2025 BTC Price Prediction: Expert Analysis of Bitcoin's Potential Trajectory and Market Catalysts

Introduction: BTC's Market Position and Investment Value

Bitcoin (BTC), as the world's leading cryptocurrency, has achieved remarkable success since its inception in 2008. As of 2025, Bitcoin's market capitalization has reached $1,792,398,007,526, with a circulating supply of approximately 19,962,334 coins and a price hovering around $89,789. This asset, often hailed as "digital gold," is playing an increasingly crucial role in the global financial system and decentralized economy.

This article will provide a comprehensive analysis of Bitcoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BTC Price History Review and Current Market Status

BTC Historical Price Evolution

- 2009: Bitcoin launched, price near zero

- 2013: First major bull run, price reached $1,000

- 2017: Massive bull market, price peaked at $20,000

- 2020: Halving event and institutional adoption, price surpassed $20,000

- 2021: All-time high of $69,000 reached

- 2022: Market downturn, price dropped to around $15,000

BTC Current Market Situation

As of December 15, 2025, Bitcoin is trading at $89,789, showing a slight decrease of 0.23% in the last 24 hours. The current price is 28.78% below its all-time high of $126,080 reached on October 7, 2025. Bitcoin's market capitalization stands at $1,792,398,007,526, maintaining its dominant position with a 54.96% market share.

The 24-hour trading volume is $800,903,498, indicating active market participation. Bitcoin's circulating supply is 19,962,334 BTC, which is 95.06% of its maximum supply of 21,000,000 BTC. The fully diluted valuation matches the current market cap, suggesting that most of the total supply is already in circulation.

Short-term price trends show mixed signals, with a 1-hour decrease of 0.09% and a 7-day decline of 2.34%. The longer-term 30-day and 1-year trends are negative at -6.31% and -11.45% respectively, indicating a bearish sentiment in recent months.

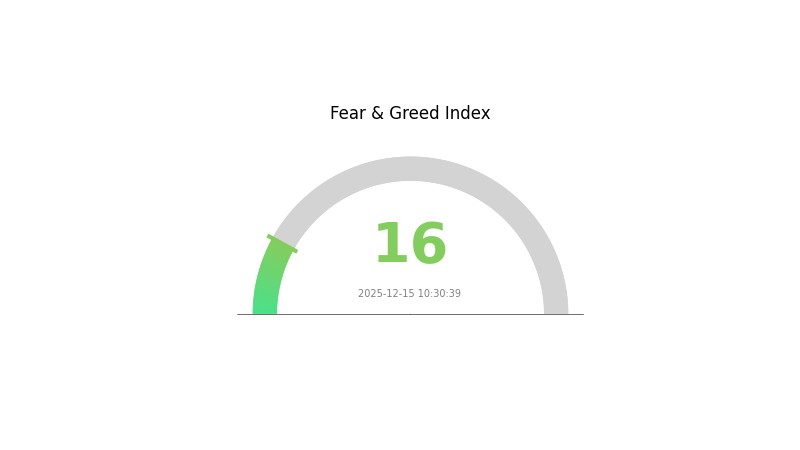

The current market emotion index stands at "Extreme Fear" with a VIX of 16, suggesting significant investor anxiety and potential overselling in the market.

Click to view the current BTC market price

BTC Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This suggests a highly pessimistic sentiment among investors. Historically, such extreme fear periods have often preceded market bottoms, potentially presenting buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider this indicator alongside other technical and fundamental analyses before making investment decisions.

BTC Holdings Distribution

The Bitcoin address holdings distribution provides crucial insights into the concentration of BTC ownership. According to the data, the top five addresses collectively hold approximately 3.81% of the total Bitcoin supply. The largest single address contains 248,600 BTC, representing 1.25% of the total supply. This distribution suggests a relatively decentralized ownership structure, as the majority of Bitcoin (96.19%) is held by addresses outside the top five.

This level of distribution indicates a healthy balance in Bitcoin's ownership structure, mitigating concerns of excessive concentration. The absence of any single address holding an overwhelming percentage reduces the risk of market manipulation by individual large holders, often referred to as "whales." However, it's important to note that these addresses could represent exchanges, institutional custodians, or large investment funds, rather than individual owners.

The current distribution pattern reflects a maturing market with a diverse set of participants. It suggests a robust on-chain structure and a high degree of decentralization, which aligns with Bitcoin's fundamental principles. This distribution pattern may contribute to market stability by reducing the impact of large sell-offs from any single entity, potentially leading to more gradual price movements and lower volatility in the long term.

Click to view the current BTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248.60K | 1.25% |

| 2 | 3M219K...DjxRP6 | 147.12K | 0.74% |

| 3 | bc1ql4...8859v2 | 140.57K | 0.70% |

| 4 | bc1qgd...jwvw97 | 130.01K | 0.65% |

| 5 | bc1qaz...uxwczt | 94.64K | 0.47% |

| - | Others | 19201.24K | 96.19% |

II. Core Factors Influencing BTC's Future Price

Supply Mechanism

- Halving: Bitcoin undergoes a "halving" event every four years, reducing the block reward by half.

- Historical Pattern: Previous halvings have led to significant price increases in the following months.

- Current Impact: The upcoming halving in 2024 is expected to reduce inflation rate below 1%, potentially triggering a new bull run.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are continuously increasing their Bitcoin holdings through ETFs and trusts.

- Corporate Adoption: Large public companies are adding Bitcoin to their balance sheets as a treasury reserve asset.

- Government Policies: The Trump administration has shown a positive attitude towards cryptocurrencies, appointing supporters to key positions and promising to make the US a "global Bitcoin center".

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve is expected to enter an interest rate cutting cycle, potentially increasing liquidity in risk assets like Bitcoin.

- Inflation Hedging Properties: Bitcoin is increasingly viewed as a hedge against currency devaluation and long-term fiscal deficit pressures.

- Geopolitical Factors: Global geopolitical risks and fiat currency devaluation are driving Bitcoin's adoption as a "digital gold" hedging tool.

Technological Development and Ecosystem Building

- Smart Contract Integration: Bitcoin network is expanding its capabilities to support complex financial applications through sidechains or protocol upgrades.

- Lightning Network: The continued development of the Lightning Network is improving Bitcoin's scalability for everyday transactions.

- Ecosystem Applications: The growing DeFi ecosystem on Bitcoin is allowing users to earn yield by collateralizing their BTC.

III. BTC Price Predictions for 2025-2030

2025 Outlook

- Conservative prediction: $51,234 - $70,000

- Neutral prediction: $70,000 - $90,000

- Optimistic prediction: $90,000 - $131,232 (requires continued institutional adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market continuation

- Price range predictions:

- 2027: $124,461 - $158,524

- 2028: $124,500 - $208,466

- Key catalysts: Halving event impact, global economic recovery

2029-2030 Long-term Outlook

- Base scenario: $176,617 - $212,824 (assuming steady adoption and regulatory clarity)

- Optimistic scenario: $212,824 - $249,030 (assuming widespread institutional integration)

- Transformative scenario: $249,030 - $272,414 (assuming Bitcoin becomes a global reserve asset)

- 2030-12-31: BTC $272,414 (potential peak of the cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 131232.39 | 89885.2 | 51234.56 | 0 |

| 2026 | 151465.55 | 110558.8 | 101714.09 | 23 |

| 2027 | 158524.73 | 131012.17 | 124461.56 | 45 |

| 2028 | 208466.57 | 144768.45 | 124500.87 | 61 |

| 2029 | 249030.69 | 176617.51 | 109502.86 | 96 |

| 2030 | 272414.85 | 212824.1 | 112796.77 | 137 |

IV. Professional BTC Investment Strategies and Risk Management

BTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking long-term value

- Operation suggestions:

- Dollar-cost averaging (DCA) to reduce entry price volatility

- Set a target holding period of at least 4-5 years

- Store BTC in a secure hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend direction and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor key support and resistance levels

- Use stop-loss orders to manage downside risk

BTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5% of portfolio

- Moderate investors: 5-10% of portfolio

- Aggressive investors: 10-20% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets and traditional markets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for BTC

BTC Market Risks

- Volatility: Extreme price fluctuations can lead to significant losses

- Liquidity risk: Large sell-offs can impact price stability

- Market manipulation: Potential for whale activities to influence prices

BTC Regulatory Risks

- Government crackdowns: Potential bans or restrictions in certain jurisdictions

- Tax implications: Evolving tax laws may impact profitability

- AML/KYC requirements: Stricter regulations may affect accessibility

BTC Technical Risks

- Network attacks: Potential 51% attacks or other security vulnerabilities

- Scaling issues: Transaction speed and fees during high network congestion

- Hard fork risks: Potential chain splits leading to market uncertainty

VI. Conclusion and Action Recommendations

BTC Investment Value Assessment

Bitcoin remains a high-risk, high-reward asset with significant long-term potential but substantial short-term volatility. Its limited supply and growing institutional adoption support its value proposition, while regulatory uncertainties and market manipulation risks pose challenges.

BTC Investment Recommendations

✅ Beginners: Start with small, regular investments using dollar-cost averaging ✅ Experienced investors: Consider a balanced approach of holding and strategic trading ✅ Institutional investors: Explore Bitcoin as a portfolio diversifier and inflation hedge

BTC Trading Participation Methods

- Spot trading: Direct purchase and sale of BTC on reputable exchanges like Gate.com

- Futures trading: Leverage opportunities for experienced traders on regulated platforms

- Bitcoin ETFs: Indirect exposure through regulated financial products (where available)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will Bitcoin be worth in 2025?

Based on current market trends and expert predictions, Bitcoin's value is expected to reach around $150,000 by 2025, driven by increased adoption and institutional investment.

What will 1 Bitcoin be worth in 2030?

Based on market analysis, 1 Bitcoin is predicted to be worth around $114,000 in 2030. However, this estimate may vary due to market volatility.

How much will BTC be worth in 10 years?

Based on current trends, BTC is projected to reach $1 million in 10 years. This estimate assumes continued growth patterns and adoption rates seen in past cycles.

Can Bitcoin drop to 10k?

Yes, Bitcoin could potentially drop to $10k. Historical price patterns and market volatility suggest this possibility, though it's not guaranteed.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What are the key fundamentals driving Polkadot (DOT) token value in 2025: whitepaper logic, use cases, and technical innovations explained

How does TAO's $16 million institutional holdings and exchange net inflow impact its market liquidity and staking rate?

What are the key regulatory risks facing crypto compliance and KYC/AML policies in 2025?

Is YearnFinance (YFI) a good investment?: A Comprehensive Analysis of Risks, Returns, and Market Potential in 2024

How do AVAX exchange inflows and staking rates impact Avalanche token holdings and market dynamics?