2025 ZEC Price Prediction: Expert Analysis and Market Outlook for Zcash's Future Value

Introduction: ZEC's Market Position and Investment Value

Zcash (ZEC), as a pioneering privacy-focused cryptocurrency, has made significant strides since its inception in 2016. By 2025, Zcash's market capitalization has reached $6.70 billion, with a circulating supply of approximately 16.44 million coins and a price hovering around $407.8. This asset, often hailed as the "privacy coin," is playing an increasingly crucial role in the field of confidential transactions and financial privacy.

This article will provide a comprehensive analysis of Zcash's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. Historical Overview and Current Market Status of ZEC

ZEC Historical Price Evolution

- 2016: ZEC launched, reaching an all-time high of $3,191.93 on October 29

- 2018: Bearish crypto market, ZEC price declined significantly

- 2020-2021: Bull market cycle, ZEC price recovered and showed strong growth

- 2022-2023: Market correction, ZEC price fluctuated

- 2024: ZEC hit an all-time low of $16.08 on July 5

Current Market Situation of ZEC

As of December 15, 2025, ZEC is trading at $407.8, with a market capitalization of $6.70 billion. It ranks 25th in the cryptocurrency market with a 0.20% market share. The 24-hour trading volume stands at $6.84 million, indicating moderate market activity. ZEC has seen a slight decrease of 0.95% in the past 24 hours, but shows a significant 6.17% increase over the past week. However, it has experienced a substantial decline of 40.089% over the last 30 days. The circulating supply of ZEC is 16,441,840.7905448, which is 78.29% of its maximum supply of 21 million coins.

Click to view the current market price of ZEC

ZEC Market Sentiment Indicator

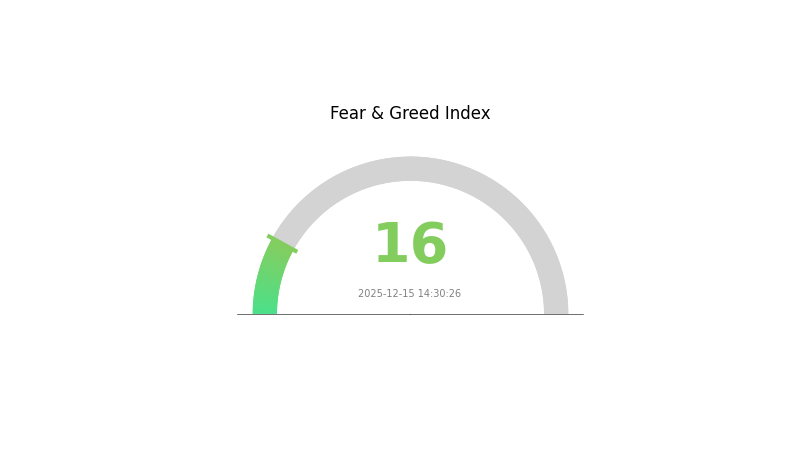

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often precedes potential buying opportunities for ZEC. Savvy investors might consider accumulating during such periods of market distress. However, it's crucial to conduct thorough research and manage risks carefully. Gate.com offers advanced tools to help navigate these turbulent market conditions. Remember, market sentiment can shift rapidly, so stay informed and trade wisely.

ZEC Holdings Distribution

The address holdings distribution data for ZEC reveals an interesting pattern in the cryptocurrency's ownership structure. However, the provided table lacks specific data points, which limits our ability to draw concrete conclusions about the concentration of ZEC holdings.

In a typical scenario, such distribution data would allow us to assess the level of decentralization and identify potential whale accounts that could influence market dynamics. Without specific figures, we can only speculate that ZEC's distribution may follow patterns seen in other cryptocurrencies, where a small number of addresses often hold a significant portion of the total supply.

The absence of clear concentration data suggests that ZEC's market structure may be relatively balanced, potentially reducing the risk of price manipulation by individual large holders. However, this assumption requires verification with actual data to provide a more accurate assessment of ZEC's on-chain stability and market characteristics.

Click to view the current ZEC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing ZEC's Future Price

Supply Mechanism

- Halving: ZEC undergoes periodic halving events, reducing the rate of new coin issuance

- Historical Pattern: Previous halvings have led to increased scarcity and potential price appreciation

- Current Impact: The next halving is anticipated to tighten supply, potentially driving up demand and price

Institutional and Whale Dynamics

- Institutional Holdings: Growing interest from institutional investors in ZEC as a privacy-focused asset

- Corporate Adoption: Increasing use of ZEC by companies seeking enhanced financial privacy

- Government Policies: Regulatory stance on privacy coins varies globally, impacting ZEC's adoption and use

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rates affect ZEC's appeal as an alternative asset

- Inflation Hedging Properties: ZEC may be viewed as a potential hedge against inflation in uncertain economic times

- Geopolitical Factors: Global political tensions and economic sanctions can drive demand for privacy-focused cryptocurrencies like ZEC

Technological Development and Ecosystem Building

- Privacy Enhancements: Ongoing improvements to ZEC's privacy features, such as zk-SNARKs technology

- Scalability Upgrades: Development of layer-2 solutions to improve transaction speed and reduce fees

- Ecosystem Applications: Growth of decentralized applications and services built on the Zcash network

III. ZEC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $224.51 - $350

- Neutral prediction: $350 - $408.20

- Optimistic prediction: $408.20 - $444.94 (requires positive market sentiment and increased adoption)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range predictions:

- 2026: $294.33 - $528.95

- 2027: $329.65 - $563.75

- Key catalysts: Technological improvements, wider acceptance of privacy coins, and overall crypto market growth

2030 Long-term Outlook

- Base scenario: $633.66 - $800 (assuming steady growth and adoption)

- Optimistic scenario: $800 - $937.81 (assuming strong market performance and increased privacy demand)

- Transformative scenario: $937.81 - $1000+ (assuming breakthrough in privacy technology and mainstream adoption)

- 2030-12-31: ZEC $937.81 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 444.94 | 408.2 | 224.51 | 0 |

| 2026 | 528.95 | 426.57 | 294.33 | 4 |

| 2027 | 563.75 | 477.76 | 329.65 | 16 |

| 2028 | 697.81 | 520.76 | 442.64 | 27 |

| 2029 | 658.03 | 609.28 | 316.83 | 48 |

| 2030 | 937.81 | 633.66 | 348.51 | 54 |

IV. Professional ZEC Investment Strategies and Risk Management

ZEC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Privacy-focused investors and those bullish on decentralized finance

- Operation suggestions:

- Accumulate ZEC during market dips

- Store in secure wallets with regular security updates

- Consider staking options for passive income

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Moving Averages: Identify trends and potential reversal points

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Monitor privacy regulation news for potential market impacts

ZEC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance ZEC with other cryptocurrencies and traditional assets

- Options trading: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for ZEC

ZEC Market Risks

- High volatility: Price can fluctuate dramatically in short periods

- Liquidity risk: Lower trading volumes compared to top cryptocurrencies

- Correlation risk: Often moves in tandem with broader crypto market

ZEC Regulatory Risks

- Privacy coin scrutiny: Increased regulatory attention on anonymous transactions

- Delisting risk: Some exchanges may remove ZEC due to compliance concerns

- Tax implications: Complex reporting requirements for privacy transactions

ZEC Technical Risks

- Network upgrades: Potential for bugs or vulnerabilities during protocol updates

- Quantum computing threat: Long-term risk to cryptographic security

- Centralization concerns: Mining concentration could impact network security

VI. Conclusion and Action Recommendations

ZEC Investment Value Assessment

ZEC offers strong privacy features and potential for long-term growth in the privacy-focused crypto sector. However, it faces short-term regulatory uncertainties and market volatility.

ZEC Investment Recommendations

✅ Beginners: Start with small positions, focus on understanding privacy technology ✅ Experienced investors: Consider ZEC as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate regulatory compliance before significant allocation

ZEC Trading Participation Methods

- Spot trading: Buy and hold ZEC on Gate.com

- Futures trading: Access leveraged exposure through Gate.com futures contracts

- Staking: Participate in ZEC staking programs for passive income

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will Zcash go?

Zcash could potentially reach $800 by November 2025, as there's little resistance between $400 and $800. Prepare for significant growth!

What is the price of Zcash in 2025?

Based on current projections, the price of Zcash in 2025 is expected to reach approximately €545,438. This forecast is derived from long-term market analysis and trends.

What is ZEC all time high?

ZEC reached its all-time high of $3,191.93 on October 29, 2016. Since then, it has traded significantly below this peak.

What is the Zcash prediction for 2026?

Based on a 5% annual price change, Zcash is predicted to reach $426.73 by 2026. This forecast assumes current market trends continue.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What Is Gate Vault? An Easy Guide to the New Crypto Vault

Is Neo (NEO) a good investment?: A Comprehensive Analysis of NEO's Market Potential, Technology, and Future Prospects in the Cryptocurrency Landscape

Is Plasma (XPL) a good investment?: A Comprehensive Analysis of Technology, Market Potential, and Risk Factors

Is LayerZero (ZRO) a good investment?: A Comprehensive Analysis of the Omnichain Protocol's Potential and Risks

Is ZEEBU (ZBU) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential