# BitcoinFallsBehindGold

4.15K

MrFlower_XingChen

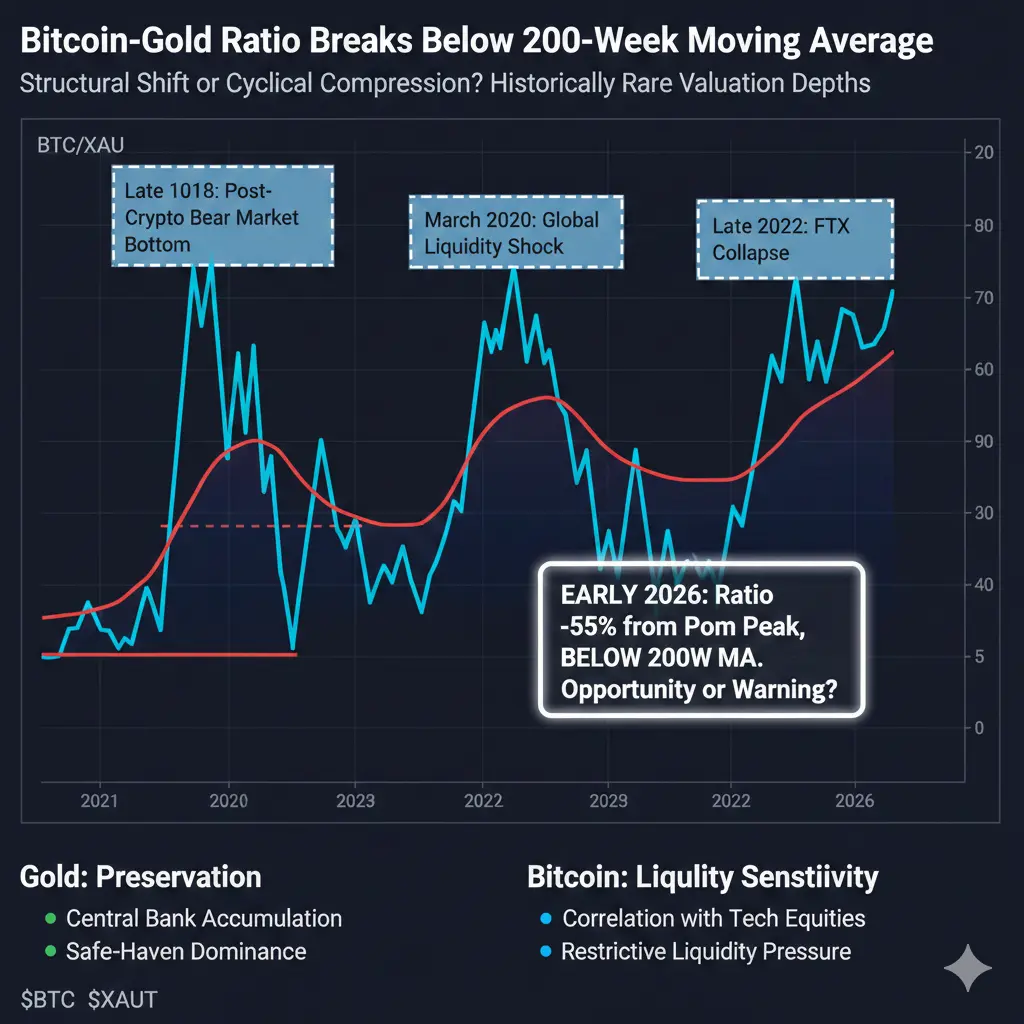

#BitcoinFallsBehindGold Bitcoin–Gold Ratio Breaks Below 200-Week Moving Average — Opportunity or Structural Warning?

In the global macro-financial environment of early 2026, a highly important long-term indicator has once again sent a powerful signal. The Bitcoin-to-Gold ratio has retraced approximately 55% from its previous peak and has now decisively fallen below the 200-week moving average, a level widely regarded as the long-term equilibrium threshold.

Within crypto market structure, the 200-week moving average is often described as the final line of defense. Historically, only a handful o

In the global macro-financial environment of early 2026, a highly important long-term indicator has once again sent a powerful signal. The Bitcoin-to-Gold ratio has retraced approximately 55% from its previous peak and has now decisively fallen below the 200-week moving average, a level widely regarded as the long-term equilibrium threshold.

Within crypto market structure, the 200-week moving average is often described as the final line of defense. Historically, only a handful o

XAUT0.79%

- Reward

- 5

- 145

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

BTC-1.11%

- Reward

- 5

- 108

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Why the “Safe Haven” Narrative Is Being Repriced

In an environment of rising global uncertainty, markets are sending a clear signal:

capital is prioritizing stability over growth.

While gold and silver continue to print new highs, Bitcoin is lagging both in price action and investor confidence.

📊 Crypto Fear & Greed Index: 20 — Extreme Fear

This level reflects a market driven more by defensive positioning than risk-taking.

🔍 Key Market Signals

Bitcoin price: ~88,150 USDT

BTC YTD performance: -6.25%

Gold: +65–70% over the past year

Volatility: Elevated across BTC & ETH

Capital flow: Risk-off

In an environment of rising global uncertainty, markets are sending a clear signal:

capital is prioritizing stability over growth.

While gold and silver continue to print new highs, Bitcoin is lagging both in price action and investor confidence.

📊 Crypto Fear & Greed Index: 20 — Extreme Fear

This level reflects a market driven more by defensive positioning than risk-taking.

🔍 Key Market Signals

Bitcoin price: ~88,150 USDT

BTC YTD performance: -6.25%

Gold: +65–70% over the past year

Volatility: Elevated across BTC & ETH

Capital flow: Risk-off

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 11

- 13

- Repost

- Share

Ryakpanda :

:

Hold on tight, we're about to take off 🛫View More

#BitcoinFallsBehindGold

The Traditional Victor of the Digital Age

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

The Traditional Victor of the Digital Age

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

BTC-1.11%

- Reward

- 16

- 21

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

- Reward

- 13

- 16

- Repost

- Share

ShainingMoon :

:

HODL Tight 💪View More

#BitcoinFallsBehindGold

Today’s market conversation is increasingly shaped by a quiet but meaningful comparison: Bitcoin, often called “digital gold,” is currently falling behind actual gold in terms of performance and investor preference. While Bitcoin remains a dominant force in the crypto ecosystem, gold has taken the lead as capital seeks stability over speculation. This shift doesn’t signal the end of Bitcoin’s relevance, but it does highlight how market priorities change when uncertainty rises.

Gold’s recent strength reflects a classic flight-to-safety move. As macro pressures persist r

Today’s market conversation is increasingly shaped by a quiet but meaningful comparison: Bitcoin, often called “digital gold,” is currently falling behind actual gold in terms of performance and investor preference. While Bitcoin remains a dominant force in the crypto ecosystem, gold has taken the lead as capital seeks stability over speculation. This shift doesn’t signal the end of Bitcoin’s relevance, but it does highlight how market priorities change when uncertainty rises.

Gold’s recent strength reflects a classic flight-to-safety move. As macro pressures persist r

BTC-1.11%

- Reward

- 7

- 10

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

PANews January 26 News, according to an official announcement, Gate CandyDrop launched an exclusive airdrop event for precious metals and index zones from 17:00 on January 26 to 17:00 on February 10 (UTC+8). During the event, users who complete designated contract trading tasks can earn candies and participate in sharing a super airdrop of 20 XAUT (approximately 622g of physical gold value), with a maximum of 0.15 XAUT (about 4.665g of gold) per person.

In addition, Gate has comprehensively covered precious metal assets across multiple product lines including spot trading, TradFi, flash exchan

In addition, Gate has comprehensively covered precious metal assets across multiple product lines including spot trading, TradFi, flash exchan

XAUT0.79%

- Reward

- 5

- 7

- Repost

- Share

MoonGirl :

:

2026 GOGOGO 👊View More

🪙 📉 📈 🟡🛡️🌍 ⚖️ ⏳🔒💰 🔥

"Gold tests time, and Bitcoin tests patience." This idea sounds especially relevant today. At the beginning of 2026, financial markets again remind us that during periods of uncertainty, investors instinctively return to what has withstood the test of a century. While Bitcoin is trying to maintain balance after powerful growth cycles, gold confidently occupies a central place in the global capital allocation.

The current dynamics clearly demonstrate a shift in priorities. Bitcoin mostly fluctuates within a limited range, responding to every signal from liquidity, i

View Original"Gold tests time, and Bitcoin tests patience." This idea sounds especially relevant today. At the beginning of 2026, financial markets again remind us that during periods of uncertainty, investors instinctively return to what has withstood the test of a century. While Bitcoin is trying to maintain balance after powerful growth cycles, gold confidently occupies a central place in the global capital allocation.

The current dynamics clearly demonstrate a shift in priorities. Bitcoin mostly fluctuates within a limited range, responding to every signal from liquidity, i

- Reward

- 8

- 4

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊View More

#BitcoinFallsBehindGold

Today's market chatter around **#BitcoinFallsBehindGold** is heating up, but the narrative feels a bit too defeatist for my taste. The original take paints it as gold decisively winning while Bitcoin sits on the sidelines—almost like a temporary funeral for "digital gold." I see it differently: this isn't Bitcoin losing; it's a classic cyclical pause in a much longer game where Bitcoin's upside asymmetry still dwarfs gold's steady grind. Here's my fully rewritten take in English, with my own commentary woven in.

### Bitcoin Isn't Falling Behind Gold—It's Just Playing a

Today's market chatter around **#BitcoinFallsBehindGold** is heating up, but the narrative feels a bit too defeatist for my taste. The original take paints it as gold decisively winning while Bitcoin sits on the sidelines—almost like a temporary funeral for "digital gold." I see it differently: this isn't Bitcoin losing; it's a classic cyclical pause in a much longer game where Bitcoin's upside asymmetry still dwarfs gold's steady grind. Here's my fully rewritten take in English, with my own commentary woven in.

### Bitcoin Isn't Falling Behind Gold—It's Just Playing a

BTC-1.11%

- Reward

- 7

- 14

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold

BTC vs Gold ratio down 55% and now below the 200W MA — that’s a serious shift in relative strength.

Capital is hiding in metals while Bitcoin cools off.

For me, this is not panic — this is a rotation signal.

I’m slowly accumulating BTC on weakness while keeping gold exposure as hedge on Gate TradFi.

When the ratio reverses, BTC usually moves fast.

Are you buying this dip or waiting for confirmation?

BTC vs Gold ratio down 55% and now below the 200W MA — that’s a serious shift in relative strength.

Capital is hiding in metals while Bitcoin cools off.

For me, this is not panic — this is a rotation signal.

I’m slowly accumulating BTC on weakness while keeping gold exposure as hedge on Gate TradFi.

When the ratio reverses, BTC usually moves fast.

Are you buying this dip or waiting for confirmation?

BTC-1.11%

- Reward

- 6

- 5

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

10.74K Popularity

91.79K Popularity

64.65K Popularity

19.42K Popularity

37.59K Popularity

31.49K Popularity

22.21K Popularity

96.45K Popularity

62.11K Popularity

31.92K Popularity

21.92K Popularity

15.58K Popularity

141.91K Popularity

32.29K Popularity

171.28K Popularity

News

View More3KDS(3KDS) will be launched on Gate for the first time. Hold 1GT to participate for free in the 333rd HODLer Airdrop to share 1 million tokens.

1 m

BitMine disclosed that last week they increased their holdings by 40,302 ETH, bringing the total holdings to approximately 4,243,000 ETH.

25 m

Société Générale: Now expects gold prices to reach $6,000 per ounce by the end of the year

29 m

U.S. publicly listed company OFA launches RWA tokenization platform Hearth

38 m

Zama's first crypto ICO completed, with a total auction amount of $118 million

43 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889