Post content & earn content mining yield

placeholder

AuntieDoesn_tCook

Has crypto died? Or is it time to buy the dip and increase positions?

View Original

- Reward

- like

- 1

- Repost

- Share

纽约翻仓大神 :

:

The formerReady for another day in crypto. #Bitcoin

BTC-5,78%

- Reward

- like

- Comment

- Repost

- Share

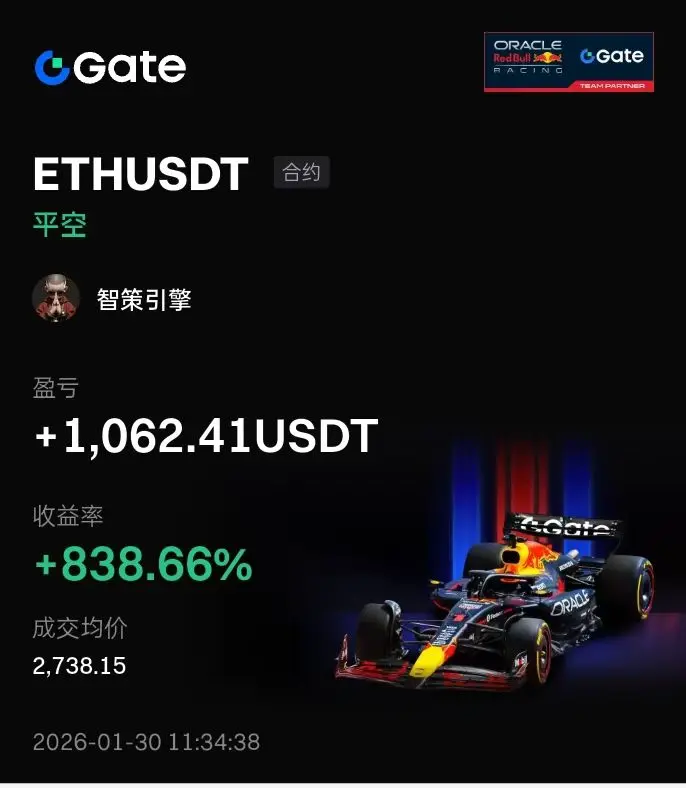

$ETH enters an observation period after a volume-expanding decline. Price action shows significant selling pressure. Combined with high trading volume and open interest, caution is needed to determine whether it is a liquidation of long positions or a phase of main force distribution. Currently, there is no clear bottom structure, and market sentiment is bearish.

ETH-6,49%

- Reward

- 1

- 1

- Repost

- Share

HenanBuffet :

:

Are you free?势不可挡

势不可挡

Created By@TokenDiscovererForTheWeb

Subscription Progress

0.00%

MC:

$0

Create My Token

Today I learned a chemistry fact: copper turns green after being exposed for a long time.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

GateUser-37f4a2e7 :

:

2026 GOGOGO 👊Crypto market wiped out overnight Total market cap plunges below $3 trillion with crypto-related stocks tumbling nearly 10

- Reward

- 1

- Comment

- Repost

- Share

Claiming airdrops in 2023: 1h before TGEClaiming airdrops in 2024: during TGEClaiming airdrops in 2025: 1h after TGEClaiming airdrops in 2026: next day after TGE

- Reward

- 2

- Comment

- Repost

- Share

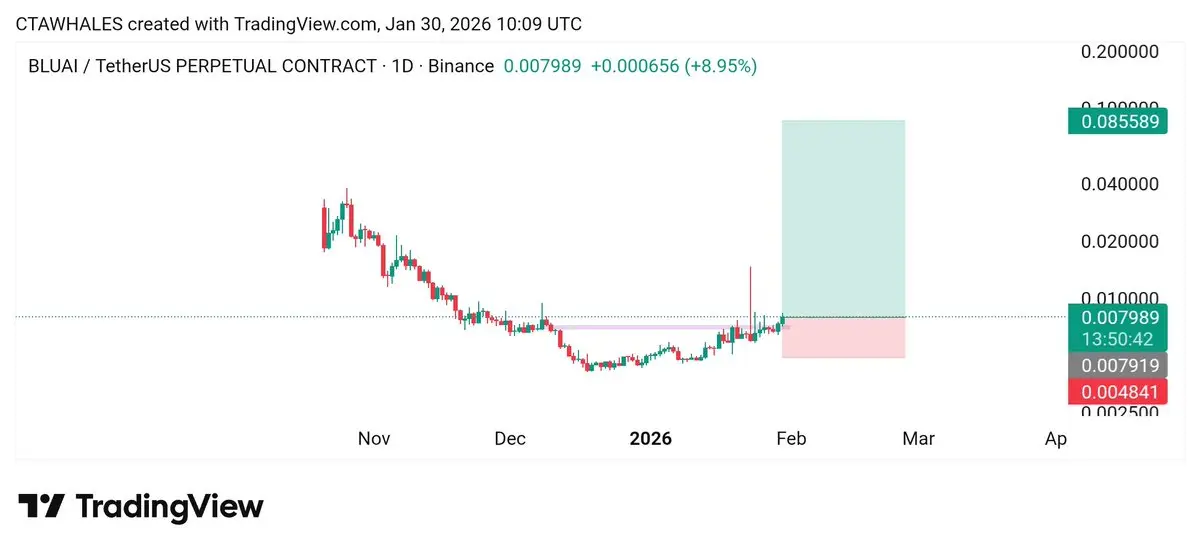

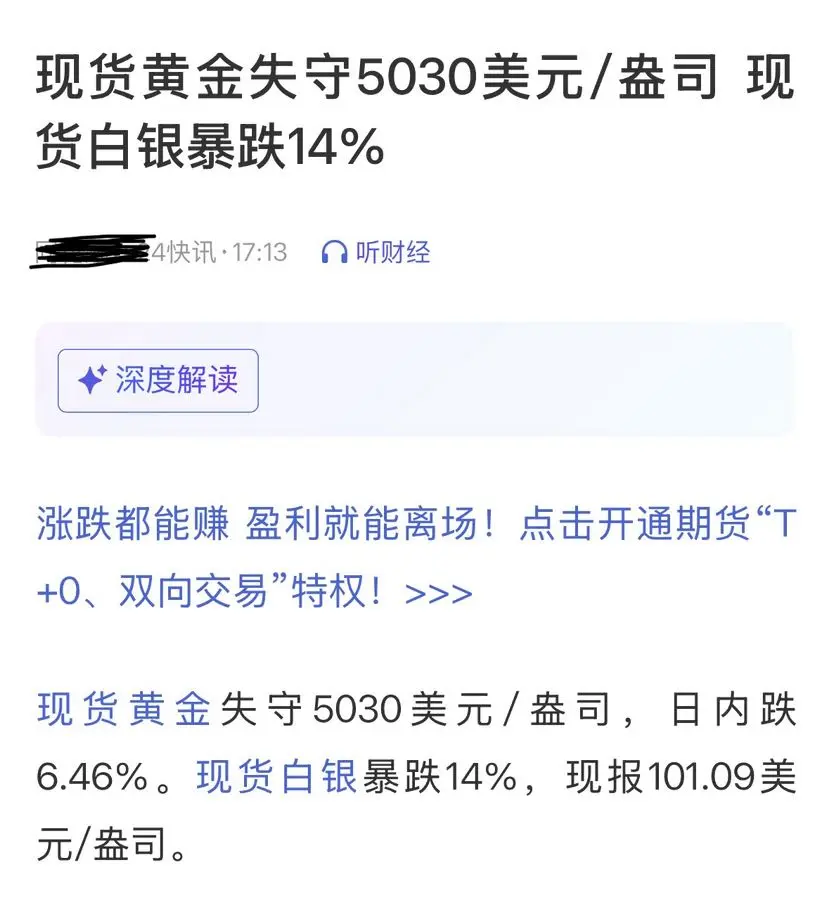

#PreciousMetalsPullBack 1. The "Dual Engine" Demand

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

DEFI-3,18%

- Reward

- like

- Comment

- Repost

- Share

Recently, do you feel that many crypto friends have shifted to trading gold and silver? They are also sharing on social media, but we've experienced this script before! BTC went crazy, ETH went crazy, and looking back, it's always the same beginning: prices soar to make everyone doubt their lives, then pull back and you can't find the bottom…^_^ History doesn't lie: In 1979, the Hunt brothers drove silver from $6 to $50, and gold surged to $850. And then? Silver hit a knee-jerk decline, and chaos ensued. In 2011, silver skyrocketed 150% in 8 months, and gold broke through $1900. Then a news st

View Original

- Reward

- 1

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3863?ref=AlZAVw8L&ref_type=132&utm_cmp=NVHYRllJ

- Reward

- like

- Comment

- Repost

- Share

IKUN

GTIKUN

Created By@GateUser-969f2f06

Listing Progress

0.05%

MC:

$3.23K

Create My Token

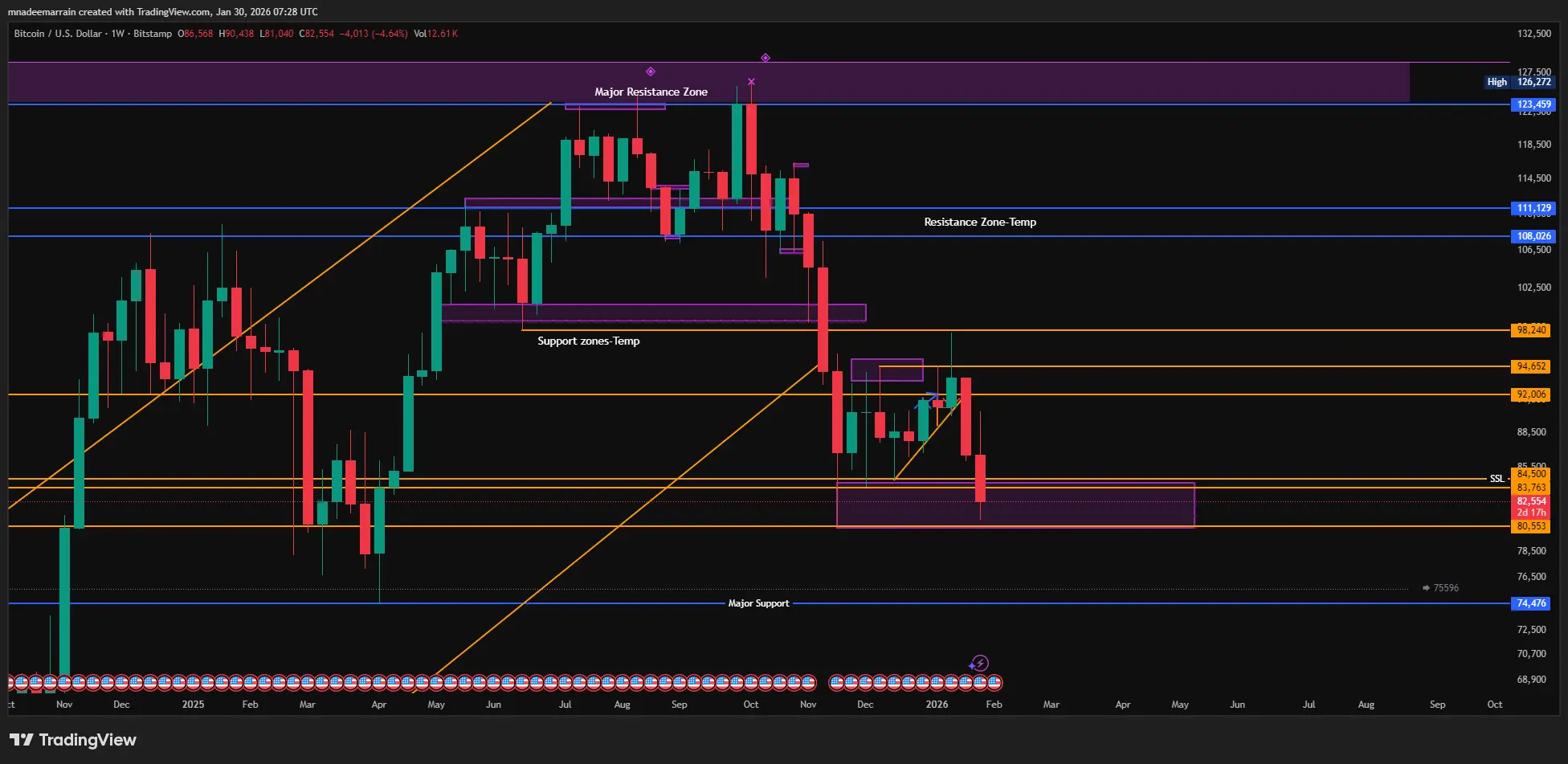

#btc Hold on

1. $BTC Almost touched the November lows. Now all eyes are on the $80,000 level, as if losing this level would mean Bitcoin's next price has entered a deep bear market.

2. Bitcoin at this level is teetering, with most retail investors looking at a target price of 74k. And hoping for a move to 64k. It sounds like a dramatic upcoming event, but reality often diverges from expectations. This level is just making you panic, so stay calm and step away from the trading surface.

1. $BTC Almost touched the November lows. Now all eyes are on the $80,000 level, as if losing this level would mean Bitcoin's next price has entered a deep bear market.

2. Bitcoin at this level is teetering, with most retail investors looking at a target price of 74k. And hoping for a move to 64k. It sounds like a dramatic upcoming event, but reality often diverges from expectations. This level is just making you panic, so stay calm and step away from the trading surface.

BTC-5,78%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Nothing to do, trading is also very boring. Starting next week, I will begin working on some project research. If you know any good projects, let's share and discuss together. 🥰 If there's a group I can join, that would be the best. Sending red envelopes to everyone 🫶🫶

View Original

- Reward

- like

- 1

- Repost

- Share

Horsemoney :

:

Do you also ski?Bitcoin is trading around $82,000. As I’ve been saying, the weekly 99 EMA is the strongest support. We’re seeing a clear breakdown attempt, but the weekly candle still has two days left to close. Confirmation only comes with a weekly close below this level.I’m still holding my short position. As I’ve said before, this is a short-side market for me. I added more shorts around the $97,000 area, as I mentioned multiple times. Since then, BTC is down nearly $16,000. I’m staying patient here. $72,000 is loading.As you know, I remain strongly bullish on gold and silver, while staying bearish on cry

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

Thank you for the information.View More

BTC Price Action Breakdown (Educational)

- Reward

- like

- Comment

- Repost

- Share

Over $70.36M in leveraged Silver positions has been wiped out in the past two hours, surpassing total crypto liquidations.Risk rotated from crypto to metals, and excessive leverage was punished once again.

- Reward

- like

- Comment

- Repost

- Share

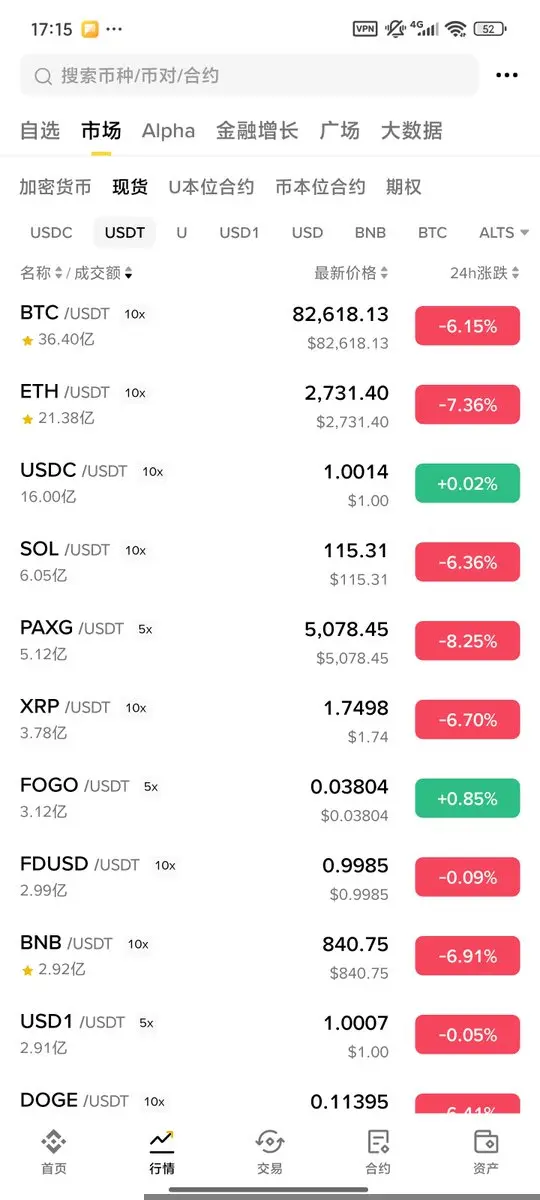

Based on the market performance in the early hours of January 30th, the cryptocurrency market experienced a broad and significant decline. Below is a summary of key market data and dynamics:

📉 Mainstream Coin Market (As of the morning of January 30th)

· Bitcoin (BTC): Price fell below $85,000, with the lowest point reaching $83,338, a drop of over 5% in 24 hours.

· Ethereum (ETH): Declined by over 6%, with a peak drop of more than 8%.

· Other major altcoins: Generally followed the decline, such as SOL, Dogecoin (DOGE), Cardano (ADA), with 24-hour drops mostly between 6% and 8%.

💥 Market Chai

View Original📉 Mainstream Coin Market (As of the morning of January 30th)

· Bitcoin (BTC): Price fell below $85,000, with the lowest point reaching $83,338, a drop of over 5% in 24 hours.

· Ethereum (ETH): Declined by over 6%, with a peak drop of more than 8%.

· Other major altcoins: Generally followed the decline, such as SOL, Dogecoin (DOGE), Cardano (ADA), with 24-hour drops mostly between 6% and 8%.

💥 Market Chai

- Reward

- like

- Comment

- Repost

- Share

Fascinating Report Exposes New Trends in UK #Crypto Ownership🇬🇧 An official report reveals the latest trends surrounding #crypto ownership in the UK, and it\'s bad news for #altcoins#crypto

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More9.02K Popularity

25.23K Popularity

352.23K Popularity

31.7K Popularity

48.17K Popularity

News

View MoreHong Kong Financial Services and the Treasury Bureau: Will submit four draft regulations for virtual asset service providers this year and promote the trial operation of the gold clearing system

4 m

Opinion: Increased miner migration intensifies bearish sentiment, and Bitcoin may fall below $60,000

12 m

Nomura Holdings subsidiary Laser Digital is reducing its crypto asset exposure due to losses in fiscal year 2025 Q3.

22 m

Czech Central Bank Governor: Understand BTC, Do Not Oppose the Future

35 m

Overview of mainstream Perp DEXs: Hyperliquid trading volume increased by 57% in a single day, reaching the highest level since early November last year

39 m

Pin