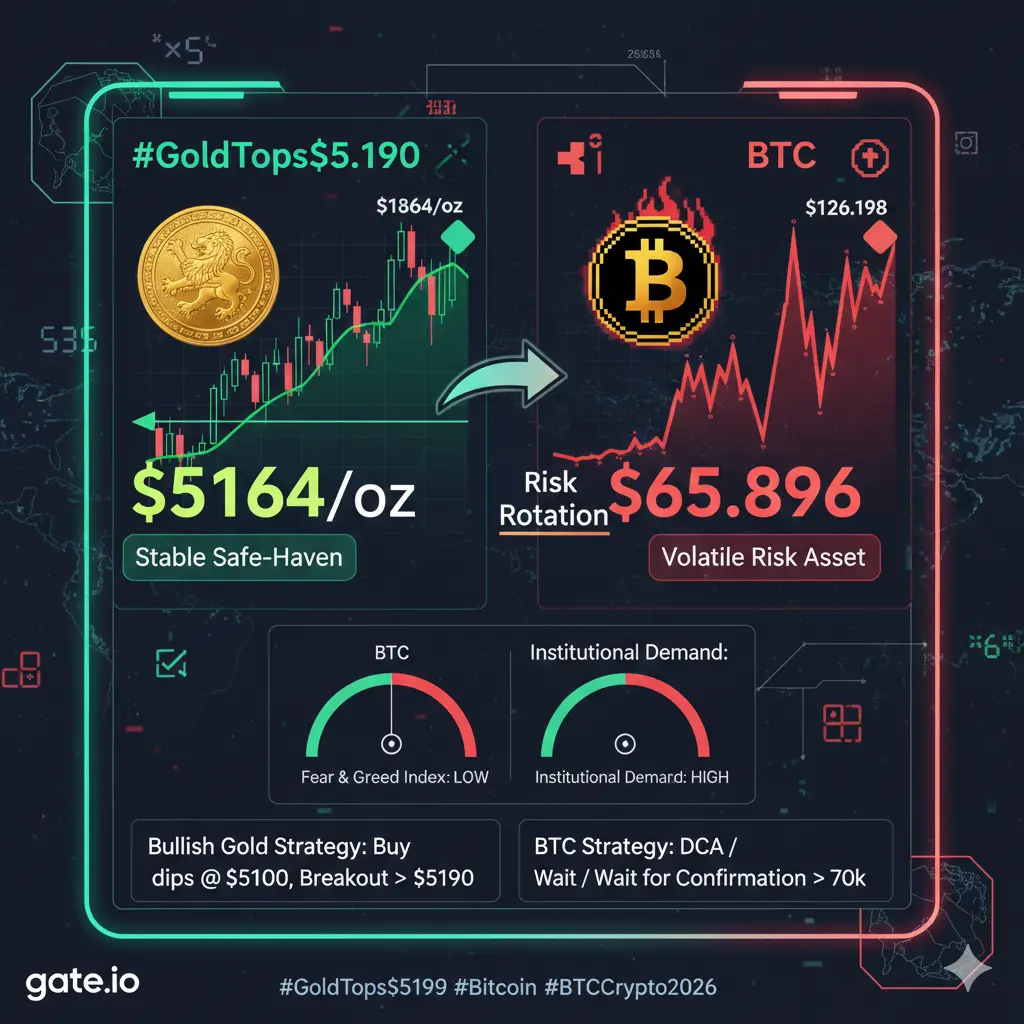

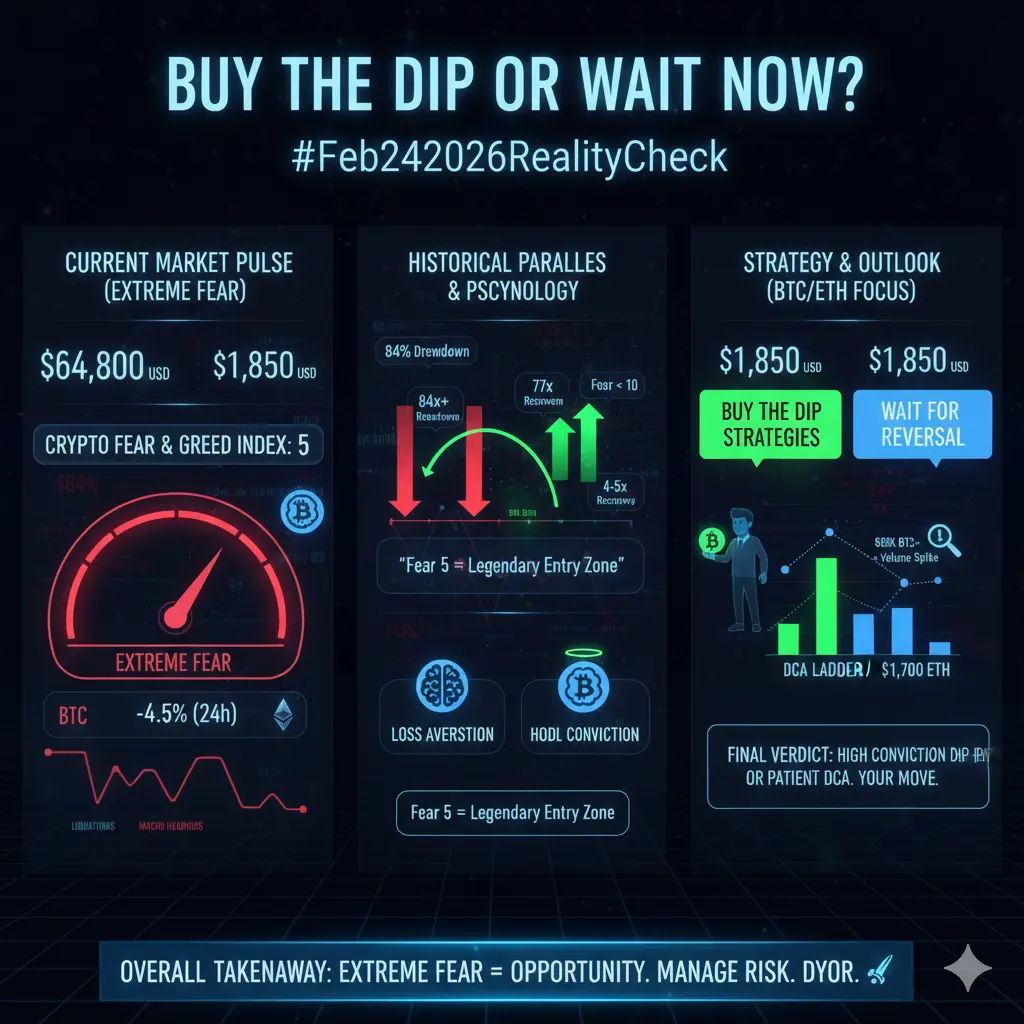

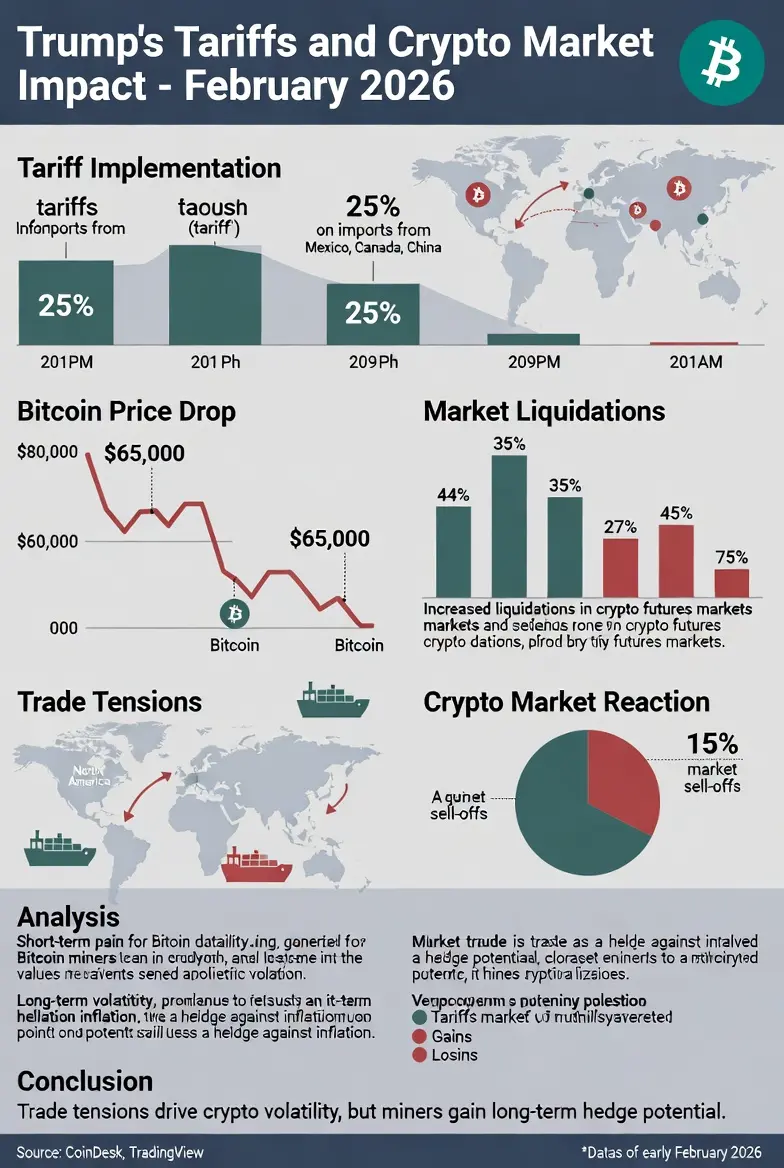

ビットコイン (BTC) は、週初の下落から回復し、$68,000〜$69,000付近に戻っています (直近のセッションで安値の$63,000以下から約7〜10%上昇)。

暗号市場全体の時価総額は、過去24時間で約6%以上増加し、リスク志向の回復を反映しています。

このリリーフラリーは、数週間にわたる圧力の後に起こったもので、BTCは年初から大きく下落していますが、マクロ経済のセンチメント改善や業界内の好調な企業収益、ショートスクイーズにより安定化の兆しを見せています。

「仮想通貨関連株が広範に上昇する」ことの真意 – 詳細な解説

仮想通貨関連株の定義

これらは、仮想通貨に直接関与している上場企業です:

仮想通貨取引所 (例:Coinbase – COIN)

ビットコインの保有/管理企業 (例:MicroStrategy/Strategy Inc. – MSTR)

ステーブルコイン発行者 (例:Circle Internet Group – CRCL)

AIや高性能コンピューティングに pivot するマイニング企業 (例:Cipher Mining – CIFR、その他ビットコインマイニング株指数の企業)

その他、デジタル資産に関わるカストディ、決済、インフラ関連企業。

広範な上昇の説明

「広範に」とは、上昇がグループ全体にわたっていることを意味します — 1つや2つの銘柄だけではなく。ビットコインや暗号市場が反発すると、これらの株は高いベータ値 (市場全体よりも大きく動く)ため、動きが増幅されることが多いです。

これは、2026年の厳しいスタートの後に、セクター全体に楽観的なムードが戻りつつあることを示しています (一部の報告では、年初から2月中旬までBTCは約23%下落しており、記録的に弱い年始となっています)。

最新の主要例とパフォーマンス (2026年2月のアップデート)

Coinbase Global (COIN): 直近のセッションで約13〜14%上昇 — 取引量の増加、新規ユーザーの活発化、全体的な暗号熱の高まりの恩恵を受けています。米国最大の取引所として、市場の健康状態を直接反映しています。

Strategy Inc. (MSTR – 旧MicroStrategy): 約8〜9%上昇 — 大規模な企業ビットコイン保有者は、BTCの回復時にリードしやすく、レバレッジ効果を持ちます。

Circle Internet Group (CRCL): 1日で劇的に上昇 (約32〜35%)、Q4の好調な収益発表により、ステーブルコインの収益性と売上成長が加速。(USDC発行者)。このブレイクアウトは、全体の弱さを打ち破り、センチメントを高めました。

マイニング株:ビットコインマイニング指数は約5〜6%上昇;Cipher Digital (CIFR)などの個別銘柄は、決算後に二桁の上昇を記録し、AIやデータセンターへの pivot により多角的な収益を目指す動きも見られます。

その他の銘柄:BitMineなどの銘柄も、テックラリーの波及により広範なリリーフを見せています。

これらの動きは、BTCのショートスクイーズやアルトコインの強さ (例:ETH、SOLが急騰) と一致し、アルトコインシーズンの指標を押し上げています。

なぜ今このラリーが起きているのか?

ビットコインの反発要因:過剰売り状態からの急激な回復 (ショートスクイーズ + 政策演説やマクロシフトなどのイベント後のセンチメント改善)。BTCは重要なハードルを試しており、突破すれば勢いが持続します。

収益のきっかけ:堅調な決算報告 $70K 例:Circleの収益増加(、暗号のボラティリティの中で実体的なファンダメンタルズを提供。

市場全体との連動:暗号株はしばしばテックやリスク資産と連動して動きます;最近のウォール街のテック株の反発は、マイナーや取引所の上昇を後押ししました。

圧力後のリリーフ:過去数年で最悪のスタートを切ったBTC/ETHの売り圧力の後、この反発は「リリーフラリー」のように感じられます — デレバレッジが完了し、買い手が押し目買いに入っています。アナリストは、資金流入やカタリストが持続しない限り、一時的なものと警告しています。

市場への示唆

ポジティブなセンチメントの変化:広範な参加は、暗号エコシステムに対する信頼の回復を示しています — それはBTCだけでなく、その周辺の企業も含みます。

ハイベータの投資:これらの株は、暗号の動きを増幅し、トークンを直接保有せずにレバレッジ効果を得ることができます。

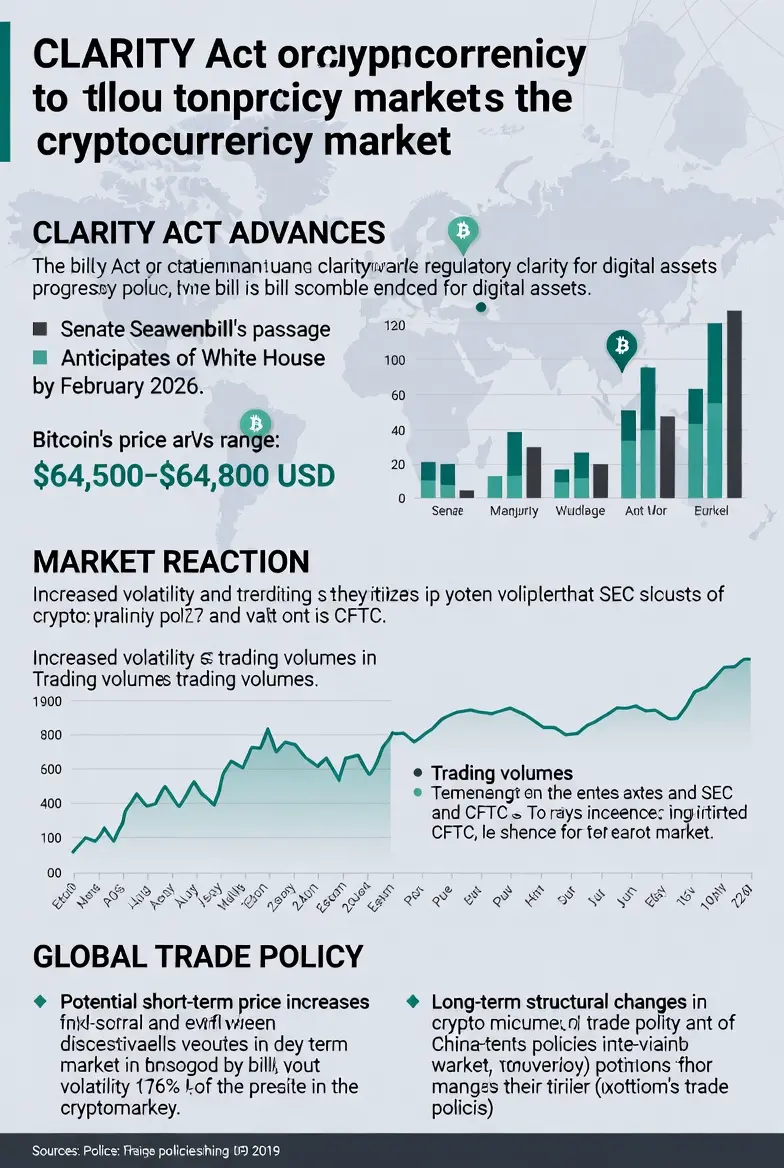

さらなる可能性:BTCが$70K超の抵抗線を突破し、維持すれば、引き続き広範な上昇が期待できます。ETFの資金流入、規制の動き、マクロリスク志向に注目しましょう。

注意点:これは継続的な調整の中の短期的な反発と見る向きもあり、保有者が強気に売る可能性や、ボラティリティが高いままであることに注意が必要です。

最終的なポイント

仮想通貨関連株の広範なラリーは、2026年2月下旬に sector が息を吹き返し、反発している明確な兆候です。ビットコインが$68K+の水準で安定し、Circleなどの主要プレイヤーの好調な収益、テック市場からの波及効果により、この広範な上昇は、年初の荒れたスタートにもかかわらず、機関投資家や個人投資家の関心が高まっていることを示しています。

これは、より強い回復の初期段階か、またはクラシックなリリーフラリーの可能性もあります。いずれにせよ、暗号関連企業がデジタル資産の勢いに非常に敏感であり続けている証拠です。

🚀 #CryptoRelatedStocksRallyBroadly – 仮想通貨関連株の広範な上昇が2026年2月下旬に到来! 🚀

仮想通貨に関連する株式は現在、広範な上昇局面を迎えています — つまり、暗号通貨、ブロックチェーン、マイニング、取引所、デジタル資産に関わるほとんどの企業が、孤立した上昇ではなく、強い価格上昇を同時に見せているのです。

これは一時的な上昇ではなく、ビットコインの急激な回復と暗号市場全体のポジティブなセンチメントの変化に密接に追随した sector 全体の調整です。

最新の状況 (2026年2月26日現在):

ビットコイン (BTC) は、週初の下落から回復し、$68,000〜$69,000付近に戻っています (直近のセッションで安値の$63,000以下から約7〜10%上昇)。

暗号市場全体の時価総額は、過去24時間で約6%以上増加し、リスク志向の回復を反映しています。

このリリーフラリーは、数週間にわたる圧力の後に起こったもので、BTCは年初から大きく下落していますが、マクロ経済のセンチメント改善や業界内の好調な企業収益、ショートスクイーズにより安定化の兆しを見せています。

「仮想通貨関連株が広範に上昇する」ことの真意 – 詳細な解説

仮想通貨関連株の定義

これらは、仮想通貨に直接関与している上場企業です:

仮想通貨取引所 (例:Coinbase – COIN)

ビットコインの保有/管理企業 (例:MicroStrategy/Strategy Inc. – MSTR)

ステーブルコイン発行者 (例:Circle Internet Group – CRCL)

AIや高性能コンピューティングに pivot するマイニング企業 (例:Cipher Mining – CIFR、その他ビットコインマイニング株指数の企業)

その他、デジタル資産に関わるカストディ、決済、インフラ関連企業。

広範な上昇の説明

「広範に」とは、上昇がグループ全体にわたっていることを意味します — 1つや2つの銘柄だけではなく。ビットコインや暗号市場が反発すると、これらの株は高いベータ値 (市場全体よりも大きく動く)ため、動きが増幅されることが多いです。

これは、2026年の厳しいスタートの後に、セクター全体に楽観的なムードが戻りつつあることを示しています (一部の報告では、年初から2月中旬までBTCは約23%下落しており、記録的に弱い年始となっています)。

最新の主要例とパフォーマンス (2026年2月のアップデート)

Coinbase Global (COIN): 直近のセッションで約13〜14%上昇 — 取引量の増加、新規ユーザーの活発化、全体的な暗号熱の高まりの恩恵を受けています。米国最大の取引所として、市場の健康状態を直接反映しています。

Strategy Inc. (MSTR – 旧MicroStrategy): 約8〜9%上昇 — 大規模な企業ビットコイン保有者は、BTCの回復時にリードしやすく、レバレッジ効果を持ちます。

Circle Internet Group (CRCL): 1日で劇的に上昇 (約32〜35%)、Q4の好調な収益発表により、ステーブルコインの収益性と売上成長が加速。(USDC発行者)。このブレイクアウトは、全体の弱さを打ち破り、センチメントを高めました。

マイニング株:ビットコインマイニング指数は約5〜6%上昇;Cipher Digital (CIFR)などの個別銘柄は、決算後に二桁の上昇を記録し、AIやデータセンターへの pivot により多角的な収益を目指す動きも見られます。

その他の銘柄:BitMineなどの銘柄も、テックラリーの波及により広範なリリーフを見せています。

これらの動きは、BTCのショートスクイーズやアルトコインの強さ (例:ETH、SOLが急騰) と一致し、アルトコインシーズンの指標を押し上げています。

なぜ今このラリーが起きているのか?

ビットコインの反発要因:過剰売り状態からの急激な回復 (ショートスクイーズ + 政策演説やマクロシフトなどのイベント後のセンチメント改善)。BTCは重要なハードルを試しており、突破すれば勢いが持続します。

収益のきっかけ:堅調な決算報告 $70K 例:Circleの収益増加(、暗号のボラティリティの中で実体的なファンダメンタルズを提供。

市場全体との連動:暗号株はしばしばテックやリスク資産と連動して動きます;最近のウォール街のテック株の反発は、マイナーや取引所の上昇を後押ししました。

圧力後のリリーフ:過去数年で最悪のスタートを切ったBTC/ETHの売り圧力の後、この反発は「リリーフラリー」のように感じられます — デレバレッジが完了し、買い手が押し目買いに入っています。アナリストは、資金流入やカタリストが持続しない限り、一時的なものと警告しています。

市場への示唆

ポジティブなセンチメントの変化:広範な参加は、暗号エコシステムに対する信頼の回復を示しています — それはBTCだけでなく、その周辺の企業も含みます。

ハイベータの投資:これらの株は、暗号の動きを増幅し、トークンを直接保有せずにレバレッジ効果を得ることができます。

さらなる可能性:BTCが$70K超の抵抗線を突破し、維持すれば、引き続き広範な上昇が期待できます。ETFの資金流入、規制の動き、マクロリスク志向に注目しましょう。

注意点:これは継続的な調整の中の短期的な反発と見る向きもあり、保有者が強気に売る可能性や、ボラティリティが高いままであることに注意が必要です。

最終的なポイント

仮想通貨関連株の広範なラリーは、2026年2月下旬に sector が息を吹き返し、反発している明確な兆候です。ビットコインが$68K+の水準で安定し、Circleなどの主要プレイヤーの好調な収益、テック市場からの波及効果により、この広範な上昇は、年初の荒れたスタートにもかかわらず、機関投資家や個人投資家の関心が高まっていることを示しています。

これは、より強い回復の初期段階か、またはクラシックなリリーフラリーの可能性もあります。いずれにせよ、暗号関連企業がデジタル資産の勢いに非常に敏感であり続けている証拠です。