Publique conteúdos e ganhe rendimentos da extração de conteúdos

placeholder

Tio Niu Ma apareceu em Shenzhen. Por que os preços dos hotéis em Shenzhen estão cada vez mais altos? Meu padrão de viagem a negócios é baixo, originalmente podia ficar no Atour, agora só posso ficar no Orange💔

Ver original

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Algo está a acontecer aqui, mas eu simplesmente não sei o quê $STABLEQuite interessante

Ver original

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

芝麻传奇

芝麻传奇之路

Criado por@gatefunuser_e111

Progresso da listagem

100.00%

LM:

$3.25K

Criar o meu token

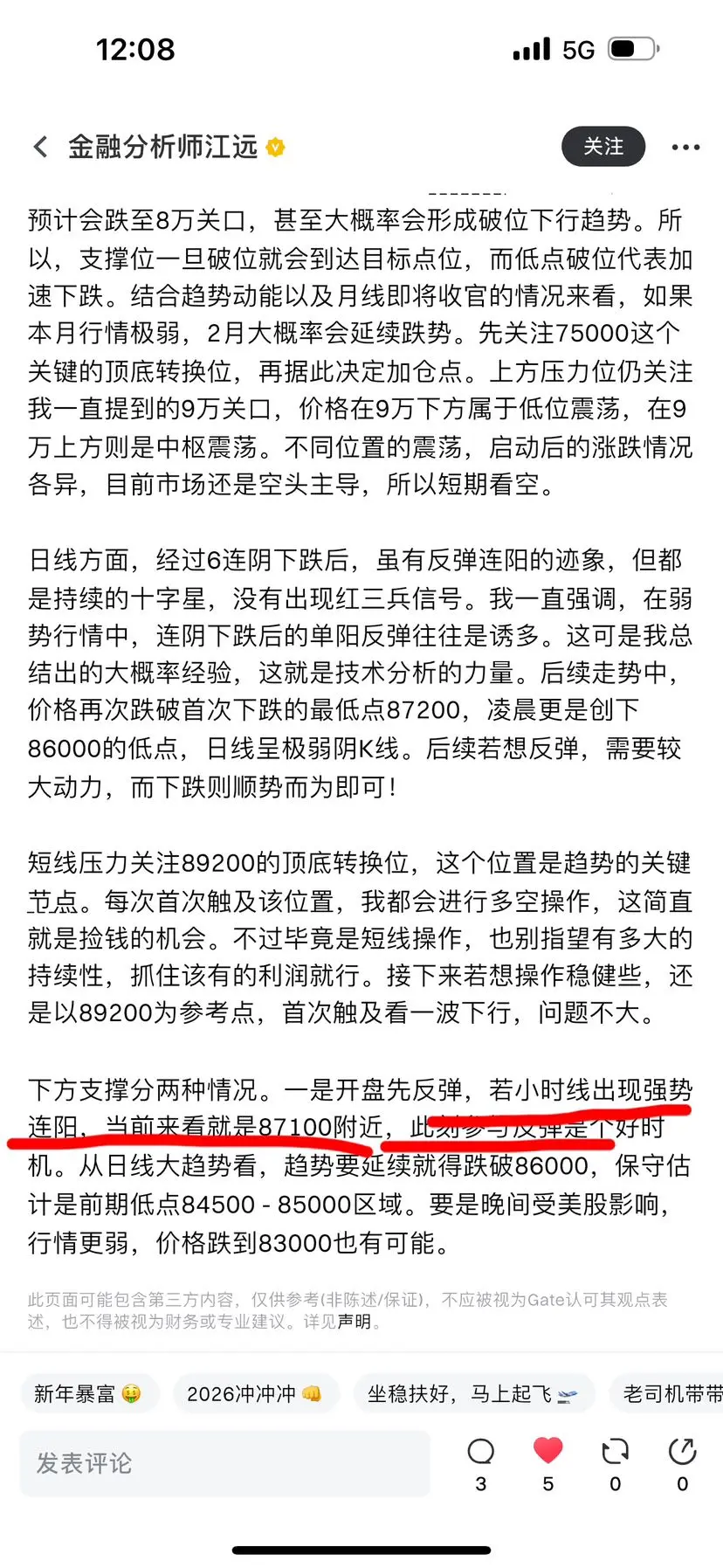

A análise de Jiang Yuan você precisa ver, os bebês que ouvem com atenção estão ganhando dinheiro

87200-89500

Duas mil pontos entregues a todos

Ver original87200-89500

Duas mil pontos entregues a todos

- Recompensa

- 1

- 2

- Republicar

- Partilhar

花间爱豆X :

:

Grande amigo, tens pontos durante o dia?Ver mais

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Olá, eu tenho agora o seu na corda de Kent, então posso aproveitar o seu tempo também mais algo, porque ele é o mais mais felicidade no ano, então estou bem para você

Ver original

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

O evento Bónus de Primeira Negociação de Ações Tokenizadas está oficialmente ativo. Novos utilizadores registados e traders de Ações Tokenizadas pela primeira vez podem ganhar airdrops acumulados ao completar negociações de baixo limiar... https://www.gate.com/campaigns/3927?ref=XgRFBg1c&ref_type=132

Ver original

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

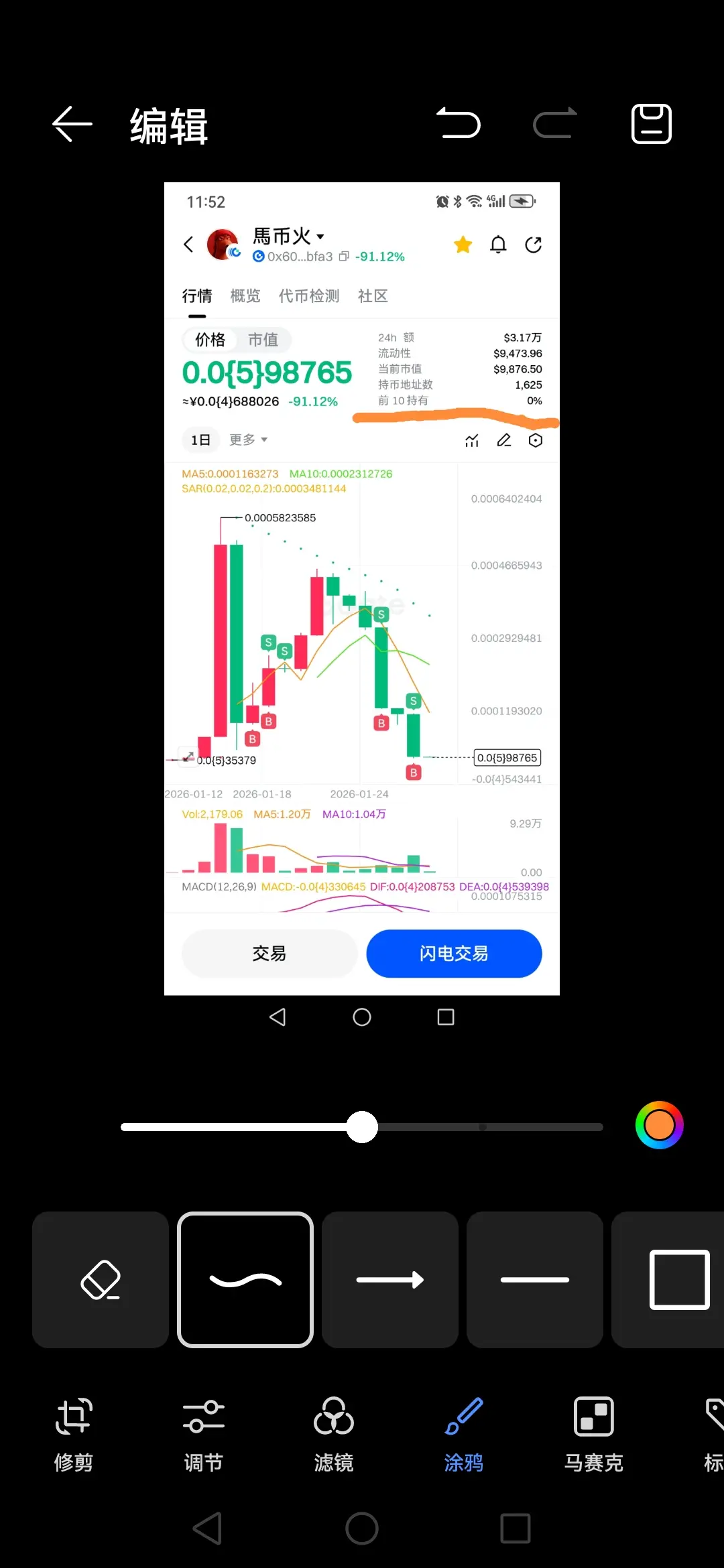

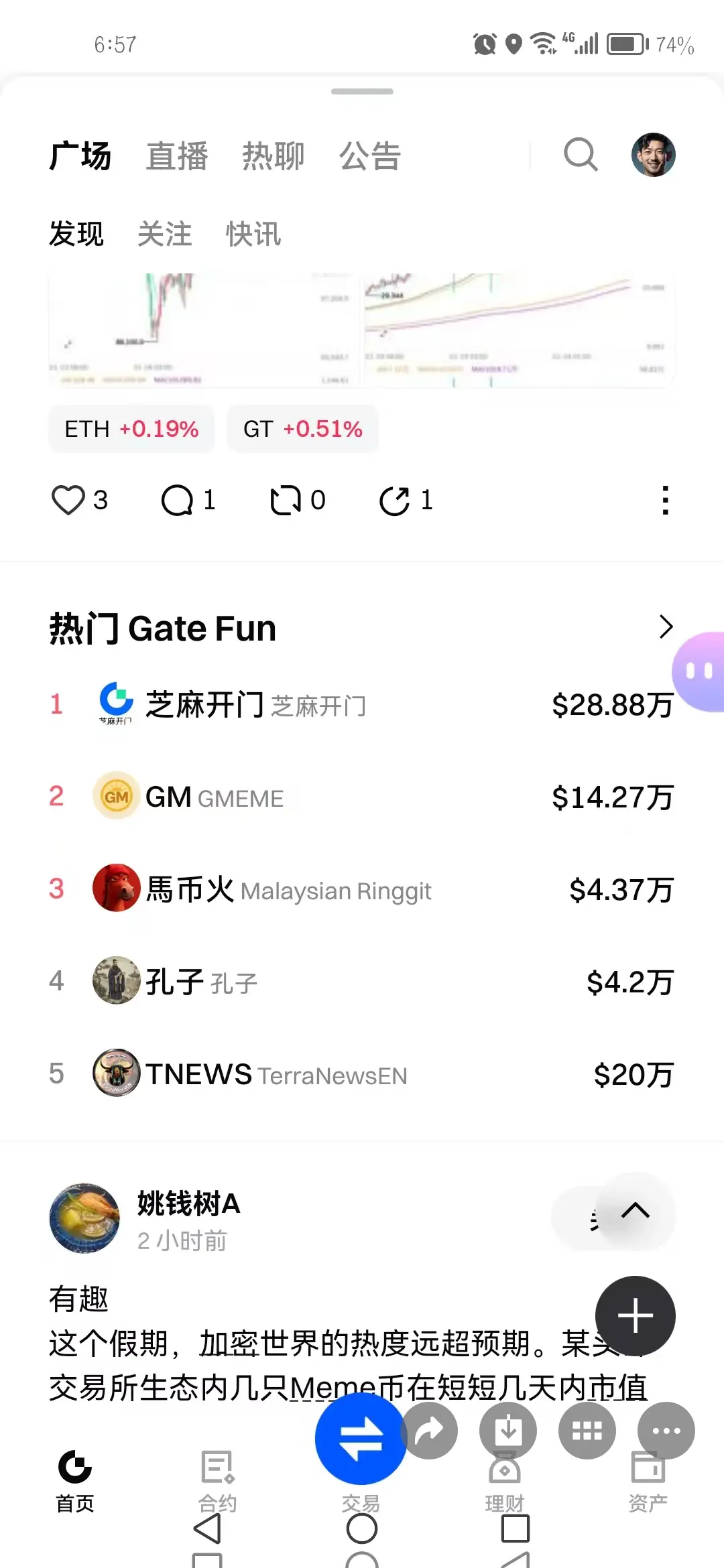

Não há grandes investidores nem manipuladores, todos estão a fazer grandes movimentos com moedas de cem ou mil vezes

Ver original

[O utilizador partilhou os seus dados de negociação. Aceda à App para ver mais].

LM:$10.84KTitulares:1625

100.00%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

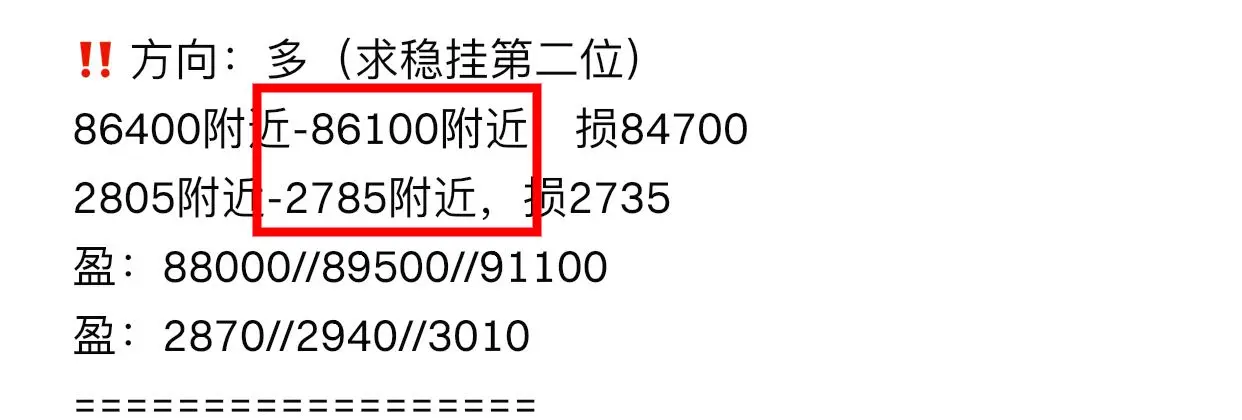

‼️ guan和平 轮老铁们给U‼️ 28号合约/现货单已更新👇币圈只跟对的人,感谢大家支持,新年3.5gt半价已破200人,优惠最后1日恢复7gt‼️ 苹果点👇

https://www.gate.com/zh/profile/缠论大师

🔥近期连吃200余万u‼️上周3400/97800空+90800/3005空本周一86000/2785再赚30万📉周一反手2780/86000多今3030/89500再吃肉🀄️#内容挖矿焕新公测开启

https://www.gate.com/zh/profile/缠论大师

🔥近期连吃200余万u‼️上周3400/97800空+90800/3005空本周一86000/2785再赚30万📉周一反手2780/86000多今3030/89500再吃肉🀄️#内容挖矿焕新公测开启

- Recompensa

- 10

- 10

- Republicar

- Partilhar

BigBigBigBigBigBubbleGum :

:

Sente-se confortavelmente, a decolagem é iminente 🛫Ver mais

Ano Novo na cadeia · Mercado não fecha https://www.gate.com/campaigns/3937?ref=VVYRBWSNBQ&ref_type=132

Ver original

- Recompensa

- 2

- Comentar

- Republicar

- Partilhar

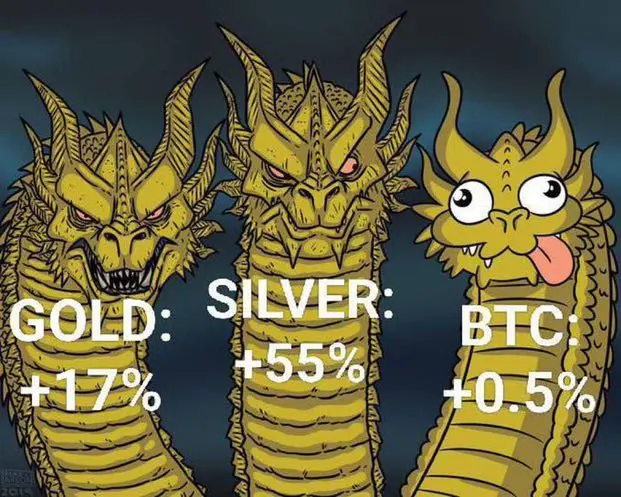

🧭 O preço do ouro ultrapassou os 5000 dólares, com um aumento súbito nos riscos geopolíticos — será momento de fazer hedge ou de aproveitar a baixa do Bitcoin?

A escalada das tensões entre os EUA e o Irã fez os mercados globais entrarem em modo de proteção. O fluxo de capitais está em rápida rotação — as divergências entre ouro e Bitcoin também estão se ampliando.

🥇 Ouro: Controle total pelo medo

A quebra do nível de 5000 dólares no ouro não é apenas uma quebra técnica normal — é uma declaração macroeconômica.

Os fatores atuais que impulsionam isso incluem:

Aumento dos riscos geopolíticos →

A escalada das tensões entre os EUA e o Irã fez os mercados globais entrarem em modo de proteção. O fluxo de capitais está em rápida rotação — as divergências entre ouro e Bitcoin também estão se ampliando.

🥇 Ouro: Controle total pelo medo

A quebra do nível de 5000 dólares no ouro não é apenas uma quebra técnica normal — é uma declaração macroeconômica.

Os fatores atuais que impulsionam isso incluem:

Aumento dos riscos geopolíticos →

BTC0,57%

- Recompensa

- 3

- 3

- Republicar

- Partilhar

MamaWang :

:

A tokenização de ouro e prata está a tornar-se produtos com maior liquidez.Ver mais

A assinatura de uma única recuada para fazer long em Bitcoin lucrou 1500 pontos! Vagas limitadas, aproveite para entrar, os pontos de assinatura foram atualizados!#内容挖矿焕新公测开启

BTC0,57%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

国投白银LOF

国投白银LOF

Criado por@ChineseMemeGlobalAmbassador

Progresso da listagem

0.00%

LM:

$3.44K

Criar o meu token

🎮 GameFi Explode com AXS a Saltar 37% — Reversão do Setor Real ou Apenas uma Rápida Rotação?

GameFi está de repente de volta ao centro das atenções. AXS disparou quase 37% em 24 horas, superando em muito o mercado de criptomoedas mais amplo e trazendo novamente o foco para um setor que muitos tinham dado como perdido.

Mas a questão-chave é simples:

Será este o começo de uma verdadeira recuperação do GameFi — ou apenas uma rotação de capital de curto prazo?

🔍 O que Está a Impulsionar o Movimento Súbito?

Este rally não está a acontecer isoladamente.

Fatores-chave por trás do pico:

Rotação de c

Ver originalGameFi está de repente de volta ao centro das atenções. AXS disparou quase 37% em 24 horas, superando em muito o mercado de criptomoedas mais amplo e trazendo novamente o foco para um setor que muitos tinham dado como perdido.

Mas a questão-chave é simples:

Será este o começo de uma verdadeira recuperação do GameFi — ou apenas uma rotação de capital de curto prazo?

🔍 O que Está a Impulsionar o Movimento Súbito?

Este rally não está a acontecer isoladamente.

Fatores-chave por trás do pico:

Rotação de c

- Recompensa

- 4

- 3

- Republicar

- Partilhar

Luna_Star :

:

Comprar Para Ganhar 💎Ver mais

Confira a Gate e junte-se a mim no evento mais quente! https://www.gate.com/campaigns/3881?ref=XgRFBg1c&ref_type=132&utm_cmp=TpIkMKPZ

Ver original

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

#CryptoMarketWatch

O mercado de criptomoedas está atualmente a navegar numa fase de neutralidade de alta, marcada por uma forte liderança dos ativos de topo e uma participação institucional crescente, enquanto as condições técnicas de curto prazo sinalizam a necessidade de uma gestão de risco disciplinada.

Esta fase reflete uma estrutura de mercado em maturação, onde a ação dos preços é cada vez mais influenciada por fluxos de ETF, fundamentos on-chain, posicionamento em derivados e correlações macroeconómicas entre ativos, em vez de puro impulso do retalho.

Visão Geral do Mercado Macro

A rec

Ver originalO mercado de criptomoedas está atualmente a navegar numa fase de neutralidade de alta, marcada por uma forte liderança dos ativos de topo e uma participação institucional crescente, enquanto as condições técnicas de curto prazo sinalizam a necessidade de uma gestão de risco disciplinada.

Esta fase reflete uma estrutura de mercado em maturação, onde a ação dos preços é cada vez mais influenciada por fluxos de ETF, fundamentos on-chain, posicionamento em derivados e correlações macroeconómicas entre ativos, em vez de puro impulso do retalho.

Visão Geral do Mercado Macro

A rec

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

No mundo do investimento de risco, btc——ETh——pi

A avaliação das pessoas é sempre a prioridade.

Especialmente na fase de semente, quando produto, mercado e dados ainda não existem, o fundador é quase o único indicador de avaliação.

Um fundador de topo deve ser um otimista paranoico, um fundador que não segue o consenso, que deve ter sonhos pouco realistas para o futuro, mas também ser capaz de resolver os problemas atuais de forma prática.

A Pi network, antes de se tornar famosa, já tinha conquistado o interesse de muitos capitais, o que justamente comprova o reconhecime

Ver originalA avaliação das pessoas é sempre a prioridade.

Especialmente na fase de semente, quando produto, mercado e dados ainda não existem, o fundador é quase o único indicador de avaliação.

Um fundador de topo deve ser um otimista paranoico, um fundador que não segue o consenso, que deve ter sonhos pouco realistas para o futuro, mas também ser capaz de resolver os problemas atuais de forma prática.

A Pi network, antes de se tornar famosa, já tinha conquistado o interesse de muitos capitais, o que justamente comprova o reconhecime

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

28/01/2026

Desafio de contrato de 500u

Continue assim

Ver originalDesafio de contrato de 500u

Continue assim

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

como aumentar o lucro e a receita seguindo agora

Ver original- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

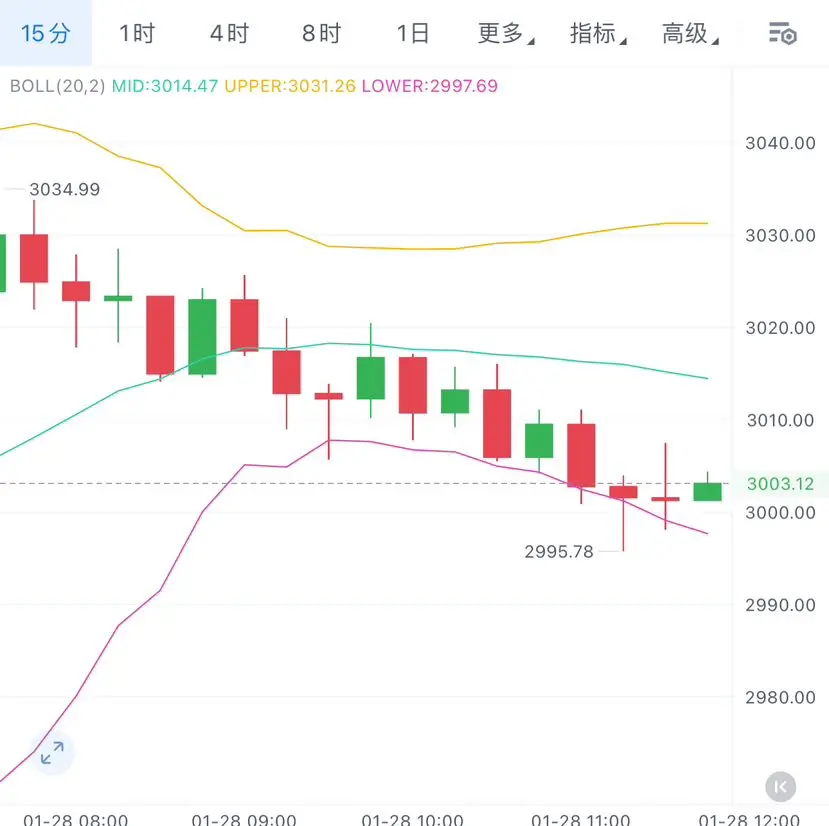

$ETH Pensamento divulgado de hoje:

Pelo ponto de vista da tendência e das médias móveis, o gráfico diário/4 horas apresenta uma disposição de alta, o preço está acima da MA20, a correção não quebrou o suporte de forma efetiva, a tendência de alta de médio prazo permanece.

Em relação às formações-chave, o gráfico semanal parece formar uma base arredondada, e no gráfico de 4 horas há um duplo fundo/formação de bandeira, indicando sinal de reversão/continuação de alta.

Segundo análise: uma correção até aproximadamente 2970-2950 pode ser uma oportunidade, com alvo próximo de 3050-3100.

#内容挖矿焕新公测开启

Ver originalPelo ponto de vista da tendência e das médias móveis, o gráfico diário/4 horas apresenta uma disposição de alta, o preço está acima da MA20, a correção não quebrou o suporte de forma efetiva, a tendência de alta de médio prazo permanece.

Em relação às formações-chave, o gráfico semanal parece formar uma base arredondada, e no gráfico de 4 horas há um duplo fundo/formação de bandeira, indicando sinal de reversão/continuação de alta.

Segundo análise: uma correção até aproximadamente 2970-2950 pode ser uma oportunidade, com alvo próximo de 3050-3100.

#内容挖矿焕新公测开启

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Carregar mais

Junte-se a 40M utilizadores na nossa comunidade em crescimento

⚡️ Junte-se a 40M utilizadores na discussão sobre a tendência das criptomoedas

💬 Interaja com os seus criadores favoritos

👍 Descubra o que lhe interessa

Tópicos em destaque

Ver mais398 Popularidade

63.25K Popularidade

23.2K Popularidade

8K Popularidade

7.04K Popularidade

Notícias

Ver maisA operação regulamentada da Gate US já cobre 44 jurisdições nos Estados Unidos, expandindo de forma constante a presença no mercado

2 m

ETF de Bitcoin à vista registou ontem uma saída líquida total de 147 milhões de dólares, com a saída líquida de 103 milhões de dólares da BlackRock IBIT a liderar

9 m

ETF de Ethereum à vista registou uma saída líquida total de 63,533,400 dólares ontem, com a saída líquida da BlackRock ETHA de 58,967,900 dólares a liderar

10 m

Dados: 187.21 BTC transferidos de um endereço anónimo, após intermediário, para outro endereço anónimo

20 m

Vitalik: Os projetos SocialFi não devem estar demasiado ligados às finanças, os utilizadores que vêm para ganhar dinheiro irão destruir a essência social

36 m

Fixar