2025 WAXP Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of WAXP

WAX Token (WAXP) serves as the native token of the WAX blockchain platform, an e-commerce-oriented blockchain designed to enable participants to conduct digital transactions easily and safely. Since its launch in 2017, WAXP has established itself as a key utility token supporting all activities and functions within the WAX ecosystem. As of December 2025, WAXP maintains a market capitalization of approximately $60.9 million, with a circulating supply of around 4.51 billion tokens and a current price hovering at $0.007267. This token, recognized as a "virtual commerce facilitator," plays an increasingly important role in enabling secure virtual asset transactions, NFT trading, and decentralized e-commerce operations.

This article will conduct a comprehensive analysis of WAXP's price trends and market dynamics through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

WAX (WAXP) Market Analysis Report

I. WAXP Price History Review and Current Market Status

WAXP Historical Price Evolution

-

January 2018: All-time high of $2.77 was reached on January 9, 2018, representing the peak of the initial market cycle following the token's launch on December 21, 2017 at $0.2.

-

2018-2025: Extended bear market phase, with the token experiencing significant depreciation over the seven-year period, declining approximately 83% from its annual perspective.

-

December 2025: New all-time low of $0.00700745 recorded on December 19, 2025, marking the lowest price point in the token's entire trading history.

WAXP Current Market Performance

As of December 19, 2025, WAX (WAXP) is trading at $0.007267, reflecting a slight upward movement of +0.21% over the past hour. However, the broader trend remains bearish, with the token experiencing:

- 24-hour decline: -1.1%

- 7-day decline: -17.66%

- 30-day decline: -27.62%

- 12-month decline: -83.02%

The token's market capitalization stands at approximately $32.78 million (circulating supply value), with a fully diluted valuation of $60.90 million. The 24-hour trading volume is relatively modest at $16,810.93, indicating low liquidity levels. WAXP ranks 653rd by market capitalization among all cryptocurrencies, with a market dominance of 0.0019%.

Current price range over the past 24 hours: high of $0.007633 and low of $0.006995. The token is held across 3,635 unique wallet addresses and is trading on 24 exchanges, with Gate.com providing a trading pair for the asset.

The current market sentiment indicates Extreme Fear (VIX score: 16), reflecting broad pessimism in the cryptocurrency market environment.

View current WAXP market price

Cryptocurrency Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with a fear and greed index reading of 16. This indicates widespread pessimism and significant selling pressure across digital assets. When the index reaches such low levels, it often signals potential oversold conditions where contrarian investors may find buying opportunities. However, extreme fear can also precede further downside, making risk management crucial. Traders should remain cautious and conduct thorough research before making investment decisions. Consider dollar-cost averaging strategies to mitigate timing risks during this volatile period. Monitor market developments closely on Gate.com for real-time sentiment analysis and trading opportunities.

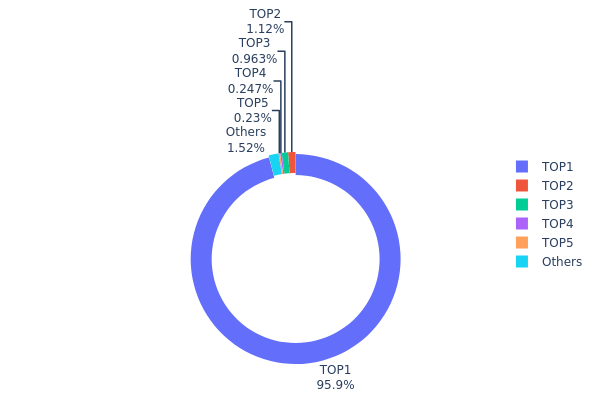

WAXP Holdings Distribution

The address holdings distribution chart illustrates the concentration of WAXP tokens across blockchain addresses, revealing the ownership structure and decentralization characteristics of the asset. By analyzing the top holders and their respective percentages, we can assess market concentration risk, potential manipulation vulnerabilities, and the overall health of the token's ecosystem distribution.

WAXP exhibits significant concentration risk, with the top address commanding 95.91% of total holdings. This extreme concentration indicates severe centralization, as a single entity controls nearly the entire token supply. The second and third largest holders possess only 1.11% and 0.96% respectively, creating a stark disparity in ownership structure. The combined holdings of the top five addresses account for 98.45% of all WAXP tokens, leaving merely 1.55% distributed among remaining addresses. This distribution pattern suggests the token operates under pronounced centralization, substantially deviating from the decentralization principles typically associated with blockchain assets.

Such concentrated holdings present considerable systemic risks to market stability and price integrity. The dominant holder retains sufficient capital to substantially influence price movements and market sentiment through coordinated actions. The extreme gap between the largest holder and secondary stakeholders limits meaningful governance distribution and reduces checks and balances within the ecosystem. Additionally, the minimal proportion of tokens available for broad circulation constrains organic market participation and may impede the development of a diverse holder base essential for long-term ecosystem resilience. These structural characteristics suggest WAXP's current market composition prioritizes centralized control over distributed participation.

Visit WAXP Holdings Distribution on Gate.com to view current data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6dcc...d6c707 | 3707005.38K | 95.91% |

| 2 | 0x2a79...f8a517 | 43221.57K | 1.11% |

| 3 | 0xf977...41acec | 37227.30K | 0.96% |

| 4 | 0xab78...3ee1bc | 9551.26K | 0.24% |

| 5 | 0xe61c...289863 | 8902.13K | 0.23% |

| - | Others | 58921.30K | 1.55% |

II. Core Factors Influencing WAXP's Future Price

Supply Mechanism

-

Block Rewards and Protocol Updates: WAXP price movements are driven by supply dynamics, influenced by factors such as block reward halving, hard forks, and protocol updates. These mechanisms directly impact the token's scarcity and long-term value proposition.

-

Deflationary Token Economics: The market views WAXP favorably regarding its deflationary token economics, which supports price appreciation over time through reduced supply pressure.

Institutional and Major Holder Dynamics

-

Enterprise Adoption: WAXP adoption is expected to increase with growing game and NFT market demand. As the NFT market becomes increasingly active, WAXP is positioned to play an important role within the ecosystem.

-

Regulatory Environment: Real-world events such as regulatory changes, enterprise adoption, and government policies significantly impact WAXP's price. Regulatory scrutiny from authorities on cryptocurrency holdings by public companies may affect market sentiment and price volatility.

Market Sentiment and Adoption

-

Investor Sentiment: Investor emotions and confidence directly influence WAXP price movements. Positive news regarding widespread WAXP adoption or major technological breakthroughs typically trigger bullish market sentiment and drive price increases. Conversely, negative developments can suppress prices.

-

Exchange Listings and Market Access: Historical listing events on major trading venues have contributed to increased trading volume and price appreciation, demonstrating the importance of market accessibility in driving WAXP demand.

Technology Development and Ecosystem Building

-

Cross-Chain Integration: WAXP operates across multiple blockchains, including Ethereum, where it is traded at a 100x price ratio relative to the WAX chain, expanding its utility and accessibility across different DeFi ecosystems.

-

NFT Market Infrastructure: WAX serves as a foundational blockchain for NFT transactions, with WAXP functioning as the native token for staking, transaction fee payments, and governance participation. The expanding NFT market directly correlates with increased WAXP utility and demand.

-

Ecosystem Expansion: New initiatives such as prediction markets and other DApp developments aim to broaden the WAX ecosystem, potentially reversing recent performance trends and increasing token adoption rates.

III. 2025-2030 WAXP Price Forecast

2025 Outlook

- Conservative Forecast: $0.00661 - $0.00727

- Base Case Forecast: $0.00727

- Optimistic Forecast: $0.00894 (requires sustained ecosystem development and increased adoption)

2026-2028 Mid-Term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth driven by platform expansion and NFT market maturation

- Price Range Forecast:

- 2026: $0.00778 - $0.01175

- 2027: $0.00596 - $0.01122

- 2028: $0.00909 - $0.01374

- Key Catalysts: Enhanced blockchain interoperability, increased institutional adoption of WAX-based NFTs, expansion of gaming and digital collectibles use cases, and strategic partnerships within the Web3 ecosystem

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.01057 - $0.01532 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.01216 - $0.01566 (assumes accelerated mainstream NFT adoption and significant increase in on-chain transaction volume)

- Transformation Scenario: $0.01374 - $0.01566 (assumes breakthrough in enterprise-level blockchain integration and establishment of WAXP as a leading platform for digital asset management)

- December 19, 2025: WAXP trading near $0.00727 (mid-cycle consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00894 | 0.00727 | 0.00661 | 0 |

| 2026 | 0.01175 | 0.0081 | 0.00778 | 11 |

| 2027 | 0.01122 | 0.00993 | 0.00596 | 36 |

| 2028 | 0.01374 | 0.01057 | 0.00909 | 45 |

| 2029 | 0.01532 | 0.01216 | 0.00632 | 67 |

| 2030 | 0.01566 | 0.01374 | 0.00907 | 89 |

WAX (WAXP) Investment Report: Strategy and Risk Management

IV. WAXP Professional Investment Strategy and Risk Management

WAXP Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: E-commerce enthusiasts, blockchain technology believers, virtual asset collectors

- Operational Recommendations:

- Establish a core position during market downturns and accumulate gradually during consolidation phases

- Set a long-term holding period of 2-3 years minimum to benefit from ecosystem development

- Maintain a diversified portfolio allocation, limiting WAXP to 5-10% of total crypto holdings

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action Analysis: Monitor support levels around $0.007 and resistance near historical levels

- Volume Analysis: Assess trading volume trends to identify breakout opportunities

- Wave Trading Key Points:

- Enter positions during oversold conditions with increased volume confirmation

- Set profit targets at 15-25% gains and stop-losses at 8-10% drawdowns

WAXP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of crypto portfolio

- Active Investors: 5-8% of crypto portfolio

- Professional Investors: 8-15% of crypto portfolio

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance WAXP holdings with stablecoins and other established cryptocurrencies

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals to reduce timing risk

(3) Secure Storage Solutions

- Hardware Wallet Method: Store larger WAXP holdings offline in secure hardware solutions for maximum protection

- Hot Wallet Solution: Use Gate.com Web3 Wallet for frequent trading and small to medium holdings

- Security Precautions: Enable two-factor authentication, use strong passwords, never share private keys or recovery phrases, regularly audit account access permissions

V. WAXP Potential Risks and Challenges

WAXP Market Risks

- Price Volatility: WAXP experienced an 83.02% decline over the past year and a 27.62% decrease in the last 30 days, indicating significant price instability

- Low Market Capitalization: With a market cap of approximately $32.78 million, WAXP has relatively low liquidity compared to major cryptocurrencies, making large transactions potentially difficult

- Limited Trading Volume: Daily trading volume of approximately $16,810 is relatively modest, which can lead to wider bid-ask spreads and slippage

WAXP Regulatory Risks

- Evolving Regulatory Landscape: Global cryptocurrency regulations continue to develop, potentially impacting WAXP's trading status and utility

- Regional Restrictions: Certain jurisdictions may restrict or prohibit the trading and use of WAXP tokens

- Classification Uncertainty: Changes in how regulators classify WAXP could affect its legal status and operational framework

WAXP Technology Risks

- Smart Contract Vulnerabilities: The WAX blockchain ecosystem may face security issues or bugs in deployed smart contracts

- Network Security: While WAX uses DPOS consensus, potential consensus mechanism vulnerabilities could affect platform security

- Ecosystem Development: Limited developer adoption or ecosystem growth could hinder WAXP's long-term utility and value proposition

VI. Conclusion and Action Recommendations

WAXP Investment Value Assessment

WAX represents a specialized blockchain platform focused on e-commerce and virtual asset transactions. With its cloud wallet infrastructure and OAuth/SSO services, WAXP offers unique utility within its niche. However, the token faces significant challenges including substantial price decline over the past year, modest trading volumes, and a relatively small market capitalization. The platform's long-term value depends on ecosystem adoption and increased enterprise usage of its e-commerce tools.

WAXP Investment Recommendations

✅ Beginners: Start with small allocations (1-2% of crypto portfolio) only if interested in e-commerce blockchain applications, focusing on understanding platform use cases before investing

✅ Experienced Investors: Consider WAXP as a speculative position with careful risk management, using dollar-cost averaging to build positions at current depressed prices while maintaining strict position sizing

✅ Institutional Investors: Evaluate WAXP based on specific enterprise e-commerce initiatives and ecosystem partnership developments; conduct thorough due diligence on adoption metrics and developer activity

WAXP Trading Participation Methods

- Spot Trading: Purchase WAXP directly on Gate.com for immediate ownership and long-term holding

- Market Monitoring: Track WAXP price movements and trading volume through Gate.com's real-time data and charting tools

- DCA Strategy: Implement systematic buying programs through Gate.com to build positions gradually over time

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult with professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of waxp?

WAX is expected to experience growth driven by increasing adoption in digital collectibles and gaming. Technical analysis suggests potential price movements, with forecasts indicating possible fluctuations through 2026. Long-term prospects depend on ecosystem expansion and market developments.

Will WAX coin prices increase?

Yes, WAX coin prices are expected to increase. Forecasts predict WAXP will reach $0.008517 by January 17, 2026, with potential gains of 14.12% in the coming months. Long-term analysis suggests continued upward momentum.

What is the highest price of waxp?

The all-time high price of WAXP reached $2.77 on January 8, 2018. Based on market trends and adoption growth, WAXP could potentially reach new heights in the coming years as the platform expands its ecosystem and user base increases.

What is a realistic price for XRP in 2025?

Based on current market analysis, XRP could realistically reach between $2.05 and $5.81 in 2025, depending on institutional adoption, regulatory developments, and macroeconomic conditions. Growth potential remains strong with continued partnerships in cross-border payment solutions.

Is ALICE (ALICE) a good investment?: Analyzing the Potential and Risks of This Gaming Token in Today's Crypto Market

ALU vs FLOW: Evaluating Different Computational Architectures for Modern Machine Learning Applications

Is Adventure Gold (AGLD) a Good Investment?: Analyzing the Long-Term Potential of this Gaming Token in the NFT Ecosystem

2025 FUNPrice Prediction: Analyzing Market Trends and Future Growth Potential of FUN Token in the Expanding Digital Entertainment Ecosystem

2025 ALUPrice Prediction: Market Analysis and Future Outlook for Aluminum Commodity Trends

Is Karrat (KARRAT) a good investment?: Evaluating the Potential and Risks of This Emerging Cryptocurrency

Comprehensive Guide to SEI Network Airdrop: Steps to Claim Your Rewards

Explore the Value of Presidential NFT Cards

MOVR vs XLM: A Comprehensive Comparison of Two Leading Blockchain Assets in 2024

Exploring the Impact of Token Burn on Cryptocurrency Supply Reduction

COOKIE vs THETA: A Comprehensive Comparison of Two Powerful Web Technologies