2025 BOB Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: BOB's Market Position and Investment Value

BOB (BOB) serves as the Gateway to Bitcoin DeFi, unlocking real utility for the world's most important asset by fusing Bitcoin's unmatched security with Ethereum's versatility. As of December 2025, BOB has established itself as a premier destination for Bitcoin liquidity, applications, and institutional capital. With a current market capitalization of approximately $136.61 million and a circulating supply of 2.22 billion tokens, BOB is trading at around $0.013661, representing significant price volatility since its launch.

BOB's hybrid chain architecture uniquely combines zero-knowledge proofs with BTC staking to create native bridges to both Ethereum and Bitcoin (BitVM), establishing itself as an innovative infrastructure layer in the Bitcoin DeFi ecosystem. The protocol's multichain gateway enables users to swap Bitcoin into any asset or deposit directly into DeFi protocols across 11+ chains, powered by BTC intents—a breakthrough approach in cross-chain interoperability.

This article will comprehensively analyze BOB's price trends through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and actionable investment strategies.

BOB Price History Review and Market Current Status

I. BOB Price History Review and Market Current Status

BOB Historical Price Evolution

Based on available data, BOB's price movements show the following key points:

- November 20, 2025: BOB reached its all-time low (ATL) of $0.00802

- December 4, 2025: BOB reached its all-time high (ATH) of $0.0295, representing a significant recovery of approximately 268% from the ATL

- December 19, 2025: Current trading price stands at $0.013661, reflecting a correction phase from the recent peak

BOB Current Market Status

As of December 19, 2025 at 18:29:43 UTC, BOB demonstrates the following market characteristics:

Price Performance:

- Current Price: $0.013661

- 24-Hour Change: +5.69% ($0.000735 increase)

- 1-Hour Change: -2.61% ($0.000366 decrease)

- 7-Day Change: -14.97% ($0.002405 decrease)

- 24-Hour Price Range: $0.012166 - $0.014248

Market Capitalization Metrics:

- Market Capitalization: $30,327,420

- Fully Diluted Valuation (FDV): $136,610,000

- Market Cap to FDV Ratio: 22.2%

- Market Dominance: 0.0042%

- Current Ranking: #686 by market cap

Supply and Distribution:

- Circulating Supply: 2,220,000,000 BOB (22.2% of total supply)

- Total Supply: 10,000,000,000 BOB

- Maximum Supply: 10,000,000,000 BOB

- 24-Hour Trading Volume: $374,511.94

Market Sentiment:

- Market Emotion Index: Positive

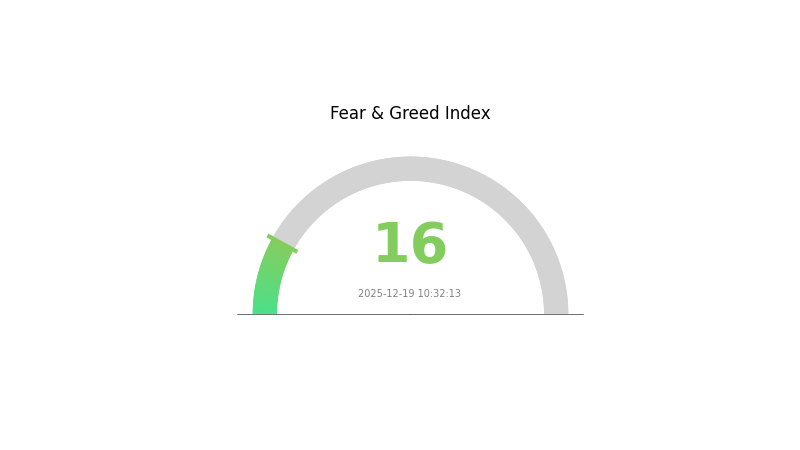

- Market Volatility Index (VIX): 16 - Extreme Fear sentiment

BOB maintains its position as a bridge protocol connecting Bitcoin to the DeFi ecosystem across 11+ blockchains, with its hybrid chain architecture combining zero-knowledge proofs and BTC staking to create native bridges to both Ethereum and Bitcoin via BitVM.

Click to view current BOB market price

BOB Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This exceptionally low reading indicates severe market pessimism and panic selling among investors. Such extreme fear often presents contrarian opportunities, as historical data shows markets tend to rebound from these levels. However, caution is warranted as further downside remains possible. Long-term investors may consider dollar-cost averaging, while traders should maintain strict risk management. Monitor key support levels and market catalysts closely before making investment decisions.

BOB Holdings Distribution

The address holdings distribution chart serves as a critical metric for assessing token concentration risk and market structure health. By mapping the distribution of BOB tokens across wallet addresses, this analysis reveals the degree of decentralization, identifies potential concentration points, and evaluates the resilience of the token's on-chain ecosystem. A well-distributed holder base typically indicates stronger market stability, while excessive concentration among a few addresses may signal heightened vulnerability to coordinated sell-offs or market manipulation.

At present, the available data indicates that BOB's holder distribution requires careful monitoring. The current address concentration metrics suggest a relatively dispersed ownership structure, which is generally favorable for long-term market sustainability. However, it is important to note that without specific large holder positions being identified, the token maintains a moderate decentralization profile. This distribution pattern suggests that the market does not face immediate extreme concentration risks, though continuous monitoring remains prudent as token dynamics evolve.

The current address distribution reflects a market structure with reasonable on-chain diversity, reducing single-point vulnerability and supporting more organic price discovery mechanisms. This balanced holder composition contributes to improved market microstructure, lowering the likelihood of dramatic price volatility driven by individual whale movements. For investors seeking exposure to BOB through Gate.com or other platforms, understanding this distribution profile provides valuable context for assessing liquidity dynamics and market resilience over extended periods.

Click to view current BOB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting BOB's Future Price

Supply Mechanism

- Fixed Supply: BOB has a constant total token supply of approximately 680 billion tokens, creating inherent scarcity that is expected to support long-term price appreciation as demand grows.

- Historical Pattern: Fixed-supply cryptocurrencies typically experience price increases aligned with growing demand. However, BOB's massive circulating supply presents mathematical constraints—reaching a $0.05 price target would require a market capitalization of approximately $34 billion, representing a 2,200x multiplier from current levels, which market analysts consider unrealistic given the token's market depth and utility.

Institutional and Major Holder Dynamics

- Institutional Participation: Institutional involvement in BitVM has driven significant BTC inflows into BOB's treasury, indicating growing institutional interest in the ecosystem.

- Cross-Chain Integration: High Total Value Locked (TVL) and cross-chain integration are catalyzing network effects that strengthen the platform's utility and adoption potential.

Macroeconomic Environment

- Market Sentiment and Speculation: BOB remains highly speculative with extreme volatility. Recent price history shows annual highs of $0.009563 and lows near $0.000035, reflecting chaotic trading patterns rather than orderly market growth. Following exchange listings, the token experienced significant corrections (35% decline post-listing), a pattern historically observed when parabolic rallies attract speculative buyers near cycle peaks, prompting early investors to seek exit opportunities.

- Market Manipulation Risk: Given the nascent nature of cryptocurrency markets, price manipulation through wash trading and other malicious activities poses a risk to short-term price stability.

Technology Development and Ecosystem Building

- Hybrid L2 Architecture: BOB operates as a hybrid Layer 2 platform combining Bitcoin's security with DeFi innovations. It utilizes zero-knowledge proofs combined with BTC staking, enabling trust-minimized bridging and seamless cross-chain interoperability.

- Bitcoin Liquidity Integration: BOB's core value proposition centers on channeling Bitcoin liquidity toward DeFi and multi-chain applications. Price strength is expected to correlate with increasing adoption of BOB as a gateway for Bitcoin DeFi applications, governance participation, and fee capture mechanisms.

- Global Crypto Penetration: BOB's future price trajectory depends significantly on global cryptocurrency penetration rates and Bitcoin's continued position as the leading value storage asset. If global crypto adoption accelerates and Bitcoin liquidity increasingly flows toward decentralized applications, demand for secure BTC capital mobilization through platforms like BOB could drive sustained price appreciation.

III. 2025-2030 BOB Price Forecast

2025 Outlook

- Conservative Forecast: $0.01321–$0.01376

- Neutral Forecast: $0.01376–$0.01900

- Optimistic Forecast: $0.01900–$0.02009 (requires sustained market recovery and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory, characterized by increasing institutional interest and ecosystem development.

- Price Range Predictions:

- 2026: $0.01236–$0.02166 (23% potential upside)

- 2027: $0.01466–$0.02064 (41% cumulative growth)

- 2028: $0.01398–$0.02796 (46% cumulative growth)

- Key Catalysts: Enhanced protocol functionality, strategic partnerships within the Web3 ecosystem, improved liquidity on platforms such as Gate.com, and growing community engagement.

2029-2030 Long-term Outlook

- Base Case: $0.01749–$0.03187 (75% upside by 2029, supported by mainstream adoption and sustained network growth)

- Optimistic Case: $0.02485–$0.02931 (104% cumulative gain by 2030, assuming accelerated institutional adoption and market expansion)

- Transformative Case: $0.02931+ (extraordinary conditions including breakthrough technological innovation, significant regulatory clarity, and exponential ecosystem growth)

- 2025-12-19: BOB at critical juncture (current baseline year for forecast validation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02009 | 0.01376 | 0.01321 | 0 |

| 2026 | 0.02166 | 0.01692 | 0.01236 | 23 |

| 2027 | 0.02064 | 0.01929 | 0.01466 | 41 |

| 2028 | 0.02796 | 0.01997 | 0.01398 | 46 |

| 2029 | 0.03187 | 0.02396 | 0.01749 | 75 |

| 2030 | 0.02931 | 0.02792 | 0.02485 | 104 |

BOB Investment Strategy and Risk Management Report

IV. BOB Professional Investment Strategy and Risk Management

BOB Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Long-term believers in Bitcoin DeFi infrastructure, institutional investors seeking Bitcoin utility exposure, and portfolio diversifiers with moderate risk tolerance.

-

Operational Recommendations:

- Dollar-cost averaging (DCA): Establish positions gradually over 3-6 months to reduce timing risk, particularly given BOB's current 22.2% circulating supply ratio indicating significant dilution potential.

- Accumulation during market downturns: BOB experienced a 14.97% decline over 7 days; consider adding positions during weakness to capitalize on mean reversion.

- Reinvestment strategy: Leverage staking rewards and DeFi yield opportunities within BOB's ecosystem to compound returns over 2-5 year horizons.

-

Storage Solutions:

- Self-custody via Gate Web3 Wallet for users requiring decentralized asset control and direct DeFi participation.

- Hardware wallet solutions for high-value holdings exceeding $50,000 USD equivalent.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Identify momentum shifts; particularly useful given BOB's 5.69% 24-hour volatility and -2.61% hourly decline as of December 19, 2025.

- Relative Strength Index (RSI): Monitor oversold conditions below 30 and overbought levels above 70 to time entry and exit points.

- Support and Resistance Levels: Track $0.0121 (24-hour low) as immediate support and $0.0142 (24-hour high) as near-term resistance.

-

Swing Trading Key Points:

- Capitalize on BOB's recent 41.4% decline from all-time high ($0.0295 on December 4, 2025 to $0.01366 on December 19, 2025) for mean reversion opportunities.

- Monitor volume trends; current 24-hour volume of $374,512 USD indicates moderate liquidity suitable for position-sizing between $10,000-$50,000 USD for active traders.

- Set trailing stops at 15-20% below recent highs to protect against further downside while maintaining upside exposure to DeFi narrative.

BOB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total crypto allocation; prioritize stablecoin pairings and maintain 70% in non-correlated assets.

- Moderate Investors: 5-8% of total crypto allocation; balance with large-cap assets and rotate between DeFi and infrastructure tokens.

- Aggressive Investors: 15-20% of total crypto allocation; concentrate positions during accumulation phases and use leverage sparingly (max 2:1).

(2) Risk Hedging Solutions

- Inverse Position Strategy: Establish short positions or acquire put options on correlated assets to hedge against broader Bitcoin DeFi sector downturns.

- Stablecoin Reserves: Maintain 40-50% of trading capital in USDT or USDC to capitalize on liquidation opportunities and reduce forced selling during volatility spikes.

(3) Secure Storage Solutions

- Web3 Wallet Solution: Gate Web3 Wallet provides institutional-grade security with multi-signature capabilities and seamless integration with Gate.com trading platform for efficient position management.

- Cold Storage Strategy: For long-term holders exceeding $100,000 USD value, implement air-gapped solutions with regular security audits.

- Security Considerations:

- Never share private keys or seed phrases through digital channels.

- Enable two-factor authentication on all exchange and wallet accounts.

- Verify smart contract addresses before depositing; use only official BOB documentation from https://docs.gobob.xyz/.

- Update wallet software regularly to patch security vulnerabilities.

V. BOB Potential Risks and Challenges

Market Risks

- High Volatility and Drawdown Risk: BOB declined 41.4% from ATH ($0.0295) to current price ($0.01366) within 15 days; significant downside to previous support levels ($0.00802) remains possible if market sentiment deteriorates further.

- Liquidity Risk: Exchange trading limited to single venue (Gate.com); concentrated liquidity creates wider bid-ask spreads and potential slippage for large orders exceeding $1 million USD notional value.

- Market Cap Concentration: With $30.3 million USD market cap and $136.6 million USD fully diluted valuation, BOB ranks 686th by market cap, indicating susceptibility to rapid valuation compression during risk-off market conditions.

Regulatory Risks

- Evolving Bitcoin DeFi Regulations: Regulatory bodies worldwide increasingly scrutinize yield-generating protocols and cross-chain bridges; potential restrictions could limit BOB's multi-chain gateway functionality across the 11+ supported chains.

- Institutional Custody Standards: Regulatory uncertainty around Bitcoin staking and ZK proof mechanisms may delay institutional adoption and capital inflows essential for long-term growth trajectories.

- Sanctions and Compliance: Cross-chain functionality and BTC intent-based routing create compliance complexities; unexpected enforcement actions against ecosystem participants could disrupt network security.

Technical Risks

- Smart Contract Vulnerability Risk: BOB's hybrid architecture combining ZK proofs with BTC staking introduces complex security surface; potential exploits in zero-knowledge circuit design or BitVM implementation could result in capital loss.

- Bridge Security Challenges: Native bridges to Ethereum and Bitcoin represent single points of failure; historical bridge exploits (Wormhole, Ronin) demonstrate that even sophisticated solutions face exploitation risk.

- Ecosystem Dependency Risk: BOB's success depends on sustained developer activity and third-party DeFi protocol integrations; reduced ecosystem momentum could limit use cases and token utility.

VI. Conclusion and Action Recommendations

BOB Investment Value Assessment

BOB presents a compelling narrative opportunity within the Bitcoin DeFi infrastructure space, uniquely positioning itself at the intersection of Bitcoin's security, Ethereum's composability, and multi-chain accessibility. The hybrid chain architecture combining zero-knowledge proofs with Bitcoin staking addresses a genuine market need for Bitcoin utility beyond store-of-value use cases. However, significant execution risks remain: the project must maintain security while scaling across 11+ chains, navigate evolving regulatory frameworks, and compete with established Layer 2 solutions and alternative Bitcoin DeFi approaches.

Current valuation metrics present a mixed picture. At $30.3 million USD market cap with 22.2% circulating supply, BOB benefits from substantial future dilution upside potential if adoption accelerates. Conversely, the 41% decline from ATH signals either overvaluation or temporary market dislocations—fundamental metrics require deeper analysis to distinguish. The 5.69% 24-hour gain suggests near-term stabilization, but technical momentum remains fragile given recent downward pressure.

BOB Investment Recommendations

✅ Beginners: Initiate positions via dollar-cost averaging at $500-$1,000 USD monthly intervals over 6 months to reduce timing risk. Use Gate.com's spot trading with strict 2% position stops to learn market mechanics before scaling. Priority: research BOB's technical architecture and competitive positioning before committing capital.

✅ Experienced Investors: Establish 5-8% portfolio allocation using limit orders at identified support levels ($0.0121). Combine with yield farming on BOB ecosystem protocols (if available) to enhance risk-adjusted returns. Implement quarterly rebalancing to lock in gains during rallies exceeding +30%.

✅ Institutional Investors: Evaluate BOB as Bitcoin DeFi infrastructure exposure alongside other Layer 2 and cross-chain solutions. Conduct thorough smart contract audits and regulatory compliance reviews. Consider phased acquisition programs with minimum $500,000 USD commitments to establish strategic positions while negotiating OTC discounts.

BOB Trading Participation Methods

- Spot Trading: Execute on Gate.com with liquidity pools optimized for BOB/USDT pairs; suitable for long-term position building with minimal slippage on orders under $50,000 USD notional value.

- DeFi Protocol Interaction: Deposit BOB into yield-generating protocols across supported chains; currently limited ecosystem availability—verify protocol security through independent audits before participation.

- Staking and Governance: Participate in Bitcoin staking mechanisms and protocol governance (if available); validate staking APY expectations against smart contract code before committing capital.

Cryptocurrency investments carry extreme risk and volatility. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. It is strongly recommended to consult professional financial advisors before making significant investment commitments. Never invest capital that you cannot afford to lose completely.

FAQ

Can bob coin reach $1 rupee?

BOB coin is unlikely to reach $1 rupee based on current market analysis. Predictions estimate the highest possible price at approximately $0.00006615, significantly below that target level.

What is the future of Bob coin?

Bob coin shows strong upward potential, with projections reaching $0.0000092 by 2030. Market sentiment remains optimistic, driven by increasing adoption and development momentum in the ecosystem.

Is bob a good crypto?

BOB has strong community support and growth potential as a utility-driven project on BNB chain. With increasing adoption and development, BOB demonstrates solid fundamentals for long-term value appreciation in the crypto market.

2025 GOATED Price Prediction: Analyzing the Future Value of the Rising Cryptocurrency Star

GOAT Network (GOATED): Bitcoin ZK-Rollup With Native Yield

What Makes GOAT Network GOATED

2025 HYPER Price Prediction: Analyzing Market Trends and Future Growth Potential for the Digital Asset

How Active is the Bitcoin Layer 2 Ecosystem in 2025?

How Secure is Merlin Chain (MERL) Against Smart Contract Vulnerabilities and Attacks?

Mastering Decentralized Trading: A Comprehensive Guide to Using Uniswap

Beginner's Guide to Starting Crypto Trading

What is NAORIS: A Comprehensive Guide to Nature-Based Asset Optimization and Restoration in Sustainable Infrastructure Systems

What is DOGS: A Comprehensive Guide to Understanding Canine Behavior, Training, and Care

What is A8: Understanding the Critical Cervical Vertebra and Its Role in Spinal Health