# JapanBondMarketSell-Off

39.86K

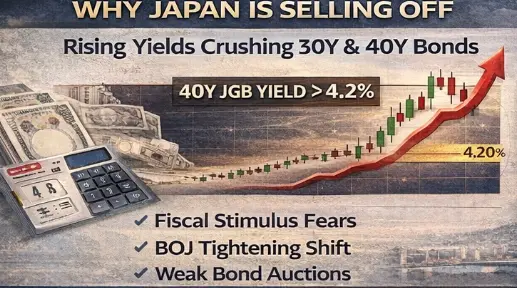

Japan’s bond market saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after plans to end fiscal tightening and boost spending. Will this impact global rates and risk assets?

Crypto_Exper

#JapanBondMarketSell-Off

A New Test for Global Markets Begins!

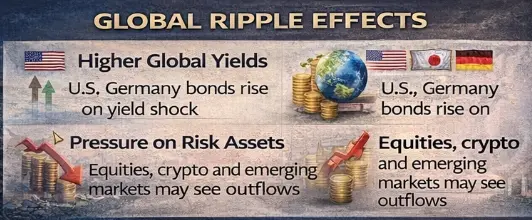

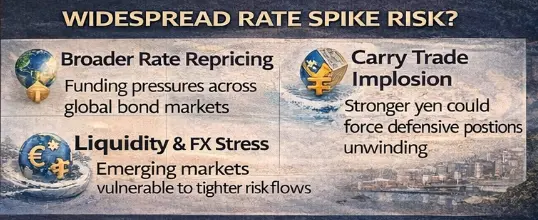

The global economy has entered 2026 with a seismic shift. The historic sell-off in the Japanese Government Bond (JGB) market is echoing far beyond Tokyo, impacting everything from Wall Street to the crypto ecosystem.

The Bank of Japan’s (BoJ) interest rate policy shift—the first in decades—is fundamentally reshaping global liquidity flows. At Gate.io, we are putting the effects of this macroeconomic storm on digital assets under the microscope!

What’s Happening? (Key Developments)

1. The End of Yield Curve Control: As the BoJ

A New Test for Global Markets Begins!

The global economy has entered 2026 with a seismic shift. The historic sell-off in the Japanese Government Bond (JGB) market is echoing far beyond Tokyo, impacting everything from Wall Street to the crypto ecosystem.

The Bank of Japan’s (BoJ) interest rate policy shift—the first in decades—is fundamentally reshaping global liquidity flows. At Gate.io, we are putting the effects of this macroeconomic storm on digital assets under the microscope!

What’s Happening? (Key Developments)

1. The End of Yield Curve Control: As the BoJ

- Reward

- 1

- Comment

- Repost

- Share

#JapanBondMarketSell-Off Japan’s bond market is experiencing one of its most important shifts in decades, quietly sending signals across global financial systems. After years of ultra-low yields, long-term Japanese government bonds have suddenly repriced, with 30-year and 40-year yields jumping sharply. This move has caught global investors off guard, as Japan has traditionally acted as the world’s anchor of low interest rates.

The primary driver behind this sell-off is growing concern over Japan’s fiscal direction. Government discussions around easing fiscal discipline, increasing public spen

The primary driver behind this sell-off is growing concern over Japan’s fiscal direction. Government discussions around easing fiscal discipline, increasing public spen

- Reward

- 18

- 18

- Repost

- Share

LittleQueen :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off After the Yield Shock — How Japan’s Quiet Shift May Reshape Global Capital

As 2026 advances, Japan’s bond market is no longer behaving like a passive observer in global finance. What began as a modest repricing in long-dated government bonds is evolving into a structural signal — one that global investors can no longer afford to ignore.

The key development is persistence.

Yields have not retraced meaningfully. Instead, they are stabilizing at higher levels, indicating that the market is beginning to accept a new equilibrium rather than reacting to a temporary distortio

As 2026 advances, Japan’s bond market is no longer behaving like a passive observer in global finance. What began as a modest repricing in long-dated government bonds is evolving into a structural signal — one that global investors can no longer afford to ignore.

The key development is persistence.

Yields have not retraced meaningfully. Instead, they are stabilizing at higher levels, indicating that the market is beginning to accept a new equilibrium rather than reacting to a temporary distortio

- Reward

- 12

- 11

- Repost

- Share

MingDragonX :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

A New Test for Global Markets Begins!

The global economy has entered 2026 with a seismic shift. The historic sell-off in the Japanese Government Bond (JGB) market is echoing far beyond Tokyo, impacting everything from Wall Street to the crypto ecosystem.

The Bank of Japan’s (BoJ) interest rate policy shift—the first in decades—is fundamentally reshaping global liquidity flows. At Gate.io, we are putting the effects of this macroeconomic storm on digital assets under the microscope!

What’s Happening? (Key Developments)

1. The End of Yield Curve Control: As the BoJ

A New Test for Global Markets Begins!

The global economy has entered 2026 with a seismic shift. The historic sell-off in the Japanese Government Bond (JGB) market is echoing far beyond Tokyo, impacting everything from Wall Street to the crypto ecosystem.

The Bank of Japan’s (BoJ) interest rate policy shift—the first in decades—is fundamentally reshaping global liquidity flows. At Gate.io, we are putting the effects of this macroeconomic storm on digital assets under the microscope!

What’s Happening? (Key Developments)

1. The End of Yield Curve Control: As the BoJ

- Reward

- 62

- 64

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off

The late-January 2026 sell-off in Japanese Government Bonds is not a local market accident. It’s a structural break. When 40-year JGB yields breach 4.2% for the first time since their 2007 debut, the signal isn’t volatility it’s regime change. Japan is no longer anchoring global rates. And that has consequences everywhere.

The immediate trigger was political, not technical. Prime Minister Sanae Takaichi’s decision to abandon fiscal tightening in favor of an expansionary stimulus roughly $135 billion, including food tax cuts shattered the assumption that Japan would re

The late-January 2026 sell-off in Japanese Government Bonds is not a local market accident. It’s a structural break. When 40-year JGB yields breach 4.2% for the first time since their 2007 debut, the signal isn’t volatility it’s regime change. Japan is no longer anchoring global rates. And that has consequences everywhere.

The immediate trigger was political, not technical. Prime Minister Sanae Takaichi’s decision to abandon fiscal tightening in favor of an expansionary stimulus roughly $135 billion, including food tax cuts shattered the assumption that Japan would re

BTC1,77%

- Reward

- 13

- 80

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#JapanBondMarketSell-Off Japan Bond Market Sell-Off: Quiet Shockwaves in Global Finance

1️⃣ Unexpected Yield Surge:

In early 2026, Japanese government bond yields surged sharply, particularly in the 30-year and 40-year maturities, moving over 25 basis points. While initially seen as a domestic event, global investors are increasingly interpreting this as a pivotal macro development.

2️⃣ Japan’s Historical Role:

For decades, Japan maintained ultra-low yields, which shaped global liquidity flows. Japanese bonds provided a baseline for risk pricing, encouraging capital to move into U.S. Treasurie

1️⃣ Unexpected Yield Surge:

In early 2026, Japanese government bond yields surged sharply, particularly in the 30-year and 40-year maturities, moving over 25 basis points. While initially seen as a domestic event, global investors are increasingly interpreting this as a pivotal macro development.

2️⃣ Japan’s Historical Role:

For decades, Japan maintained ultra-low yields, which shaped global liquidity flows. Japanese bonds provided a baseline for risk pricing, encouraging capital to move into U.S. Treasurie

- Reward

- 10

- 3

- Repost

- Share

HeavenSlayerFaithful :

:

Buy financial management 💎View More

#JapanBondMarketSell-Off JapanBondMarketSellOff The recent surge in Japanese government bond yields, particularly the sharp rise of more than 25 basis points in 30-year and 40-year maturities, represents one of the most underappreciated macro shifts of early 2026 and may signal a deeper transition in the global financial landscape rather than a simple domestic adjustment. For decades, Japan’s ultra-low-yield policy anchored global liquidity behavior, encouraging capital to flow outward into U.S. Treasuries, global equities, emerging markets, and alternative assets, effectively suppressing glob

- Reward

- 2

- 3

- Repost

- Share

Yunna :

:

2026 gogoView More

#JapanBondMarketSell-Off #JapanBondMarketSellOff

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

BTC1,77%

- Reward

- 12

- 11

- Repost

- Share

QueenOfTheDay :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off

📉 Japan’s Bond Market Shock: What’s Happening and Why It Matters Globally

Japan’s government bond market has just seen one of its most dramatic moves in decades — sharp sell-offs in 30-year and 40-year bonds, pushing yields significantly higher as fiscal policy shifts collide with investor expectations.

Recent data shows ultra-long Japanese Government Bond (JGB) yields rising to levels not seen since issuance, with the 40-year yield breaking above ~4.2% and long rates jumping more than 25 basis points in a short span.

This is notable because Japan has long been the

📉 Japan’s Bond Market Shock: What’s Happening and Why It Matters Globally

Japan’s government bond market has just seen one of its most dramatic moves in decades — sharp sell-offs in 30-year and 40-year bonds, pushing yields significantly higher as fiscal policy shifts collide with investor expectations.

Recent data shows ultra-long Japanese Government Bond (JGB) yields rising to levels not seen since issuance, with the 40-year yield breaking above ~4.2% and long rates jumping more than 25 basis points in a short span.

This is notable because Japan has long been the

- Reward

- 14

- 9

- Repost

- Share

QueenOfTheDay :

:

Happy New Year! 🤑View More

#JapanBondMarketSell-Off After the Yield Shock — How Japan’s Quiet Shift May Reshape Global Capital

As 2026 advances, Japan’s bond market is no longer behaving like a passive observer in global finance. What began as a modest repricing in long-dated government bonds is evolving into a structural signal — one that global investors can no longer afford to ignore.

The key development is persistence.

Yields have not retraced meaningfully. Instead, they are stabilizing at higher levels, indicating that the market is beginning to accept a new equilibrium rather than reacting to a temporary distortio

As 2026 advances, Japan’s bond market is no longer behaving like a passive observer in global finance. What began as a modest repricing in long-dated government bonds is evolving into a structural signal — one that global investors can no longer afford to ignore.

The key development is persistence.

Yields have not retraced meaningfully. Instead, they are stabilizing at higher levels, indicating that the market is beginning to accept a new equilibrium rather than reacting to a temporary distortio

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

6.23K Popularity

68.51K Popularity

26.26K Popularity

9.06K Popularity

8.81K Popularity

8.07K Popularity

7.33K Popularity

6.69K Popularity

73.5K Popularity

20.08K Popularity

81.61K Popularity

23.18K Popularity

49.27K Popularity

43.23K Popularity

178.35K Popularity

News

View MoreDaily Memecoin creation on Solana reaches 11-month high

9 m

SpaceX plans to launch an IPO in June 2026, with a valuation directly reaching $1.5 trillion, potentially rewriting the global listing record

13 m

Robert Kiyosaki Again Bearsish on the US Dollar: Gold and Silver Hit Record Highs, Can Bitcoin Maintain the Safe-Haven Narrative?

16 m

Trump comments on the weak dollar, options traders turn bearish on the dollar

17 m

Nietzsche Penguin Coin surges nearly 40% in a single day, with whales returning and increasing their holdings. Can it reach $0.16 again?

19 m

Pin