Bitcoin and Ethereum ETFs See Massive Outflows on December 15: What’s Driving Market Panic?

Figure: https://farside.co.uk/btc/

Overview: Crypto Market Turmoil on December 15

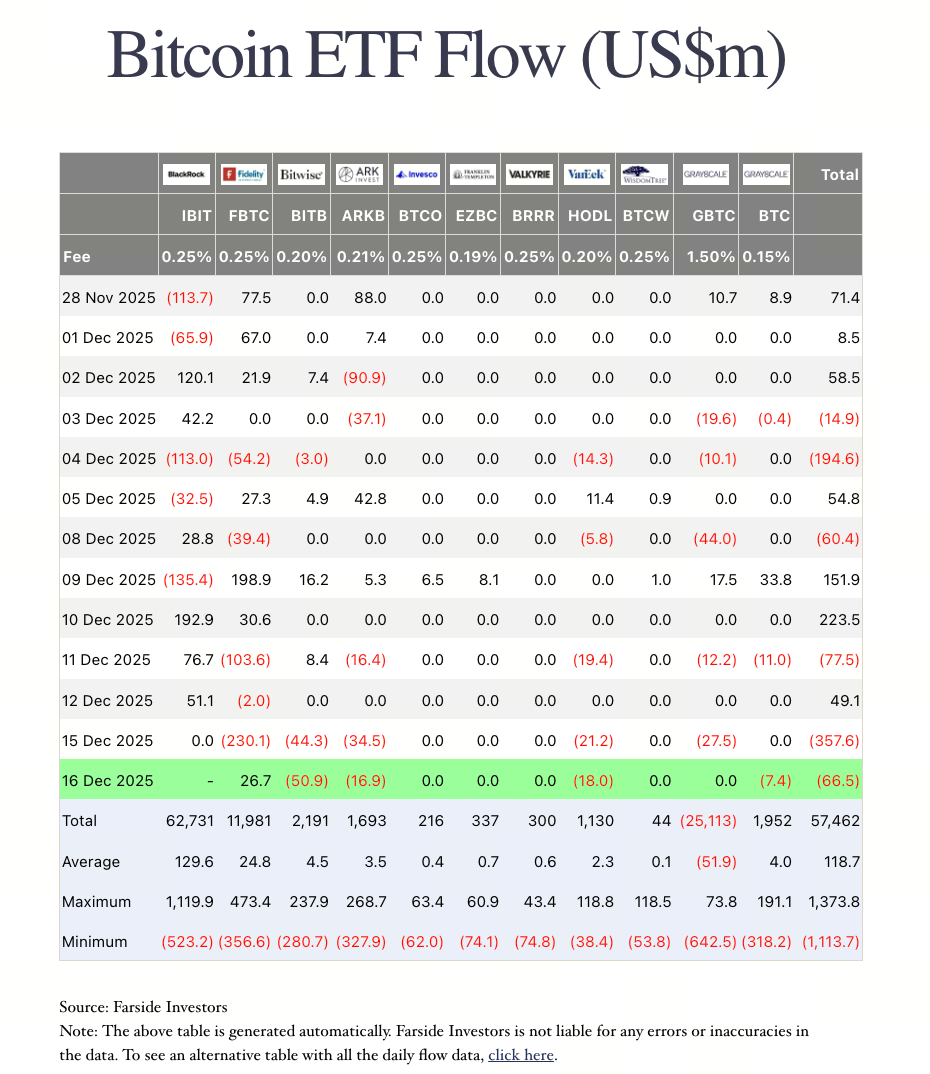

On December 15, the cryptocurrency market hit a clear turning point in sentiment. Both Bitcoin and Ethereum spot ETFs posted some of their largest single-day net outflows of the year, sparking widespread debate about shifting institutional attitudes. These ETF outflows triggered a sharp, synchronized pullback in major crypto asset prices and led to a notable cooling of overall market risk appetite.

ETF Outflows: Data Summary

Analyzing the capital structure, this round of outflows was concentrated in leading North American spot ETF products:

- Bitcoin ETF: Single-day net outflow of approximately $350 million

- Ethereum ETF: Single-day net outflow of approximately $220 million

These outflows rank among the highest in the past 30 trading days, showing that some institutional investors actively reduced exposure during periods of high volatility. Importantly, outflows were spread across multiple ETFs, not just a single product, reflecting broad institutional risk management rather than isolated fund adjustments.

Price Reaction: Technical Shifts in BTC and ETH

Figure: https://www.gate.com/trade/BTC_USDT

As capital exited, prices responded immediately:

Bitcoin (BTC)

- Briefly dropped below $88,000

- Daily candlestick chart showed a long bearish candle

- Trading volume surged, signaling increased selling pressure

Ethereum (ETH)

- Dipped below the $3,000 psychological threshold

- Short-term moving averages flattened out

- Bullish momentum weakened noticeably

Technically, ETF outflows intensified the testing of key support levels, making prices more vulnerable to news and sentiment in the short term.

Multiple Drivers Behind the Outflows

This wave of ETF outflows was driven by several overlapping factors:

- Rising macro uncertainty: Shifting interest rate expectations, US dollar index volatility, and adjustments in global risk assets led some institutions to cut allocations to high-volatility assets.

- Profit-taking: Following significant gains in the prior rally, BTC and ETH ETFs served as key vehicles for institutional profit realization.

- Asset rotation: Funds did not fully exit the crypto market but rotated from mainstream assets into higher-beta investment opportunities.

ETF Market Divergence: Mainstream vs. Alternative Assets

In contrast to BTC and ETH ETFs, some alternative asset ETFs continued to attract net inflows during the same period. This highlights a key feature of the current market: it is not broadly bearish but undergoing structural adjustments. Institutional investors are using ETFs for sector rotation rather than a full-scale exit.

Investor Strategies During Volatility

During periods of rapid ETF capital movement, investors should prioritize strategy over emotion:

- Avoid chasing rallies or panic selling in the short term

- Form comprehensive judgments by analyzing both capital flows and price structures

- Use ETF data as a sentiment gauge, not as a sole buy or sell signal

Outlook: Will ETF Capital Return?

History shows that short-term ETF outflows do not necessarily mean a trend reversal. If the macro environment stabilizes and market sentiment recovers, capital typically returns once prices settle. Over the medium to long term, Bitcoin and Ethereum remain the primary gateways for institutional crypto asset allocation.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution