What Is Infrared Finance? A Deep Dive Into Its PoL Mechanism and the Value of iBGT

What Is Infrared Finance?

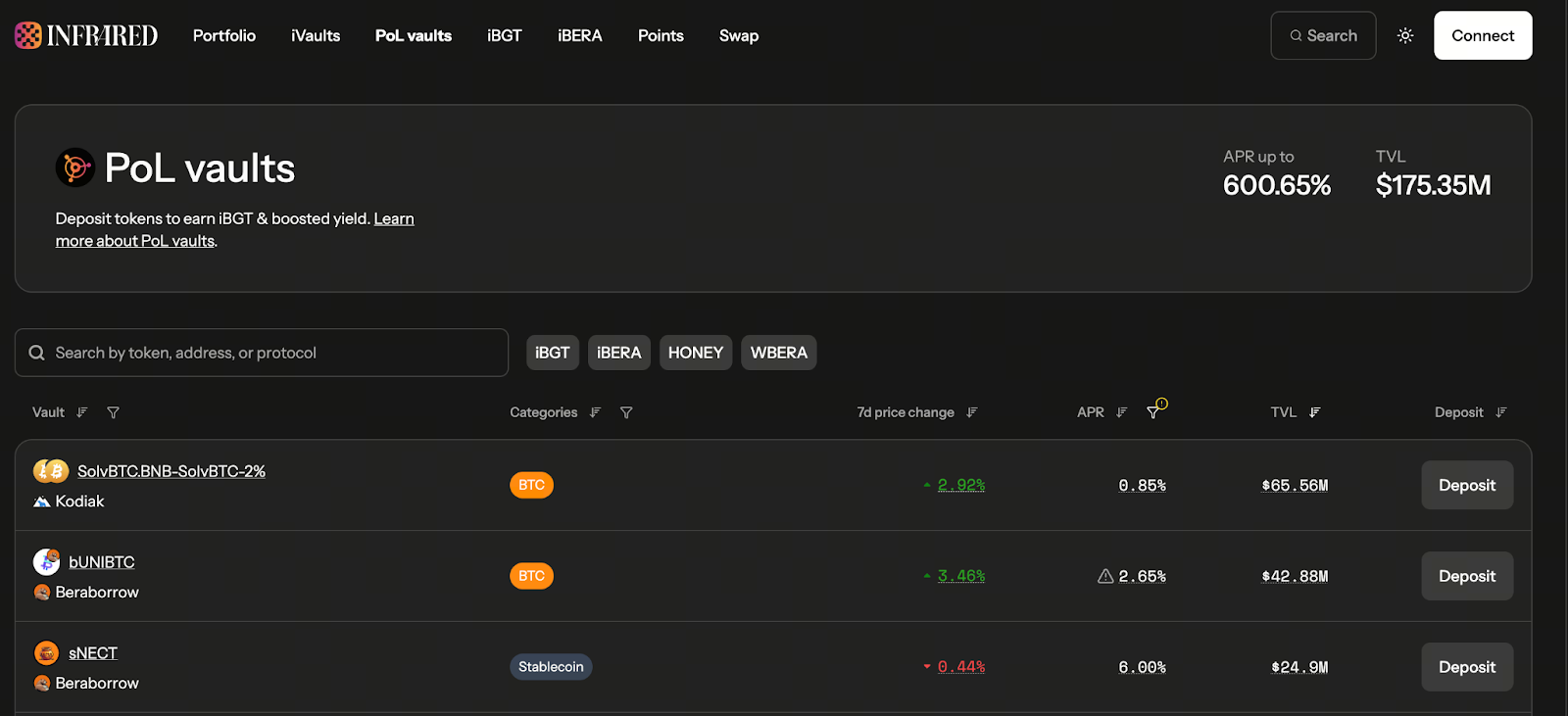

Image source: https://infrared.finance/pol-vaults

Infrared Finance is an infrastructure protocol built on the Berachain network. It specializes in developing a comprehensive suite of liquidity and staking solutions centered around Berachain’s Proof of Liquidity (PoL) mechanism. In short, Infrared’s goal is to make PoL participation accessible and secure for everyday users—eliminating the need to understand complex underlying mechanisms. With just one click, users can join liquidity vaults and claim rewards.

Infrared’s Core Mechanism: PoL and Liquid Staking

Proof of Liquidity (PoL) is Berachain’s innovative consensus and reward mechanism. Within this system, liquidity is considered essential for both network security and ecosystem health. Users who provide liquidity to Berachain are rewarded with governance tokens (BGT) and additional returns. However, native BGT is generally non-liquid and non-transferable, restricting its use in DeFi applications. Infrared addresses this by introducing liquid staking, converting BGT and BERA into tradable, usable liquid tokens—lowering the barrier to entry.

Core Products: What Are iBGT and iBERA?

- iBGT: Infrared’s liquid version of BGT. By depositing assets into PoL vaults and participating in liquidity staking, users receive iBGT. This token is freely transferable, tradable, and can be re-staked within DeFi, offering both staking rewards and liquidity.

- iBERA: Similarly, iBERA is the token generated through liquid staking of BERA. This allows previously locked or staked BERA to remain liquid, enabling users to engage in additional DeFi activities.

By leveraging these two tokens, Infrared seamlessly integrates PoL rewards and liquidity staking with DeFi utility, delivering greater flexibility and efficiency for users.

PoL Vaults: Latest Status & Market Data

According to official figures, Infrared’s PoL vaults currently have a total value locked (TVL) of approximately US$189.86 million. The platform supports multiple vault types—including stablecoin, BERA, BTC/ETH, and other major asset pairs—with wide variations in annual percentage yield (APR) across vaults. For instance, certain BERA-related vaults report APRs as high as ~80.9% (e.g., the eWBERA-4-osBGT vault).

Meanwhile, Infrared BGT (IBGT)—the platform’s liquid token—trades at roughly US$0.8474. This price is significantly below its historical peak (~US$11.74). However, since IBGT is primarily used for PoL liquidity and governance, its value is more closely tied to ecosystem expectations and long-term potential.

Why Choose Infrared? Advantages and Risk Considerations

Advantages:

- User-Friendly — Infrared streamlines PoL participation. Users can earn iBGT and iBERA by simply depositing into vaults, with no need for manual staking or complex procedures.

- Liquidity Plus Yield — iBGT and iBERA allow users to earn staking and liquidity rewards while maintaining flexibility for DeFi activities (trading, re-staking, liquidity provision, etc.). This dual benefit sets Infrared apart from traditional staking solutions.

- Foundational Infrastructure — Infrared is a leading liquid staking and vault protocol within the Berachain ecosystem, providing core liquidity infrastructure for numerous projects and holding a first-mover advantage.

Risks / Considerations:

- While some vaults offer exceptionally high APRs, these returns are accompanied by significant risks—including smart contract vulnerabilities and liquidity pool volatility (such as sharp asset price swings).

- IBGT’s market price remains far below its historical high, making short-term volatility a key risk factor for secondary market traders.

- PoL and liquid staking are novel mechanisms whose adoption depends on ecosystem and market acceptance. If Berachain’s network or ecosystem growth stalls, Infrared’s long-term value could be impacted.

Summary

Infrared Finance presents an attractive solution for users seeking both liquidity and returns within the Berachain network. With iBGT, iBERA, and PoL vaults, users can easily participate in the ecosystem, contribute liquidity, and earn rewards—without sacrificing asset flexibility. However, high yields come with high risks, so understanding the mechanisms and making careful choices regarding vaults and asset allocation is essential.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution