2025 HYPE Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: HYPE's Market Position and Investment Value

Hyperliquid (HYPE), as a high-performance L1 optimized for on-chain financial systems, has achieved significant milestones since its inception. As of 2025, HYPE's market capitalization has reached $7.78 billion, with a circulating supply of approximately 270,772,999 tokens and a price hovering around $28.73. This asset, often referred to as a "fully on-chain financial ecosystem enabler," is playing an increasingly crucial role in permissionless financial applications.

This article will comprehensively analyze HYPE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. HYPE Price History Review and Current Market Status

HYPE Historical Price Evolution

- 2024: HYPE launched, price started at $0.011812

- 2025: Significant growth, price reached all-time high of $59.4 on September 18

- 2025: Market correction, price dropped to current level of $28.733

HYPE Current Market Situation

HYPE is currently trading at $28.733, with a 24-hour trading volume of $8,854,795. The token has experienced a 2.43% decrease in the last 24 hours. HYPE's market cap stands at $7,780,120,592, ranking it 22nd in the overall cryptocurrency market. The circulating supply is 270,772,999 HYPE tokens, with a total supply of 999,835,210 HYPE. The token has seen significant growth over the past year, with a 15,950.09% increase, despite recent short-term declines of 5.43% in the past week and 25.96% in the past month.

Click to view the current HYPE market price

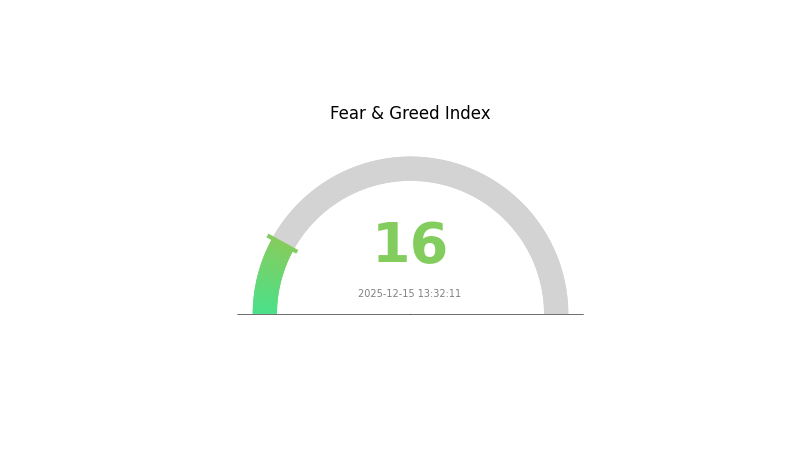

HYPE Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com are closely monitoring key support levels and on-chain metrics for signs of a potential trend reversal. Remember, while fear can present opportunities, it's crucial to manage risk and conduct thorough research before making investment decisions.

HYPE Holdings Distribution

The address holdings distribution data for HYPE is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. Without specific information on top holders and their respective percentages, it's challenging to assess the degree of centralization or decentralization in HYPE's ownership structure.

In the absence of this crucial data, we cannot determine if there are any wallet addresses holding significant portions of the total supply, which could potentially influence market dynamics. The lack of visible large holders could suggest a more distributed ownership, but this is speculative without concrete figures.

Given the current information gap, it's prudent for investors and analysts to seek additional data sources or wait for updated transparency reports from the project team to make informed assessments about HYPE's market structure and potential price stability.

Click to view the current HYPE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing HYPE's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Large-scale transactions by institutional investors have been observed, potentially impacting HYPE's price. For instance, a significant sale of 733,000 HYPE tokens by a SOL investor was reported, which could influence market sentiment.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's policy shifts are expected to have a systemic impact on the valuation of crypto assets, including HYPE.

- Inflation Hedging Properties: In an inflationary environment, HYPE's performance as a potential hedge against inflation may be a factor in its price movement.

- Geopolitical Factors: Global economic recession risks and international geopolitical tensions could affect HYPE's price trajectory.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of DeFi protocols within the Hyperliquid ecosystem may influence the value of HYPE tokens.

- Market Performance: HYPE has shown strong market performance, with its price reaching over $20 and its market cap hitting $7.5 billion, placing it among the top 30 cryptocurrencies by market capitalization.

III. HYPE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $18.69 - $25.00

- Neutral forecast: $25.00 - $32.00

- Optimistic forecast: $32.00 - $37.11 (requires strong market sentiment and adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation period

- Price range predictions:

- 2027: $29.25 - $46.88

- 2028: $24.23 - $43.52

- Key catalysts: Increased adoption, technological advancements, and overall crypto market trends

2030 Long-term Outlook

- Base scenario: $41.96 - $51.81 (assuming steady market growth)

- Optimistic scenario: $51.81 - $61.32 (with accelerated adoption and favorable regulations)

- Transformative scenario: $61.32 - $71.50 (with breakthrough use cases and mainstream integration)

- 2030-12-31: HYPE $71.50 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 37.11072 | 28.768 | 18.6992 | 0 |

| 2026 | 37.55087 | 32.93936 | 25.03391 | 13 |

| 2027 | 46.876 | 35.24512 | 29.25345 | 21 |

| 2028 | 43.52419 | 41.06056 | 24.22573 | 41 |

| 2029 | 61.32395 | 42.29238 | 28.75882 | 45 |

| 2030 | 71.49526 | 51.80816 | 41.96461 | 78 |

IV. Professional Investment Strategies and Risk Management for HYPE

HYPE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate HYPE tokens during market dips

- Set price targets and regularly review portfolio

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Hyperliquid

- Set stop-loss orders to manage downside risk

HYPE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Use of stop-loss orders: Limit potential losses on HYPE positions

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HYPE

HYPE Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in executing large trades without price impact

- Competition: Emergence of rival L1 platforms could affect HYPE's market position

HYPE Regulatory Risks

- Regulatory uncertainty: Changing global crypto regulations may impact HYPE

- Compliance challenges: Potential issues with adhering to evolving financial rules

- Cross-border restrictions: Varying international regulations may limit adoption

HYPE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Hyperliquid protocol

- Scalability challenges: Possible network congestion during high demand periods

- Interoperability issues: Compatibility problems with other blockchain networks

VI. Conclusion and Action Recommendations

HYPE Investment Value Assessment

HYPE shows promise as a high-performance L1 platform with innovative on-chain financial applications. However, it faces significant competition and regulatory uncertainties. The token's value proposition is tied to the success and adoption of the Hyperliquid ecosystem.

HYPE Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider HYPE as part of a diversified crypto portfolio

HYPE Trading Participation Methods

- Spot trading: Buy and hold HYPE tokens on Gate.com

- Futures trading: Engage in leveraged trading of HYPE contracts on Gate.com

- Staking: Participate in HYPE staking programs if available on the Hyperliquid platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will hype reach $100?

Reaching $100 by 2030 is ambitious but possible. This target depends on strong user growth and rising trading values. As of 2025, it remains uncertain but potentially achievable.

Is Hyper Coin a good investment?

Yes, Hyper Coin shows promise as an investment. Its cross-chain solutions are gaining traction, and market trends favor its growth potential. Predictions suggest significant value increase by 2025 if widely adopted.

What is the price prediction for hype usdt in 2030?

Based on current market trends, the price prediction for HYPE in 2030 is approximately $1.004018. However, cryptocurrency markets are highly volatile, so this forecast may change.

What crypto will 1000x prediction?

DeepSnitch AI is predicted to 1000x by 2026. It uses AI to find high-potential cryptos, outshining projects like PUMP and Pi Network.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

USD1 vs DOGE: Which Cryptocurrency Investment Strategy Will Dominate the Market in 2024?

XAUT vs CHZ: A Comprehensive Comparison of Gold-Backed and Gaming Tokens in the Crypto Market

What is NEAR: A Complete Guide to Understanding the NEAR Protocol and Its Ecosystem

What is OKB: A Comprehensive Guide to OKEx's Native Token and Its Use Cases

What is XAUT: Understanding the Gold-Backed Cryptocurrency Token on the Tezos Blockchain