From AI to Labubu, From Gold to Crypto: Why Speculative Bubbles Are Everywhere

Two months before the infamous “Black Monday” stock market crash that triggered the Great Depression, a Massachusetts economist named Roger Babson grew alarmed by the surge of retail investors borrowing to speculate in stocks. In a speech, he warned, “A crash is coming, and it may be terrific.” The market promptly dropped 3%, a decline soon dubbed the “Babson Break.” Yet, as Andrew Ross Sorkin recounts in his riveting book, *1929: The Inside Story of Wall Street’s Worst Crash and How It Destroyed a Nation*, the market quickly “shook off Babson’s dire prediction” in the following weeks. Optimism about new mass-market products like radios and cars helped fuel the rebound, and “imaginative” investors regained the upper hand.

Today, many “prophets of doom” are sounding similar alarms about artificial intelligence (AI)—especially regarding the lofty valuations of public and private tech companies and their relentless pursuit of artificial general intelligence (AGI). AGI refers to systems capable of performing nearly all human tasks, or even surpassing human abilities. According to data analytics firm Omdia, tech companies are projected to spend nearly $1.6 trillion annually on data centers by 2030. The AI hype machine is in full swing, but the technology’s profitability remains purely speculative, leaving many pragmatic investors perplexed. Still, as was true a century ago, FOMO—fear of missing out on the next big thing—drives many companies to ignore these “doomsday warnings.” Advait Arun, an analyst at the Center for Public Enterprise, likens it to a game of Mad Libs: “These companies believe bold new tech can solve every problem.” In a recent report echoing Babson’s concerns, *It’s Either a Bubble or Nothing*, Arun questioned the financing behind data center projects and concluded, “We are undoubtedly still in a period of irrational exuberance.”

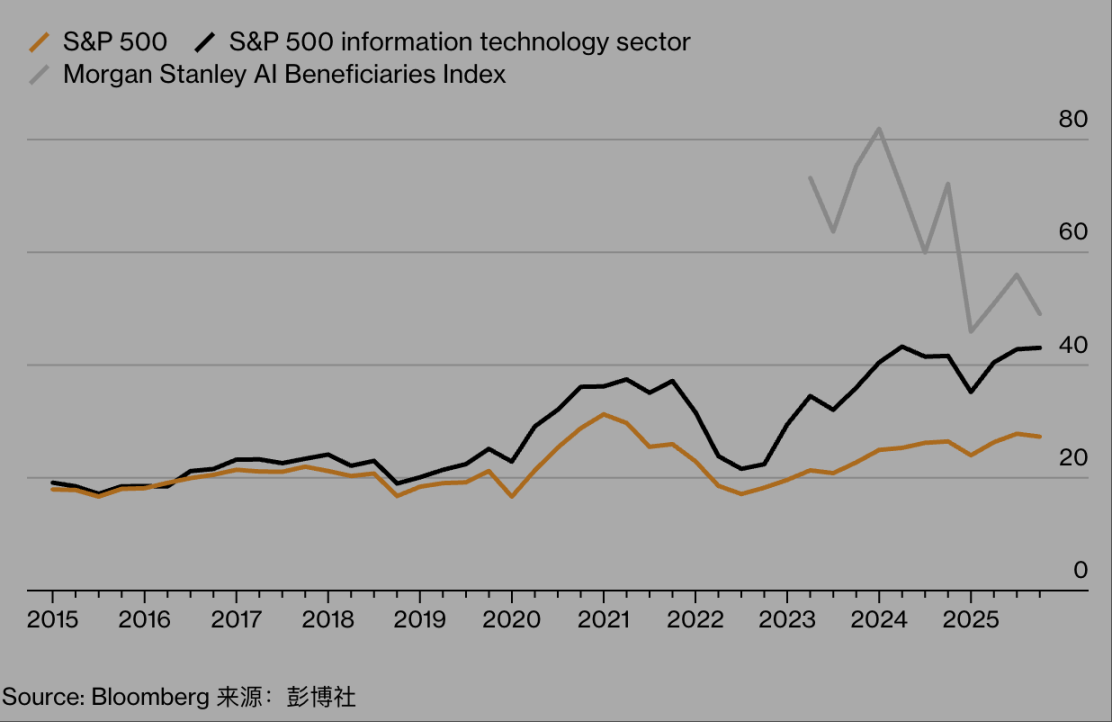

Tech stocks soar:

Source: Bloomberg

(This chart tracks three indices—the S&P 500, the S&P 500 Information Technology sector, and the Morgan Stanley AI Beneficiaries Index—illustrating how, from 2015 to 2025, AI-themed stocks in the US market first surged on speculation, then retreated as the bubble deflated, diverging from the broader market and traditional tech sectors. It highlights both the speculative frenzy in AI and the risks of a subsequent downturn.)

Journalists generally avoid debating whether a particular resource or technology is overvalued. I don’t take a strong stance on whether we’re in an “AI bubble,” but I suspect the question itself may be too narrow. If we define a “speculative bubble” as an asset’s value detaching from its fundamental basis and rising unsustainably, then bubbles seem to be everywhere, inflating and deflating in sync.

Børge Brende, CEO of the World Economic Forum, has pointed to potential bubbles in gold and government bonds. He recently noted that global debt is at its most severe level since World War II; as of December 12, gold prices had jumped nearly 64% in one year. Many financial professionals see a bubble in private credit as well. This $3 trillion market—where large investment institutions provide loans, often for building AI data centers, outside the purview of tightly regulated commercial banks—is largely unregulated. Jeffrey Gundlach, founder and CEO of DoubleLine Capital, recently called this opaque, unruly lending environment “junk lending” on Bloomberg’s Odd Lots podcast. JPMorgan CEO Jamie Dimon has labeled it a “trigger for financial crises.”

The most extreme distortions appear in markets where “intrinsic value is hard to gauge.” For example, from January to October 6, Bitcoin’s total market cap jumped by $636 billion, only to not just lose those gains but fall even further by December 12. According to Blockworks, a crypto media company, trading volume in “meme coins”—tokens created to commemorate internet fads—peaked at $170 billion in January before plunging to $19 billion by September. The biggest declines came from TRUMP and MELANIA—two coins launched by members of the US First Family just before Inauguration Day—which have dropped 88% and 99% in value, respectively, since January 19.

Many investors in these cryptocurrencies are not evaluating their potential to create lasting value for shareholders or society—as one would with a profitable traditional company—but are simply chasing “get-rich-quick” opportunities. Their approach to crypto resembles the speculative thrill of rolling dice at a Las Vegas casino.

Investors—especially those drawn to crypto, sports betting, and online prediction markets—are treating financial markets like casinos, a trend likely driven by demographic shifts. A recent Harris Poll found that 60% of Americans now aspire to amass great wealth; among Gen Z and Millennials, 70% want to become billionaires, compared to just 51% of Gen X and Boomers. A study by Empower last year found that Gen Z defines “financial success” as an annual salary of nearly $600,000 and a net worth of $10 million.

With TikTok, group chats, Reddit, and the internet’s “instant and inescapable” reach, people everywhere now learn about money-making opportunities at the same time. In theory, this seems harmless, but in practice, it fuels copycat behavior, fierce competition, and “herd mentality”—which makes Apple TV’s new show *Pluribus* especially timely. The traditional economy, with its complexity and diversity, has been supplanted by the “attention economy”—where “everyone is obsessed with the same thing at the same time.”

In business, the current “collective obsession” is AI; in pop culture, after the “Pedro Pascal craze,” we’ve seen “Sydney Sweeney fever” and “6-7 fever” (if you don’t have teens at home, Google it). Over the past year, thanks to celebrities like BLACKPINK’s Lisa, Chinese toymaker Pop Mart’s “adorable but essentially useless animal plushies” have become a global sensation—what we might call the “Labubble.”

The food industry is also caught in a “protein bubble”: from popcorn makers to breakfast cereal brands, everyone is touting protein content to attract health-conscious consumers and GLP-1 users (a diabetes drug often used for weight loss). In media, Substack newsletters, celebrity-hosted podcasts (like Amy Poehler’s *Say More* and Meghan Markle’s *Archetypes*), and a steady stream of “authorized celebrity documentaries” (Netflix’s latest include *Becoming Eddie* about Eddie Murphy and a Victoria Beckham documentary) may also be showing bubble-like signs. W. David Marx, author of *Status and Culture*, notes, “Everyone’s reference group is now global, far beyond their immediate circles or actual social standing. This enables ‘global synchronous trends’ that were previously unimaginable.”

Of course, the risks in AI far exceed those of the “Labubu craze.” No company wants to be left behind, so every industry giant is racing ahead, building out computing infrastructure through “complex financing arrangements.” Sometimes this involves “special purpose vehicles” (recall those from the 2008 financial crisis?)—entities that take on debt to buy Nvidia GPUs (AI chips), which some observers think may depreciate faster than expected.

Tech giants can weather the fallout from this “FOMO-fueled frenzy”—their robust balance sheets fund data center buildouts, and even if most white-collar workers believe “the current version of ChatGPT is good enough for annual self-evaluations,” these giants remain unshaken. But others are taking bigger risks. Oracle—a traditionally conservative database vendor, not usually a challenger in the AI gold rush—is raising $38 billion in debt to build data centers in Texas and Wisconsin.

Other so-called “new cloud providers” (such as CoreWeave and Fluidstack, both relatively young companies) are building dedicated data centers for AI, Bitcoin mining, and more—also piling on debt. At this stage, the “cumulative impact” of the AI bubble is becoming increasingly serious. Gil Luria, managing director at D.A. Davidson & Co., echoes Roger Babson’s century-old warning: “When institutions are borrowing to build multibillion-dollar data centers without real customers, I get worried. Lending to speculative investments has never been wise.”

Carlota Perez, a British-Venezuelan scholar who has spent decades studying economic booms and busts, is also concerned. She warns that in a “casino-like economy marked by excessive leverage and fragility, where bubbles burst at the first sign of doubt,” technological innovation is morphing into high-risk speculation. In an email, she wrote, “If the AI and crypto sectors crash, it could trigger a global crisis of unimaginable scale. Historically, only when the financial sector pays for its own mistakes—and isn’t endlessly bailed out—and when society imposes sensible regulation, does a truly productive golden age emerge.” Until then, you might want to hold on tight to your Labubu plushie.

Statement:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [Brad Stone, Bloomberg]. If you have any concerns about this reprint, please contact the Gate Learn team, and we will address your request promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without reference to Gate, copying, distributing, or plagiarizing the translated article is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?