2025 DSYNC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: DSYNC's Market Position and Investment Value

Destra Network (DSYNC) is building a decentralized ecosystem for cloud computing, AI, and web services, aiming to solve the problems of centralization, censorship, and privacy that plague traditional web infrastructure. Since its launch in April 2024, the project has been developing unique features including Destra DNS, Destra RPC, and its Proof of Sync consensus mechanism. As of December 2025, DSYNC has a market capitalization of approximately $19.09 million with a circulating supply of 1 billion tokens, trading at around $0.01913 per token. This asset is playing an increasingly critical role in the decentralized cloud computing and GPU network sectors.

This article will provide a comprehensive analysis of DSYNC's price trends and market dynamics, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the period through 2030.

Destra Network (DSYNC) Market Analysis Report

I. DSYNC Price History Review and Market Status

DSYNC Historical Price Trajectory

-

2024: Project launched with initial price of $0.016, marking the entry point for early investors and establishing the foundation for the Destra Network ecosystem focused on decentralized cloud computing and AI services.

-

January 2025: DSYNC reached its all-time high (ATH) of $0.548 on January 6, 2025, representing a significant 3,325% appreciation from the launch price and reflecting strong market enthusiasm for the project's decentralized infrastructure vision.

-

December 2025: Significant market correction phase, with DSYNC declining from its peak to $0.01588 on December 19, 2025 (all-time low or ATL), and currently trading at $0.01913 as of December 20, 2025, representing a 94.13% decline over the one-year period.

DSYNC Current Market Status

As of December 20, 2025, DSYNC is trading at $0.01913 with a 24-hour trading volume of $46,306.72. The token demonstrates modest positive momentum in the short term, with a 24-hour price increase of 8.74%, though this gains perspective when noting the 1-hour change of -0.05% and the 7-day decline of -21%.

The current market capitalization stands at approximately $19.13 million with a fully diluted valuation of $19.09 million, indicating that nearly 100% of the maximum supply of 1 billion tokens is already in circulation (1 billion DSYNC circulating out of 1 billion max supply). The token maintains a market dominance of 0.0059% in the broader cryptocurrency ecosystem and holds a ranking of #886 across all cryptocurrencies.

With 50,084 active token holders and a presence on 9 exchanges, DSYNC demonstrates reasonable network distribution and accessibility. The current trading range shows support near $0.01733 (24-hour low) and resistance near $0.02011 (24-hour high).

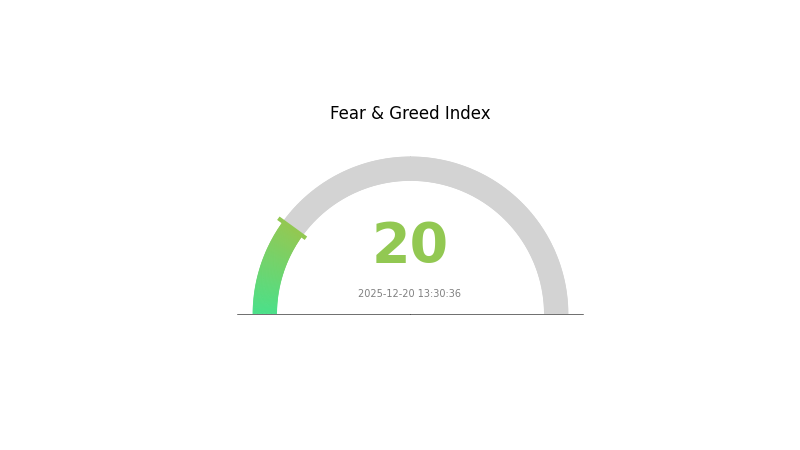

Market sentiment indicators reflect "Extreme Fear" (VIX: 20) in the broader market environment as of December 20, 2025, which may be influencing the downward pressure on DSYNC along with the broader cryptocurrency market conditions.

Click to view current DSYNC market price

DSYNC Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting 20. This reading signals significant market pessimism and heightened uncertainty among investors. During periods of extreme fear, risk-averse behavior typically dominates, with many traders seeking to minimize exposure. However, contrarian investors often view such conditions as potential buying opportunities, as assets may be trading at depressed valuations. Market participants should exercise caution, conduct thorough analysis, and consider their risk tolerance before making investment decisions in this volatile environment.

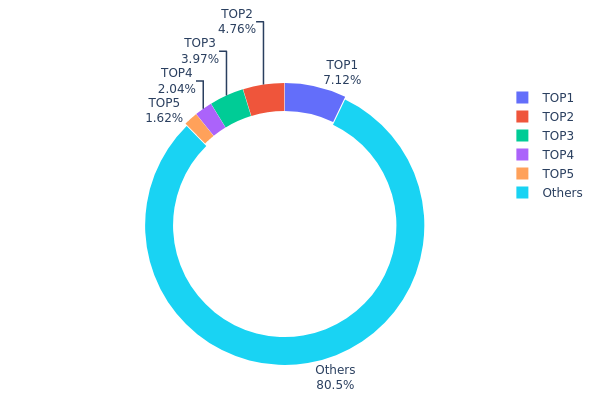

DSYNC Holdings Distribution

The address holdings distribution chart illustrates the concentration of DSYNC tokens across the blockchain network by tracking the top token holders and their respective portfolio percentages. This metric serves as a critical indicator of market concentration risk and provides insights into the decentralization characteristics of the token ecosystem.

Current analysis of DSYNC's holder concentration reveals a relatively healthy distribution pattern. The top five addresses collectively hold approximately 19.49% of total supply, with the largest holder commanding 7.11% and the second-largest holder at 4.76%. This distribution suggests moderate concentration levels, as the majority of tokens (80.51%) remain dispersed among other addresses. The gradual decline in holdings from rank one through rank five indicates an absence of extreme concentration by a single entity, which typically would signal heightened manipulation risks.

The existing address distribution structure demonstrates encouraging characteristics for market stability. With over four-fifths of the supply distributed among numerous addresses beyond the top five, DSYNC exhibits a degree of decentralization that mitigates concerns regarding coordinated price manipulation or flash crash scenarios. The top holder's 7.11% stake, while significant, remains within acceptable parameters for established cryptocurrency projects. This distribution pattern suggests a relatively mature holder base, reducing the likelihood of sudden large-scale liquidations that could trigger severe price volatility. The current structure reflects a stable on-chain ecosystem where no single entity maintains decisive market control, supporting healthier price discovery mechanisms and more authentic market sentiment representation.

Click to view current DSYNC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9642...2f5d4e | 71154.36K | 7.11% |

| 2 | 0x1ffe...6e6ae1 | 47642.47K | 4.76% |

| 3 | 0xf974...3aeb9c | 39712.38K | 3.97% |

| 4 | 0xc062...390581 | 20449.32K | 2.04% |

| 5 | 0x0d07...b492fe | 16155.20K | 1.61% |

| - | Others | 804886.28K | 80.51% |

Core Factors Influencing DSYNC Future Price

Market Demand and Investor Sentiment

DSYNC's future price is primarily influenced by market demand, technological development, and investor confidence. The project's innovativeness and market acceptance are key determining factors. Investor sentiment and overall cryptocurrency market trends have a significant impact on price movements.

Ecosystem Development

Destra Network provides a series of decentralized services including web hosting, storage, and related infrastructure solutions. The adoption and utility of these services within the ecosystem will be crucial in driving long-term value proposition for the DSYNC token.

III. 2025-2030 DSYNC Price Forecast

2025 Outlook

- Conservative Prediction: $0.01317 - $0.01908

- Neutral Prediction: $0.01908 (average level)

- Optimistic Prediction: $0.02652 (with sustained market recovery momentum)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation, characterized by steady accumulation and incremental value recognition in the ecosystem.

- Price Range Forecast:

- 2026: $0.01208 - $0.03374 (19% upside potential)

- 2027: $0.01640 - $0.03138 (47% cumulative gain)

- 2028: $0.02714 - $0.03221 (55% cumulative gain)

- Key Catalysts: Increased protocol adoption, ecosystem expansion, improved market liquidity on trading platforms like Gate.com, and positive regulatory developments.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02885 - $0.03909 (62% gain by 2029), suggesting sustained growth trajectory

- Optimistic Scenario: $0.03505 - $0.04031 (83% gain by 2030), contingent on mainstream institutional adoption and significant ecosystem partnerships

- Transformation Scenario: $0.04031+ (extreme conditions including breakthrough technological innovations, major enterprise integrations, and macroeconomic tailwinds favoring digital assets)

Note: These forecasts represent technical analysis-based projections and should be evaluated alongside fundamental research and risk assessment before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02652 | 0.01908 | 0.01317 | 0 |

| 2026 | 0.03374 | 0.0228 | 0.01208 | 19 |

| 2027 | 0.03138 | 0.02827 | 0.0164 | 47 |

| 2028 | 0.03221 | 0.02983 | 0.02714 | 55 |

| 2029 | 0.03909 | 0.03102 | 0.02885 | 62 |

| 2030 | 0.04031 | 0.03505 | 0.02384 | 83 |

Destra Network (DSYNC) Professional Investment Analysis Report

I. Executive Summary

Destra Network (DSYNC) is building a decentralized ecosystem for cloud computing, AI, and web services. The token operates on the Ethereum blockchain as an ERC-20 token with a maximum supply of 1,000,000,000 DSYNC. As of December 20, 2025, DSYNC is trading at $0.01913 with a market capitalization of approximately $19.13 million, ranking #886 by market cap.

Key Metrics Overview

| Metric | Value |

|---|---|

| Current Price | $0.01913 |

| 24H Change | +8.74% |

| 7D Change | -21% |

| 30D Change | -38.01% |

| 1Y Change | -94.13% |

| Market Cap | $19.13M |

| 24H Trading Volume | $46,306.72 |

| All-Time High | $0.548 (Jan 6, 2025) |

| All-Time Low | $0.01588 (Dec 19, 2025) |

| Circulating Supply | 1,000,000,000 DSYNC |

| Token Holders | 50,084 |

II. Project Overview and Technical Foundation

Project Vision and Mission

Destra Network addresses critical challenges in traditional web infrastructure by providing decentralized alternatives for cloud computing, artificial intelligence, and web services. The platform aims to eliminate centralization, censorship, and privacy concerns that plague conventional infrastructure solutions.

Core Features and Technology Stack

Decentralized GPU Network

- Users can share computing power and earn rewards

- Enables distributed computing resource allocation

- Supports AI and machine learning applications

Infrastructure Components

- Destra DNS: Censorship-resistant domain name services

- Destra RPC: Decentralized remote procedure call infrastructure

- Proof of Sync Consensus Mechanism: Ensures fair, secure, and censorship-resistant operations

- Cloud Solutions: Decentralized storage and web hosting services

Blockchain Implementation

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract Address: 0xf94e7d0710709388bCe3161C32B4eEA56d3f91CC

- Launch Date: April 10, 2024 (Initial Price: $0.016)

III. Market Position and Performance Analysis

Market Performance

Short-Term Performance (Last 24 Hours)

- Price Change: +8.74%

- Trading Range: $0.01733 - $0.02011

- Volume Dynamics: Moderate trading activity at $46,306.72

Medium-Term Trends (7-30 Days)

- 7-Day Performance: -21%

- 30-Day Performance: -38.01%

- Indicates sustained downward pressure over the medium term

Long-Term Performance

- 1-Year Performance: -94.13%

- Price Decline from ATH: 96.51% (from $0.548 to current $0.01913)

- Currently Trading Near All-Time Low (Dec 19, 2025: $0.01588)

Market Dynamics

Liquidity and Exchange Presence

- Available on 9 cryptocurrency exchanges

- Tradable on Gate.com with verified trading pairs

- Relatively limited liquidity compared to major tokens

Community and Distribution

- 50,084 token holders

- Fully diluted valuation matches current market cap (100% circulating)

- Market dominance: 0.00059% of total crypto market

IV. DSYNC Professional Investment Strategy and Risk Management

DSYNC Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investor Profile: Technology enthusiasts, decentralized infrastructure believers, long-term value investors with high risk tolerance

-

Operational Guidelines:

- Dollar-Cost Averaging (DCA): Systematically accumulate DSYNC over extended periods to reduce entry price volatility impact

- Fundamental Thesis Alignment: Only invest if you believe in Destra Network's vision for decentralized cloud infrastructure and are willing to hold through significant price fluctuations

- Secure Storage: Utilize Gate.com's Web3 wallet for self-custody while maintaining active trading capability

-

Position Sizing: Conservative allocation of 1-3% of total portfolio, given the project's early-stage status and extreme price volatility

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at $0.01588 (ATL), $0.01913 (current), and $0.02011 (24H high) for entry/exit decision-making

- Volume Analysis: Monitor 24-hour volume changes to confirm price movements and identify potential reversals

-

Swing Trading Considerations:

- Entry Points: Consider accumulation during extreme weakness (near ATL levels) with strict position limits

- Risk/Reward Ratios: Maintain 1:3 minimum risk-reward ratios before initiating positions given the token's volatility profile

DSYNC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% allocation to DSYNC within overall crypto portfolio

- Moderate Investors: 1-3% allocation, with clear stop-loss orders at -20% from entry

- Aggressive Investors: 3-5% allocation maximum, accepting potential total loss scenarios

(2) Risk Hedging Strategies

- Portfolio Diversification: Never allocate a significant portion of investable capital to DSYNC; maintain exposure across multiple sectors and market-cap ranges

- Profit-Taking Discipline: Implement systematic profit-taking at predetermined price targets to secure gains during rallies

(3) Security and Storage Solutions

- Recommended Approach: Utilize Gate.com's integrated Web3 wallet for seamless trading and secure custody, offering balance between accessibility and security

- Security Best Practices:

- Enable two-factor authentication on all exchange accounts

- Maintain separate wallets for trading and long-term storage

- Never share private keys or seed phrases

V. DSYNC Potential Risks and Challenges

Market Risks

- Extreme Price Volatility: 94.13% year-over-year decline with potential for further depreciation indicates speculative nature and unsuitable for risk-averse investors

- Liquidity Risk: With only $46,306 in 24-hour volume, large orders could face significant slippage, limiting entry and exit flexibility for institutional participants

- Market Sentiment Deterioration: Steep 38% monthly decline suggests eroding investor confidence; recovery dependent on significant positive catalysts

Regulatory Risks

- Evolving Compliance Framework: Decentralized infrastructure projects face increasing regulatory scrutiny across major jurisdictions regarding classification and compliance requirements

- Geographic Restrictions: Some regions may restrict or prohibit trading in tokens that provide decentralized infrastructure services

- Governance Uncertainty: Lack of clear regulatory precedent for decentralized cloud computing and GPU networks creates long-term compliance uncertainty

Technical Risks

- Smart Contract Vulnerabilities: ERC-20 token contracts could contain undiscovered security flaws; community audits and professional security reviews status unknown

- Ecosystem Maturity: Platform infrastructure components (Destra DNS, Destra RPC) may not be fully audited or battle-tested in production environments

- Adoption Barriers: Achieving meaningful adoption of decentralized infrastructure requires solving user experience and cost-competitiveness challenges against entrenched centralized providers

VI. Conclusion and Action Recommendations

DSYNC Investment Value Assessment

Destra Network represents an early-stage, highly speculative project attempting to solve legitimate infrastructure centralization problems. However, the token's 94% year-over-year decline and current trading near all-time lows suggest significant headwinds. The project's technical vision is compelling, but execution risk is substantial. Investment viability depends entirely on Destra's ability to achieve meaningful platform adoption and demonstrate competitive advantages over both traditional cloud providers and competing decentralized infrastructure projects. Current valuation offers potential asymmetric upside for risk-tolerant investors, but downside risks remain considerable.

DSYNC Investment Recommendations

✅ Beginners: Consider minimal exploratory positions (0.5% or less of crypto allocation) only after comprehensive research; prioritize learning about project fundamentals before deploying capital

✅ Experienced Investors: Implement systematic accumulation strategies during extreme weakness if maintaining conviction in Destra's long-term vision; employ strict risk management with predetermined exit criteria

✅ Institutional Investors: Monitor project development metrics and ecosystem adoption indicators; consider participation only after major technical milestones and regulatory clarity achieved

DSYNC Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of DSYNC tokens through Gate.com's trading platform, enabling flexible entry and exit strategies

- Dollar-Cost Averaging Approach: Automated periodic purchases through Gate.com to accumulate positions systematically while reducing timing risk

- Staking or Yield Programs: Monitor Destra Network's official channels for potential staking opportunities or liquidity mining programs offering additional returns

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must evaluate DSYNC based on individual risk tolerance and financial circumstances. Consult qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose entirely. The information presented reflects market conditions as of December 20, 2025, and may not represent future conditions.

FAQ

What is Dsync's price prediction?

DSYNC is expected to trade between $0.01141 and $0.01637 in 2025, based on current market trends and technical analysis of the network's growth potential.

Will Dsync be listed on Binance?

Yes, Dsync is expected to be listed on major exchanges very soon. Based on current market momentum and development progress, a listing is likely to occur in the coming weeks, which could significantly boost trading volume and price performance.

What factors influence Dsync's price movement?

Dsync's price is influenced by market sentiment, overall crypto market trends, trading volume, regulatory developments, and investor adoption. Supply and demand dynamics also significantly impact price fluctuations.

What is the market cap and circulating supply of Dsync?

As of 2025-12-20, Dsync has a market cap of $19,833,281 and a circulating supply of 974,947,710 tokens.

What are the risks and challenges for Dsync's price growth?

DSYNC faces market volatility and competitive pressures from emerging AI projects. Mainnet execution risks, regulatory uncertainties, and trading volume fluctuations could impact price momentum. Success depends on adoption rates and market sentiment shifts.

2025 BLESS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 ROAM Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Pi Network Mainnet Launch and Future

Jelly-My-Jelly: Beyond Memes - Analyzing Its Whitepaper Logic and Real Use Cases

EGL1: The Rising Dark Horse with 60% Completed Roadmap

Manyu Whitepaper Deep Dive: Core Logic, Use Cases, and Technical Innovation

Uncovering Top Altcoin Picks for Massive Growth in 2025

What is EL: A Comprehensive Guide to Expression Language in Modern Web Development

Discover Promising Cryptocurrencies for 1000x Returns by 2026

What is LYX: A Comprehensive Guide to the Document Preparation System

What is ENSO: Understanding the El Niño-Southern Oscillation and Its Global Climate Impact