# GOLD

232.99K

Abidhayatkhizarnaseem

#GOLD MAY CRASH THE GLOBAL MARKET NEXT WEEK!

Gold surged 85% in 12 months — and that’s dangerous.

When gold goes parabolic, history shows it eventually corrects hard.

Past Parabolic Gold Tops

1980

• Gold peaked near $850

• Then dumped 40–60%

• Took years to recover

2011

• Gold peaked near $1,920

• Fell ~43% over the next years

2020

• Gold topped $2,075

• Corrected 20–25% and then consolidated

The Pattern is Clear

After 60–85% rallies, gold typically:

• Corrects 20–40%

• Moves sideways for years

• Resets the market

📌 Gold is a long-term hedge — not a straight-line asset.

Parabolic rallies inv

Gold surged 85% in 12 months — and that’s dangerous.

When gold goes parabolic, history shows it eventually corrects hard.

Past Parabolic Gold Tops

1980

• Gold peaked near $850

• Then dumped 40–60%

• Took years to recover

2011

• Gold peaked near $1,920

• Fell ~43% over the next years

2020

• Gold topped $2,075

• Corrected 20–25% and then consolidated

The Pattern is Clear

After 60–85% rallies, gold typically:

• Corrects 20–40%

• Moves sideways for years

• Resets the market

📌 Gold is a long-term hedge — not a straight-line asset.

Parabolic rallies inv

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊#NextFedChairPredictions

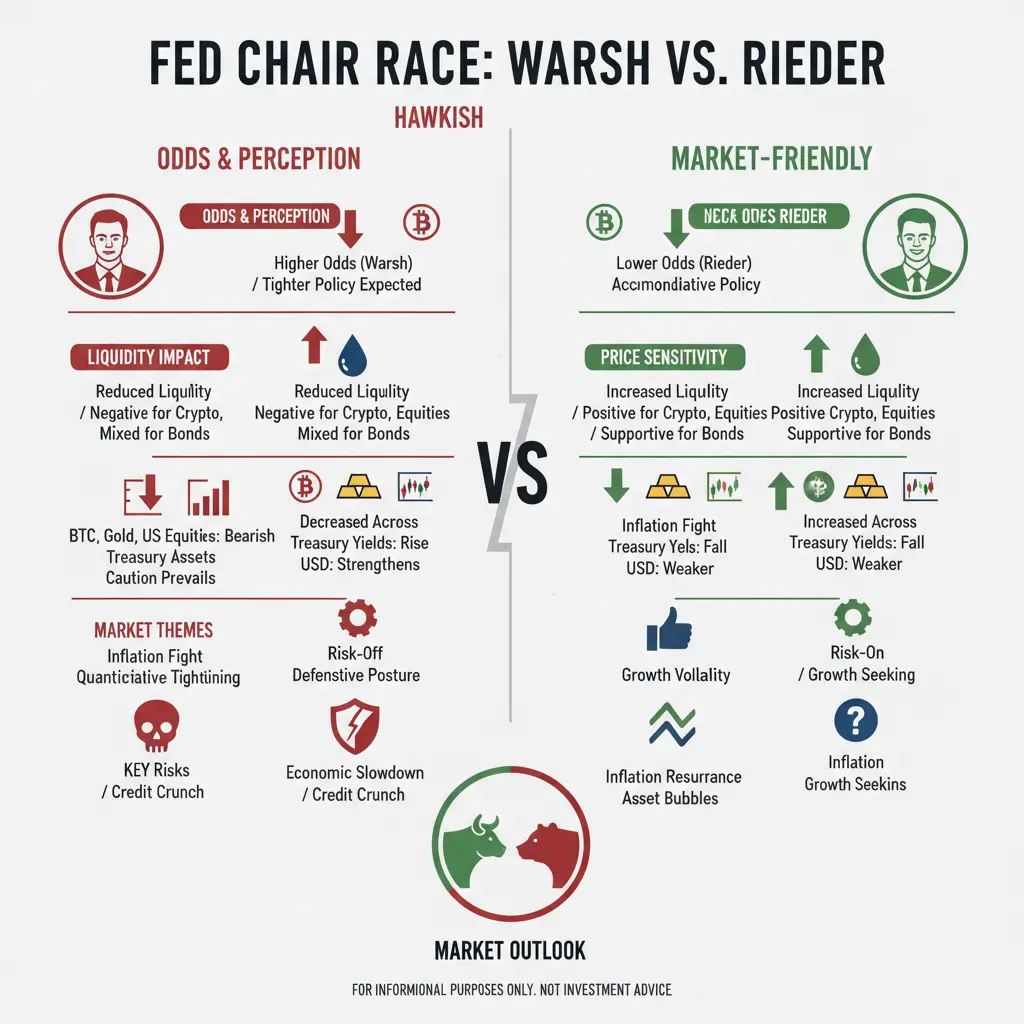

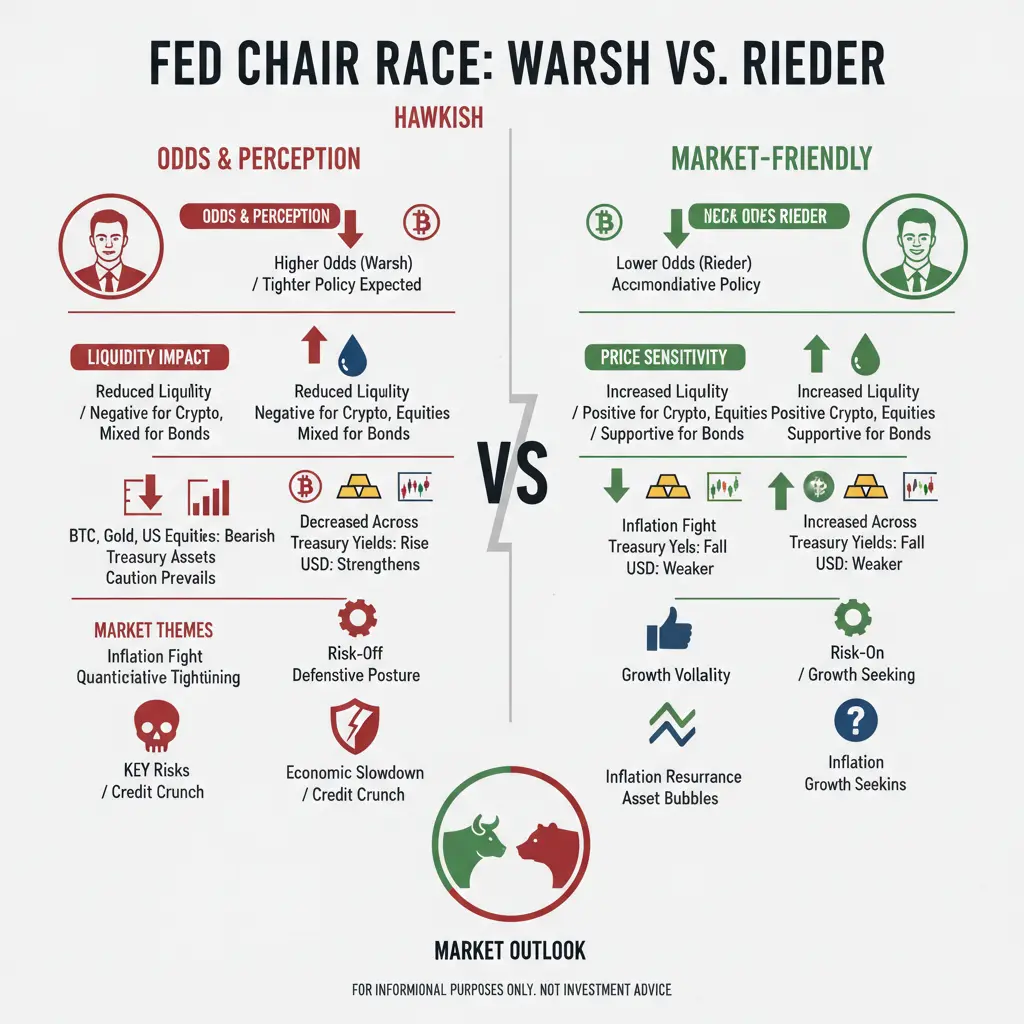

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 12

- 20

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊View More

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 6

- 3

- Repost

- Share

Selmus :

:

BTC ETH BTC ETH BTC ETHView More

#GoldAndSilverSoar ✨

Gold and silver are shining brighter than ever! 🌟 Both metals are hitting fresh highs, showing strong investor confidence in safe-haven assets. 📈

Gold is rallying amid economic uncertainty, while silver gains traction as both a precious and industrial metal. Together, they prove why metals remain a top hedge against inflation and market swings. 💰

With global risks still on the horizon, the precious metals market looks rock-solid — and traders and long-term investors are taking notice. 👀

Is this just the start of a major metals cycle? 🔥

#Gold #Silver #PreciousMetals #M

Gold and silver are shining brighter than ever! 🌟 Both metals are hitting fresh highs, showing strong investor confidence in safe-haven assets. 📈

Gold is rallying amid economic uncertainty, while silver gains traction as both a precious and industrial metal. Together, they prove why metals remain a top hedge against inflation and market swings. 💰

With global risks still on the horizon, the precious metals market looks rock-solid — and traders and long-term investors are taking notice. 👀

Is this just the start of a major metals cycle? 🔥

#Gold #Silver #PreciousMetals #M

- Reward

- 1

- 2

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

🥇 Gold & 🥈 Silver Hit New Highs! 🚀

Precious metals are shining brighter than ever ✨

Gold and Silver have surged to new all-time highs, signaling growing investor confidence amid global uncertainty 🌍📈

As inflation concerns, geopolitical tension, and market volatility rise, smart money is rotating toward safe-haven assets 💼🛡️

This move reminds us of one key rule of the markets:

➡️ When risk increases, value finds safety.

Are metals leading the next macro trend, or is this just the beginning? 👀🔥

#Gold #Silver #NewHighs #SafeHaven #Investing #MacroTrends

Precious metals are shining brighter than ever ✨

Gold and Silver have surged to new all-time highs, signaling growing investor confidence amid global uncertainty 🌍📈

As inflation concerns, geopolitical tension, and market volatility rise, smart money is rotating toward safe-haven assets 💼🛡️

This move reminds us of one key rule of the markets:

➡️ When risk increases, value finds safety.

Are metals leading the next macro trend, or is this just the beginning? 👀🔥

#Gold #Silver #NewHighs #SafeHaven #Investing #MacroTrends

- Reward

- 5

- 4

- Repost

- Share

PumpSpreeLive :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

Gold and silver have surged to fresh record highs, signaling a strong shift in global investor sentiment toward safe-haven assets. As uncertainty rises across financial markets, precious metals are once again taking center stage.

🔹 What’s driving the rally?

Safe-haven demand: Ongoing geopolitical tensions and economic uncertainty are pushing investors to protect capital in gold and silver.

Monetary policy expectations: Growing bets on future interest-rate cuts reduce the opportunity cost of holding non-yielding assets like gold.

Weaker U.S. dollar outlook: A softer d

Gold and silver have surged to fresh record highs, signaling a strong shift in global investor sentiment toward safe-haven assets. As uncertainty rises across financial markets, precious metals are once again taking center stage.

🔹 What’s driving the rally?

Safe-haven demand: Ongoing geopolitical tensions and economic uncertainty are pushing investors to protect capital in gold and silver.

Monetary policy expectations: Growing bets on future interest-rate cuts reduce the opportunity cost of holding non-yielding assets like gold.

Weaker U.S. dollar outlook: A softer d

BTC-0.85%

MC:$5.24KHolders:2

0.06%

- Reward

- 8

- 9

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

🥇 Gold & 🥈 Silver Hit New Highs! 🚀

Precious metals are shining brighter than ever ✨

Gold and Silver have surged to new all-time highs, signaling growing investor confidence amid global uncertainty 🌍📈

As inflation concerns, geopolitical tension, and market volatility rise, smart money is rotating toward safe-haven assets 💼🛡️

This move reminds us of one key rule of the markets:

➡️ When risk increases, value finds safety.

Are metals leading the next macro trend, or is this just the beginning? 👀🔥

#Gold #Silver #NewHighs #SafeHaven #Investing #MacroTrends

Precious metals are shining brighter than ever ✨

Gold and Silver have surged to new all-time highs, signaling growing investor confidence amid global uncertainty 🌍📈

As inflation concerns, geopolitical tension, and market volatility rise, smart money is rotating toward safe-haven assets 💼🛡️

This move reminds us of one key rule of the markets:

➡️ When risk increases, value finds safety.

Are metals leading the next macro trend, or is this just the beginning? 👀🔥

#Gold #Silver #NewHighs #SafeHaven #Investing #MacroTrends

- Reward

- 1

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs 🏆✨ #GoldandSilverHitNewHighs

📅 25 January 2026 — A Historic Day for Precious Metals!

Gold and Silver have officially smashed new all-time highs today! 📈🔥

Investors are rushing toward safe-haven assets as bullish momentum dominates the market.

🥇 Gold shining at record levels

🥈 Silver breaking major resistance

The trend is strong. The momentum is real.

Smart money is flowing into metals. 💰

Are you watching this rally? 👀

#Gold #Silver #RecordHigh #MarketUpdate

📅 25 January 2026 — A Historic Day for Precious Metals!

Gold and Silver have officially smashed new all-time highs today! 📈🔥

Investors are rushing toward safe-haven assets as bullish momentum dominates the market.

🥇 Gold shining at record levels

🥈 Silver breaking major resistance

The trend is strong. The momentum is real.

Smart money is flowing into metals. 💰

Are you watching this rally? 👀

#Gold #Silver #RecordHigh #MarketUpdate

- Reward

- 1

- 1

- Repost

- Share

repanzal :

:

Buy To Earn 💎🚨 #Bitcoin vs Gold: Risk vs Safety (2026 Outlook) 🚨

Bitcoin (BTC) Price: ~$88,762

BTC ek critical psychological zone par consolidate kar raha hai after a strong bull run. Long-term strong asset hone ke bawajood, short-term pressure nazar aa raha hai.

🔻 Why BTC is Weak Short-Term • ETF inflows slow

• Liquidity tight

• Profit-taking pressure

• High global interest rates

📊 Key Levels • Resistance: $90K – $100K (Breakout = Strong Rally)

• Support: $85K – $65K (Breakdown = Deep Correction)

🔮 BTC Forecast • 🟢 Bullish: $150K – $200K (ETF + Liquidity boost)

• 🟡 Neutral: $75K – $130K (Sideways i

Bitcoin (BTC) Price: ~$88,762

BTC ek critical psychological zone par consolidate kar raha hai after a strong bull run. Long-term strong asset hone ke bawajood, short-term pressure nazar aa raha hai.

🔻 Why BTC is Weak Short-Term • ETF inflows slow

• Liquidity tight

• Profit-taking pressure

• High global interest rates

📊 Key Levels • Resistance: $90K – $100K (Breakout = Strong Rally)

• Support: $85K – $65K (Breakdown = Deep Correction)

🔮 BTC Forecast • 🟢 Bullish: $150K – $200K (ETF + Liquidity boost)

• 🟡 Neutral: $75K – $130K (Sideways i

BTC-0.85%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊#GoldandSilverHitNewHighs

Gold and Silver: The 2026 "Grand Breakout" Analysis

The weekend of January 24–25, 2026, has solidified its place in financial history. As Spot Gold hits $4,988/ounce and Silver storms past $103/ounce, we are no longer just looking at a price rally—we are witnessing a fundamental shift in the global valuation of hard assets.

1. Macro Analysis: The Perfect Storm of 2026

The current surge isn't a fluke; it is the result of three powerful forces converging simultaneously:

Geopolitical Friction over Greenland: Tensions between the U.S. and the EU regarding strategic resou

Gold and Silver: The 2026 "Grand Breakout" Analysis

The weekend of January 24–25, 2026, has solidified its place in financial history. As Spot Gold hits $4,988/ounce and Silver storms past $103/ounce, we are no longer just looking at a price rally—we are witnessing a fundamental shift in the global valuation of hard assets.

1. Macro Analysis: The Perfect Storm of 2026

The current surge isn't a fluke; it is the result of three powerful forces converging simultaneously:

Geopolitical Friction over Greenland: Tensions between the U.S. and the EU regarding strategic resou

- Reward

- 2

- 1

- Repost

- Share

QueenOfTheDay :

:

good postLoad More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

69.03K Popularity

43.41K Popularity

36.36K Popularity

13.77K Popularity

28.97K Popularity

20.72K Popularity

17.01K Popularity

86.31K Popularity

46.05K Popularity

26.97K Popularity

16.78K Popularity

5.62K Popularity

262.4K Popularity

26.67K Popularity

184.5K Popularity

News

View MoreGate has launched MEMES perpetual contract trading

15 m

Next week, the US stock market faces a life-and-death situation with earnings reports, shifting from the "Seven Giants' Faith" to "Letting Performance Speak."

24 m

Data: 1,565,600 TON transferred from an anonymous address to TON, worth approximately $2.41 million

28 m

CZ: The new book may be published in late February or early March.

35 m

Data: If BTC breaks through $93,121, the total liquidation strength of mainstream CEX short positions will reach $1.087 billion.

40 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889