CryptoHODL

No content yet

CryptoHODL

📈 Bitcoin is preparing to reach $100,000.

A CoinDesk analyst has identified bullish factors that point to continued growth.

▪️ $BTC (BVIV) volatility fell to 48, breaking the bullish trend. Panic is easing, and the market is stabilizing.

The downtrend in the dollar is an additional plus.

🕯 Technical factors:

BTC has consolidated above $93,104 and the Ichimoku cloud.

▪️ Next target: $98,000 - $100,000.

However, there is a risk that a break below the Ichimoku cloud will weaken the momentum.

Key targets for other coins:

🔹 $ETH - $3,500.

🔹 $SOL - $165.

🔹 $XRP - $2.30.

A CoinDesk analyst has identified bullish factors that point to continued growth.

▪️ $BTC (BVIV) volatility fell to 48, breaking the bullish trend. Panic is easing, and the market is stabilizing.

The downtrend in the dollar is an additional plus.

🕯 Technical factors:

BTC has consolidated above $93,104 and the Ichimoku cloud.

▪️ Next target: $98,000 - $100,000.

However, there is a risk that a break below the Ichimoku cloud will weaken the momentum.

Key targets for other coins:

🔹 $ETH - $3,500.

🔹 $SOL - $165.

🔹 $XRP - $2.30.

- Reward

- like

- Comment

- Repost

- Share

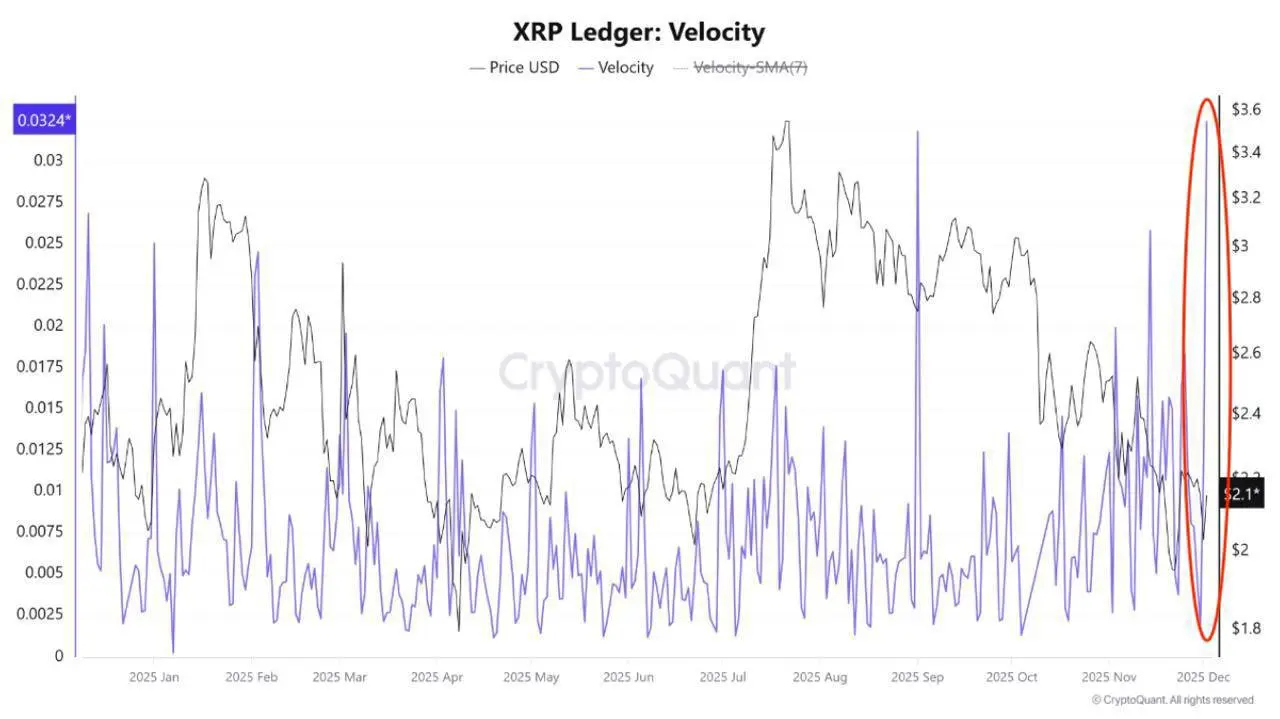

🐋 Activity is being observed among $XRP whales.

Whales have begun to show activity and gradually buy back this asset.

The coin has reached a favorable $2 level, which likely prompted these investors to add to their positions.

I believe their activity will be sufficient to maintain this price level, and we won't see any significant declines in the near future.

Whales have begun to show activity and gradually buy back this asset.

The coin has reached a favorable $2 level, which likely prompted these investors to add to their positions.

I believe their activity will be sufficient to maintain this price level, and we won't see any significant declines in the near future.

XRP0.54%

- Reward

- like

- Comment

- Repost

- Share

💠The $ETH network has undergone the Fusaka update.

Developers have deployed an update that has reduced network fees. The main update is PeerDAS. Instead of each node downloading the entire network, they now check only random fragments. This reduces the load and saves computing resources, thereby increasing throughput. The update schedule has also changed; they will now be performed twice a year.

Ethereum is actively developing, making it one of the most promising assets on the market. I've repeatedly told you that Ether should be in your portfolio. I hope you've listened and are gradually ac

Developers have deployed an update that has reduced network fees. The main update is PeerDAS. Instead of each node downloading the entire network, they now check only random fragments. This reduces the load and saves computing resources, thereby increasing throughput. The update schedule has also changed; they will now be performed twice a year.

Ethereum is actively developing, making it one of the most promising assets on the market. I've repeatedly told you that Ether should be in your portfolio. I hope you've listened and are gradually ac

ETH0.57%

- Reward

- like

- Comment

- Repost

- Share

💸 Funds are buying Bitcoin

Larry Fink said that sovereign wealth funds have bought a large amount of $BTC , around $80,000. This isn't speculation, but genuine accumulation.

🐂 Fink also said that the Bitcoin market will soar much faster than expected.

The main driver of this growth will be the tokenization of assets.

BlackRock is confident that this will become the foundation of a new financial system in the coming years.

Larry Fink said that sovereign wealth funds have bought a large amount of $BTC , around $80,000. This isn't speculation, but genuine accumulation.

🐂 Fink also said that the Bitcoin market will soar much faster than expected.

The main driver of this growth will be the tokenization of assets.

BlackRock is confident that this will become the foundation of a new financial system in the coming years.

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

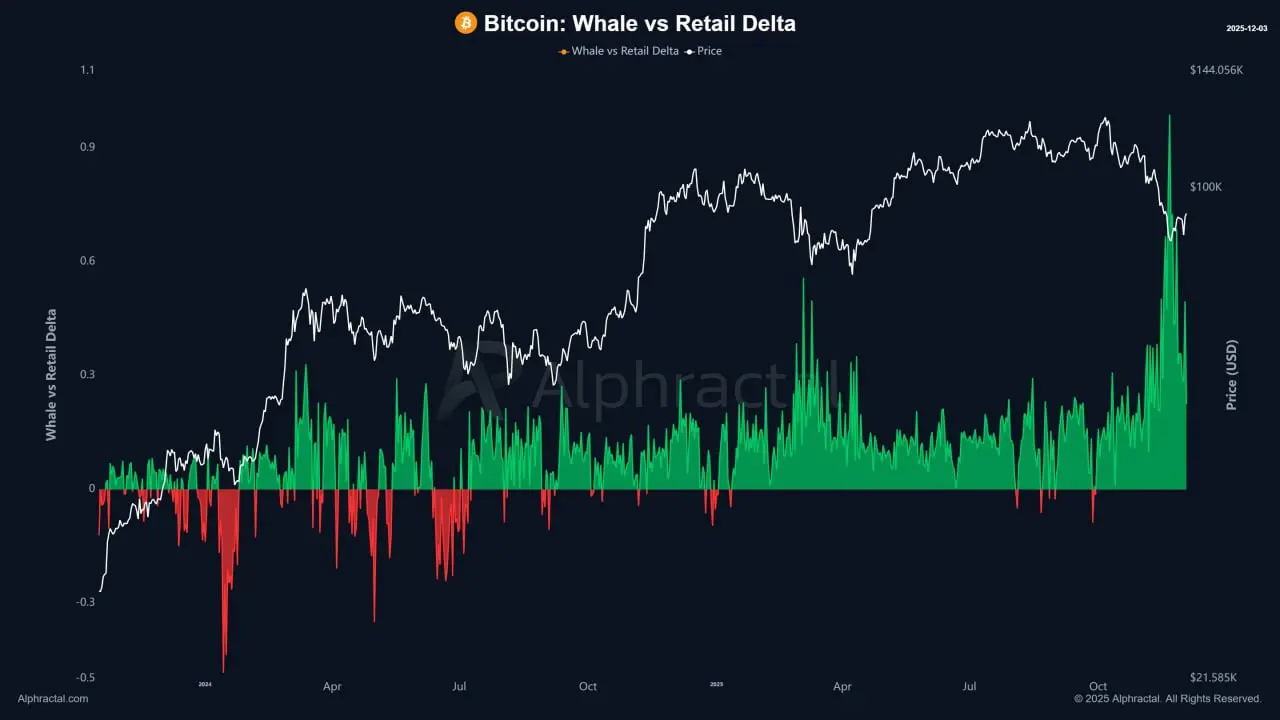

🐋 Whales are gradually closing their long positions.

Whales are gradually closing long positions and a small increase in short positions, which could indicate another market correction. If short positions gain the upper hand, we expect another decline to $81,000. While the market is still uncertain, buying activity has noticeably decreased, and we've entered a consolidation phase, the outcome of which will determine the future price movement of $BTC .

However, momentum remains weak, volumes have dropped, and it looks like we're unlikely to be able to hold the $93,000 BTC area.

🏦 This year, t

Whales are gradually closing long positions and a small increase in short positions, which could indicate another market correction. If short positions gain the upper hand, we expect another decline to $81,000. While the market is still uncertain, buying activity has noticeably decreased, and we've entered a consolidation phase, the outcome of which will determine the future price movement of $BTC .

However, momentum remains weak, volumes have dropped, and it looks like we're unlikely to be able to hold the $93,000 BTC area.

🏦 This year, t

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

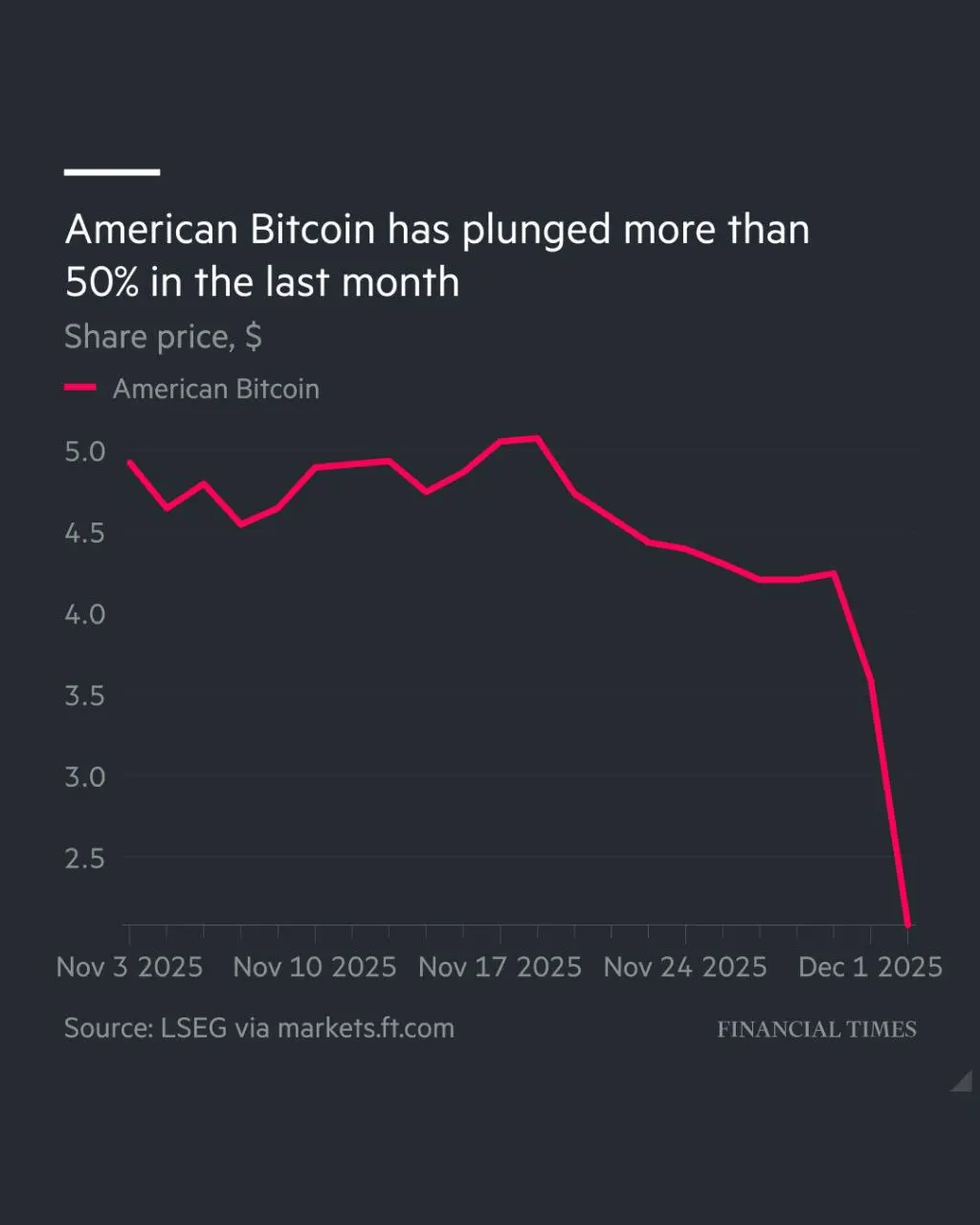

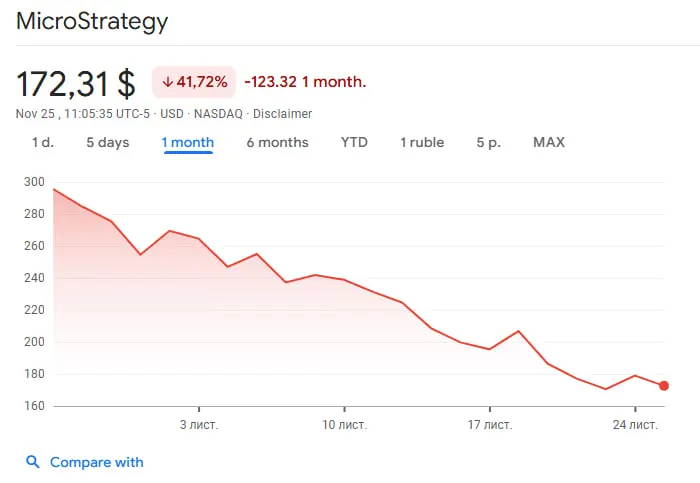

🐋📊 A whale's perfect $ETH trade, American Bitcoin shares are falling, and Michael Saylor isn't doing so well.

The whale sold 1,900 ETH at $4,500 for $9 millions, and has now bought the coin back – 2,017 ETH ($6.17 millions) at $3,061.

Meanwhile, American Bitcoin shares have lost more than 50% of their value in a month, as investors are exiting the project en masse. Strategy (MSTR) Chairman Michael Saylor stated that the company is in discussions with MSCI regarding a possible exclusion from its indices. If MSCI decides to exclude Strategy from the index on January 15, it will lead to an out

The whale sold 1,900 ETH at $4,500 for $9 millions, and has now bought the coin back – 2,017 ETH ($6.17 millions) at $3,061.

Meanwhile, American Bitcoin shares have lost more than 50% of their value in a month, as investors are exiting the project en masse. Strategy (MSTR) Chairman Michael Saylor stated that the company is in discussions with MSCI regarding a possible exclusion from its indices. If MSCI decides to exclude Strategy from the index on January 15, it will lead to an out

- Reward

- like

- Comment

- Repost

- Share

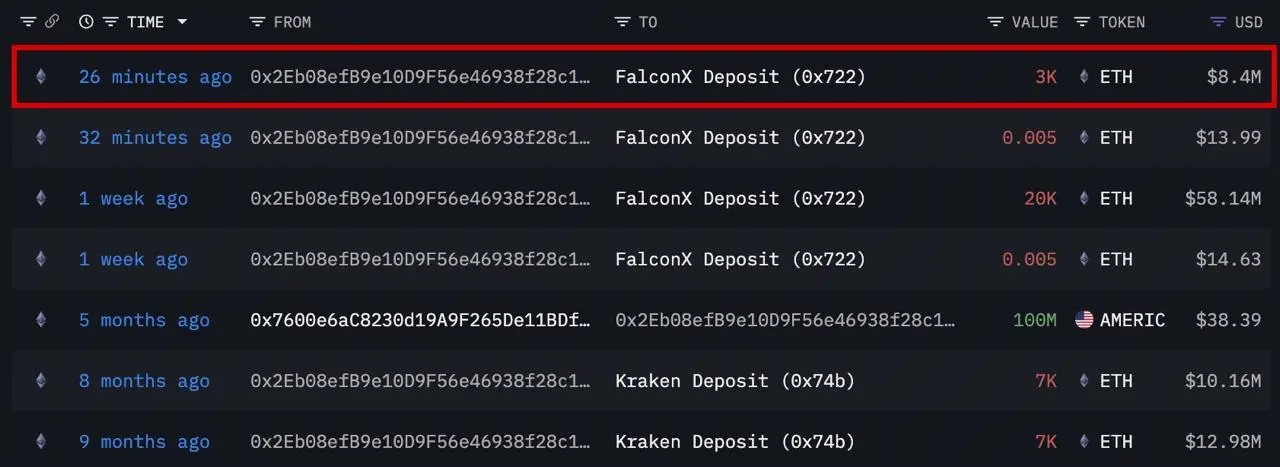

🐋 One of the whales is actively selling $ETH

This investor acquired his coins during the ICO, buying 254,908 $ETH for just $79.3k. Over the past week, he has been gradually selling his holdings, having already sold approximately 23,000 $ETH ($66.53 millions). He deposited another 3,000 ETH ($8.4 millions) on FalconX, likely for a similar purpose, and these coins will be sold soon.

Even though Ethereum isn't near its all-time high, this whale will still be making a significant profit. However, he still has a significant amount of coins in his wallet, which he may hold onto for a resurgence.

This investor acquired his coins during the ICO, buying 254,908 $ETH for just $79.3k. Over the past week, he has been gradually selling his holdings, having already sold approximately 23,000 $ETH ($66.53 millions). He deposited another 3,000 ETH ($8.4 millions) on FalconX, likely for a similar purpose, and these coins will be sold soon.

Even though Ethereum isn't near its all-time high, this whale will still be making a significant profit. However, he still has a significant amount of coins in his wallet, which he may hold onto for a resurgence.

ETH0.57%

- Reward

- like

- Comment

- Repost

- Share

🐋🦈The number of whale and shark wallets holding $XRP has decreased significantly - Santiment

Over the past couple of months, the number of wallets holding over $100 million XRP has decreased by 20%.

However, this group of investors still holds 48 billion coins, a record high in recent years.

It's possible that large players are redistributing their capital to avoid stashing the majority of their savings in this asset, which is why we're seeing this trend.

Over the past couple of months, the number of wallets holding over $100 million XRP has decreased by 20%.

However, this group of investors still holds 48 billion coins, a record high in recent years.

It's possible that large players are redistributing their capital to avoid stashing the majority of their savings in this asset, which is why we're seeing this trend.

XRP0.54%

- Reward

- like

- Comment

- Repost

- Share

📉November ended negative, and a whale is selling $BTC at a loss.

We closed November in the red, but December hasn't been encouraging either. The last month of the year began with a $BTC decline to the $85,000 region.

And so far, we haven't seen a buyback from buyers, which will likely lead the asset to support at $80,000, thus developing a negative scenario. It's too early to draw conclusions; we could very well see a rebound from $80,000, but that would require strong buyer activity, which we're not currently seeing.

Altcoins are also in a bleak spot; they fell 10%-20% following $BTC, and

We closed November in the red, but December hasn't been encouraging either. The last month of the year began with a $BTC decline to the $85,000 region.

And so far, we haven't seen a buyback from buyers, which will likely lead the asset to support at $80,000, thus developing a negative scenario. It's too early to draw conclusions; we could very well see a rebound from $80,000, but that would require strong buyer activity, which we're not currently seeing.

Altcoins are also in a bleak spot; they fell 10%-20% following $BTC, and

BTC0.19%

- Reward

- 1

- Comment

- Repost

- Share

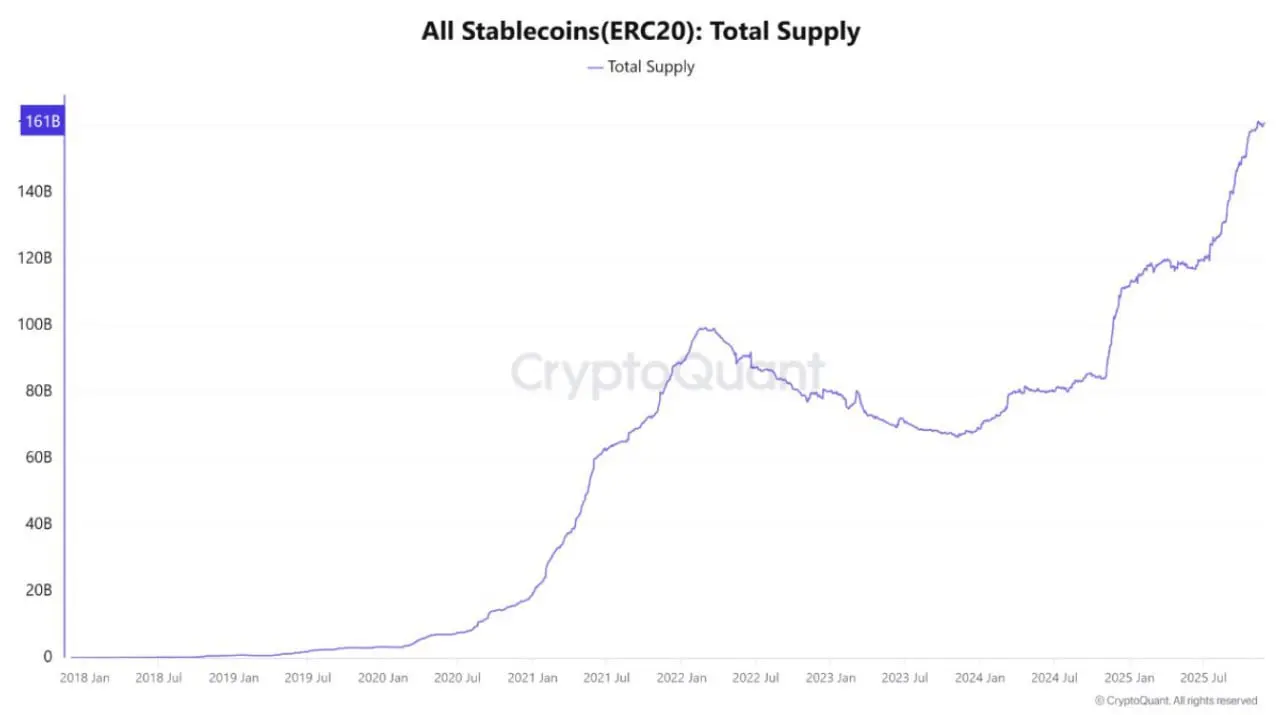

📈 The number of stablecoins continues to grow.

CryptoQuant notes growing liquidity worldwide, which indicates an increase in the volume of money in markets, including crypto.

This year, stablecoin supply has reached new records, growing to over $160 billion.

This is one of the most important factors for the growth of $BTC —the influx of capital necessary for the asset's upward momentum.

Arthur Hayes, meanwhile, believes that BTC has reached its local bottom and will reach $250,000 by the end of 2025. Yes, you heard that right.

🥶 Meanwhile, Bitcoin has fallen from $91,000 to $84,000 in the l

CryptoQuant notes growing liquidity worldwide, which indicates an increase in the volume of money in markets, including crypto.

This year, stablecoin supply has reached new records, growing to over $160 billion.

This is one of the most important factors for the growth of $BTC —the influx of capital necessary for the asset's upward momentum.

Arthur Hayes, meanwhile, believes that BTC has reached its local bottom and will reach $250,000 by the end of 2025. Yes, you heard that right.

🥶 Meanwhile, Bitcoin has fallen from $91,000 to $84,000 in the l

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

📊 $BTC futures trading hits all-time high

Over the past four months, leveraged futures traders have seen intense activity, chasing quick profits using massive leverage. But there's a downside to this situation: massive liquidations of positions, both long and short.

💰Texas invests $5 million in $BTC ETF

The US state of Texas has made its first allocation to a strategic Bitcoin reserve.

🐋 On Hyperliquid, the majority of whales are short.

Shorts are slightly overweight, with their positions profiting $224 million, while longs are down -$92 millions.

🐋 Whales inflows have increased over the

Over the past four months, leveraged futures traders have seen intense activity, chasing quick profits using massive leverage. But there's a downside to this situation: massive liquidations of positions, both long and short.

💰Texas invests $5 million in $BTC ETF

The US state of Texas has made its first allocation to a strategic Bitcoin reserve.

🐋 On Hyperliquid, the majority of whales are short.

Shorts are slightly overweight, with their positions profiting $224 million, while longs are down -$92 millions.

🐋 Whales inflows have increased over the

- Reward

- like

- Comment

- Repost

- Share

📈 Investors are expecting a quick rebound in $BTC

Last week, the long-to-short ratio for the leading cryptocurrency on Binance exceeded 3.8, the highest level in more than three years.

The peak value of 3.99 was recorded on November 21st, and it currently stands at around 2.2.

Of course, this metric doesn't reflect position sizes, but it does at least indicate direction, which speaks to traders' positive sentiment, as a reading above 1 indicates a predominance of long positions.

The market situation has stabilized somewhat. Currently, we are seeing positive market momentum, with $BTC reachin

Last week, the long-to-short ratio for the leading cryptocurrency on Binance exceeded 3.8, the highest level in more than three years.

The peak value of 3.99 was recorded on November 21st, and it currently stands at around 2.2.

Of course, this metric doesn't reflect position sizes, but it does at least indicate direction, which speaks to traders' positive sentiment, as a reading above 1 indicates a predominance of long positions.

The market situation has stabilized somewhat. Currently, we are seeing positive market momentum, with $BTC reachin

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

📊 Solana ETF is holding up well, but not DOGE

The $SOL ETF was launched relatively recently and has demonstrated exceptionally positive results since then.

Currently, there hasn't been a single outflow from this instrument.

The asset itself has dropped significantly, but it remains a promising altcoin; now is an excellent opportunity to consider buying it.

Meanwhile, the $DOGE ETF was a complete disappointment.

GDOG (the first DOGE ETF) showed volume of only $1.8 millions. This is an extremely low figure. The instrument has proven unpopular and there's no excitement around it. Similar volum

The $SOL ETF was launched relatively recently and has demonstrated exceptionally positive results since then.

Currently, there hasn't been a single outflow from this instrument.

The asset itself has dropped significantly, but it remains a promising altcoin; now is an excellent opportunity to consider buying it.

Meanwhile, the $DOGE ETF was a complete disappointment.

GDOG (the first DOGE ETF) showed volume of only $1.8 millions. This is an extremely low figure. The instrument has proven unpopular and there's no excitement around it. Similar volum

- Reward

- 2

- 1

- Repost

- Share

GateUser-fa1d8e41 :

:

Bitcoin's dominance was 59% after surpassing 60%, a harsh reminder that every dip in the market drives capital back to the king. When liquidity hides, it hides in $BTC

Watch what smart money does, not what it says.

📊 The market continues to rise slightly.

Over the past 24 hours, we saw continued growth in $BTC , but most of the activity was in altcoins, according to Santiment.

The situation currently appears ambiguous, as the main asset's dynamics are quite weak and occurring on relatively low volumes.

Locally, everything points to an imminent reversal:

1) Selling pressure on $BTC is easing, and there are the first signs of a reversal. Selling volumes are declining, which is a good sign of market recovery.

2) Analysts are noting a strong surge in capitulation among short-term $BTC holders; such surges u

Over the past 24 hours, we saw continued growth in $BTC , but most of the activity was in altcoins, according to Santiment.

The situation currently appears ambiguous, as the main asset's dynamics are quite weak and occurring on relatively low volumes.

Locally, everything points to an imminent reversal:

1) Selling pressure on $BTC is easing, and there are the first signs of a reversal. Selling volumes are declining, which is a good sign of market recovery.

2) Analysts are noting a strong surge in capitulation among short-term $BTC holders; such surges u

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

📉 Strategy is gradually losing ground.

The company is becoming less and less attractive to outside investors. Several major companies reduced their positions in Strategy (MSTR) by approximately $5.4 billions in Q3 2025—largest managers, including Capital International, Vanguard, BlackRock, and Fidelity, each reduced their holdings by more than $1 billion.

And November saw the largest cryptocurrency outflow in a long time—$5 billions. We've seen outflows for four weeks in a row. Over the past week, $1.94 billions was withdrawn.

Strategy's market capitalization is plummeting—down 41% in a month

The company is becoming less and less attractive to outside investors. Several major companies reduced their positions in Strategy (MSTR) by approximately $5.4 billions in Q3 2025—largest managers, including Capital International, Vanguard, BlackRock, and Fidelity, each reduced their holdings by more than $1 billion.

And November saw the largest cryptocurrency outflow in a long time—$5 billions. We've seen outflows for four weeks in a row. Over the past week, $1.94 billions was withdrawn.

Strategy's market capitalization is plummeting—down 41% in a month

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

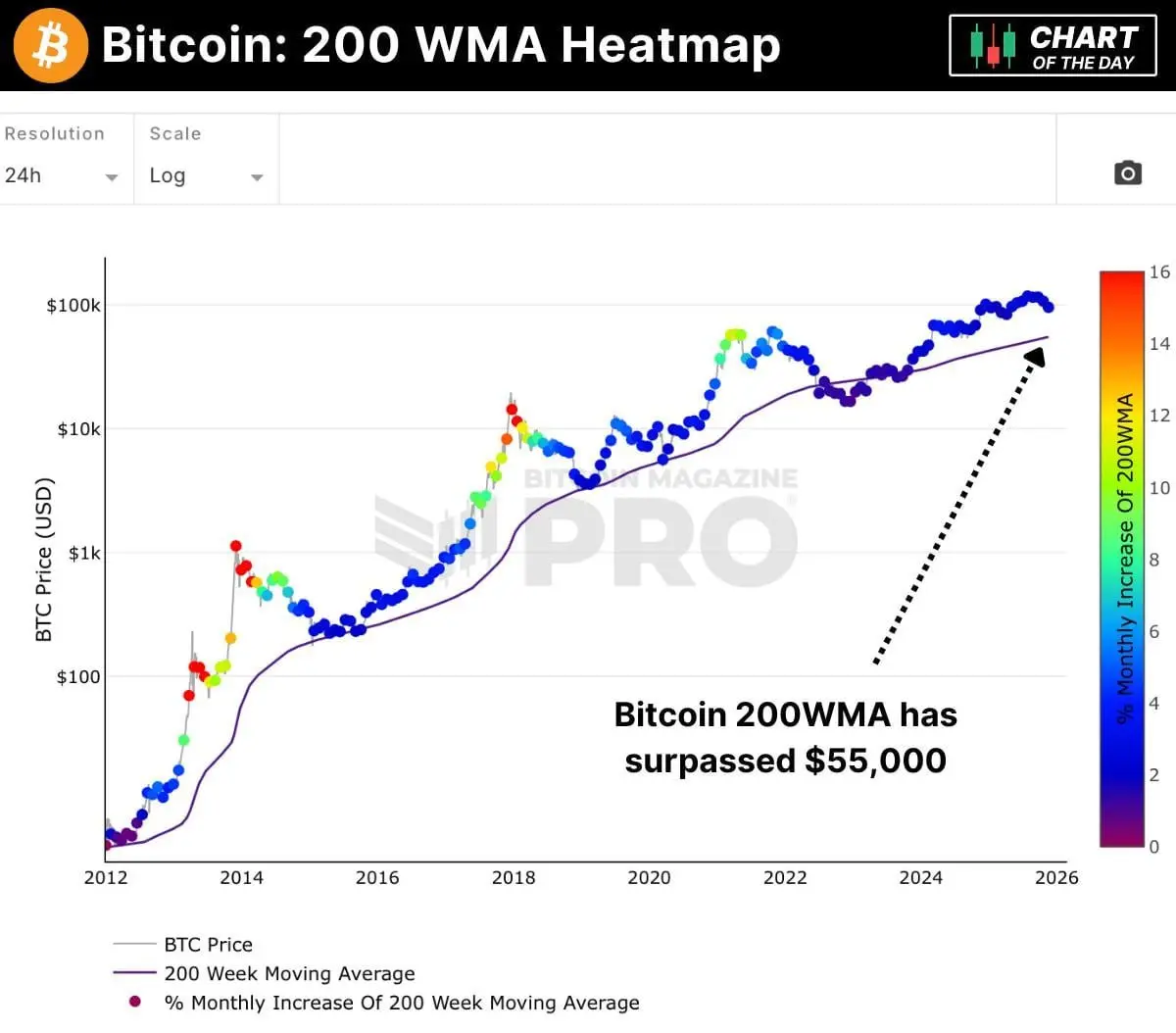

📉 Could $BTC go lower?

Let's look at 2020-2021. Back then, the peak correction from the ATH was 50%+, and we still remained in a bullish cycle. Now we're seeing a correction of only 30%+, which potentially suggests a possible decline to the $60,000 region without losing the global structure.

At $55,000, we're seeing the WMA 200, which has historically served as strong support and a long-term bottom. I wouldn't rule out a decline into this area in the next couple of months, but the likelihood is an order of magnitude lower than a return to $100,000 and a return to the usual sideways range.

Not

Let's look at 2020-2021. Back then, the peak correction from the ATH was 50%+, and we still remained in a bullish cycle. Now we're seeing a correction of only 30%+, which potentially suggests a possible decline to the $60,000 region without losing the global structure.

At $55,000, we're seeing the WMA 200, which has historically served as strong support and a long-term bottom. I wouldn't rule out a decline into this area in the next couple of months, but the likelihood is an order of magnitude lower than a return to $100,000 and a return to the usual sideways range.

Not

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share

🫠 Investors sentiment has plummeted.

Currently, many are negative and don't believe in continued growth for $BTC , leaning bearish, but I don't share this position.

Bitcoin sentiment on social media has fallen to its lowest since December 11, 2023. The current environment is a prime time for a reversal, with everyone selling off assets amid negativity and panic.

The "Greed and Fear" indicator is at 10. Panic persists in the market; this indicator indicates "extreme fear" among investors, who are panicking and exiting the market. I believe the bullish cycle is over

Psychology is one of the mos

Currently, many are negative and don't believe in continued growth for $BTC , leaning bearish, but I don't share this position.

Bitcoin sentiment on social media has fallen to its lowest since December 11, 2023. The current environment is a prime time for a reversal, with everyone selling off assets amid negativity and panic.

The "Greed and Fear" indicator is at 10. Panic persists in the market; this indicator indicates "extreme fear" among investors, who are panicking and exiting the market. I believe the bullish cycle is over

Psychology is one of the mos

BTC0.19%

- Reward

- like

- Comment

- Repost

- Share